Brazil Soybean Market – 2022 Overview

Reading time: 6 minutes

![]() Free Report

Free Report

Brazil’s Soybean Production Will Be 30 Mmt Higher Than That of the U.S. in MY 2022/2023

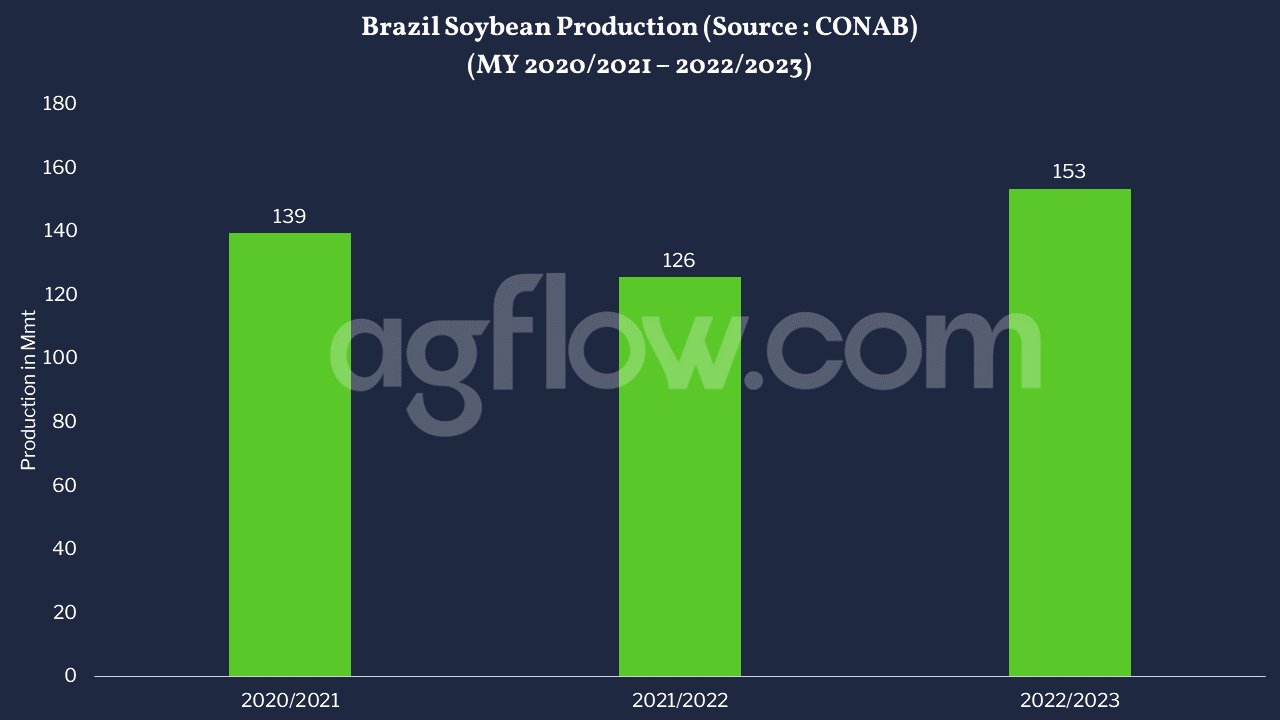

Brazilian Soybean production reached 126 Mmt in MY 2021/2022, a 13 Mmt lower YoY (CONAB), due to La Niña affecting yields mainly in the southern region where Soybean production concentrates. In MY 2022/2023, the USDA estimated a 1.9 Mmt increase in harvested area. In addition, predictions suggest a neutral El Niño Southern Oscillation (ENSO) in February-April 2023. Thus Soybean yields will improve by 0.4 mt/ha YoY, and production will increase by 27 Mmt YoY to reach a record 153 Mmt, 30.4 Mmt higher than U.S production. How does Brazil compete for Soybean trading compared to other large producers, particularly the U.S. and Argentina?

Figure 1: Brazil Soybean Production ( MY 2020/2021 – 2022/2023) (Source: CONAB)

Track Soybean production from Brazil, Argentina, and Up to 62 Other Origins

Free & Unlimited Access In Time

Read also: Kazakhstan Aims to Increase Soybean Output

Brazil Remains the Largest Soybean Exporter in 2022 Despite a 9.2 Mmt Decrease YoY

