Morocco Turns to Grain Unions and Cooperatives for Wheat Import

Talk to our team about AgFlow's offering →

Reading time: 2 minutes

Morocco, officially the Kingdom of Morocco, is a country in the Maghreb region of North Africa. The current population of Morocco is 37.9 million as of September 3, 2023. Its GDP is USD 143 billion (2022). It ranks the country as the 60th largest economy in the world.

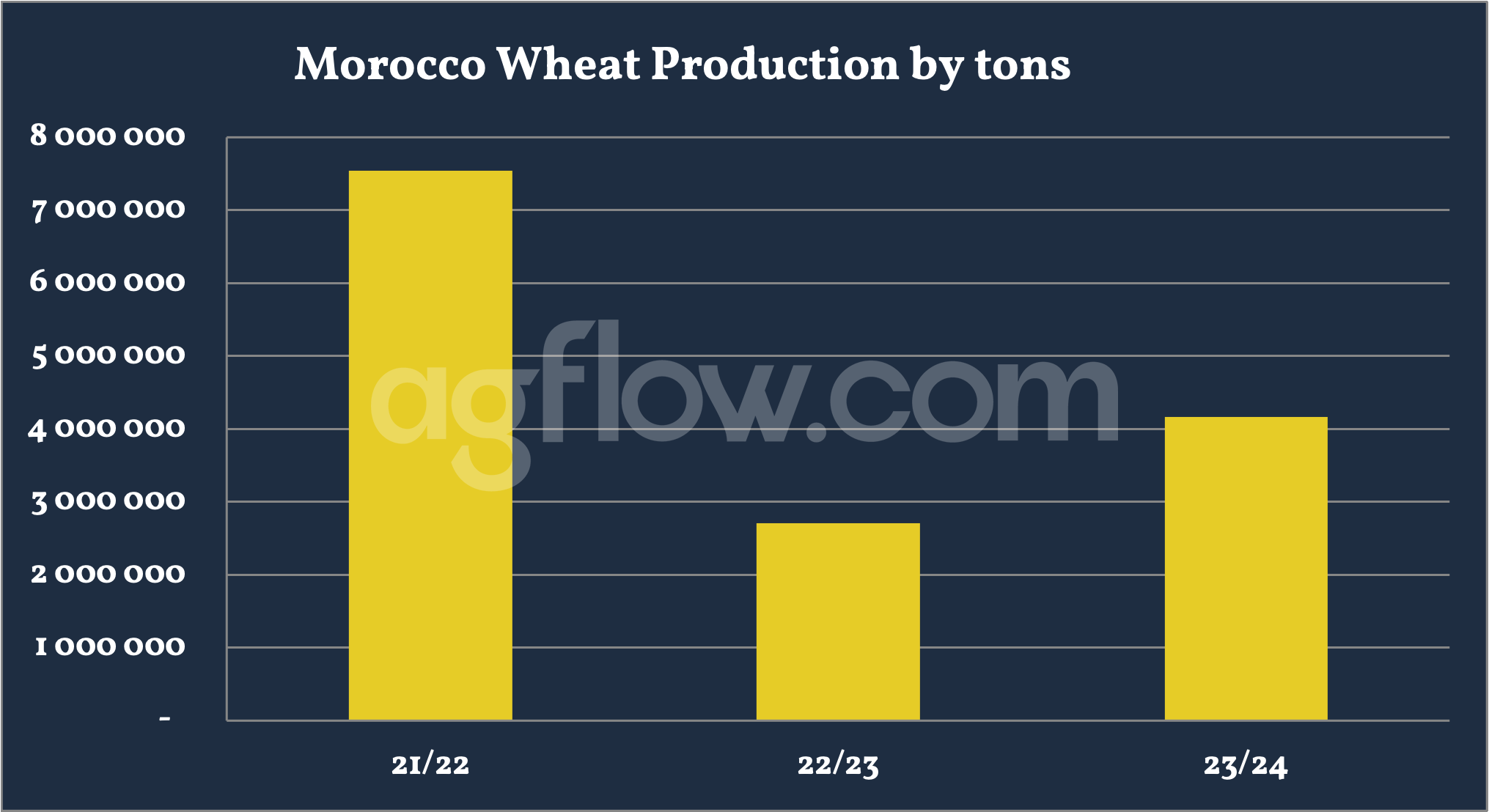

Morocco expects a significant boost in Wheat and Barley production, with a forecasted increase of 62% in the 2023-24 marketing year compared to the previous season. Morocco projects to produce approximately 3 million tons of common Wheat, 1 million tons of durum Wheat, and 1.3 million tons of Barley during the upcoming year. However, the projected Wheat output remains below historical averages due to the prolonged impact of the recent dry spells.

