Will Egypt Corn Imports Rise In 2022/23?

Reading time: 1 minute

Egypt Corn Imports Decreasing In H1 2022

Corn is a staple commodity for Egypt as it is the main feed supply for its Poultry, Dairy, Eggs, & Red Meat industries. Egypt Corn imports dropped in H1 22 due to high stocks in Q1. Indeed, in Jan & Feb 22, Corn imports fell 631 & 632 kmt YoY respectively. In Mar 22, the Ukraine war cut a major Corn pipeline for Egypt, and imports continued decreasing through to Apr, tumbling by 441 kmt YoY for the period. Overall, Egypt imported 1.68 Mmt less Corn YoY in H1 22. However, Egypt managed to get by without the Ukraine supply since Mar as imports in May were almost stable (-0.8%) and even increased by 35 & 42 kmt YoY in Jun & Jul 22. Therefore, from which origins does Egypt import Corn?

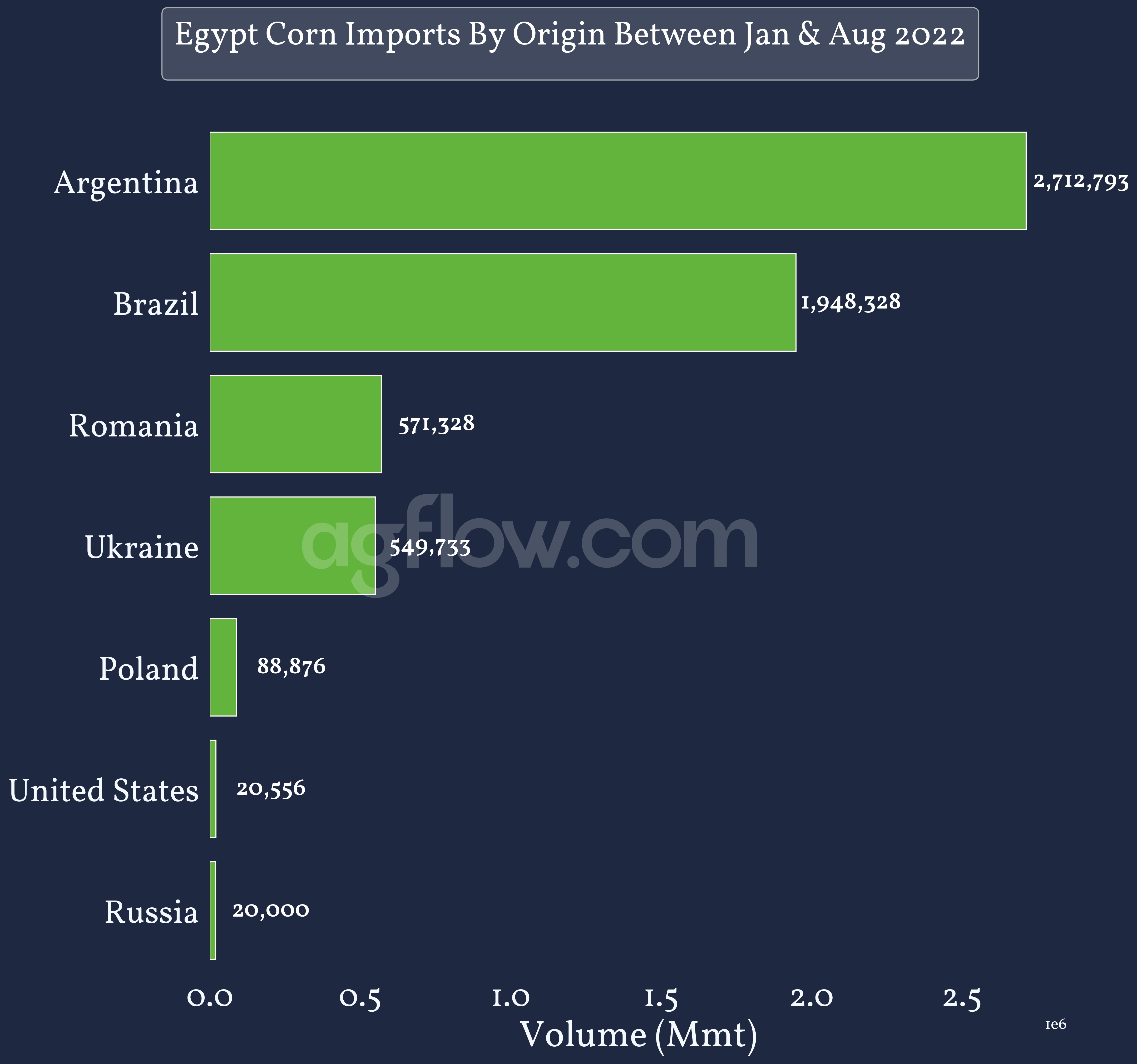

Figure 1: Egypt Corn Imports Between Jan & Aug 2022

Track Corn Monthly Import Volumes & Individual Cargos to Egypt Since 2017

Free & Unlimited Access In Time

Egypt Sought Corn In Brazil & Romania As Alternative to Ukraine in 2022

Egypt was one of Ukraine’s top Corn importers before the war. Due to the blockade in the Black Sea, Egypt had to seek other sources of Corn. Indeed, Egypt favored its Brazil & Romania Corn pipelines, increasing imports by 481.5 & 284.4 kmt YoY between Jan & Aug. Moreover, Egypt imported Corn from Poland & Russia during the period, which it did not at the same time last year. Nonetheless, Egypt lost most of the supply from its major pipelines, decreasing imports from the US, Argentina, & (necessarily) Ukraine by 484 kmt, 465 kmt, & 2.03 Mmt YoY. Yet, the US & Argentina have available supplies. Did Corn pricing influence Egypt’s Corn Import pipelines?

Figure 2: Egypt Corn Imports By Origin Between Jan & Aug 2022

Track Corn Cargoes to Egypt From Brazil, the US, & 5 Other Origins

Free & Unlimited Access In Time

Egypt Corn Shipping Costs Were Mixed in H1 2022

In Q1 22, Egypt benefited from better execution from Romania, thanks notably to a shorter freight distance and a cheaper product. Indeed, Romania Corn CFR Egypt prices remained around 300 $/mt between Jan & Feb 22. Meanwhile, Argentina, Brazil, & the US were 37, 42, & 43 $/mt above those of Romania on average during the period. Due to the war in Ukraine and the Black Sea blockade, prices surged in Mar 22, reaching the 450$/mt bar. From Mar until July, prices remained high and volatile, with US prices being around 25$/mt higher than the rest of the market. Since the beginning of the war, Brazil & Argentina prices remained roughly similar. Thus the surge in Brazil Corn imports is primarily due to its ample supply accessible earlier in the year. As prices are coming down in Aug 22, does Egypt need to increase the pace of imports in H2 22?

