Agricultural Market Coverage – Week 24

Reading time: 5 minutes

Japan Wheat Imports Grow Despite Surging Prices

Due to tight global supply, global inflation, and the conflict in Ukraine (among others), Wheat export prices to Japan surged above the 600 $/mt in May. However, Japan Wheat imports increased throughout 2022 so far; Japan Wheat imports increased by ~54 kmt in Feb, ~150 kmt in Apr, & 220 kmt in May YoY. Overall in 2022, Japan increased Wheat imports by 349 kmt YoY. The cost of the commodity seems to be the price to pay for one of Japan’s staple foods. Japanese Farmers are switching Rice fields to Wheat to try and curb prices, but Japan cannot be self-sufficient in the long term, depending on the US, Australia, and Canada for its Wheat imports.

Japan Monthly Wheat Imports Between Jan & May 2022

Track Wheat Cargos to Japan From Australia, Canada, & the US

Free & Unlimited Access In Time

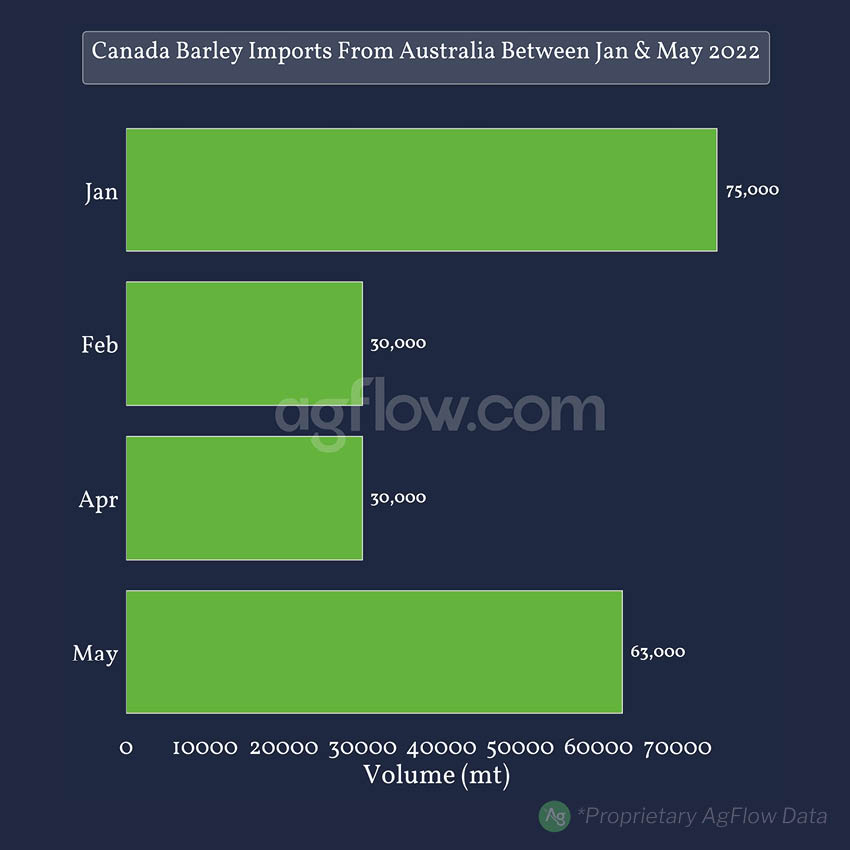

Canada Forced to Import Barley From Competing Australia

Canada Barley 21/22 production suffered heavily from droughts, limiting exports and domestic consumption. The impact was so severe that Canada has had to import Barley from competitor Australia in 2022. Officially, Canada is expected to import 100 kmt of Barley from Australia (ABARES & other private sources) before the next crop in Aug 22. However, according to our data, from Jan & by Feb 22, Canada had already imported 105 kmt of the commodity. So far, 198 kmt of Barley has been shipped to Canada from Australia, slightly less than twice the amount announced. If Canada imports continue following the same pace, they could reach more than 250 kmt by the end of MY 21/22.

