The Baltic Players Contrast Much by Wheat FOB Prices

Talk to our team about AgFlow's offering →

Reading time: 2 minutes

In terms of territory, the 3 Baltic States do not have much difference. For GDP, Lithuania leads by far with USD 80 billion, followed by Latvia (USD 47 billion) and Estonia (USD 42 billion). Lithuania also has the largest population of 2.8 million people. Latvia and Estonia have 1.8 million and 1.4 million, respectively. All are a net exporter of grains. They compete in grain export markets while they partner in grain trade. Let’s look at their Wheat production and trade pattern.

According to the USDA, Lithuania’s Wheat production was estimated at 4.6 million tons in 2021-2022. Its Wheat export was 3.5 million tons in the first nine months of the 2020/2021 season. For the same period, Latvia’s Wheat production was 2.5 million tons, with Wheat export of 2.3 million tons in the first seven months of 2020/2021. Estonia’s performance was much lower, with Wheat output of 0.8 million tons and export of 0.5 million tons in the first nine months of 2020/2021.

Latvia

In general, winter Wheat harvests were 4.2 t/ha in Latvia, which is lower than in 2022 (5 t/ha). This year, the areas of winter sowing (503.5 thousand ha) decreased compared to 2022, when 511.8 thousand ha were sown. On the other hand, the summer area increased from 268.3 thousand ha last year to 285.8 thousand ha this year.

This year’s Wheat quality of Latvian growers can be characterized as averagely good. The quality of Wheat is different in each region; if in Latgale there are very few grains with a low falling number, then in Kurzeme, approximately 20% of all Wheat accepted so far has a low falling number. On the other hand, the volume weight of Wheat this year is relatively high throughout Latvia and is, on average, within 78.5 kg/hl. The protein in Wheat this year is in the range of 12-13% on average; there is not much food Wheat with 14% protein, but not much with protein below 11% either.

According to AREI data, the purchase price of food Wheat in Latvia was 195.13 EUR/t in the week of October 2, down 31% year-on-year. The purchase price of fodder Wheat in the week of October 2 was 158.47 EUR/t, down 39.5% year-on-year.

Lithuania

Grain buyers from Lithuanian farms are mainly supplied with second-class grain. High-quality Wheat, with a high protein and gluten content, makes up only one-tenth of the harvest. “The protein content of second-class Wheat is about 12.5 percent. This is an indicator that shows that the grain is suitable for export. However, the amount of gluten in Wheat this year is low; its average amount is 24 percent, and it must be at least 26 percent in grains intended for export.

“We buy Class II grain from farmers, but it is a challenge for exporters. We will have to mix them with high-class grains so that the indicators correspond to the parameters set for exported grains”, said Svajūnas Banelis, Head of trade in Lithuanian, Latvian, and Estonian grain at the Linas Agro company.

Buyers also put third-class Wheat in the elevators, with 11-11.5 percent protein content. This kind of Wheat is abundant in France because the low-protein grain flour is needed for certain baked goods, such as biscuits.