Figure 3: Argentina, Brazil, Romania, & US Corn CFR Egypt Indications Between Jan & Aug 2022

Find the Best Spot & Forward Corn Executions to Egypt From Up to 9 Origins

Free & Unlimited Access In Time

Egypt Corn Imports Continue Rising Regardless of Production

According to USDA data, Egypt Corn production remained relatively stable between 18 & 21, except for 19. Meanwhile, Egypt Corn imports have continued increasing since 18. Indeed, imports rose by 197 kmt YoY in 19 and surged 1.9 Mmt YoY in 20. Nonetheless, the uptrend slowed down in 21, increasing imports only by 1 Mmt YoY, perhaps due to Egypt’s stock reaching its limits. In 22, USDA expects Egypt Corn production to ramp up by 1.04 Mmt. However, Egypt Corn’s current import pace is much slower than in 21, decreasing by 2.1 Mmt YoY as of Aug 17th. Despite a more significant domestic production than in previous years, Egypt will likely need to ramp up imports in H2 22 to meet the demand.

Figure 4 : Egypt Corn Yearly Production & Imports Between 2018 & 2022

Track Corn Monthly Import Volumes & Individual Cargos to Egypt Since 2017

Free & Unlimited Access In Time

In a Nutshell

Egypt Corn supply depends strongly on imports despite a solid domestic production. In 2022, Egypt Corn imports tumbled from Jan through to Apr. Additionally, the loss of Ukraine supply due to the war and the blockade in the Black Sea was a severe hit to Egypt’s Corn pipeline as it was one of the top Ukraine importers.

Despite this loss, Egypt managed to fall back on its feet, creating new pipelines with Poland & Russia, and strengthening existing ones with Brazil & Romania, profiting from cheaper tariffs from the latter in Q1 22. Meanwhile, imports from the US —usually also an essential source of Corn for Egypt— crashed due to overly non-competitive prices throughout the end of Q1 & Q2 22.

Egypt is also counting on its domestic Corn crop. The 21/22 Corn crop was a record one due to the effort to improve the Grains’ domestic production and increased stock capacity. Therefore, USDA expected a 5% decline in Corn imports for the marketing year. However, Egypt Corn imports declined 25.75% (-2 Mmt) YTD, showing that despite the expected decrease, Egypt Corn imports suffered from the conflict in Ukraine and are still lacking pace mid-Aug.

All in all, Egypt managed to be flexible enough to find new pipelines and improve existing ones to ensure its Corn supply continuity. Yet, due to the global competitive demand and 21/22 rapidly drying up, Egypt did not manage to meet its domestic market so far and will probably increase the import pace in Sep & Oct 22. Thus, it might benefit from the global Corn prices cooling off, particularly with the US, as its product’s prices regain competitiveness and potentially more availability due to tensions with China.