The UAE Import: White Medium Hard Wheat Accounts for 70%

Reading time: 2 minutes

Although none of the previous trials to grow certain grain commodities successfully addressed the UAE’s food security concerns, the country continues to implement more of these trials. In February 2023, the Emirate of Sharjah announced that the harvest of 400 hectares of Wheat planted in the Mleiha region will start between March 15 to April 15, 2023. The farm is expected to produce around 1,600 tons of Wheat annually, a small but significant step towards the country’s long-term goal of increasing its farming industry.

Sharjah’s Department of Agriculture and Livestock stated that the project would be completed in three phases; the first phase will be on an area of 400 hectares, which has already been completed, the second phase will be on an area of 880 hectares in 2024, and the third phase will reach its completion on an area of 1,400 hectares in 2025. The project also includes experimental fields of 35 different types of Wheat worldwide, spread across two hectares, to explore compatibility with Emirati soil and weather.

In addition to the UAE’s efforts to increase local agricultural production, the country invests in agrarian production abroad. Abu Dhabi’s largest government-owned holding company (ADQ) purchased a 50 percent stake in Al Dahra, solidifying Government control over the UAE’s most prominent food conglomerate. Al Dahra manages or owns farmland worldwide, including 20,000 ha in Serbia, 4,047 ha in Spain, 2,023 ha in Australia, and 4,047 ha in the United States.

While little rainfall precludes the production of row crops like Wheat, corn, rice, and barley, the UAE is making some progress in developing local production of field greens. Despite these advances, demand for grains will continue to be met through import and storage programs. Total Wheat consumption (July 2023–June 2024) is forecast to increase slightly by three percent or 50,000 MT to reach 1.650 MMT. Post has revised the MY 2022/23 Wheat consumption estimate downward to 1.6 MMT, equal to the USDA official estimate.

The UAE has a Wheat milling capacity of 1.67 MMT per year and a total storage capacity of around 920,000 MT—both re-export demand and local consumption drive Wheat milling and processing. Miscellaneous baked goods reflect the international origins of the UAE’s population, with Arab, Eastern, and Western baked goods widely available. White medium hard accounts for 70 percent of Wheat imported to the UAE; the remainder is a blend of white hard and soft. Soft red Wheat is the least imported, given its limited use in local baking.

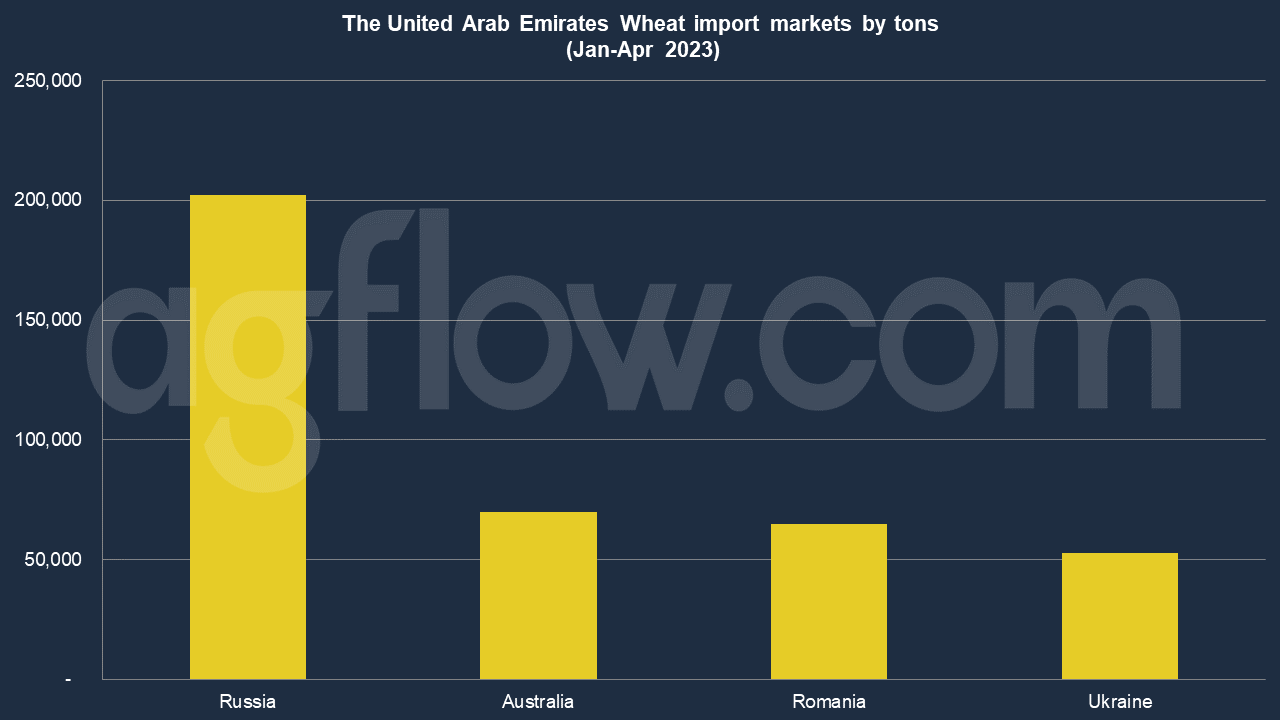

Wheat Import in the United Arab Emirates

After Russia invaded Ukraine, the UAE turned to India as a major supplier of Wheat. While India has become the UAE’s largest supplier, the Grain Corridor Agreement may mollify concerns and cause the Black Sea region to become the largest supplier to the UAE again. Traders have reported to Post that despite the UAE’s large imports of Indian Wheat, the change in quality has significantly affected operations.

According to the AgFlow data, Russia led its import market with 0.2 million tons of Wheat in Jan-Apr 2023, followed by Australia (70,000 tons), and Romania (64,772 tons). One Wheat miller indicated to Post that after the change in origins, foreign matter rose significantly, well above 10 percent from a 90,000 MT shipment they purchased last year. Contacts had reported that high FM from new sources had caused damage to equipment, requiring Wheat to be milled multiple times before it was suitable for sale or further processing. When combined with variable production in India, this factor will likely temper long-term imports of Indian Wheat.

Other sources: USDA

Try AgFlow Free

Access Free On Updates for Corn, Wheat, Soybean,

Barley, and Sunflower Oil.

No Credit Card Required & Unlimited Access In Time