Turkey Mills Wheat and Earns Millions from Its Export to Angola

Talk to our team about AgFlow's offering →

Reading time: 2 minutes

In the vast landscape of global trade, the intricate dance of supply and demand is ever-evolving. One such dance that has caught the world’s attention in 2023 is Angola’s wheat imports. But what factors have been shaping this trend from January to July? Let’s delve deeper.

One must first grasp the broader context to understand the dynamics of Angola’s wheat imports. Angola, a nation with a rich tapestry of resources, has historically been more focused on oil exports than agricultural imports. So, why the sudden interest in wheat?

The answer lies in a combination of factors. Population growth, urbanization, and changing dietary preferences have all played a role. As more Angolans move to cities and adopt a more westernized diet, the demand for wheat-based products, such as bread and pasta, has surged. But can Angola produce enough wheat domestically to meet this demand?

The Tradeoffs of Domestic Production vs. Imports

Angola faces a conundrum. On one hand, increasing domestic wheat production could boost the local economy and reduce dependency on imports. On the other, the country’s climatic conditions and soil types are not ideally suited for large-scale wheat cultivation. This is where the tradeoffs come into play.

Investing in domestic wheat production would require significant resources, both in terms of capital and time. It would mean diverting resources from other sectors, potentially impacting the nation’s overall economic health. Moreover, would the yield be sufficient to meet the burgeoning demand?

On the flip side, relying on imports, especially in a volatile global market, comes with its own set of challenges. Price fluctuations, geopolitical tensions, and supply chain disruptions can all impact the steady flow of wheat into Angola.

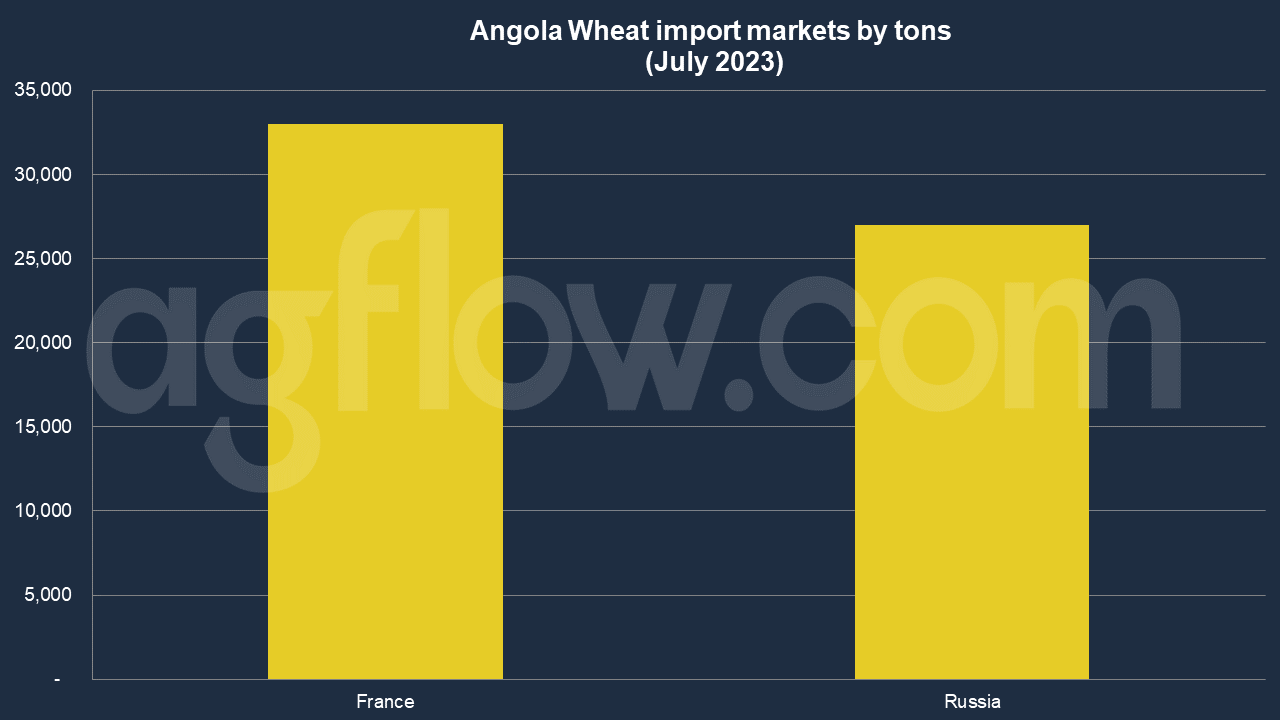

According to AgFlow data, Angola imported 33,000 tons of Wheat from France in July 2023, followed by Russia (27,000 tons). In 2021, Angola imported Wheat Flours worth $64.4 million for its 36 million people, becoming the 22nd largest importer of Wheat Flours in the world. At the same year, Wheat Flours was the 36th most imported product in Angola. Angola imports Wheat Flours primarily from: Turkey ($57 million), Belgium ($2.82 million), Portugal ($2.28M), Republic of the Congo ($652k), and France ($628k). Angola, which relies entirely on imported wheat, has increased its wheat flour consumption in recent years to about 650,000 tons.

Challenges in the Current Market

The first half of 2023 has not been without its challenges. Global wheat prices have seen an uptick due to unfavorable weather conditions in major producing regions. How does this affect Angola? As a net importer, any price surge directly impacts the nation’s food security and inflation rates.

Furthermore, navigating the complex web of international trade agreements and tariffs is no easy feat. Angola has had to strike a delicate balance between securing a steady supply of wheat at reasonable prices and ensuring that its trade practices align with its broader economic and diplomatic goals.

Looking Ahead: A Path Forward

So, where does Angola go from here? The answer may lie in a multifaceted approach. While ramping up domestic production might be a long-term goal, diversifying import sources and investing in strategic grain reserves could be prudent moves in the short term.

In conclusion, the story of Angola’s wheat imports in 2023 is a testament to the intricate interplay of global forces and local needs. It serves as a poignant reminder of the challenges nations face in ensuring food security for their citizens. As we move forward, one can only hope that with careful planning and strategic decision-making, Angola will successfully navigate the choppy waters of the global wheat market.

Try AgFlow Free

Access Free On Updates for Corn, Wheat, Soybean,

Barley, and Sunflower Oil.

No Credit Card Required & Unlimited Access In Time