Japan Corn Import: Brazil Wins the Price Game

Talk to our team about AgFlow's offering →

Reading time: 7 minutes

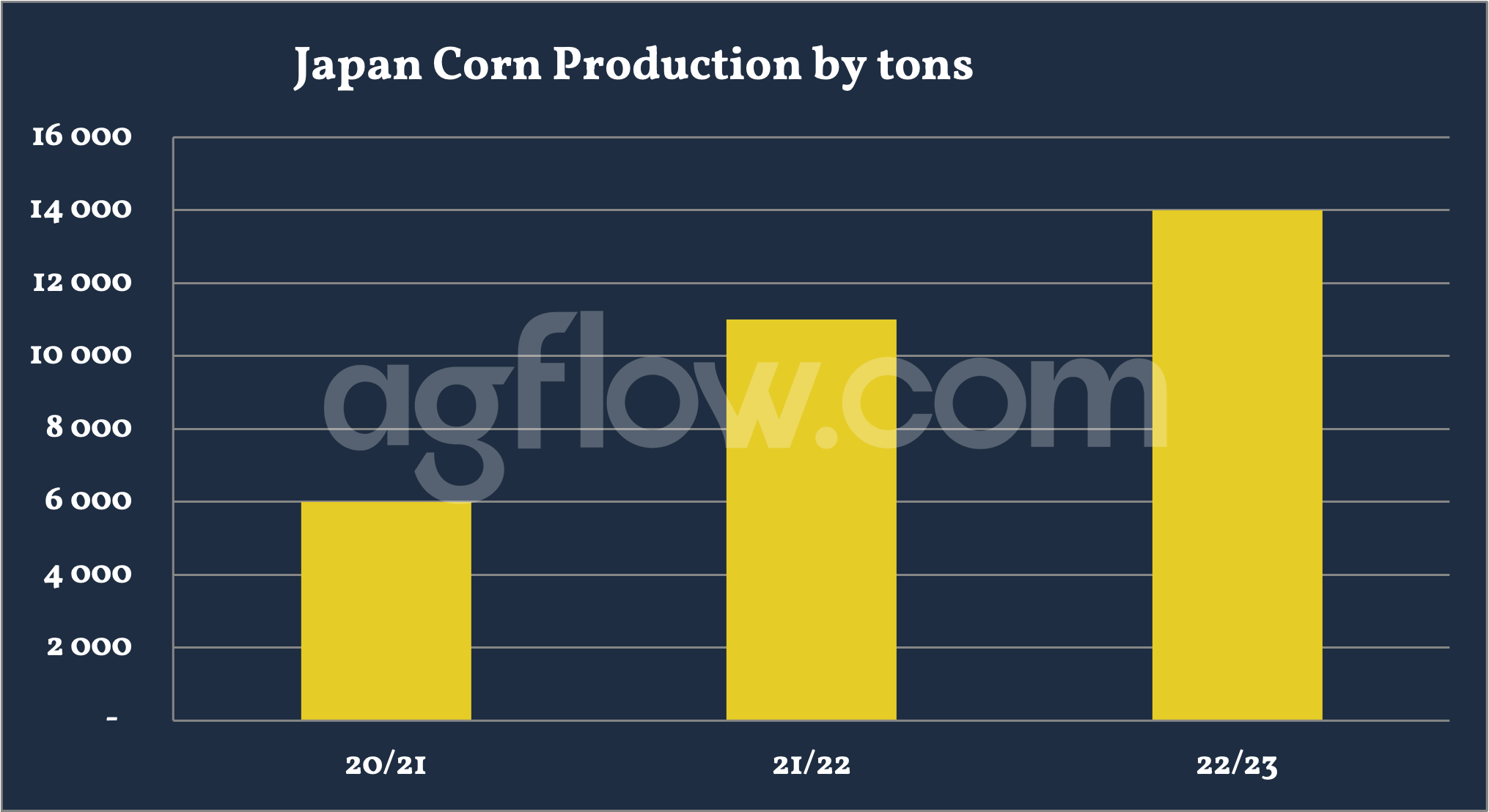

Japan’s MY2023/24 Corn planting area and production are to increase to 2,400 hectares and 14,000 metric tons, respectively, based on projected shifts from rice to grain Corn production, according to the FAS/Tokyo forecasts. Ministry of Agriculture figures show domestic production of Corn used for livestock feed is expanding rapidly. In 2021, about 8,000 tons were harvested, more than four times the amount produced seven years ago. Officials regard locally-produced Corn as a step toward better national food security.

