Brazilian Corn: A Good Alternative to Ukrainian Cuts

Reading time: 8 minutes

![]() Free Report

Free Report

Brazil Improved Corn Yields Thanks to GM Seeds

Brazil is a leading Corn producer, reaching 116 Mmt in MY 2021/2022. However, Due to La Niña in 2020, Brazilian Corn yields decreased to 4.37 mt/ha, the lowest rate in the past four years, leading production to decline by 16 Mmt YoY in MY 2020/2021, despite a 1.4 Mha increase in the harvested area. In MY 2021/2022, Brazil increased the Corn harvested area by 1.9 Mha, and improved yields by 0.95 mt/ha YoY partially due to the expansion of genetically modified Corn seed; thus, production increased by 30 Mmt YoY. In MY 2022/2023, the USDA estimates yields will improve by 0.23 mt/ha, and the harvested area will increase by 900 kha. Thus, Brazil’s Corn production should increase by 10 Mmt YoY.

Figure 1: Brazil Corn Production (MY 2018/2019 – 2022/2023)

Track Corn Production in Brazil & Up to 138 Other Origins Since 2015

Free & Unlimited Access In Time

Read also:Ecuador to Reduce Corn Planting Area

Brazil Corn Domestic Consumption Exceeds Exports

In MY 2021/2022, Brazil exported a mere 27 Mmt of Corn – the lowest volumes over the past four years – even though Corn production reached 116 Mmt. Meanwhile, domestic consumption reached 72.5 Mmt (~ 63% of production) in the same MY, the highest volume over the past four years. Brazilian Corn domestic consumption averages more than 67 Mmt yearly, of which 57 Mmt heads to the animal feed sector. The USDA estimated domestic consumption will increase by 4.5 Mmt YoY in MY 2022/2023. Yet, Corn Exports reached 41 Mmt between Mar and Nov 2022, increasing by 17.2 Mmt YoY. Has the global Corn shortage due to the war in Ukraine in 2022 prompted Brazil to export more Corn than usual?

Figure 2: Brazil Corn Exports (MY 2019/2020 – 2022/2023)

Track Corn Production in Brazil & Up to 138 Other Origins Since 2015

Free & Unlimited Access In Time

Brazilian Corn Remains the Main Supplier for Iran in 2022

Iran is the primary destination for Brazilian Corn, reaching 4.2 Mmt in MY 2021/2022, followed by Egypt with 4.1 Mmt. Due to troubled relations with Argentina, and limited supply in Ukraine, Brazil remained the main Corn supplier for Iran in 2022, increasing by 2.5 Mmt YoY between Mar and Nov 2022. Similarly, Egypt increased Brazilian Corn imports by 1.3 Mmt YoY, however, it ranked as the fifth destination. Meanwhile, Japan increased imports by 3 Mmt YoY and ranked second, followed by Panama and Taiwan, which increased their imports by 172 kmt YoY and 516 kmt YoY, respectively. In addition, the supply disruption due to the war in Ukraine pushed Brazil to look for new markets, particularly the UAE with 673 kmt and the US with 254 kmt in 2022. How did the war in Ukraine affect Brazilian Corn prices?

Figure 3: Brazil’s 5 Top Corn Destinations (MY 2021/2022 & Mar – Nov 2022)

Track Brazil, and Argentina Soybean Exports to Up to 79 Destinations Since 2017

Free & Unlimited Access In Time

Read also: Brazil Is Losing the Italian Soybeans Market

China’s Imports From Brazil Remain Stable Despite Prices Rising

China’s Soybean imports have remained stable over the last three years, ranging from 4.2 Mmt to 12.7 Mmt monthly. In 2020, the delta between Brazilian and U.S. CFR price indications remained in favor of the U.S., with peak spreads at USD 57/mt in Jan and USD 50/mt in Dec. In 2021, China’s Soybean imports from the U.S. peaked at 8 Mmt in Oct, with U.S. CFR prices at USD 33/mt cheaper than in Brazil. Yet, in 2022, Brazil will remain the major Soybean supplier for China despite lower U.S. Soybean CFR prices, meaning that Soybean prices are less of a driver of Chinese demand than the seasonal supply.