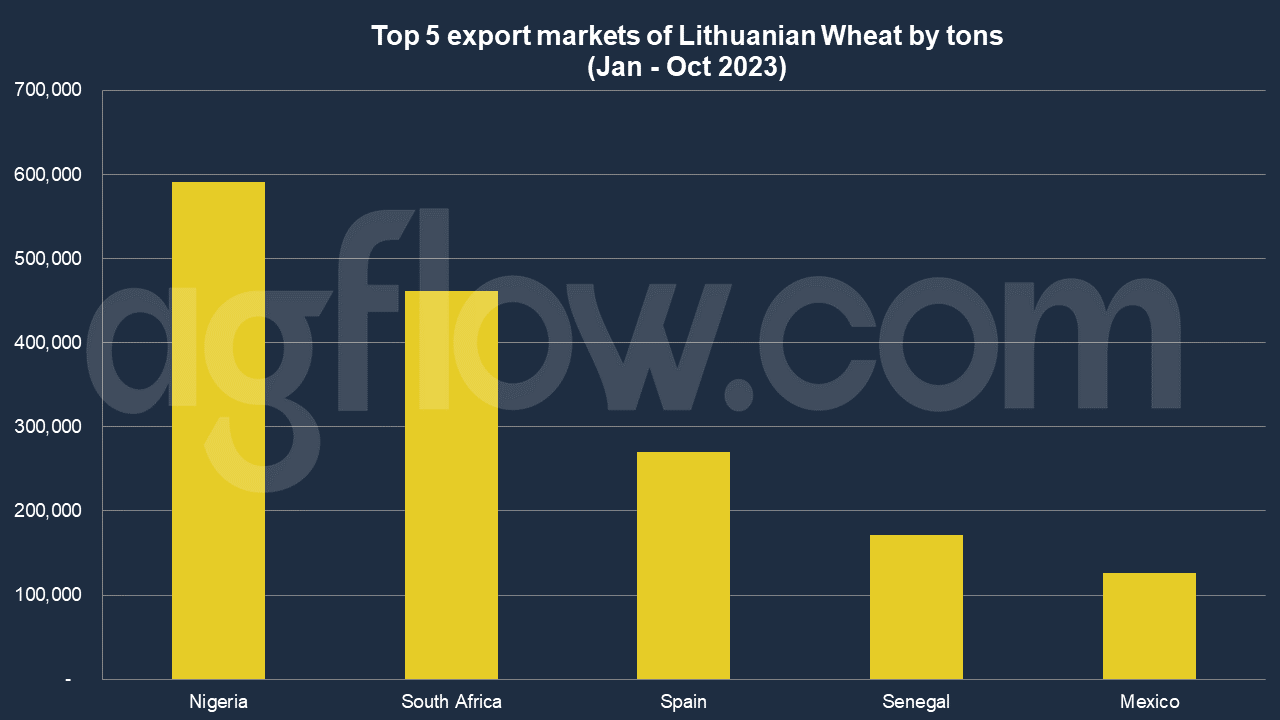

Meanwhile, the main export direction of second-class Lithuanian Wheat is currently the African continent, high-class – Spain. Some of them are transported to Scandinavian countries as well. The “Matif” exchange dictates the purchase prices of Wheat, and the final prices are calculated considering discounts and ship freights – grain transportation costs.

“A ton of class II Wheat cost around 300-310 euros in the second half of August last year. Currently, it is much less, around 100 euros. Grain prices in Poland, France, and Germany differ from those in Lithuania, fluctuating only in the range of 10-15 euros”, Svajūnas explained. More grain is being transported from Ukraine by land. Some of them are transported through the territory of Lithuania in transit to the port of Klaipėda, while some remain in the Lithuanian market.

“It should cost 20 percent more than it does.” The level of export will be equal to the average of the last five years; it may be between 5-6 million tons, nothing special will be done here – there is an average harvest, and export will be as usual”, said A. Macijauskas, the head of the association of grain growers.

Estonia

According to Ege Kirs, a leading analyst at Statistics Estonia, the area of cereals planned to be harvested for grain, 351,200 hectares, is 3 percent smaller this year than in 2022. Wheat is down 5 percent on last year, barley 4 percent, oats 3 percent, and buckWheat 24 percent. Of the 173,000 hectares under Wheat, 85 percent is under winter Wheat.

