Olive Oil Sales Are Growing Fast in South Korea

Reading time: 2 minutes

Retail sales of Vegetable Oils in South Korea had a value of US$478.7 million in 2021. Sales of Vegetable Oil are forecast to grow by 1% from 2022 to 2026, reaching US$522 billion in 2026.

According to Euromonitor International, other Edible Oil was the top category, with sales valued at US$187 million. Sales of other Edible Oils are forecast to hit US$195 million by 2026.

Soybean Oil ranked second with US$93.2 million, while Rapeseed Oil was third, which were US$91 million, from US$131 million in 2017, a decrease of 9% during this period. Sales of Rapeseed Oil are forecast to reach US$95 million by 2026.

In the past five years, sales of Olive Oil recorded the highest growth, with a CAGR of 17%. Sales of Olive Oil are forecast to grow at a CAGR of 5% from 2022 to 2026, amounting to US$110 million in 2026. Olive Oil’s sales value was US$82 million, followed by Corn Oil (US$15.5 million) and Sunflower Oil (US$10 million).

South Korea is a net importer of Cooking Oils, its imports valued at US$2 billion while its exports are valued at US$36 million. Palm Oil and its fractions were leading in import values with US$662 million, representing 35% of total Vegetable Oil imports in the country. From 2017 to 2020, South Korea’s imports of Vegetable Oils increased by a CAGR of 16%.

Among South Korea’s Cooking Oil commodities, Sunflower-seed, Safflower, or Cotton-seed Oil is the commodity that recorded the highest growth between 2017 and 2021 with a CAGR of 21%, while Groundnut Oil and its fractions recorded the most significant decline with a CAGR of 2%.

Indonesia is South Korea’s largest supplier of Vegetable Oils. Imports from Indonesia were valued at US$428 million, followed by Malaysia, with imports valued at US302 million, and the United States, with imports valued at US$266 million. Among South Korea’s top 10 suppliers of Vegetable Oils, the Philippines recorded the most considerable growth between 2017 and 2021, with a CAGR of 140%, followed by Ukraine (CAGR of 60%) and Vietnam (CAGR of 34%).