The Corn for local farmer’s pigs comes from a neighboring town, Wakuya. Farmers there harvested the first crop just last year. Town officials had encouraged them to turn to Corn because it had become more expensive and required less work than rice. In most rural Japan, the number of people available for agricultural labor is declining due to an aging population, and the farmers often feel overworked.

Town official Fujisaki Koji explains that “rice is the mainstay crop for the town, but it requires a lot of work by the farmers. Corn production is less labor intensive, so we decided to introduce it”. For the past few months, the pigs at the Shiwahime Swaine farm in Miyagi Prefecture, northern Japan, have consumed a diet comprised mostly of Corn and rice. Everything they eat is grown in Japan.

Argentina and South Africa Are on the Battlefield

Almost all Corn consumed in Japan is imported from foreign countries, mainly from the US. About 70% of the Corn is consumed as feed, and the rest is consumed as food. As for feed, 80% is used as raw material for compound feed for pigs, dairy cows, beef cattle, and poultry. As for food, 70% is processed into Corn starch used for saccharification of glucose, starch syrup, isomerized sugar, fiber, paper paste, and other food ingredients. The remaining 30% is processed into grit, used as fermentation raw material for distilled liquor and beer. It is also used as a raw material for confectioneries such as Corn flakes and popcorn or miso.

FAS/Tokyo forecasts MY2023/24 Corn imports to increase to 15 million metric tons, up 1.4 percent from Post’s MY2022/23 estimates, based on projected increases in feed and FSI demand. Post projects MY2022/23 imports to drop to 14.8 million metric tons, down 1.4 percent from the previous marketing year, based on reduced feed demand.

Japan imports Corn mainly from the United States and Brazil. In MY2021/22, due to high U.S. Corn prices, imports from the United States decreased 5.2 percent to 10.4 million metric tons. Imports from Brazil also dropped 44 percent due to a decline in exportable Corn supplies. Imports from Argentina and South Africa jumped 166 percent and 290 percent, respectively, due to price advantages over U.S. Corn.

In MY2021/22, Japan imported 108,380 metric tons of Corn from Ukraine, most of which was contracted before Russia invaded Ukraine. After a year with no imports of Corn from Russia, Japan imported 1,947 metric tons of Corn in December 2022 and 528 metric tons in January 2023 from Russia.

