Will Brazil Corn Exports Cover the Lack of Supply in 2022/23?

Reading time: 5 minutes

Brazil Corn Record Production in Light of 2021/22 Exports

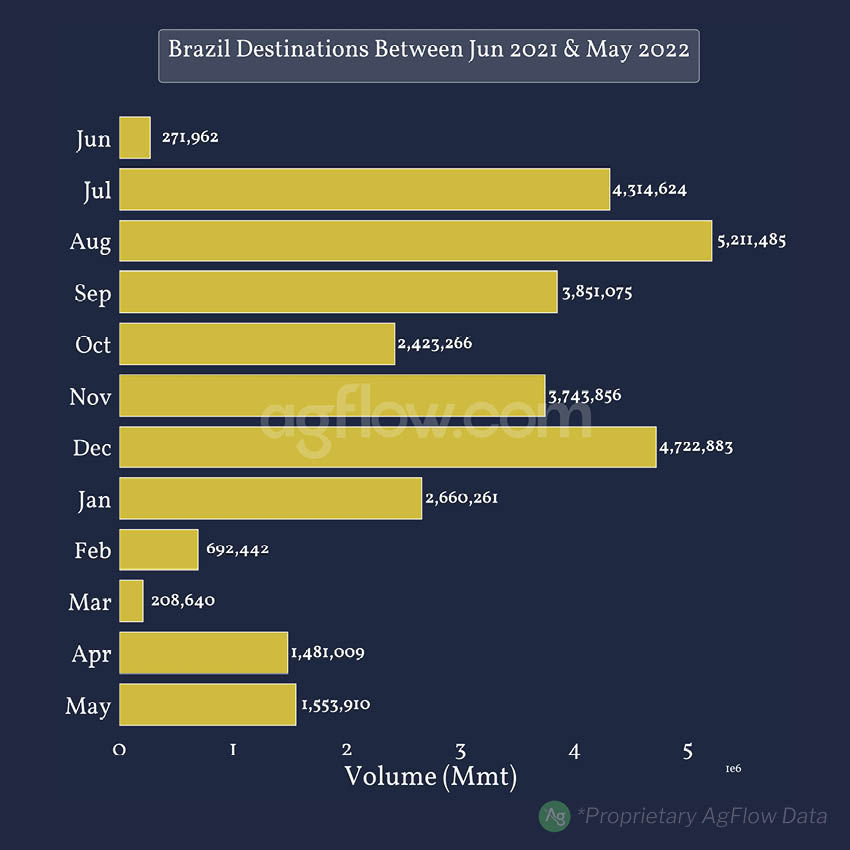

As the harvest season for Brazil Safrinha Corn crop continues, the production forecast remained stable in Jul 2022, with a record 44.5 Mmt available at export. Between Jun 21 and May 22, Brazil exported 31.1 Mmt of Corn, down 10 Mmt YoY. Between Jun and Dec 21, monthly exports decreased YoY, by as much as ~3.5 Mmt in Sep 21. However, since Mar 22 and the loss of the Ukraine Corn supply (4th largest exporter in the world), out-of-season exports picked up considerably, increasing by 1.46 Mmt & 1.52 Mmt YoY in Apr & May 22. The new Safrinha Corn crop comes into the second half of 22 with a tighter market but a slow demand nonetheless. Now, are Brazil Corn prices competitive with the major origins?

Brazil Corn Exports Between Jun 2021 & May 2022

Track Corn Cargos From Brazil to Up to 49 Destinations

Free & Unlimited Access In Time

Brazil Corn Prices Hike & Fall in H1 2022

Brazil Corn prices mainly compete with Argentina & the US. Since the beginning of 22, Corn prices surged, reaching ~364 USD/mt for Brazil & the US on the first week of Mar with the start of the war in Ukraine. Between Jan & Mar, prices hiked for Brazil the most, gaining 93 USD/mt (+34%). However, Brazil prices rapidly tumbled despite swelling 30 USD/mt between the last week of May & the 1st week of Jun 22 due to weather-induced incertitude. Indeed, Soil moisture levels were at 37% saturation level on May 20th (10% below the 5Y avg) but rapidly rose to 55% in Jun, 2% above the 5Y avg. Brazil prices are currently more competitive than main competitors’ by ~ 5 USD/mt with Argentina & by 69+ US/mt with the US. With competitive prices and a record export crop, which importers will benefit from the Brazil Safrinha Corn crop?