Trade Race – Nigeria Dominates, Mexico Emerges

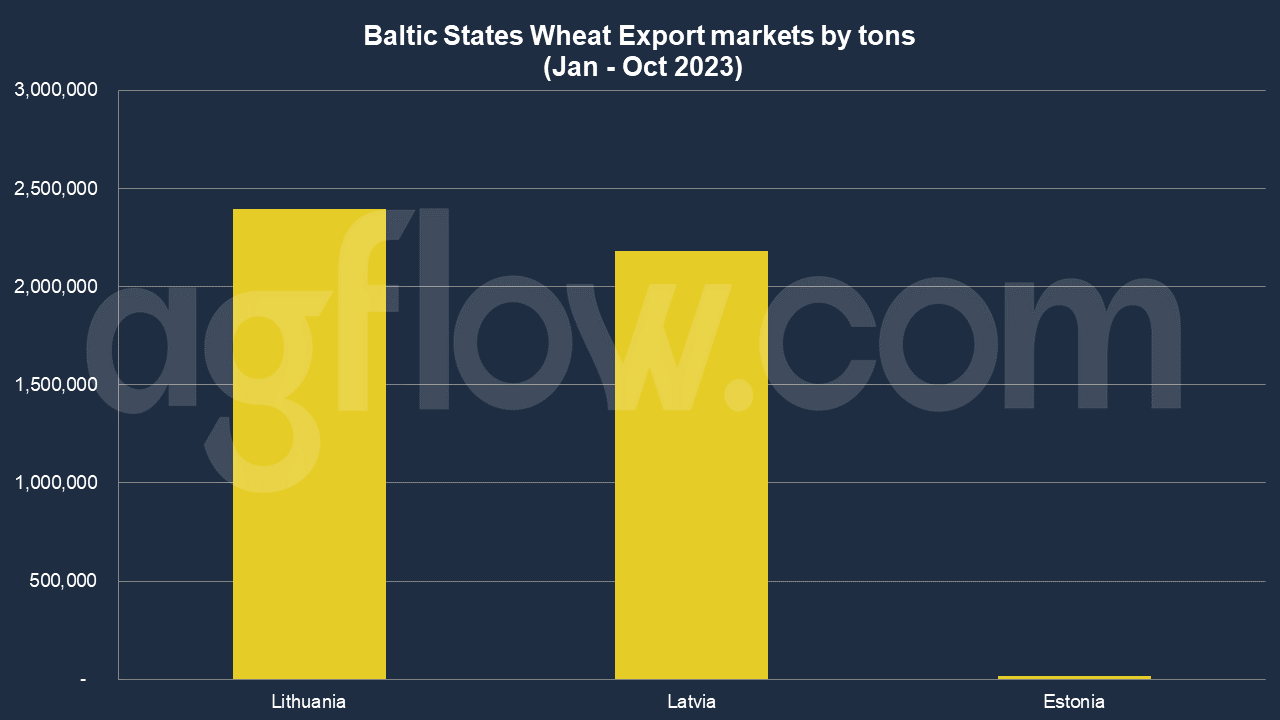

According to AgFlow data, Lithuania shipped 2.4 million tons of Wheat in Jan – Oct, while Latvia exported 2.2 million tons of Wheat. Estonia’s was 16,956 tons.

Lithuania exported 0.6 million tons of Wheat to Nigeria, followed by South Africa (0.46 million tons), Spain (0.27 million tons), Senegal (0.17 million tons), and Mexico (0.12 million tons).

