The United Kingdom Starts Buying Wheat from Turkey

Talk to our team about AgFlow's offering →

Reading time: 2 minutes

Have you ever stopped to ponder the intricacies of the wheat trade in the United Kingdom? It’s not just about a daily loaf of bread on our table but rather an intricate interplay of socio-economic, climatic, and political factors. This year, from January to August 2023, the UK wheat trade has exhibited some surprising trends and challenges. Let’s dive deep into this essential commodity’s journey.

Wheat is the main UK arable grain crop with around 2,000,000 hectares grown, 25% of which is exported. It has a value of about £1.2 billion although the price is variable. Average yield is about 8 tons per hectare.

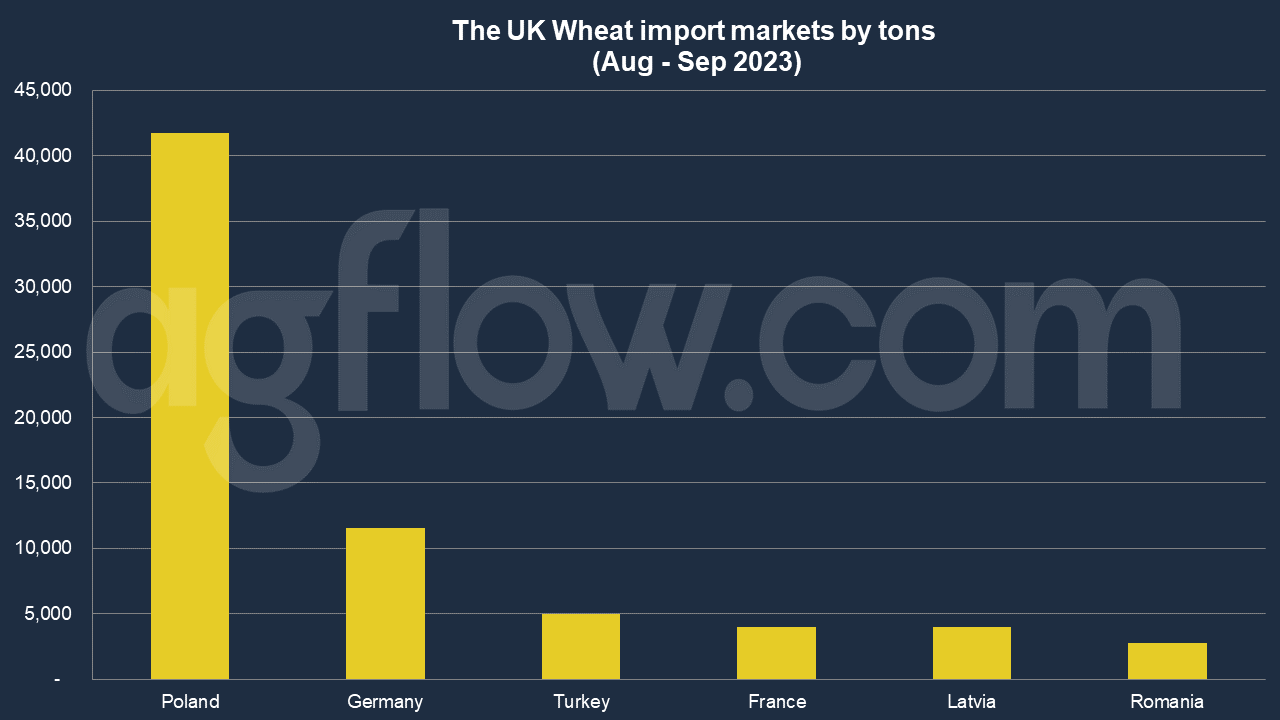

According to AgFlow data, the United Kingdom imported 41,733 tons of Wheat from Poland in Aug – Sep 2023, followed Germany (11,586 tons), Turkey (5,000 tons), France (4,000 tons), Latvia (3,990 tons), and Romania (2,800 tons). In the previous months, the UK also purchased Wheat from Canada, Estonia, and Lithuania. Total imports hit 0.34 million tons in Jan – Sep 2023. Average volume of shipments was 13,210 tons.

Wheat is more than just a staple; it’s an economic linchpin. Traditionally a significant wheat producer, the UK has often struck a balance between domestic production and imports. But what have been the dominant factors influencing this equilibrium in 2023?

1. Climatic Challenges and the UK Wheat Production:

The first half of 2023 saw unpredictable weather patterns, with bouts of extended rainfalls in regions previously considered the UK’s “wheat belt.” Can we solely blame climate change for these fluctuations? Perhaps. However, it’s an undeniable truth that unpredictable weather patterns have made wheat production more of a gamble than ever before.

2. Global Market Dynamics:

Did you know that international events could directly impact our morning toast? The geopolitical situation in some of the world’s leading wheat producers, such as Russia and the U.S., has led to fluctuations in global wheat prices. For the UK, this translates into a careful juggling act of deciding when to import and when to rely on domestic produce.

3. Brexit’s Residual Impact:

Remember the uncertainties around Brexit? It’s been a while, but the effects are still rippling. The UK’s departure from the EU has fundamentally changed its trade dynamics, leading to a careful reevaluation of import partners for wheat.

4. The Quest for Quality:

Wheat is not just wheat. Are we discussing hard, soft, red, white, spring, or winter wheat? The demands of the UK’s diverse food industry, ranging from bakeries to breweries, play a pivotal role in import decisions. It’s not just about quantity but the kind of wheat that’s in demand.

So, with all these factors at play, what’s the balancing act? The answer isn’t straightforward. If we import more, we are cushioned against domestic production failures but at the mercy of global price fluctuations. Are we prepared for a potential shortfall if we lean heavily on our domestic production?

And here’s another grain of thought: How sustainable are our current practices? In the race to meet demands, are we, perhaps unknowingly, compromising on ecological balance and soil health?

Conclusion

The story of UK wheat in 2023 is one of tradeoffs and tightropes. A narrative where the past, present, and future are intricately woven together by the golden threads of wheat strands. It’s a tale that underscores the importance of diversifying sources, innovating agricultural practices, and understanding that every grain counts.

In conclusion, the UK wheat market of 2023 is a mirror to global dynamics, a testament to the nation’s resilience and adaptability. As we slice into our sandwiches or enjoy a warm pastry, let’s spare a thought for the complex journey of the humble wheat grain. The message is clear for professionals in the agricultural commodity industry: adaptability, foresight, and innovation are the keys to thriving in this ever-evolving market. To the general audience, know that every bite is a story of challenges, triumphs, and relentless pursuit of balance.

Try AgFlow Free

Access Free On Updates for Corn, Wheat, Soybean,

Barley, and Sunflower Oil.

No Credit Card Required & Unlimited Access In Time