Will There Be A Canada Barley Exports Resurgence in 2022/23?

Reading time: 1 minute

Canada Barley Exports Downfall In 2021/22

Canada is a net Barley exporter. However, the production collapsed due to the heat dome that hit North America during Summer 21. Despite the poor production, exports rose in the first two months of the marketing year, increasing by 224 & 97 kmt YoY in Sep & Oct 22, respectively. However, the pace rapidly decreased as the supply could not follow, with exports dropping 253 kmt YoY in Nov 22 and rising by 146 kmt YoY in Dec 22. Consequently, exports also plunged continuously from Jan through to Jun, by as much as 552 kmt in Apr. Overall, Canada Barley exports fell by 1.8 Mmt YoY in MY 21/22, a 47.2% decrease. Since Canada wasn’t able to supply its usual markets, which destinations were impacted?

Figure 1: Canada Barley Monthly Exports Between Aug 2021 & Jul 2022

Track Barley Cargoes From Canada, Australia, & Other 23 Origins

Free & Unlimited Access In Time

Canada Barley Exports Rose in South Korea But Couldn’t Fulfill China in 2022

In 20/21, Canada Barley exports rose to China as political tensions with Australia led the country to source premium Barley from other origins. In 21/22, Canada could not follow the previous year’s pace, and Barley exports to China decreased by 1.7 Mmt (-50%) YoY. This downtrend also happened in the formerly top 2 and 3 destinations, with Barley exports to Japan & the US down by 79 & 53 kmt YoY, respectively. Nonetheless, Canada Barley exports found solace in South Korea, rising 127 kmt YoY. With Canada Barley occupying a lower share of almost all its top markets, which origin did importers turn to in 21/22?

Figure 2: Canada Barley Exports Destination Between Aug 2021 & Jul 2022

Track Barley Cargoes From Canada to Up to 9 Destinations

Free & Unlimited Access In Time

The Rise of Argentina Barley Exports in 2021/22

Due to Canada Barley exports’ downfall, China—the largest Barley importer globally— relied even more on Ukraine Barley supply in 21/22. However, with the war in Ukraine blocking the supply, imports decreased severely, dropping by 912 kmt YoY. This situation benefitted Argentina & Australia the most, as exports to China surged 1.03 Mmt & 340 kmt YoY, respectively. Moreover, the US & Japan also promoted these pipelines, as Japan increased Australia Barley imports by 235 kmt YoY, and the US introduced Argentina Barley with 135 kmt in 21/22. Overall, Argentina & Australia allowed the US & Japan to increase Barley imports by 117 & 156 kmt YoY. Meanwhile, China is struggling without Ukraine or Canada, as imports decreased by 1.36 Mmt YoY.