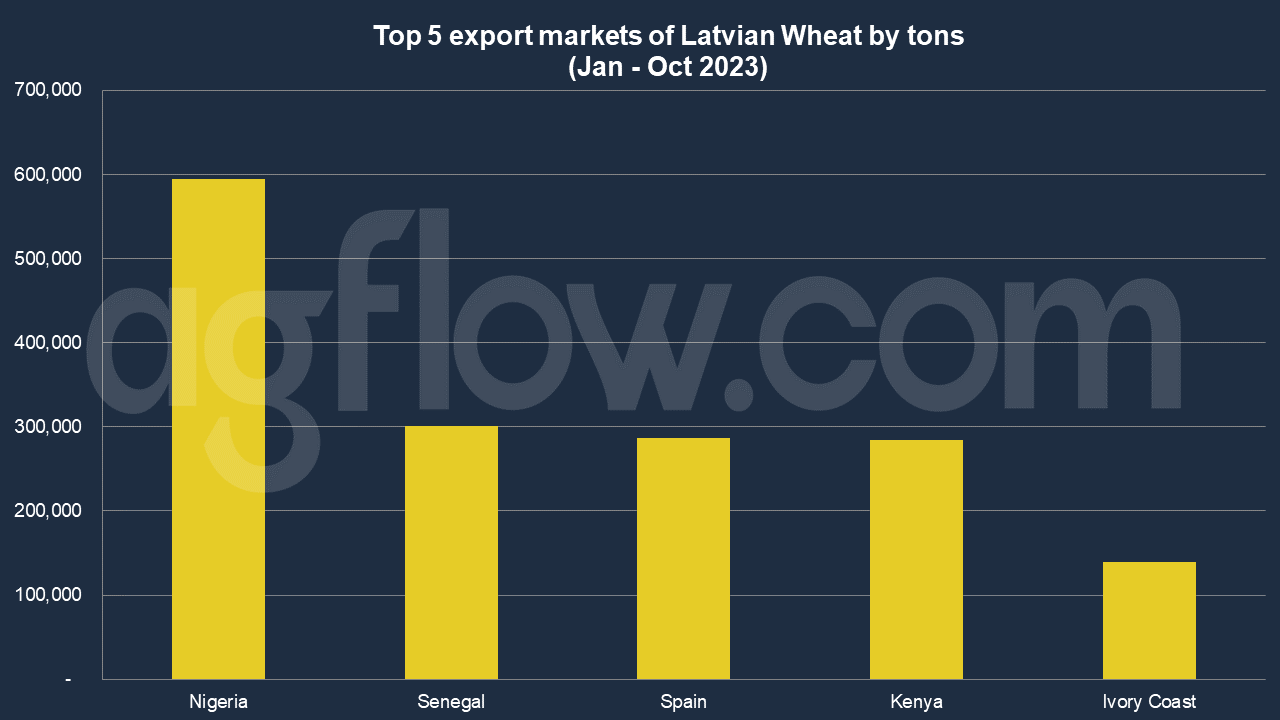

Meantime, Latvia shipped the same volume of Wheat to Nigeria, followed by Senegal (0.3 million tons), Spain (0.28 million tons), Kenya (0.28 million tons), and Ivory Coast (0.14 million tons).

Lithuania exported Wheat worth $1.27 billion in value in 2021, making it the 12th largest Wheat exporter in the world. The same year, Wheat was Lithuania’s 3rd most exported product. The main destinations of Wheat exports from Lithuania are Nigeria ($582M), Spain ($128M), Latvia ($119M), South Africa ($103M), and Saudi Arabia ($60.9M).

In 2021, Latvia imported Wheat worth $302M, becoming the world’s 51st most significant importer of Wheat. In the same year, Wheat was Latvia’s 9th most imported product. Latvia imports Wheat primarily from Russia ($175M), Lithuania ($119M), Kazakhstan ($3.98M), Estonia ($2.61M), and Poland ($491k). It appears that Latvia re-exports Russian and Lithuanian Wheat.

