Agricultural Market Coverage – Week 26

Reading time: 5 minutes

China Livestock Market Drives Soybean Meal Imports

China is the world’s largest Soybean importer, which is usually crushed domestically. Recently, however, China saw its Soybean Meal imports increase in an effort to increase its stocks, reduce input costs, and increase the pork margins. By Feb 22, the Brazil Soybean crop was out, and China Soybean Meal imports increased by 126 kmt YoY. From Mar to May, China Soybean Meal imports started ramping up, peaking in Mar with a 264 kmt increase YoY. Despite Soybean imports picking up again in Jun, Soybean Meal imports remained strong. Overall, China imported 1.06 Mmt of Soybean in the first half of 2022, more than three times that of 2021.

2022 China Soybean Meal Imports

Track Soybean Complex Cargos to China From Brazil, Argentina, & 4 Other Origins

Free & Unlimited Access In Time

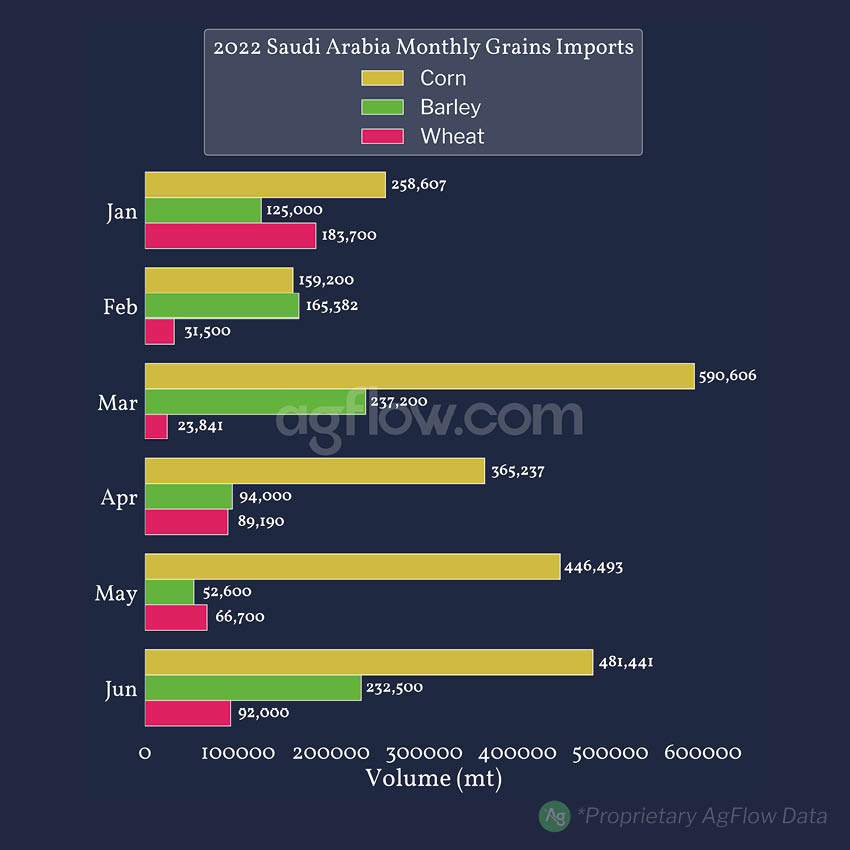

The Strange Case of Saudi Arabia Grains Imports

Saudi Arabia relies on Wheat & Barley to make bread, a staple food for the country. Since Jan 22, Saudi Arabia Barley & Wheat imports have plummeted, decreasing every month and down by as much as 459 kmt in Mar for Barley & 179 kmt in May for Wheat. Meanwhile, Corn imports thrived, increasing by as much as 416 kmt in Mar 22, also becoming the second-largest import month for Corn in 3 years. In the first half of 22, Saudi Arabia decreased Barley & Wheat imports, down by 1.39 Mmt & 457 kmt, respectively. Conversely, Corn imports increased by 690 kmt, perhaps to increase livestock production? SAGO repeatedly announced its stocks were high since 2021 but will probably have to pick up the pace with the 22/23 crop, as reserves are slowly but surely depleting.