Figure 3: China, Japan, US Barley Imports By Origin Between Aug 2021 & Jul 2022

Track Barley Cargoes to China, US, & Japan From 13 Origins

Free & Unlimited Access In Time

Canada Short Barley Supply Lead to Extraordinary Imports in 2021/22

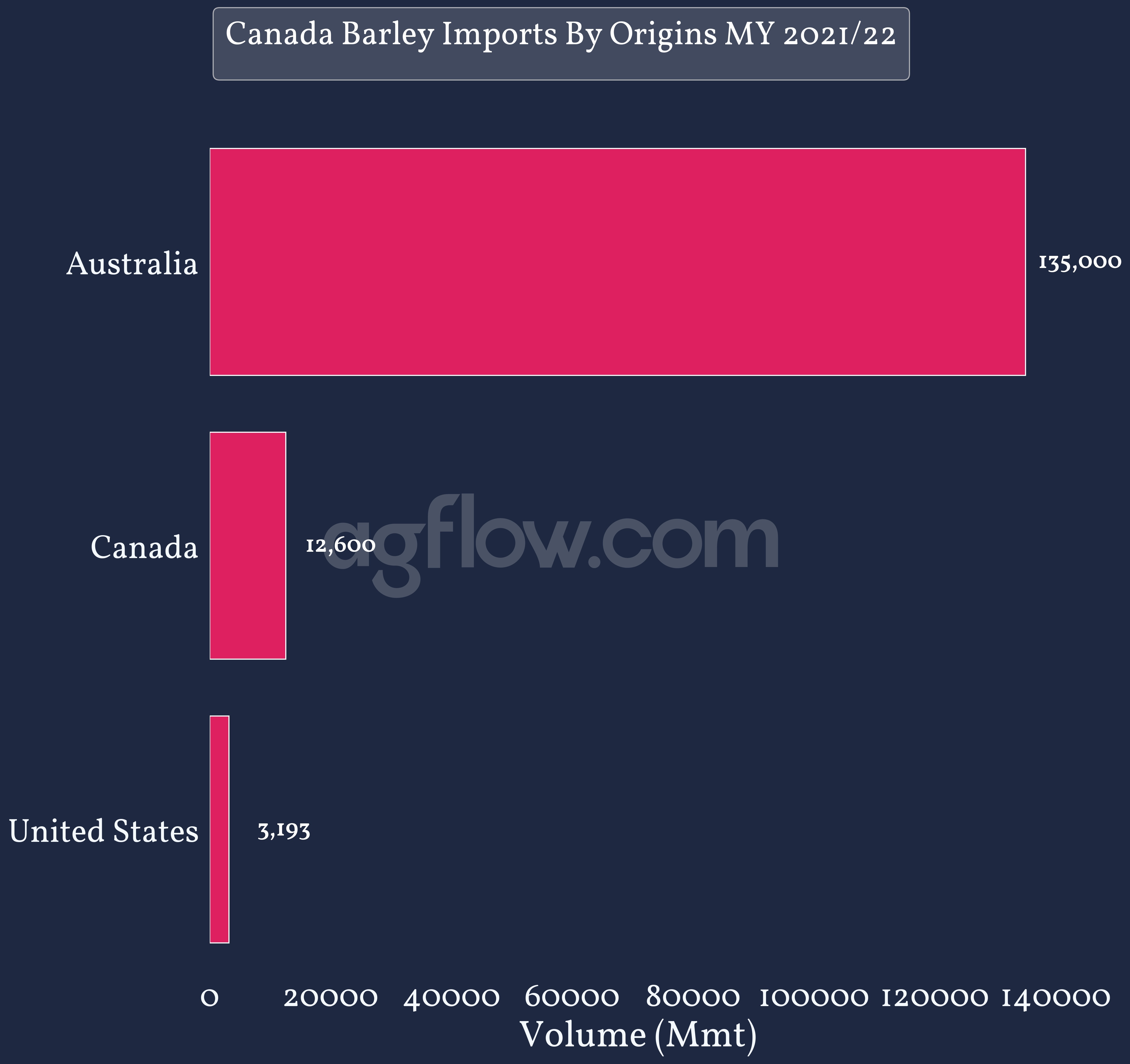

While Canada Barley exports tumbled in 21/22, the Barley supply did not manage to satisfy domestic consumption. As a net exporter of Barley, Canada Barley imports usually remain low, importing only ~41 kmt in 20/21, mainly from France. Exceptionally, Canada imported 135 kmt Barley from competitor Australia to meet the demand and some of its reserves. Moreover, though in small volumes, the US increased Barley exports to Canada by 2.3 kmt YoY. Overall, Canada Barley imports (proportionally) surged 109.9 kmt YoY, reaching 150.3 kmt in 21/22. Consequently, 22/23 Canada Barley supply started lower, which will pressure export prices.

Figure 4: Canada Barley Imports Between Aug 2021 & Jul 2022

Track Barley Cargoes to Canada From 4 Origins

Free & Unlimited Access In Time

In a Nutshell

Canada Barley production faced a severe cut in 21/22 due to the extreme droughts and temperatures during Summer 2021. Consequently, Canada Barley exports decreased YoY significantly and could not follow the pace of the previous seasons. This situation impacted China primarily (as it relied heavily on Canada and Ukraine Barley supplies since political tensions arose with Australia in 20/21), Japan, and the US.

Canada Barley exports limitations in 21/22 then allowed other origins —Argentina and Australia in particular— to increase their exports towards these critical destinations. Moreover, the 21/22 Canada Barley supply forced actors in the Canada Barley supply chain to import from Australia to meet the domestic demand.

Overall, the dire Barley production conditions limited Canada exports and self-sufficiency in 21/22, leading to a historically low carryover supply in 22/23 and forcing exporters to rely directly on the new crop. Nonetheless, the growing conditions were more favorable in Summer 2022 than in the previous year, and the production —while below average— should increase 30% YoY according to CGC. Therefore, Canada Barley exports in 22/23 should recover to near-average levels and well above 21/22.