Qatar – The Largest Market for the Philippines’ Barley

Reading time: 2 minutes

For MY 2022/23, Wheat’s food consumption was lowered in the Philippines compared to USDA Official because of lower demand, as observed by industry contacts for the year. Feed consumption was also reduced because of ASF outbreaks that year in areas in the Visayas (Negros Oriental and Aklan). FAS Manila declined the Philippines’ ending stocks because of a downward import adjustment for MY 2021/22 and MY 2022/23. Milling Wheat industry contacts reported they maintained inventory from 30 to 45 days (around 775,000 MT), while feed milling industry contacts reported inventories of 2½ to 3 months (almost 400,000 MT).

FAS Manila maintains Wheat imports for MY 2023/24 in line with USDA Official. FAS Manila lowered MY 2022/23 Wheat imports in line with historical trade data. MY 2022/23 July through April Wheat exports reflected a drop of 21 percent. Based on SPSIC applications with the Bureau of Plant Industry (BPI), there was a drop of 48 percent in the number of applications from MY2021/22 July to May to MY2022/23 (1,901 vs. 980). The volume applied for also dropped 38 percent (9,094,257 MT vs. 5,593,077 MT). A Sanitary and Phytosanitary Import Clearance (SPSIC) is issued if an agricultural product like Wheat does not pose a food safety/disease risk to the Philippines. While SPSIC applications do not necessarily translate to 100 percent arrival, they are a crucial indicator of willingness to import Wheat.

The United States has traditionally been the leading exporter of the Philippine milling Wheat industry, with a 96 percent market share (MY 2020/21). The average landed price during this period was about $261 per MT. Recent trade data showed the U.S. market share went down to 72 percent (MY 2022/23 July to February). Industry contacts mentioned the higher price of U.S. milling Wheat as the reason. Industry contacts added they are more concerned with competition from Canada in milling Wheat than Australia based on quality considerations. There are still flour milling companies that use 100 percent U.S. milling Wheat, though.

Wheat and Barley Trade Value in the Philippines

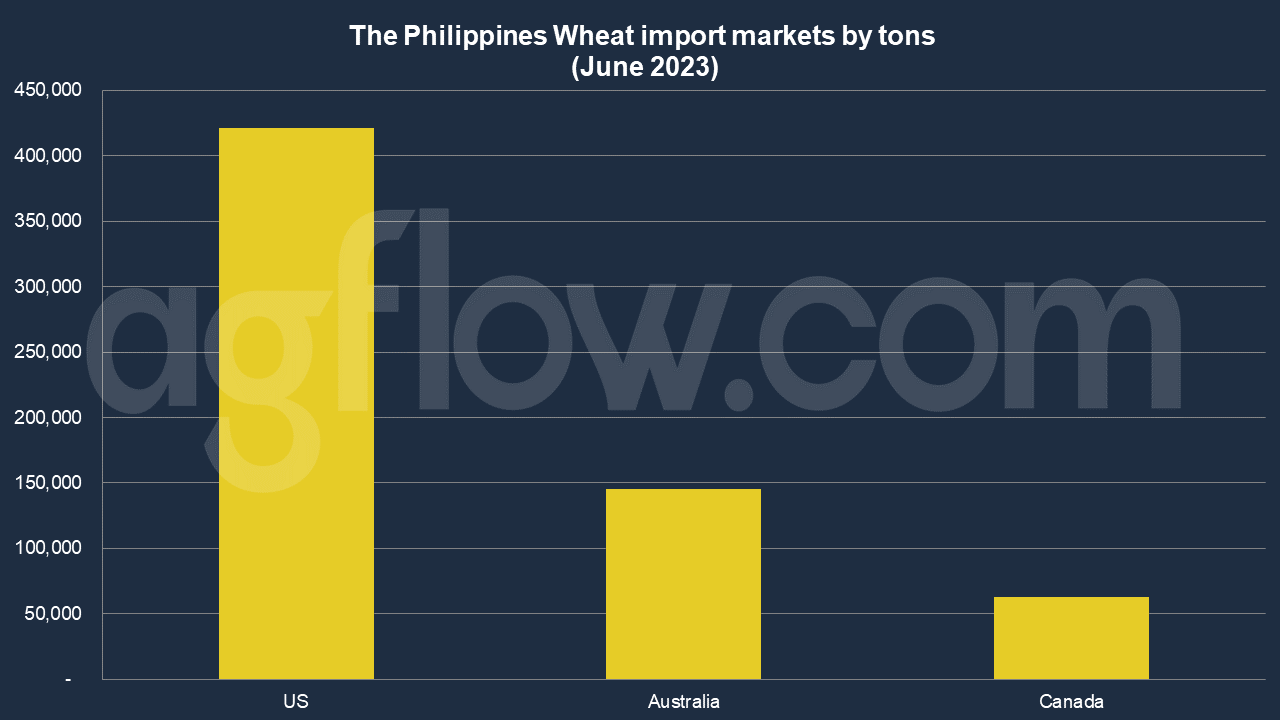

According to AgFlow data, the Philippines imported 2.4 million tons of Wheat in Jan-Jun 2023. In June, key suppliers were the United States (0.4 million tons), Australia (0.14 million tons), and Canada (63,000 tons).

In 2021, the Philippines imported Wheat worth $1.72 billion, becoming the world’s 9th largest importer of Wheat. Wheat was the 10th most imported product in the Philippines in the same year. The Philippines imports Wheat primarily from: the United States ($891 million), Australia ($539 million), India ($90 million), Ukraine ($84.4 million), and Bulgaria ($41.1 million). The fastest-growing import markets in Wheat for the Philippines between 2020 and 2021 were Australia ($369 million), India ($89.7 million), and the United States ($76.9 million).

In 2021, the Philippines imported Barley worth $104 million in Barley, becoming the 23rd most significant importer of Barley in the world. The same year, Barley was the 243rd most imported product in the Philippines. The Philippines imports Barley primarily from: Australia ($104 million), Singapore ($308k), China ($89.2k), South Korea ($4.84k), and New Zealand ($3.32k). The fastest-growing import markets in Barley for the Philippines between 2020 and 2021 were Australia ($100 million), Singapore ($253k), and China ($89.2k).

The Philippines exported Barley worth $542k in 2021, making it the world’s 54th largest exporter of Barley. The same year, Barley was the 650th most shipped product in the Philippines. The leading destination of Barley exports from the Philippines is Qatar ($232k), Cyprus ($129k), Singapore ($106k), Italy ($53.5k), and the United Arab Emirates ($10.9k). The fastest-growing export markets for Barley in the Philippines between 2020 and 2021 were Cyprus ($129k), Qatar ($67.6k), and Italy ($53.5k).

Other sources: USDA

Try AgFlow Free

Access Free On Updates for Corn, Wheat, Soybean,

Barley, and Sunflower Oil.

No Credit Card Required & Unlimited Access In Time