More Wheat Mills Open in Indonesia

Reading time: 2 minutes

During the pre-deregulation era from 1970 to 1998, when Wheat imports were carried out by a single state-owned procurement company, BULOG, only five flour mills operated in Indonesia. Thirty flour mills are operational across the archipelago, including 24 mills on Java Island, six on Sumatera, and two in South Sulawesi. Despite high international Wheat prices and global geopolitical challenges, the expansion of existing mills continues. Two new mills located in Sumatera and West Java started operations in 2022.

Therefore, installed capacity in 2022/23 is estimated to increase to 14 MMT compared to 13.1 MMT in 2021/22. However, running capacity remains at an average of 60-70 percent, a decline from 80 percent in 2018/19. As more mills open and expand capacity, competition in the market is expected to increase further price sensitivities, which is a significant factor in determining the source of imports.

Restrictions on corn imports continue to drive feed mills to use Wheat. The GOI continues to restrict imports of corn for feed mills, authorizing only state-owned BULOG to import corn for feed use. Imports of corn for feed use are permitted when prices are high due to domestic supply shortages. BULOG may only distribute imported corn to small-holder farmers. Regardless of the annual production volume, the combination of the seasonality of domestic corn supplies, little drying and storage facilities, high corn production costs, and increasing demand from feed mills have become the factors for high corn prices, even during the main harvest period.

Hence, feed mills include Wheat as one of the ingredients in feed formulation to meet energy demand in feed. However, due to soaring international prices of Wheat and other sources of protein for feed, as well as the increased availability of domestic corn, feed mills started purchasing more corn from the domestic market in 2021/22, and this consumption level has been maintained.

Wheat Import in Indonesia

According to AgFlow data, Indonesia imported 0.4 million tons of Wheat from Australia in

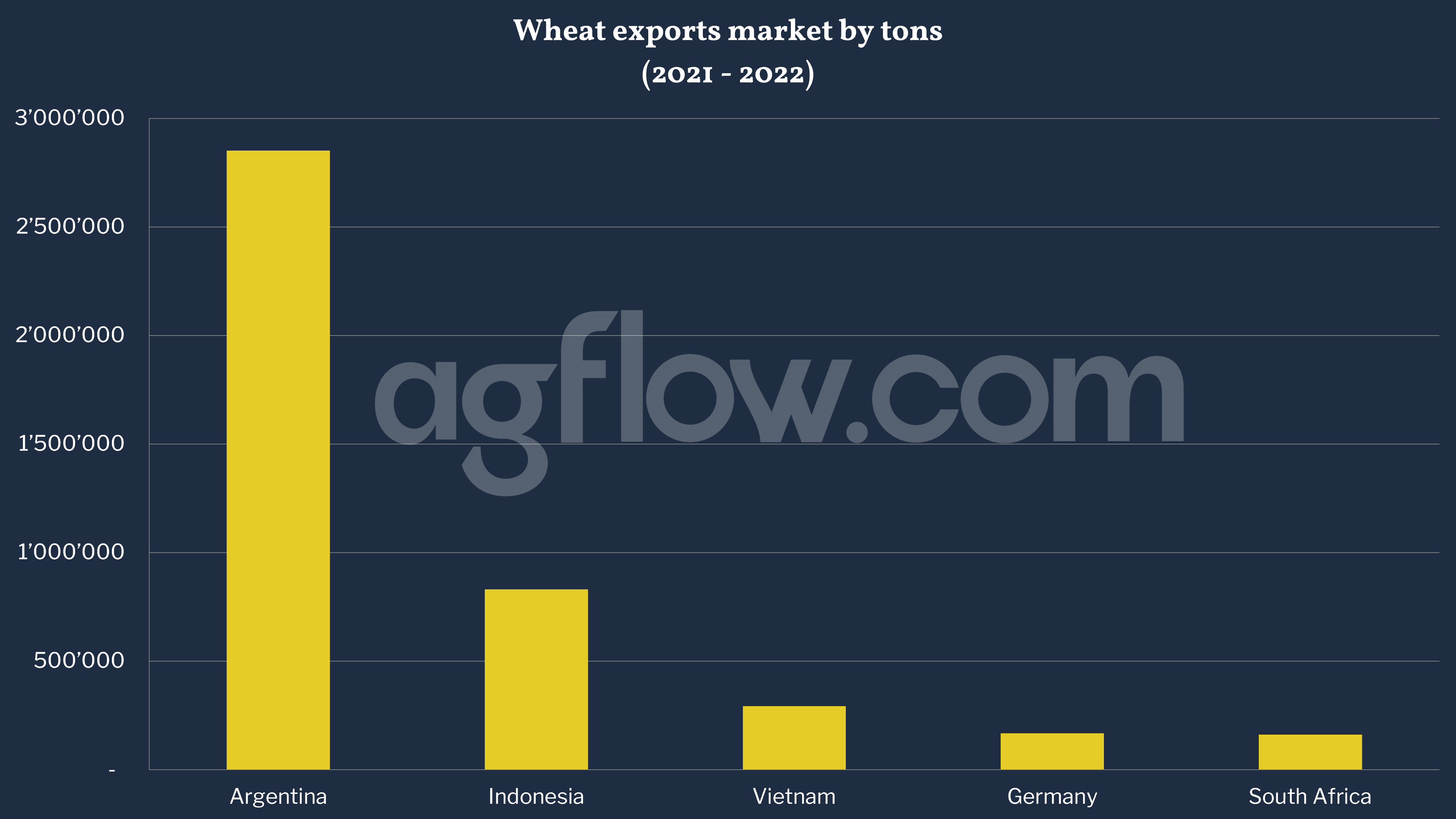

Jan-Apr 2023, followed by Canada (0.37 million tons), Brazil (0.26 million tons), and the United States (0.16 million tons). Total imports reached 1.4 million tons in Jan-Apr of this year. In 2021/22, Indonesia imported 11.2 MMT of Wheat equivalent. Australia was the largest Wheat supplier to Indonesia, with a 34.2 percent market share, followed by Ukraine (25.5 percent) and Argentina (14.1 percent). The United States accounted for just 1.24 percent market share due to U.S. Wheat’s premium prices over other suppliers. The ongoing Russian invasion of Ukraine has impeded imports of Wheat from Ukraine. Feed mills that always sought cheaper Wheat from Ukraine for feed production had to switch to Indian Wheat.

With Australia’s record Wheat production in 2022/23, proximity to Indonesia, and lower freight costs, Indonesian flour mills are highly likely to switch from Ukraine to Australia as the leading supplier of Wheat. Indonesia’s Wheat imports from Australia during the first six months of 2022/23 have increased by 20 percent compared to 2021/22. Australia now leads the market with a 49.6 percent market share. Canada, India, and the United States follow with 17.0 percent, 12.1 percent, and 6.0 percent market share, respectively.

Despite the recovering economy, high international Wheat prices hindered the growth of Indonesian Wheat imports in 2022/23, which is estimated to decline by 4.7 percent to 10.7 MMT compared to 11.229 MMT imported in 2021/22. Imports of Wheat in 2023/24 are forecast to rebound to 11.0 MMT as optimism from an improving Indonesian economy post-COVID-19 and population growth will drive up more demand for Wheat-based foods.

Other sources: USDA

Try AgFlow Free

Access Free On Updates for Corn, Wheat, Soybean,

Barley, and Sunflower Oil.

No Credit Card Required & Unlimited Access In Time