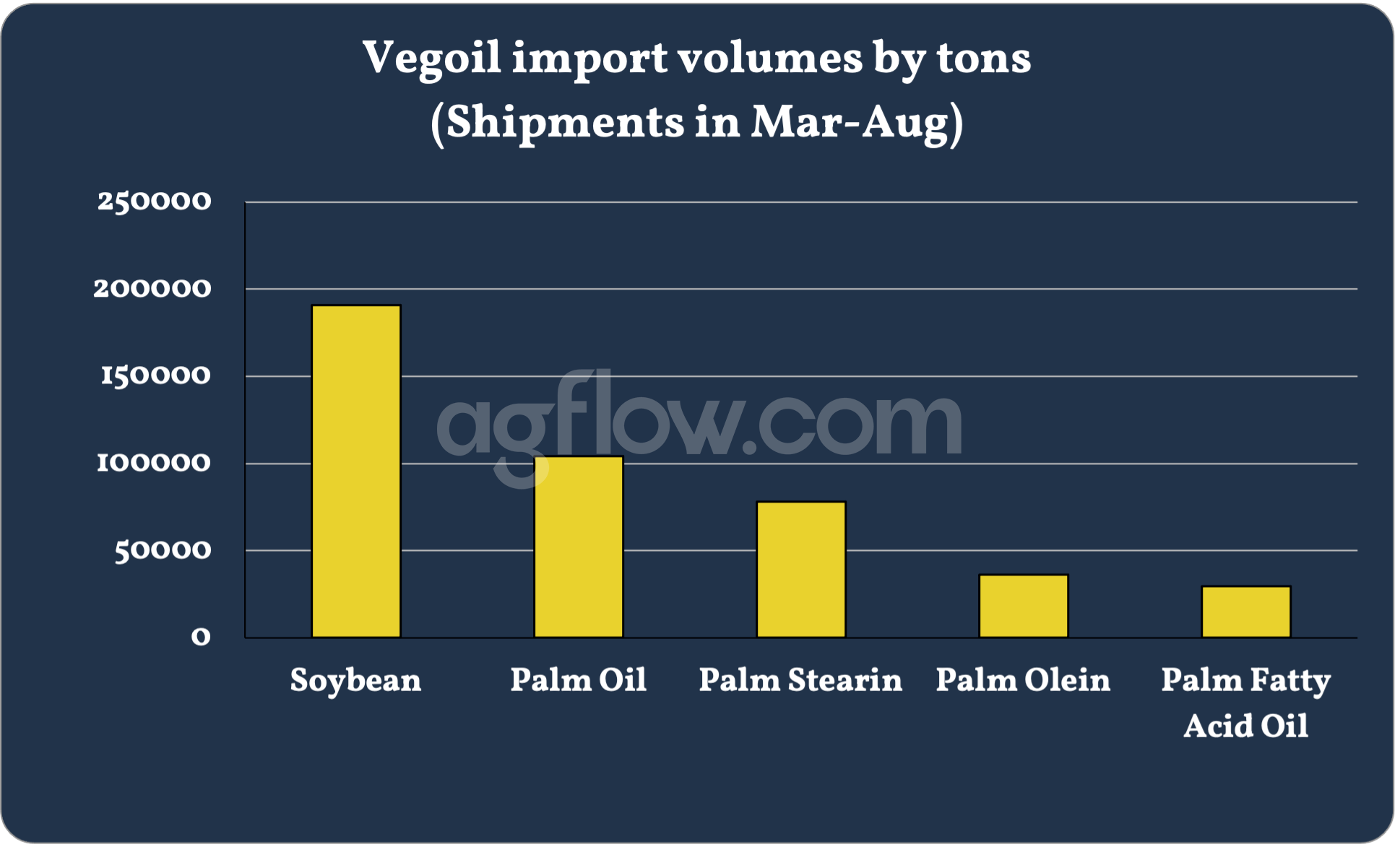

Canada was South Korea’s fourth-largest supplier of Vegetable Oils, with imports valued at US$204.2 million. As per AgFlow data, Soybean Oil led their import market with 190,900 tons in March-August shipments, followed by Palm Oil, Palm Stearin, and Palm Olein.

South Korea’s Vegoil Market Players

CJ Corp was the most significant player in the Cooking Oil market in South Korea in the last year. The company’s sales of Edible Oils are valued at US$183 million, representing a market share of 38%. The company’s sales grew by a compound annual growth rate (CAGR) of 4.5% from 2017 to 2021, increasing its market share by 1.8% during the same period.

Sajohaepyo Corp is the second leading category in sales, with US$83.6 million, representing a market share of 17.5%. Ottogi Foods Co Ltd was the third-largest company in the market, with retail sales estimated at US$69.5 million, representing a 14.5% market share.

Beksul and Ottogi are the two largest Cooking Oil brands in South Korea, with sales valued at US$156 million (32.5% market share) and US$63.7 million (13.3% market share), respectively.

Happy was the third-largest brand with US$52.9 million, representing a market share of 11.1%, followed by Dongwon, Chungjungone, and Borges.

The majority of Cooking Oils are sold through store-based retailing. Sales through store-based retailing were valued at US$401.2 million, representing a market share of 84%. Within this category, grocery retailers were leading with US$391.6 million, representing a market share of 81.3% of total Cooking Oil sales, followed by mixed retailers with sales valued at US$9.6 million.

In 2021, sales of Cooking Oils through non-store retailing were valued at US$77.6 million, representing a market share of 16.2%. Between 2017-2021, sales through this category increased by a CAGR of 16.5%, spearheaded by the increasing importance of e-commerce.

Free & Unlimited Access In Time