Recognizing the importance of revitalizing the agricultural sector, the Moroccan Government has recently introduced various measures to support domestic agriculture.

The measures are expected to boost Morocco’s agricultural industry, safeguarding food security and strengthening the economy. With the increase in Wheat and barley production, the country can reduce its reliance on imports and enhance its self-sufficiency in staple grains.

Moroccan Wheat Subsidy

In late June, Morocco’s Government introduced a subsidy for importing 2.5 million metric tons of soft Wheat from July to September. The program will benefit agricultural cooperatives, treadmills, and grain and legume unions seeking to import Wheat from countries including Russia and Ukraine.

The National Professional Office for Grains released a circular on June 23, providing that the program will support importers every month, covering the difference between the cost of Wheat and the reference import price of MAD 270 ($27) per quintal.

The program will primarily benefit people who seek to import Wheat from Russia, Ukraine, France, Germany, Argentina, and the US. The grant exclusively concerns the planned quantities of Wheat to be imported by storage institutions like grain and legume unions and Moroccan agricultural cooperatives and their unions.

According to AgriMaroc, traders had anticipated that Morocco would resume Wheat imports after experiencing another below-average harvest this year, albeit with production levels above 2022 yields. However, the need to import Wheat to compensate for the decline in domestic production has become apparent.

The fund comes amid concerns about insufficient Wheat production in the agricultural season of 2022-2023 due to adverse climate conditions such as drought. In April, Morocco’s Agriculture Ministry reassured citizens that cereal production is expected to rise by 62% in 2023 compared to the previous season.

According to the pledges, cereal production is expected to reach approximately 55.1 million quintals, up from 34 million quintals in the previous agriculture campaign, noting that soft Wheat production is forecasted to make up 29.8 million quintals of the overall volume of cereal production this year. Meanwhile, durum Wheat is set to reach 11.8 million quintals and barley 13.5 million quintals.

In late May, the Government decided to halt its common Wheat import support program, as prices declined with the arrival of the new world Wheat crop and other factors alleviating inflationary pressures. Import duties on Wheat will also remain scrapped until the end of 2023 to encourage stock building and ensure sufficient supplies in the market.

To mitigate the adverse effects of drought on the agricultural sector, the Government launched a comprehensive plan in June, allocating a substantial $1 billion budget. The initiative aims to support the importation of barley and dairy cattle feed through a subsidy program, which will receive half of the allocated funds.

Approximately $400 million will be utilized to aid farmers with the purchase and distribution of inputs, while the remaining $100 million will be dedicated to enhancing Credit Agricole and improving farmers’ access to financing, as outlined by the FAS.