2022 Saudi Arabia Grains Imports

Track Grains Cargos to Saudi Arabia From Up to 8 Origins, & Track Tender Results

Free & Unlimited Access In Time

Russia Grains Exports Pace Brakes in June

Since the Ukraine conflict started at the end of Feb 22, Russia Grains exports have performed very well, outpacing the previous years’ monthly exports. However, exports slowed down rapidly in Jun, as Russian Wheat exporters are reaching their quotas. The pace reduced each week except for week 23, where Russia improved exports only by 7 kmt versus the same period in 2021. In week 25 alone (Jun 20 – 26), exports dropped 508 kmt YoY. Despite Corn & Barley export pace increasing for the month, the dwindling supply of Wheat —Russia’s top agricultural export— led Russia exports to plummet to 2.07 Mmt for the entire month.

Russia Cumulative Grain Exports Delta in Jun: 2022 v. 2021

Track Grains Cargos From Russia to Up to 55 Destinations

Free & Unlimited Access In Time

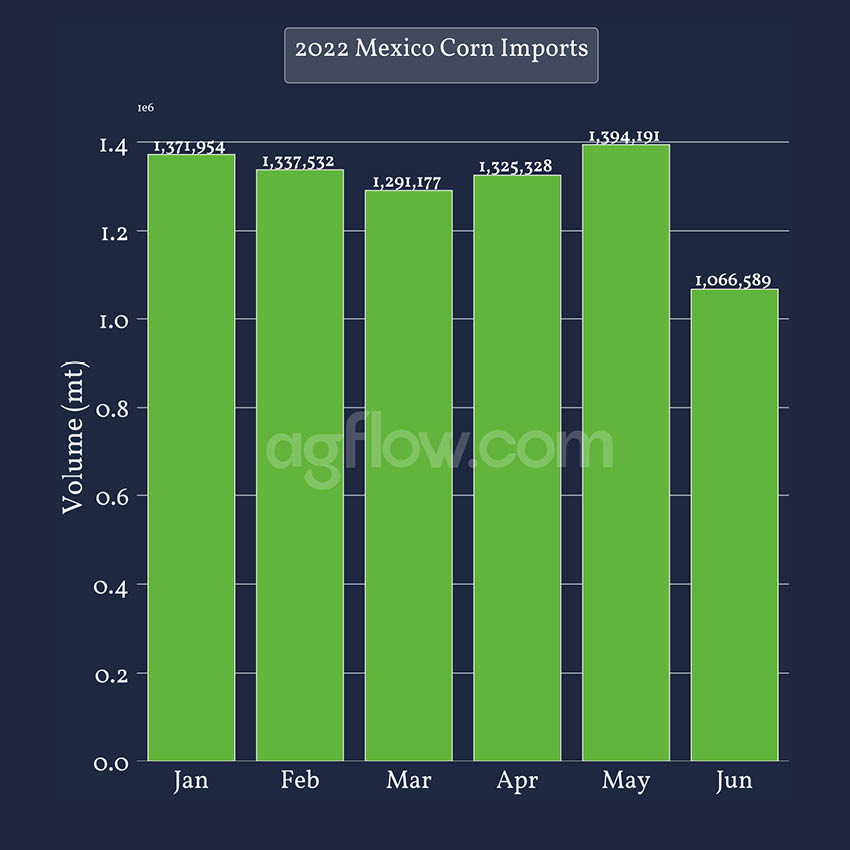

Mexico Corn Imports Decrease In 2022

Mexico is the largest importer of Corn from the US and relies heavily on this supply to fulfill the domestic demand, as it serves as animal feed and a staple food. Despite a strong start in early 22, with Jan & Feb imports increasing by 303 & 205 kmt respectively, Mexico Corn imports decreased YoY, starting in Mar by 355 kmt, by 223 kmt in May, & 244 kmt in Jun. Overall, Mexico imported ~7.78 Mmt in the first half of 22, ~357 kmt less YoY. The most recent USDA reports estimate that Mexico imports will increase by 200 kmt in 22/23, reaching 17.7 Mmt. Is Mexico slowing down as it waits for the Brazilian market, or is the demand waning?

Mexico Monthly Corn Imports Between Jan & Jun 2022

Track Corn Cargos To Mexico From Up to 15 Ports in the US & Brazil

Free & Unlimited Access In Time