Argentina, Brazil, & US Yellow Corn FOB Spot Prices Jan to Jul 2022

Follow +13k Monthly Corn Cash Prices From Brazil, the US, & to Up to 27 Other Origins

Free & Unlimited Access In Time

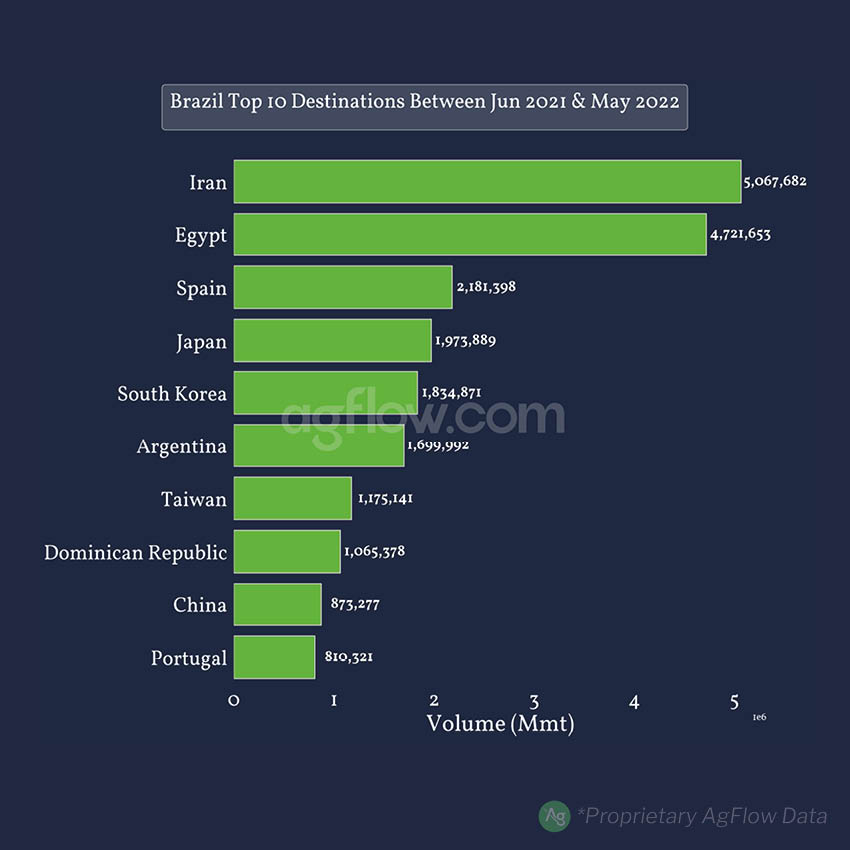

Brazil Corn Exports Focused on MENA & MERCOSUR in 2021/22

As one of the world’s largest Corn exporters, Brazil’s supply is critical to many significant importers. Between May 21 & Jun 22, Brazil supplied heavily to Iran—the top commodity importer— which relied even more on this crucial feed product due to poor crops domestically, and imports rose by 836 kmt YoY. Egypt also increased its imports by 409 kmt YoY in light of the Ukraine Corn supply loss in Mar 22. Nonetheless, exports to Asian countries such as China, Japan, & South Korea dropped drastically by 409 kmt, 300 kmt, & 1.64 Mmt YoY, respectively. Meanwhile, MERCOSUR intra-trade with Argentina surged by 1.64 Mmt YoY. Brazil strengthened its largest market in MENA due notably to the loss of Ukraine supply. Therefore, which origin is Brazil competing with for these markets?

Brazil Corn Top 10 Destinations By Volume Between Jun 2021 & May 2022

Track Corn Cargos From Brazil to Up to 49 Destinations

Free & Unlimited Access In Time

Brazil Corn Exports Compete With Argentina in Egypt, Thrives in Iran in 2022

Iran & Egypt are major Corn importers and the top 2 destinations for Brazil Corn exports. In Egypt, Brazil Corn increased its market share as imports rose ~333 kmt YoY while Argentina Corn imports decreased 72 kmt YoY in H1 22. The conflict in Ukraine also helped Brazil in this instance, as Ukraine Corn imports dropped 1.84 Mmt over the period YoY. Moreover, Brazil thrives in Iran and even more so in 22. Indeed Brazil Corn imports surged by 1.47 Mmt YoY, the most considerable growth for any competing origins. Meanwhile, Russia & Romania Corn exports also benefitted from the situation, increasing by 204 & 255 kmt YoY.

Egypt & Iran Corn Imports By Origin Between Jan & Jul 2022

Track Corn Cargos to Egypt & Iran From Brazil & Up to 5 Other Origins

Free & Unlimited Access In Time

In a Nutshell

Brazil Safrinha Corn comes in 2022 with a record crop production, thanks to a larger crop area and suitable weather conditions providing above-average soil moisture during the growth stage.

Additionally, the supply availability and current slow demand for Corn globally have driven prices below last year’s level for Brazil, and it is now the cheapest origin compared with Argentina and the US, as well as the de-facto most competitive origin on the market as of July 2022. Moreover, Brazil Corn consolidates its position in Egypt & Iran, even gaining more market share in 2022 in these countries. This is due notably to droughts reducing domestic crops & the war in Ukraine making this supply unavailable— despite intense competition from Argentina in Egypt.

All in all, Brazil Safrinha Corn will be able to supply its core markets with ample supply and low prices. It will also benefit from Ukraine’s difficulties in exporting its staple product in 22/23 to diversify its pipelines, providing more Corn globally and in the MENA region particularly.