One Year Later: War Effects on Ukraine Wheat Trade

Reading time: 8 minutes

![]() Free Report

Free Report

Ukraine Wheat Production is 41% Lower YoY in MY 2022/2023

Ukrainian Wheat Production reached 33 Mmt in MY 2021/2022, an 8 Mmt increase YoY, due to a 0.6 Mmt increase in harvested area and a 0.75 mt/ha improvement in yields. In MY 2022/2023, the FAO estimated a 40% decrease due to financial constraints, infrastructure damage and obstructed access to fields in parts of the country due to the ongoing Russian war. At the same time, The USDA estimated Ukrainian Wheat harvested area to decrease by 2.18 Mha (-30% YoY), with yields decreasing by 0.57 mt/ha YoY. Thus, Ukrainian production will decrease by 13.5 Mmt YoY (-41% YoY). How did the production decline in MY 2022/2023 affect exports so far?

Figure 1: Ukraine’s Wheat Production and Harvested Area (MY 2019/2020 – 2022/2023)

Track Wheat Production from Ukraine and Up to 109 Other Origins

Free & Unlimited Access In Time

Ukraine Wheat Exports Are 0.5 Mmt higher YoY in Jan 2023

Ukrainian Wheat exports reached 21.4 Mmt in MY 2021/2022, increasing by 4 Mmt YoY. However, 20.8 Mmt of these exports occurred between Jul 2021 and Feb 2022. Since the war started in late Feb, exports only reached 0.6 Mmt between Mar and Jun 2022, a 2.5 Mmt decrease YoY. The Russian war in Ukraine caused exports to stop partially for the rest of MY 2021/2022. However, at the beginning of MY 2022/2023, thanks to the grain corridor agreement in late Jul 2022, Wheat exports reached 10 Mmt between Jul 2022 and Jan 2023, with a 1.8 Mmt decrease YoY. Nevertheless, In Jan 2023, particularly, exports reached 1.6 Mmt, a 0.5 Mmt increase YoY. Thus, what are the main destinations for Ukrainian Wheat in January 2023?

Figure 2: Ukraine’s Monthly Wheat Exports (Jan 2021 – Jan 2023)