Wheat Trade Pattern

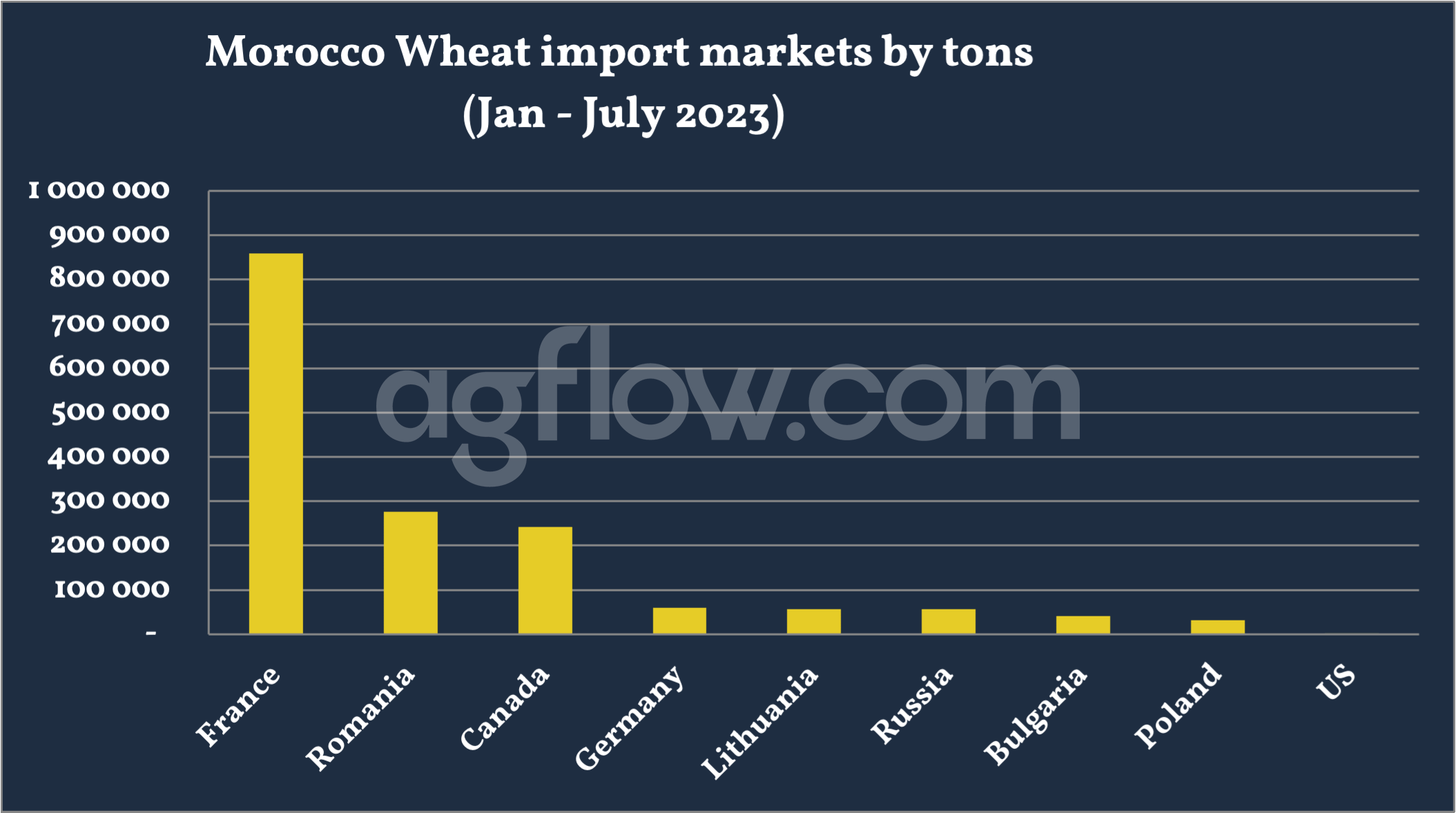

According to AgFlow data, Morocco imported 0.85 million tons of Wheat from France in Jan – July 2023, followed by Romania (0.27 million tons), Canada (0.24 million tons), Germany (59,949 tons), Lithuania (56,800 tons), Russia (56,700 tons), Bulgaria (41,000 tons), and Poland (32,342 tons).

It is worth noting that Morocco has become the leading destination for EU Wheat exports in the 2022/23 season, overtaking Algeria, which has turned to Russian Wheat to meet its needs. In the 2022/2023 agriculture season, Morocco has emerged as the largest importer of Wheat from the European Union. The European Commission’s report shows that in the first four months of 2023, Morocco imported over 4 million tons of Wheat, up from 1.4 million tons a year earlier.

The EU exported close to 16% of its Wheat harvest to the North African country by the end of April 2023, up from 6.1% the previous year. Algeria was the second largest Wheat importer over the same period, with 3.6 million tons, making up 14% of the bloc’s harvest, the report indicates.

In terms of exports, Morocco shipped Wheat worth $86k in 2021, making it the 88th largest exporter of Wheat in the world. The main destination of Wheat exports from Morocco are: Spain ($53.9k) and the Netherlands ($31.9k).

France and Germany Conspire CFR Price?