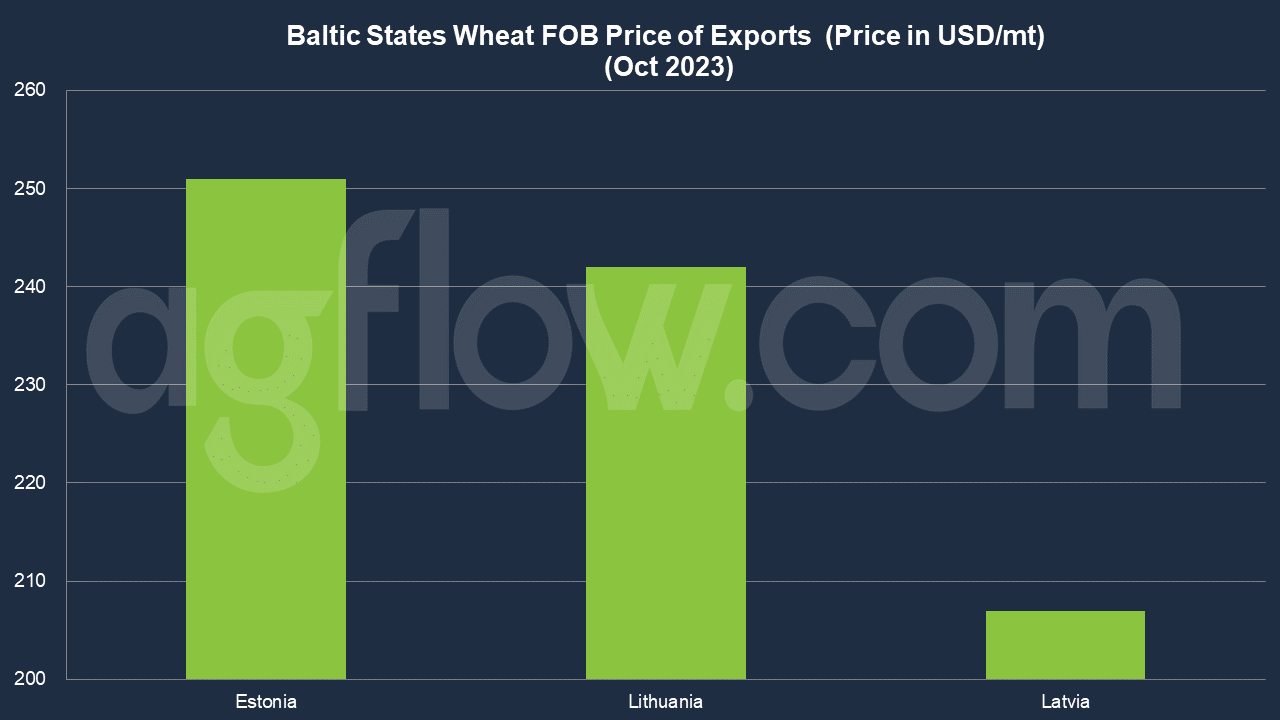

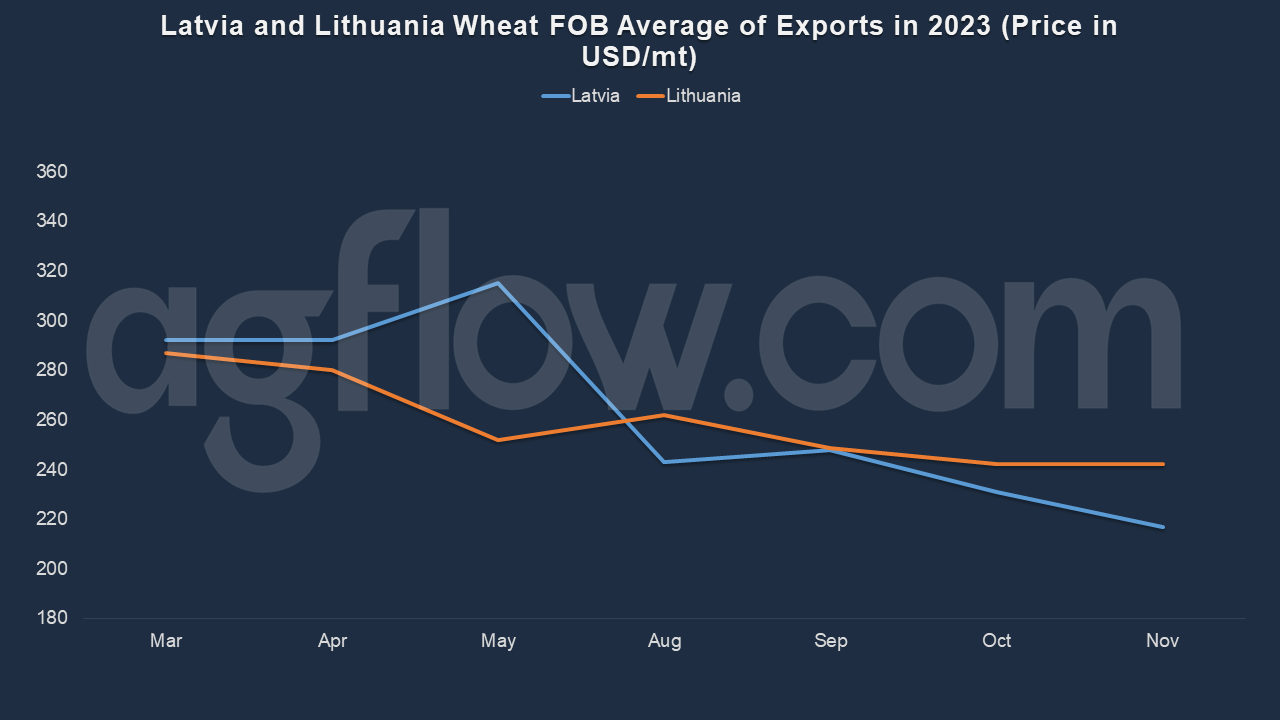

Estonia quoted the highest FOB price, USD 251, in October 2023, followed by Lithuania (USD 242) and Latvia (USD 207). These neighboring rivals offer much different FOB price.

For Latvia and Lithuania, their Wheat FOB price differed much in May. Since September, Latvia has been decreasing its FOB price, while Lithuania has been reluctant to drop their FOB price. Latvia offers a FOB price of USD 254 in Wheat shipments for Feb 2024.

Try AgFlow Free

Access Free On Updates for Corn, Wheat, Soybean,

Barley, and Sunflower Oil.

No Credit Card Required & Unlimited Access In Time