Track Ukraine’s Monthly Wheat Exports Since 2017

Free & Unlimited Access In Time

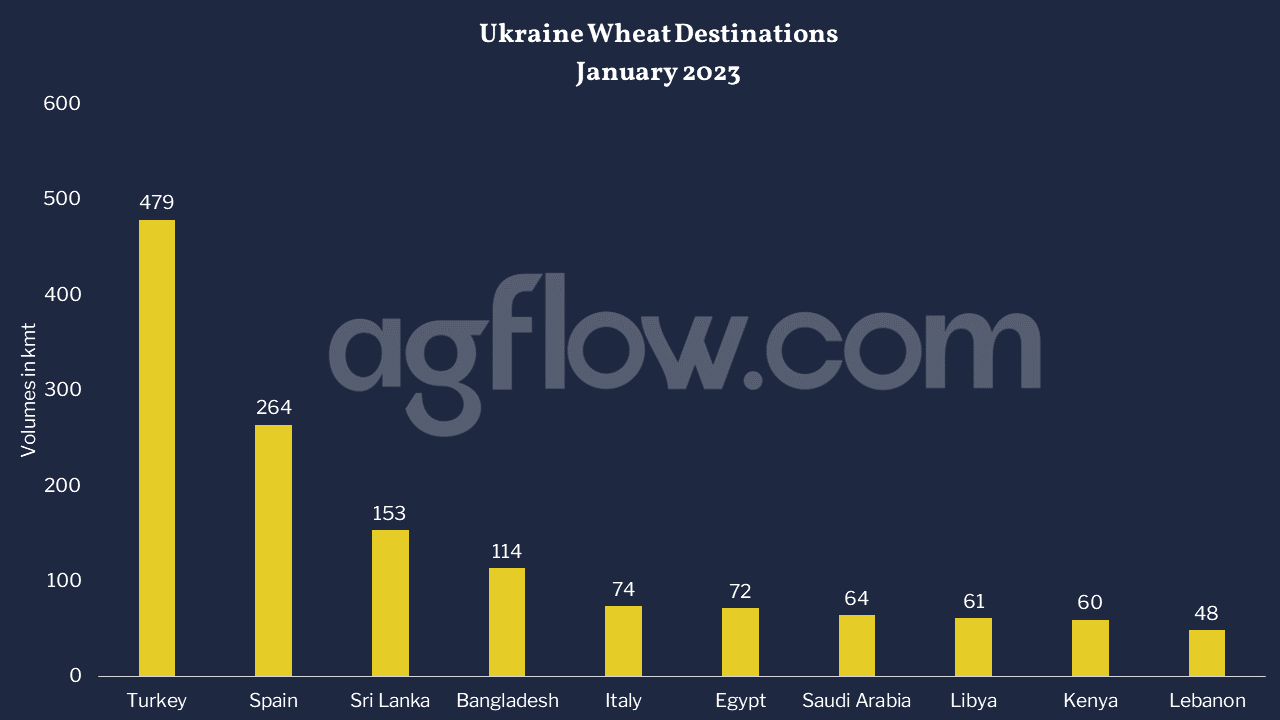

Turkey Remains the Main Destination for Ukraine Wheat in Early 2023

The main destination for Ukrainian Wheat in MY 2021/2022 was Egypt, reaching 3.8 Mmt, an 0.9 Mmt increase YoY, followed by Indonesia with 2.7 Mmt, 0.65 Mmt higher YoY. In MY 2022/2023, Ukrainian exports to Egypt and Indonesia reached 0.5 Mmt and 0.4 Mmt, respectively, between Jul 2022 and Jan 2023. Meanwhile, Turkey ranked as the main destination during the same period, reaching 3 Mmt, and increasing by 1.2 Mmt YoY. Spain ranked second with 1.5 Mmt, followed by Italy with 0.5 Mmt, increasing by 1.1 Mmt and 0.2 Mmt YoY, respectively. So far in February 2023, Ukrainian exports reached 0.6 Mmt, with 0.3 Mmt heading to Turkey and 0.2 Mmt to Spain. However, Turkey‘s top exporter is Russia, with 0.6 Mmt so far. How do Russian Wheat FOB prices compare to Ukrainian prices since the war?

Figure 3: Ukraine’s 10 Top Wheat Destinations in January 2023

Track Ukraine’s Wheat Exports to Up to 71 Destinations Since 2017

Free & Unlimited Access In Time

Ukraine Wheat FOB Prices Remain Lowest Despite Tight Supply

Ukrainian wheat FOB prices are lower than Russia’s , with the exception of a peak at USD 391/mt on average in April 2022. Two months after the war, Ukraine Wheat prices were USD 9/mt higher. Ukrainian wheat prices declined thereafter and continued to be lower in MY 2022/2023 despite the ongoing war. In Jan 2023, Ukrainian wheat FOB prices were 24 USD/mt lower than Russia’s. Similarly, in February, they are 18 USD/mt lower, so far. In addition, prices are USD 37 /mt and USD 26 /mt lower YoY in Jan and Feb, respectively, despite Shortages and reductions in Ukrainian production. This is partially due to the lower demand for Ukrainian products, as fewer insurers provide Ukrainian commodities shipments with their services.

Figure 4: Russia and Ukraine Wheat FOB Prices ( Jan 2022 – Feb 2023)

Access +3.9k Wheat Monthly FOB Prices

Free & Unlimited Access In Time

In a Nutshell

The FAO and USDA estimate a high decline in Ukrainian Wheat production for MY2022/2023, driven mainly by the Russian war starting in Late Feb 2022. However, Ukrainian Wheat exports were relatively high at the beginning of MY 2022/2023, thanks to the grain corridor agreement.

In MY 2022/2023, Ukraine exported Wheat mainly to Turkey, Spain and Italy between Jul 2022 and Jan 2023. Yet, more Wheat heads to Europe through rail and road networks that connect to Eastern Europe and on barges travelling to the Danube River.

Finally, Ukrainian Wheat FOB prices remain lower YoY because it is hard to ship Ukrainian commodities as shipping insurers altered their policies for 2023 to exclude claims linked to Russia’s war in Ukraine.