Sri Lanka Imports Wheat, Mills, and Then Exports to the East

Reading time: 2 minutes

With no domestic production of its own, Sri Lanka for decades has been importing Wheat for flour milling. Recently the Government began to allow Wheat flour imports. However, the imported Wheat flour quantity remains minimal compared to the import volume of Wheat grain for flour milling. FAS Colombo forecasts Sri Lanka’s MY 2023/2024 (July-June) Wheat total consumption at 1.18 MMT, up by 54,000 MT, from Post’s MY 2022/2023 estimate of 1.12 MMT. The increase is seen as a result of the gradual recovery from the economic crisis of 2021/22, with more foreign exchange set to become available for the financing of Wheat imports with the IMF bailout.

The renewed influx of foreign tourists in late 2022 will also fuel increased consumption as these tend to eat flour-based products rather than rice. During the latter part of MY2021/2022 and into the early part of MY 2022/2023, Wheat consumption was affected by the high price of Wheat flour resulting from the lack of foreign currency availability, the rapid depreciation of the Sri Lankan rupee, and increased international prices. With higher Wheat flour prices taking hold, consumers have reduced their consumption, turning to alternative sources of carbohydrates such as those derived from root flour and even jackfruit.

FAS Colombo forecasts Sri Lanka’s MY 2023/2024 Wheat ending stocks at 250,000 MT. With Wheat imports increasing, along with marginal increments in consumption combined with a slower pace in exports, stocks should again rise. Some Wheat for flour milling will go into storage, contributing to rising stock numbers.

In Sri Lanka, only two flour millers (Prima Ceylon Ltd. and Serendib Flour Mills) are operating (milling Wheat for human consumption). These millers are responsible for most of Sri Lanka’s annual Wheat imports. With a 3,600 MT/day milling capacity, the more prominent two millers account for the bulk of Sri Lanka’s flour milling. Sri Lanka has excess milling capacity that outpaces domestic demand for Wheat flour. [Note: The largest milling facility has 350,000 MT storage capacity]. In previous years, a significant volume of Sri Lanka’s Wheat imports reached other Asia-Pacific region countries as milled Wheat flour exports.

Given the staunch political-economic support for rice production, Wheat consumption has been increasing marginally. Imported Wheat is milled under highly controlled conditions at the port-of-entry (Colombo and Trincomalee).

Wheat Import in Sri-Lanka

Wheat and Wheat flour account for the largest share of Sri Lanka’s cereal imports. Large quantities of rice and corn are only imported when local production is insufficient to cover domestic needs.16 FAS Colombo forecasts Sri Lanka’s MY 2023/2024 imports at 1.4 MMT, up by 200,000 MT, from Post’s MY 2022/2023 estimated volume of 1.2 MMT. Generally, Sri Lanka’s leading Wheat suppliers include Canada, Russia, Australia, Pakistan, India, and Romania.

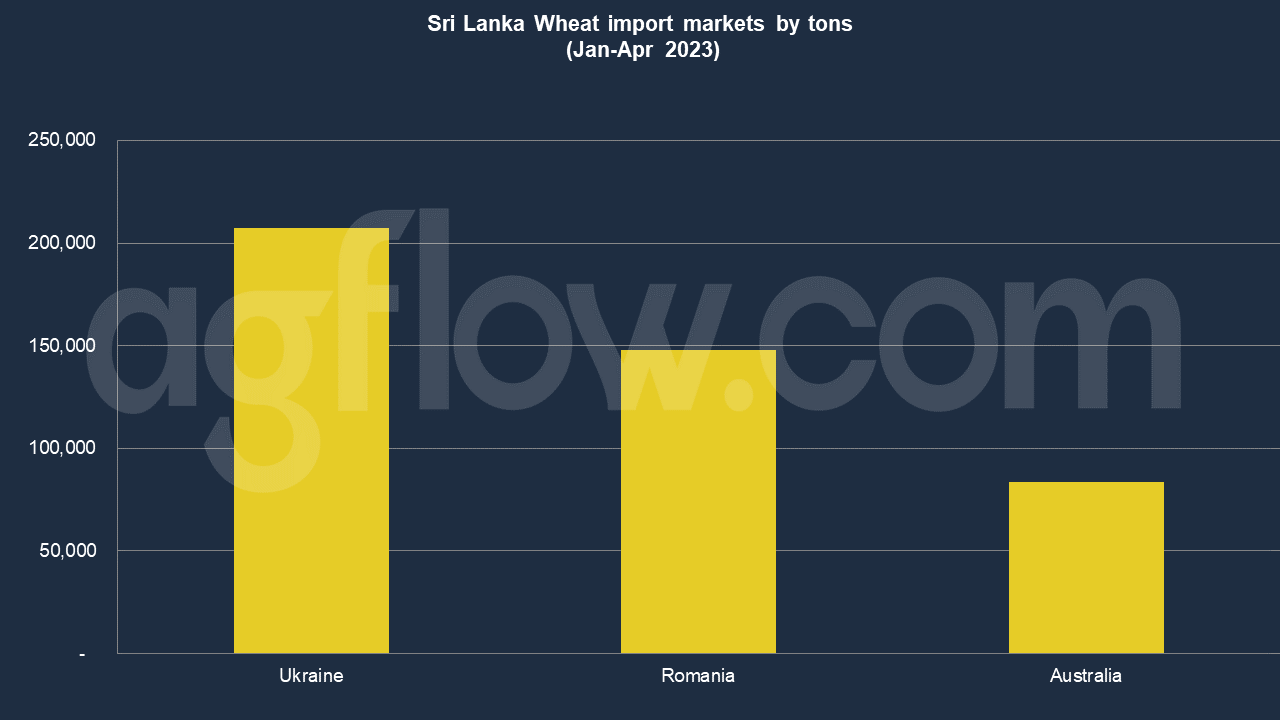

According to the AgFlow data, Ukraine led its import market with 0.2 million tons of Wheat in Jan-Apr 2023, followed by Romania (147,824 tons) and Australia (83,398 tons). Due to the foreign exchange crisis, in MY 2021/2022, nearly the entire stock of Wheat was imported from India, facilitated by a $4 billion Indian credit line. The importation of Wheat flour for animal feed is under import control licenses and requires prior approval from the Department of Animal Production and Health.

Post is revising its earlier MY 2021/2022 imports volume from 1.032 MMT to 1.102 MMT to reflect actual Wheat imports volumes better. Current import requirements disallow U.S.-origin feed Wheat. Entry requirements are highly restrictive for de-husked, bulk Wheat imported for animal feed production. Unlike the case of Wheat imports for human consumption, where the two millers’ production locations are easily verifiable by authorities, small- to medium-sized feed mills are scattered throughout the county and often lack adequate infrastructure (i.e., including silos).

Other sources: USDA

Try AgFlow Free

Access Free On Updates for Corn, Wheat, Soybean,

Barley, and Sunflower Oil.

No Credit Card Required & Unlimited Access In Time