Figure 4: Monthly U.S. & Brazil Soybean Exports CFR Estimations to China Between January 2020 and September 2022

Access + 1k Daily Soybean CFR indications to Up to 24 Destinations

Free & Unlimited Access In Time

Read also: Indian Soybean Oil Traders Turn to the US

In a Nutshell

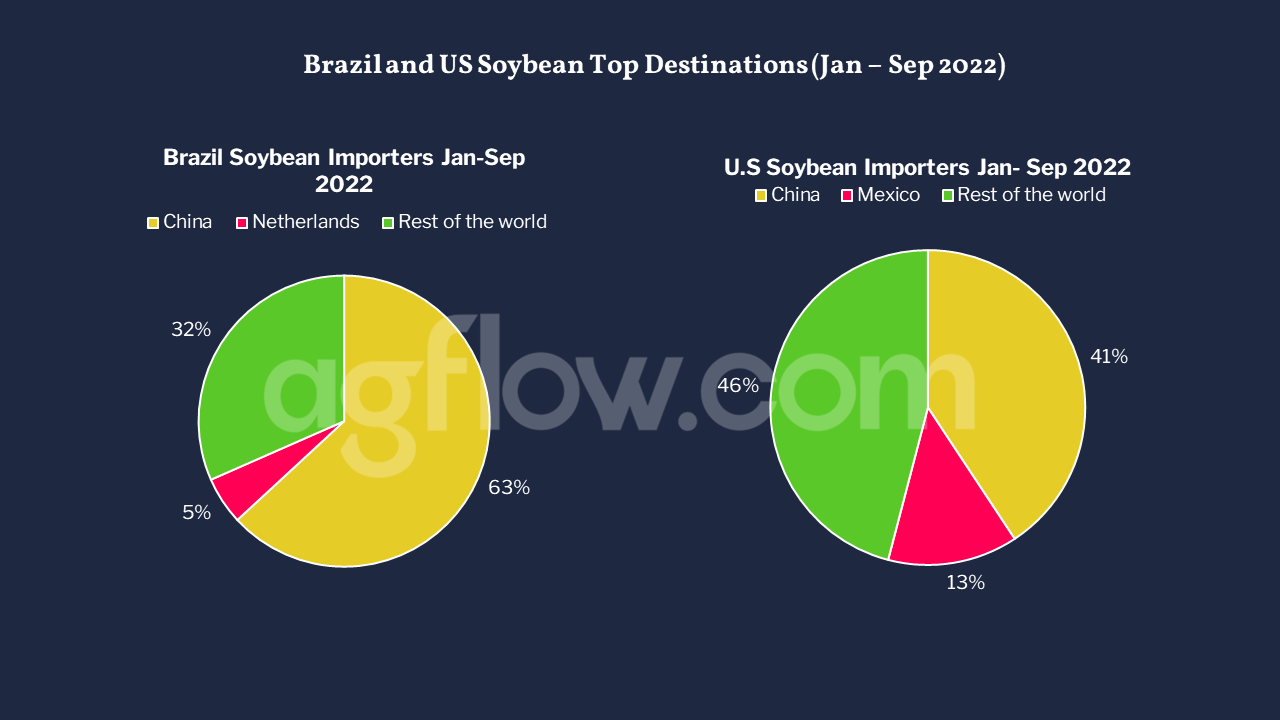

With a population of 1.426 bn China has one of the largest global consumer markets, especially when it comes to Soybean used for animal feed and edible oils making China the largest export market for Soybeans worldwide. The country only produces 15% of its Soybean consumption and imports the rest mainly from Brazil and the U.S.

Brazil is the primary supplier of Soybean to China, with exports rising periodically regardless of prices. Soybean imports from Brazil increased by 7 Mmt between 2020 & 2021, while imports from the U.S. decreased by the same amount. Yet, U.S. Soybean exports to China increased in Q1 & Q2 2022 YoY, showing a renewed interest in U.S. Soybean products.

Finally, in addition to the growing consumption, China’s Soybean area harvested decreased by 1.29 Mha over the past five years to 23.38 Mha in 2020/2021. Thus, China’s reliance on Soybean imports is meant to last. With rising tensions with the U.S., China is developing new import pipelines in LatAm and Russia.