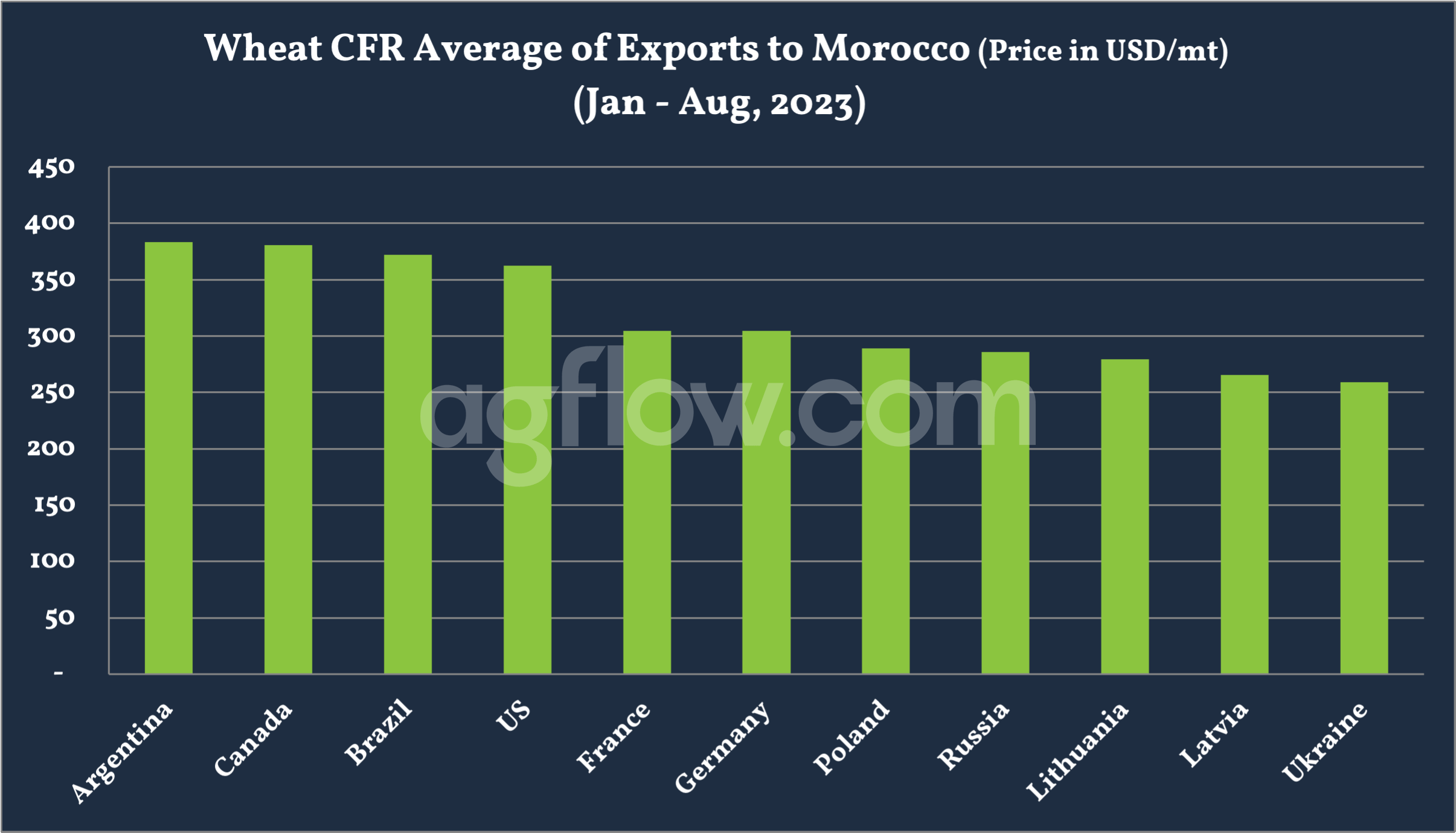

As usual, Argentina offered the highest CFR price, USD 384 on average. The following countries were Canada (USD 381), Brazil (USD 372), the US (USD 363), France (USD 304), Germany (USD 304), Poland (USD 289), Russia (USD 286), Lithuania (USD 279), Latvia (USD 266), and Ukraine (USD 259). Due to its short route, Argentina offered a lower CFR price than Bangladesh (USD 421).

