Spain Palm Oil Trade: Egypt Overtakes Malaysia

Talk to our team about AgFlow's offering →

Reading time: 2 minutes

In 2023, Spain has navigated treacherous waters when it comes to palm oil trade and imports. But what are the key factors shaping this intricate tapestry? As the hands of time continue their march, it becomes crucial to decode the challenges, tradeoffs, and dynamics of this trade. Let’s explore.

A Tale of Two Entities: Spain and Palm Oil

One must first appreciate the deep-rooted relationship between Spain and palm oil to comprehend the full scope. As a nation that prides itself on a rich culinary heritage, it’s no surprise that oils play a quintessential role in Spanish kitchens. But palm oil? That’s a slightly more nuanced tale. While native olive oil has been the linchpin, palm oil has steadily entered various industries, from food to cosmetics.

So, why has palm oil become such a significant import for Spain? Imagine you’re balancing a scale. On one side, there’s the allure of an affordable, versatile oil; on the other, there’s the weight of environmental and ethical concerns. It’s a delicate equilibrium.

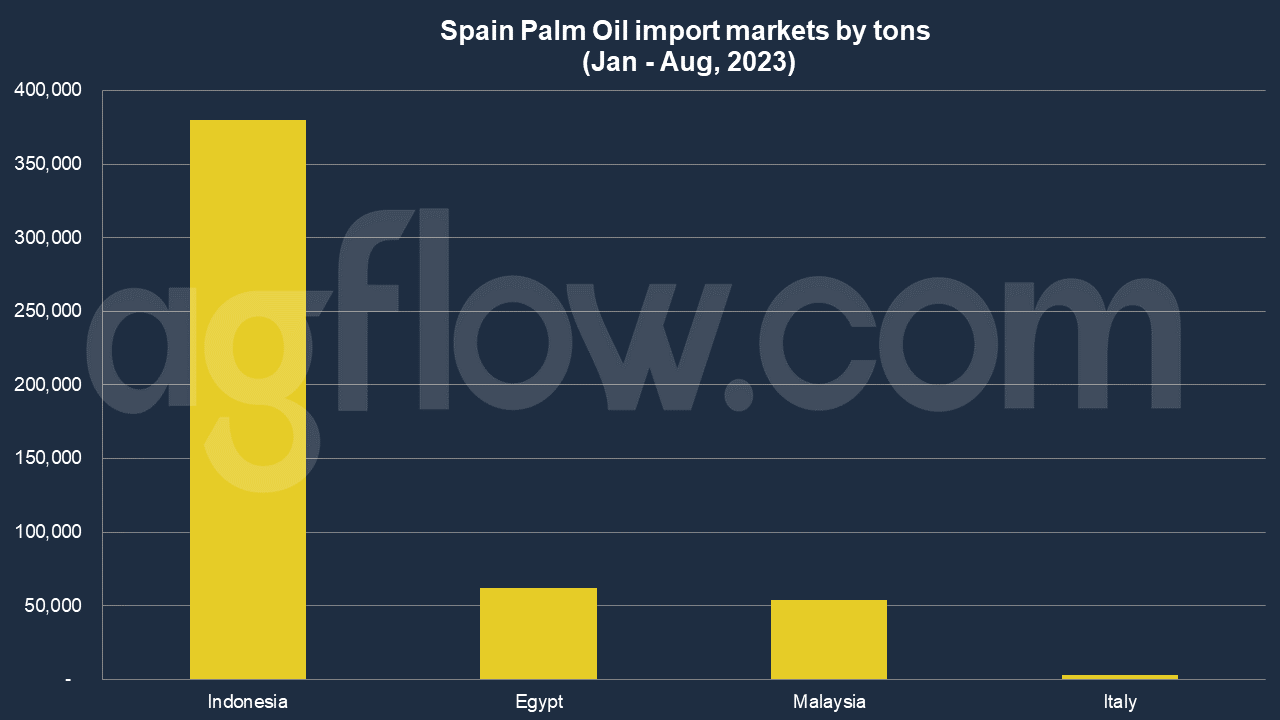

As per AgFlow data, Spain imported 0.5 million tons of Palm Oil in Jan – Aug 2023. The key suppliers were Indonesia (0.38 million tons), Egypt (62,000 tons), Malaysia (54,000 tons), and Italy (3,050 tons). Average volume of shipment was 15,500 tons. Spain was buying large amounts of Palm Oil from Indonesia such as 44,300 tons.

In 2021, Spain imported Palm Oil worth $1.37 billion, becoming the 8th largest importer of Palm Oil in the world. At the same year, Palm Oil was the 63rd most imported product in Spain. Spain imports Palm Oil primarily from: Indonesia ($985M), Guatemala ($157M), Colombia ($61.4M), Malaysia ($54.5M), and Cote d’Ivoire ($24.8M).

The 2023 Paradigm Shift

From January to August 2023, several influencing factors swayed Spain’s palm oil trade. But before we dive in, ponder this – have you ever felt the tension of two opposing forces pulling at you? Spain’s palm oil scenario can be likened to just that.

- Economic Repercussions of Global Trends: The global palm oil market has been tumultuous. Prices surged due to unpredictable weather patterns in major producing countries and labor shortages. This meant paying higher prices for Spain, leading businesses to reevaluate their sourcing strategies. Might there be a pivot towards more sustainable or alternative oils in the future?

- Regulatory Measures: Amid growing global outcry over deforestation and indigenous rights, Spain, being an EU member, was adhering to stricter regulations. This, in essence, transformed the very anatomy of their palm oil imports. Were the imports 100% sustainable? Did they adhere to a stringent code of ethics?

- Consumer Awareness: The Spanish populace is becoming increasingly eco-conscious. A demanding consumer base sought transparency in sourcing and sustainability practices. Does the average Spaniard know where their products come from, and more importantly, at what cost?

Balancing Act: The Challenges and Tradeoffs

Juggling economic viability, environmental responsibility, and ethical practices is no child’s play. For Spain, this meant:

- Diversifying Import Sources: To mitigate dependency risks, Spain explored newer markets, like Africa, as potential palm oil sources. A wise move? Time will tell.

- Exploring Alternatives: Some Spanish industries began looking into alternative oils, like sunflower or rapeseed. But can they truly replace palm oil in terms of efficiency and cost?

- Investing in Sustainability: Spain aimed to strike a balance by backing sustainable palm oil initiatives. But will the scales tip in favor of a greener tomorrow?

Conclusion

In conclusion, Spain’s palm oil trade and imports in 2023 have been a lesson in dexterity. As the nation maneuvers the labyrinth of global markets, regulatory frameworks, and shifting consumer preferences, it stands at a crossroads. The decisions made today will echo into the future, influencing Spain and the global agricultural commodity industry. As professionals and consumers watch with bated breath, one can only hope for choices that prioritize the planet and its people.

Try AgFlow Free

Access Free On Updates for Corn, Wheat, Soybean,

Barley, and Sunflower Oil.

No Credit Card Required & Unlimited Access In Time