Oman Has 2 Wheat Imports Choices: Russia and Australia

Talk to our team about AgFlow's offering →

Reading time: 2 minutes

In the vast expanse of the global agricultural landscape, wheat stands tall as a staple, nourishing billions. Oman, a nation with a rich history and a keen eye on the future, has been navigating the intricate maze of wheat imports. But what factors have been shaping Oman’s wheat imports from January to July 2023? Let’s delve deep into this grainy matter.

Oman, a country known for its strategic location and rich cultural heritage, has always been a hub for trade. But when it comes to agriculture, Oman faces a conundrum. The nation’s arid climate and limited arable land make cultivating wheat at the scale required to feed its growing population challenging. Enter imports.

The Dynamics of Wheat Imports in 2023

The first half of 2023 has been a whirlwind for Oman’s wheat imports. Several key factors have come into play:

• Global Wheat Production: The global wheat yield in 2023 has been a mixed bag. Certain regions faced droughts, while others reaped bumper harvests. How does this affect Oman? It’s simple. A dip in global production can drive up prices, making imports costlier.

• Trade Relations: Oman’s diplomatic ties play a pivotal role. Countries with robust trade agreements tend to offer better rates and smoother transaction processes. Has Oman leveraged its diplomatic prowess in 2023 to secure favorable deals?

• Domestic Consumption Patterns: Has there been a surge in wheat consumption in Oman? Cultural festivals, population growth, and changing dietary habits can all influence demand.

• Storage and Logistics: How efficient is Oman’s infrastructure? After all, importing wheat is one thing; storing it without waste is another challenge.

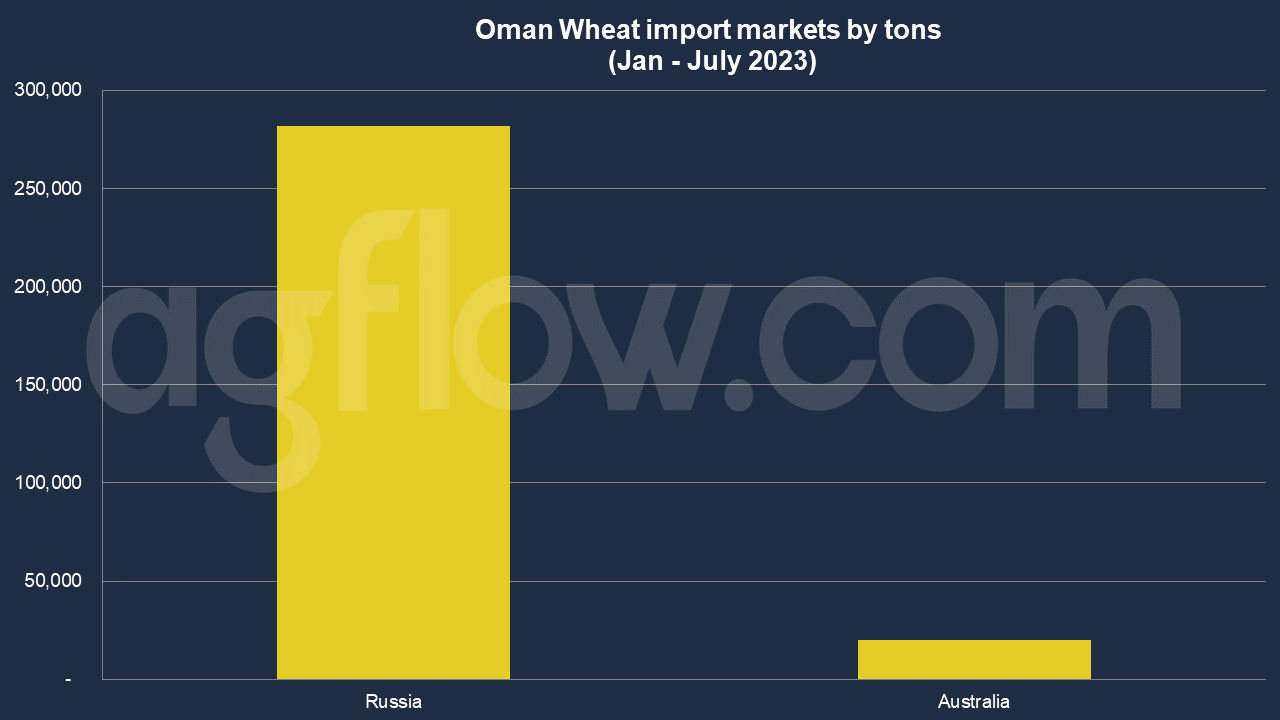

According to AgFlow data, Oman imported 0.28 million tons of Wheat from Russia in Jan – July 2023, followed by Australia (20,000 tons). Total imports hit 0.3 million tons in Jan-July 2023. Oman was purchasing large amounts of Wheat from Russia, such as 68,000 tons, and 65,000 tons.

March shipments were the largest in Jan – July of 2023, with 88,000 tons. The following months were Jan (65,000 tons), July (61,000 tons), Feb (50,000 tons), and May (36,000 tons). The wheat is used for making Omani bread resembling thin papery sheets locally known as ‘Khubz’ or ‘Karam’ besides its use in ‘Omani Halwa’.

Balancing the Scales: Trade-offs and Challenges

Every decision in the realm of imports comes with its set of trade-offs. For Oman, the challenge lies in balancing quality with quantity. Do they opt for premium wheat at a higher price or go for a more economical variety in larger volumes?

Moreover, with the global push towards sustainable agriculture, how does Oman ensure that the wheat they import is ethically sourced? And let’s not forget the logistical challenges. Ensuring timely delivery, preventing spoilage, and managing fluctuating demand are all part and parcel of the import game.

Looking Ahead: The Future of Wheat Imports in Oman

So, where does Oman go from here? The nation’s reliance on wheat imports is undeniable. But as the global landscape shifts, Oman must adapt. Exploring new trade partners, investing in storage infrastructure, and perhaps even dabbling in hydroponic farming could be potential avenues.

In conclusion, Oman’s journey in the wheat import sector from January to July 2023 is a testament to the nation’s resilience and adaptability. It’s a dance of diplomacy, economics, and strategy. And as the world watches, one thing is clear: Oman is more than ready to rise to the challenge. Whether you’re a casual observer or a professional in the agricultural commodity industry, Oman’s wheat story is one to watch.

Try AgFlow Free

Access Free On Updates for Corn, Wheat, Soybean,

Barley, and Sunflower Oil.

No Credit Card Required & Unlimited Access In Time