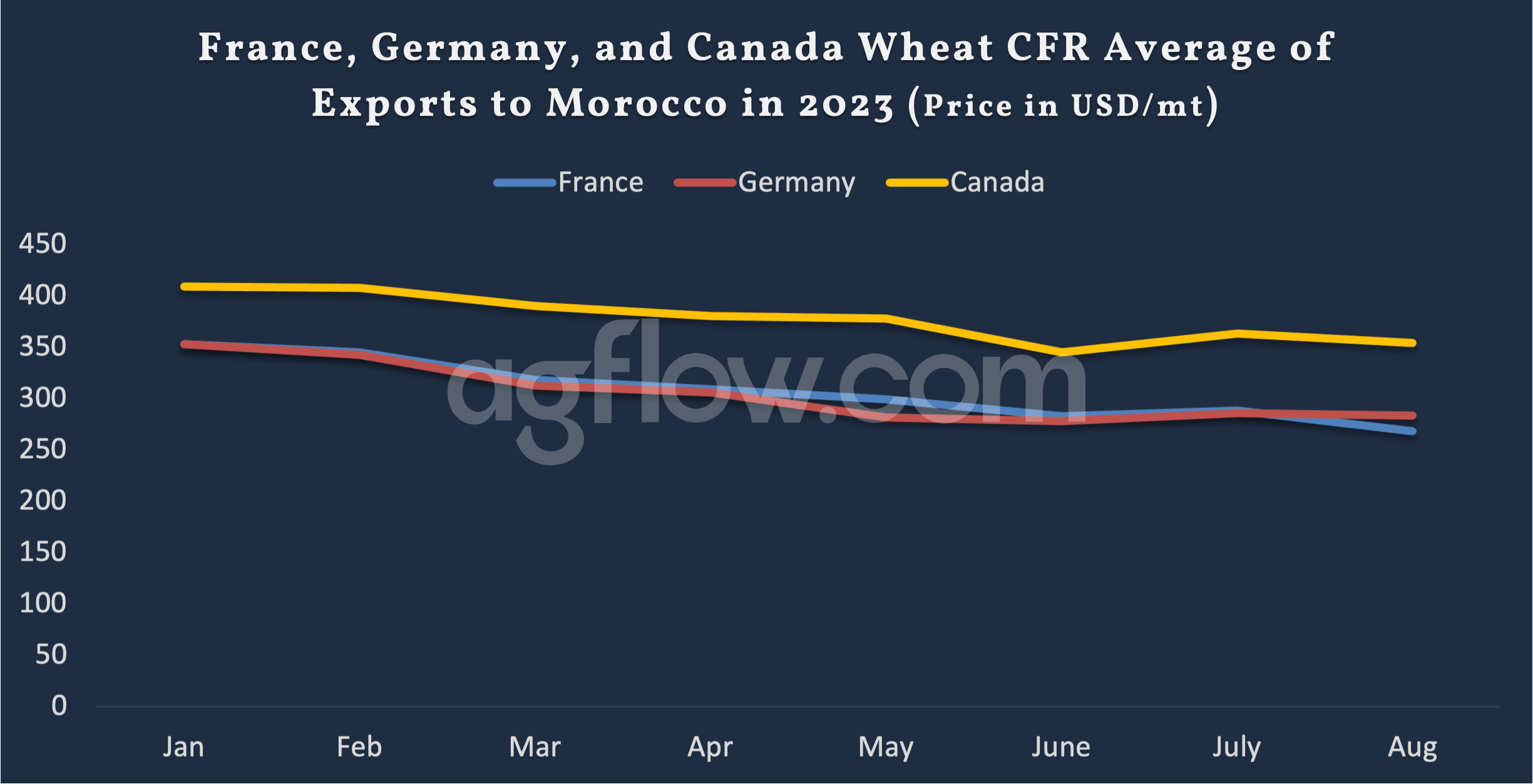

France and Germany offered the same CFR of USD 304. Interestingly, their average CFR prices have shown a similar trend since the beginning of 2023, except a little difference occurred in May and August. Did they talk and agree in advance? Canada’s CFR price trend was also similar to France’s.

In A Nutshell

Morocco has become a battlefield for EU Wheat-supplying countries, having a Wheat import market value worth over USD 1.4 billion. It appears Ukraine loses the Moroccan market compared with 2021. Canada and Poland also seem to be shipping lower volumes this season. The case might be worse for Argentina, which supplied Wheat worth USD 144 million in 2021. Because Argentina loses advantages due to higher CFR, the same applies to Canada.

Try AgFlow Free

Access Free On Updates for Corn, Wheat, Soybean,

Barley, and Sunflower Oil.

No Credit Card Required & Unlimited Access In Time