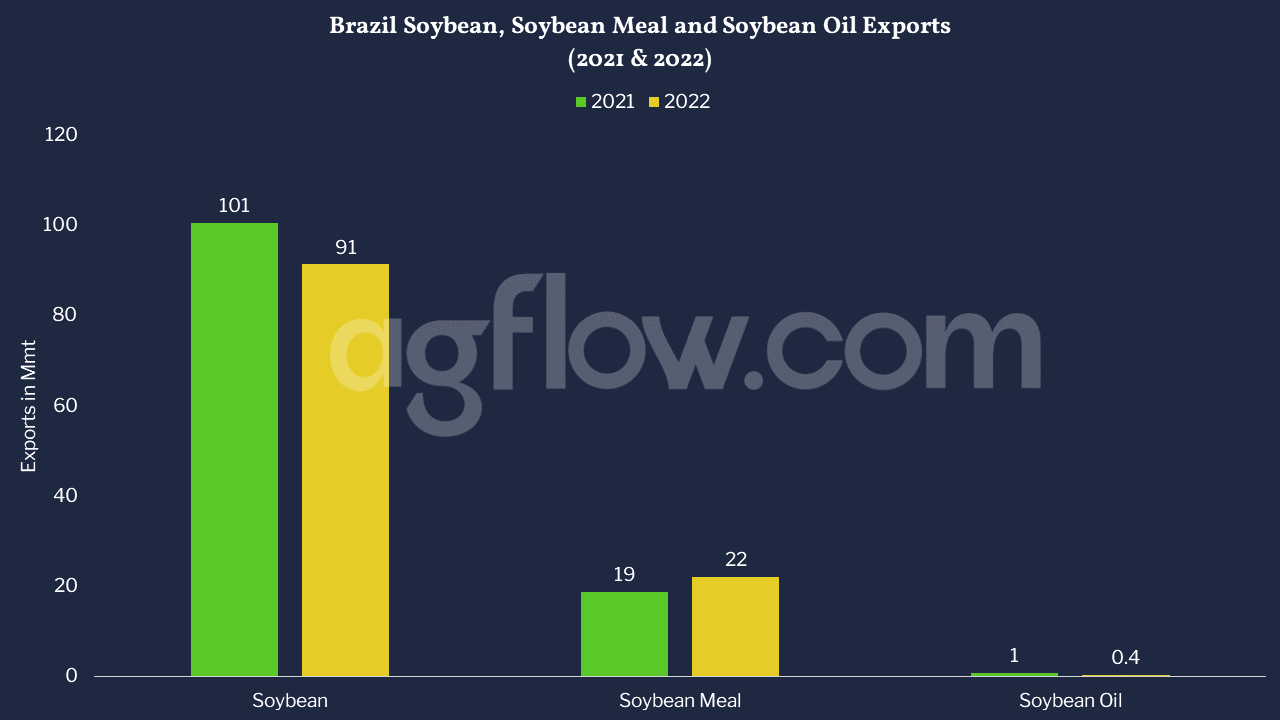

Brazil’s Soybean exports reached 91.4 Mmt in 2022. Soybean Meal exports reached 22.2 Mmt, and Soybean Oil reached 0.4 Mmt. Argentina mostly competes in Soybean Meal and Soybean Oil exports, as it only exports 6 Mmt of Soybean yearly. On the other hand, The U.S., the world’s leading producer, reached 55 Mmt of Soybean exports in 2022, ranking as the world’s second-largest exporter, with 36 Mmt lower Soybean exports than Brazil. However, although Brazil was the largest exporter of Soybeans in 2022, its exports have declined by 9.2 Mmt YoY. Thus, in which markets did Brazil decrease Soybean exports in 2022?

Figure 2: Brazil Soybean, Soybean Meal and Soybean Oil Exports 2021 and 2022

Track Monthly Soybean Exports

From Up to 43 Origins since 2017

Free & Unlimited Access In Time

How Does China’s Limitation on Soybean Imports Affect Brazilian Exports?

Brazilian Soybean exports decreased in 2022 YoY, mainly because China decreased its imports from Brazil by 8.5 Mmt YoY. Meanwhile, China increased Soybean imports by 3.3 Mmt from the U.S., 0.8 Mmt from Uruguay and 0.6 Mmt from Canada. Brazilian exports mainly decreased in April and May 2022 by 4.4 Mmt and 5.3 Mmt YoY, respectively. Yet, despite the overall decline in exports, Brazil partially compensated in other markets, including 1.8 Mmt to the Netherlands, 1 Mmt to Algeria and 0.9 Mmt to Iran. How did Brazilian Soybean and Soybean Meal prices compare with the U.S. and Argentina in 2022?

Figure 3: Brazil’s 3 Top Soybean Destinations (2021 & 2022)

Track Brazil, and Argentina Soybean Exports to Up to 79 Destinations Since 2017

Free & Unlimited Access In Time

Brazil Is the Most Competitive Soybean Exporter in Early 2023

Brazilian FOB Soybean prices peaked at USD 689/mt in April 2022, with the U.S. reaching the same price in March, April, and May and peaking at USD 700/mt in June. After that, Brazilian FOB prices declined to USD 569/mt in July, USD 16/mt lower than US prices on average. In Q4 2022, Brazilian and U.S. Soybean prices were similar. However, since December, Brazilian prices have declined to USD 575/mt, USD 19/mt lower than U.S. prices. Similarly, in the first half of January 2023, Brazilian prices fell to USD 560/mt, USD 28/mt lower than the average U.S. FOB price. For the Soybean Meal, Brazilian FOB prices were higher than Argentina’s in 2022, except in June, when prices were USD 37/mt lower than Argentina’s. Yet, in the first half of 2023, Brazilian Soybean Meal prices are USD 12/mt lower than Argentina’s on average due to the drought conditions affecting Soybean production in Argentina.

Figure 4: Brazil Soybean & Soybean Meal, U.S. Soybean and Argentina Soybean Meal FOB average Prices (Jan 2022 to (1st to 16th) Jan 2022)

Access Up to 1k Soybean, Soybean Meal and Soybean Oil Monthly FOB prices

Free & Unlimited Access In Time

Read also: Indian Soybean Oil Traders Turn to the US

In a Nutshell

While Argentina exports mainly Soybeans in the form of Soybean Meal and Oil, The U.S. exports primarily Soybean. However, Brazil exports Soybean and Soybean Meal and competes with both exporters on both productions.

The leading destination for Brazilian Soybeans in 2022 was China, but overall volumes to China decreased by 8.5 Mmt YoY, contributing to Brazil’s total export decline of 9.2 Mmt YoY.

Despite Brazil’s lower production and exports in 2022, USDA and CONAB estimate that Brazil will record the highest production volumes in MY 2023/2024. In addition, Brazil is already exporting Soybean and Soybean Meal at the lowest prices in early 2023, compared to the U.S. and Argentina, where prices are increasing month on month.