Spain: Most of the Imported Wheat Come From Odessa Port

Reading time: 2 minutes

In Spain, area statistics reflect the continuation of the long-term decline trend and is expected to amount to just below 5.8 million hectares. Winter Grain crops in Spain compete in areas with more profitable tree crops (tree nuts, olive groves) and alternative annual crops such as rapeseed, which registered historically record levels, or pulses (lentils and chickpeas), whose area expanded in 2022.

In the case of Corn, primarily grown under irrigation, the higher input costs (energy and fertilizers) combined with irrigation water limitations in particular river basins have forced the area down. For instance, farmers in the Guadalquivir basin (Andalucía) face limits for irrigation purposes for the second consecutive year in crops such as cotton, Corn, and rice, whose area has reportedly been halved in this autonomous region. Moreover, competition by less input-intensive and highly demanded sunflower plantings in irrigated and non-irrigated land has resulted in what Post estimates as a 12 percent Grain-Corn area reduction compared to the previous marketing year.

With winter Grain harvest operations well-advanced, Spanish total Grain production (including winter Grains and Corn) in MY2022/23 is anticipated to decline significantly from the sizeable crops achieved in the close-to-record MY2021/22 season when a sizeable crop was harvested. In the case of Corn, primarily grown under irrigation, the production reduction stems from the 12 percent decline in planted area, which could lead to a Grain Corn production of 3.6 MMT. Without official estimates, industry sources concur that winter Grain production will be well below last year’s figure and average levels in all growing regions. Spain’s MY2022/23 total Grain output, including Corn, could be as low as just 17.6 MMT.

Spain’s total Grain consumption in MY2022/23 is currently projected at 34.5 MMT, down from the 36 MMT estimate for MY2021/22. The country’s Grain users are struggling with the commodity price surge initiated in the second half of 2021 and aggravated by Russia’s invasion of Ukraine in February 2022 and soaring energy costs. However, in MY2021/22, only slight downward corrections are being reported. Animal feed is Spain’s primary Grain destination, accounting for over 75 percent of the country’s demand. Spain’s feed compounders supply the dynamic domestic livestock sector.

Livestock products demand hinges on the evolution in export markets demand, led by other EU Member States and China, as well as internal household and Hotel, Restaurants, and Institutions (HRI) demand. In MY2022/23, if the tight market situation continues, shrinking livestock producers’ margins could ultimately result in demand destruction, pressuring Grain feed uses down. However, limited pasture availability is another factor supporting feed demand stability. Spain’s Feed Compounders Association (CESFAC) anticipates a 4 percent reduction in industrial feed production in CY2022.

In terms of a preferred type of Grain, given the price differential, Wheat is anticipated to see its competitiveness eroded against Corn, which is anticipated to remain the preferred Grain for feed purposes.

Grain Imports in Spain

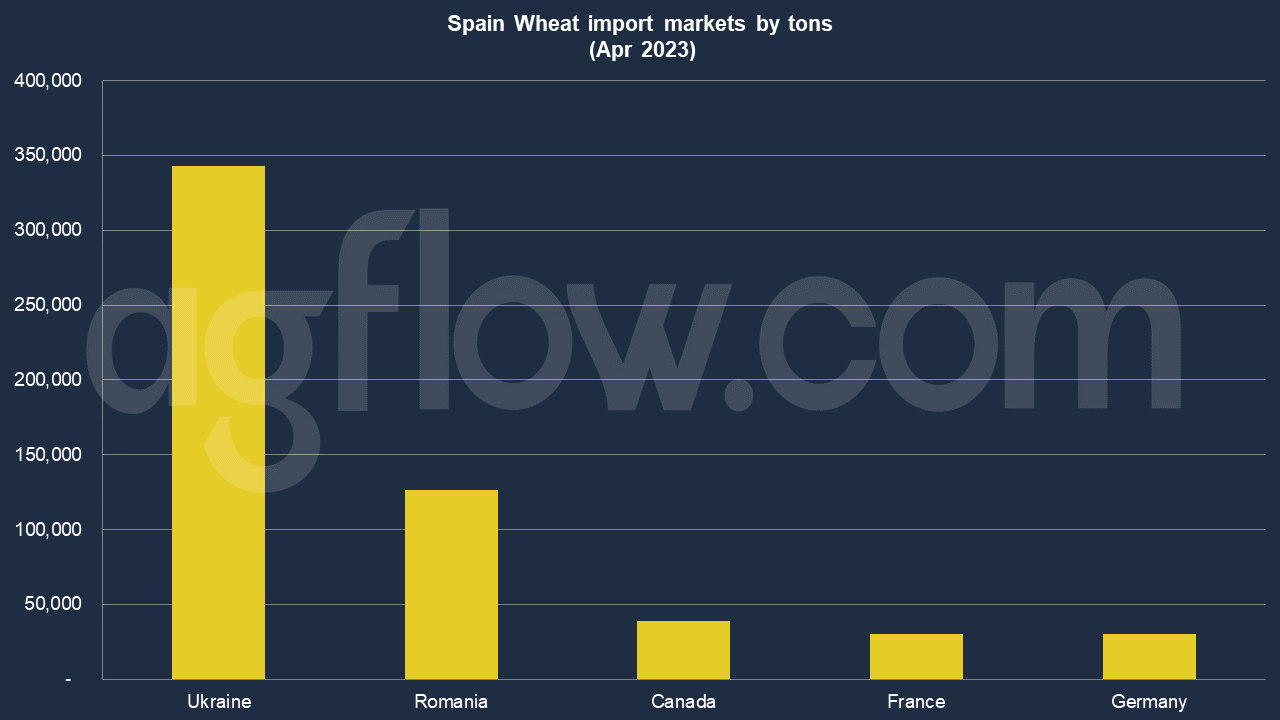

According to AgFlow data, Spain imported 1.7 million tons of Wheat in Jan-Apr 2023. In April, key suppliers were Ukraine (0.3 million tons), Romania (0.1 million tons), and Canada (39,000 tons). The combination of the previous season’s ample domestic supplies, somewhat higher volumes imported during the first half of the MY2021/22, and timely U.S. Corn and sorghum imports helped Spanish feed chain compounders cushion the negative impacts of the constraints affecting the other large Grain suppliers, such as Ukraine.

Demand contraction in MY2022/23 could partially negate the need for more significant Grain imports, given the well-below-average in-country Grain crop anticipated. Spain’s Grain imports are currently forecast at 15 MMT. In MY2022/23, Spain’s Grain imports may be affected by the looming prospects regarding Ukraine’s Grain exports arriving in western EU destinations, concerns over other EU Member States’ Grain production, and anticipated shorter domestic crop.

Other sources: USDA

Try AgFlow Free

Access Free On Updates for Corn, Wheat, Soybean,

Barley, and Sunflower Oil.

No Credit Card Required & Unlimited Access In Time