Canada Barley Imports From Australia Between Jan & May 2022

Track Barley Cargos From Australia to Canada, Saudi Arabia, & 26 Other Destinations

Free & Unlimited Access In Time

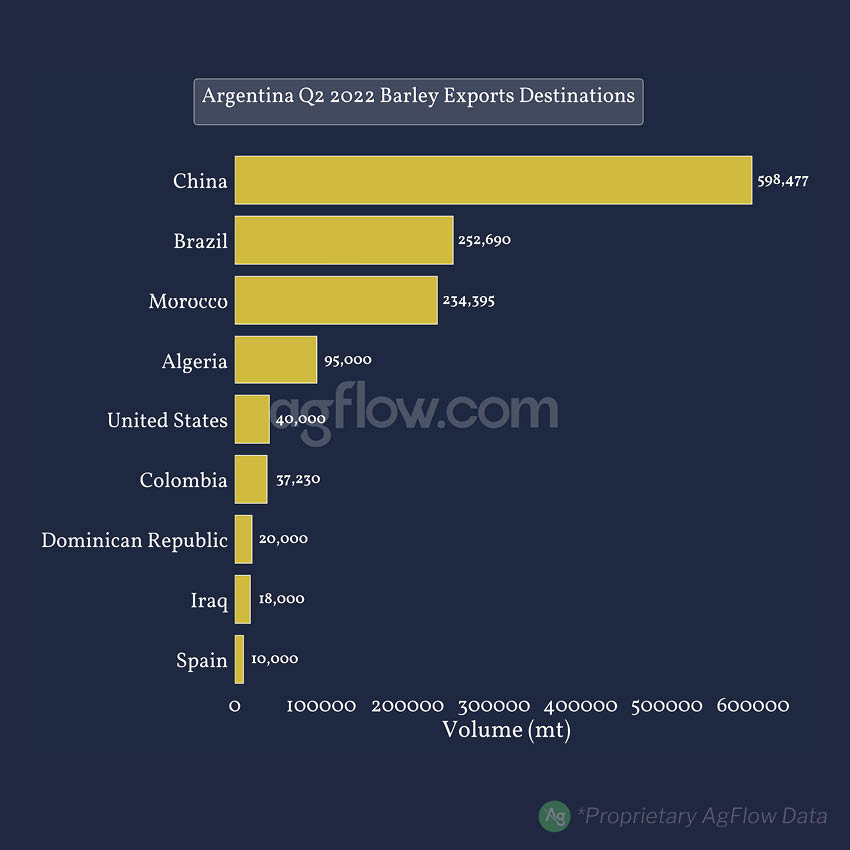

Argentina Barley Exports Soar in Q2 2022

Following China’s embargo on Australia Barley in 2020, Argentina Barley exports rose as the product became more attractive. In Q2 2022, China remains the largest importer of Argentina Barley, increasing imports by 226.5 kmt YoY. MERCOSUR Intra trade with Brazil & Colombia also increased ~47 kmt & 7 kmt respectively. Argentina also diversified destinations, with Morocco & Algeria (which did not import Barley from Argentina in Q2 2021) demand shifting due partly to Ukraine exports stopping with the conflict. On Jun 14th, 22, Argentina increased Q2 Barley exports by 698 kmt YoY.

Argentina Barley Exports Between May & Jun 14th, 2022

Track Barley Cargos From Argentina to China, Indonesia, & 34 Other Destinations

Free & Unlimited Access In Time

Can Russia Reach Sunseed Oil Export Quotas?

Following an announcement made on Mar 31th, 2022, Russia banned exports of Sunseed & imposed export restrictions on Sunseed Oil, with a quota of 1.5 Mmt between Apr 15th & Aug 31st, 2022. In Apr & May 22, Russia increased its Sunseed Oil exports by 48 kmt & 66 kmt YoY, respectively, and doubled exports volume YoY over the two months. Nonetheless, the quota time limit is now one and a half months away, and Russia exported only 227 kmt of Sunseed Oil —as measured on June 15th, 22— representing only 15% of the imposed limit. Are Russian exporters struggling to export Sunseed Oil, or did the government allow a large degree of leeway?

Russia Sunseed Oil Exports In Apr & May 2022

Track Sunseed Oil Cargos From Russia to India, Turkey, & 8 Other Destinations

Free & Unlimited Access In Time