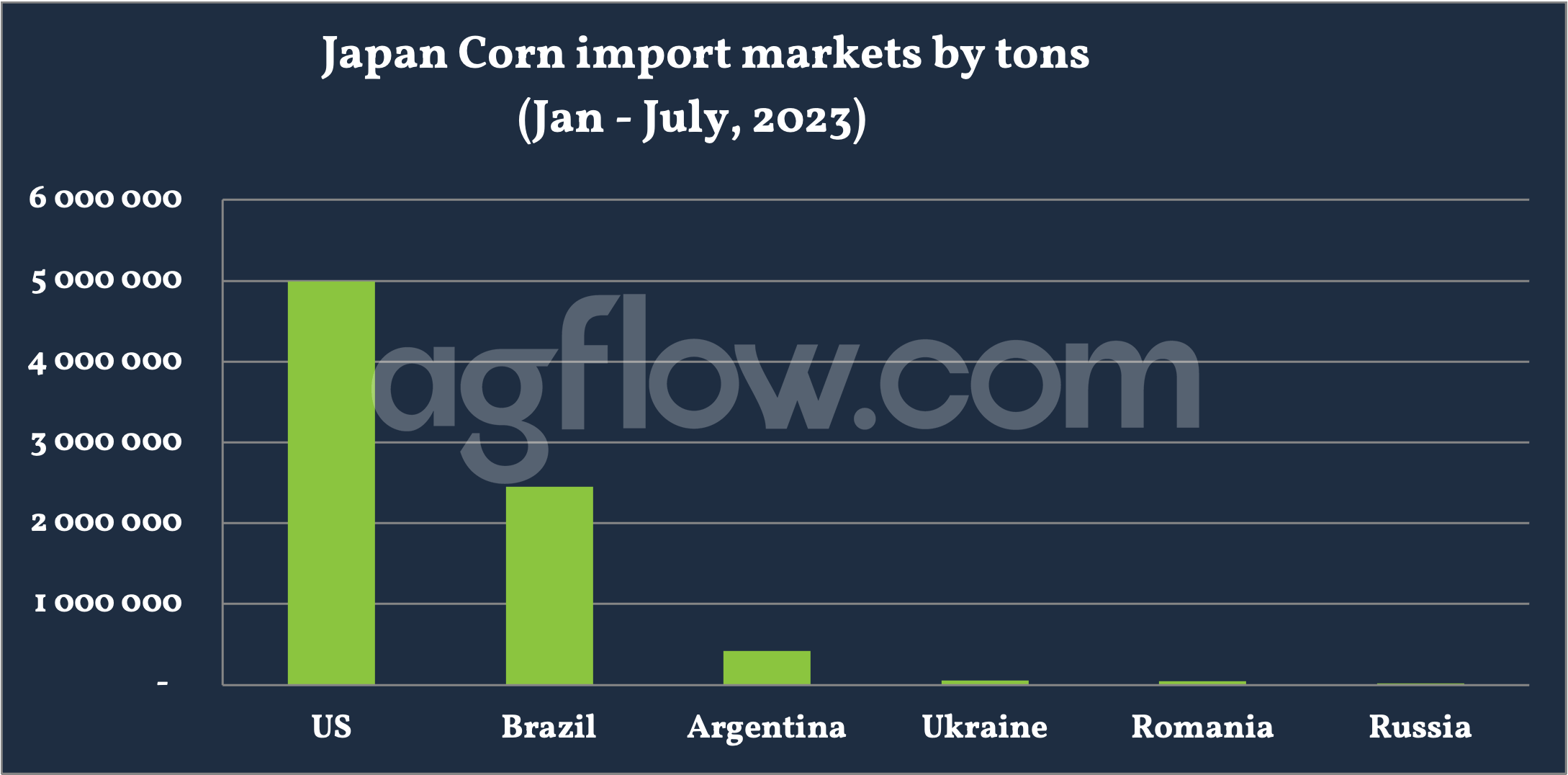

According to AgFlow data, Japan imported 5.0 million tons of Corn from the United States in Jan – July 2023, followed by Brazil (2.4 million tons), Argentina (0.4 million tons), Ukraine (55,950 tons), Romania (50,000 tons), and Russia (19,930 tons).

In 2021, Japan imported Corn worth $3.93 billion, the world’s 3rd largest importer of Corn. In the same year, Corn was Japan’s 25th most imported product. Japan imports Corn primarily from the United States ($3.11 billion), Brazil ($323 million), Argentina ($231 million), South Africa ($184 million), and Ukraine ($25.6 million). In 2019, the import value of Corn from the United States to Japan amounted to approximately 2 billion U.S. dollars.

In 2021, Japan exported Corn worth $130k, making it the world’s 112th most significant exporter of Corn. In the same year, the leading destination of Corn exports from Japan was Hong Kong ($31.9k), South Korea ($23.5k), France ($18.2k), China ($15k), and Germany ($11k).

The US Strength Weakens

Corn prices are heavily influenced by the yield from the Corn Belt, a significant production area in the US. Attention must be paid to exchange rates, freight rates, and trends in soybeans and wheat that could be replaced as Corn is an imported product. In addition to trends in inventory rates and exports announced by the US Department of Agriculture (USDA), attention must be paid to bioethanol demand, which crude oil prices have recently influenced.

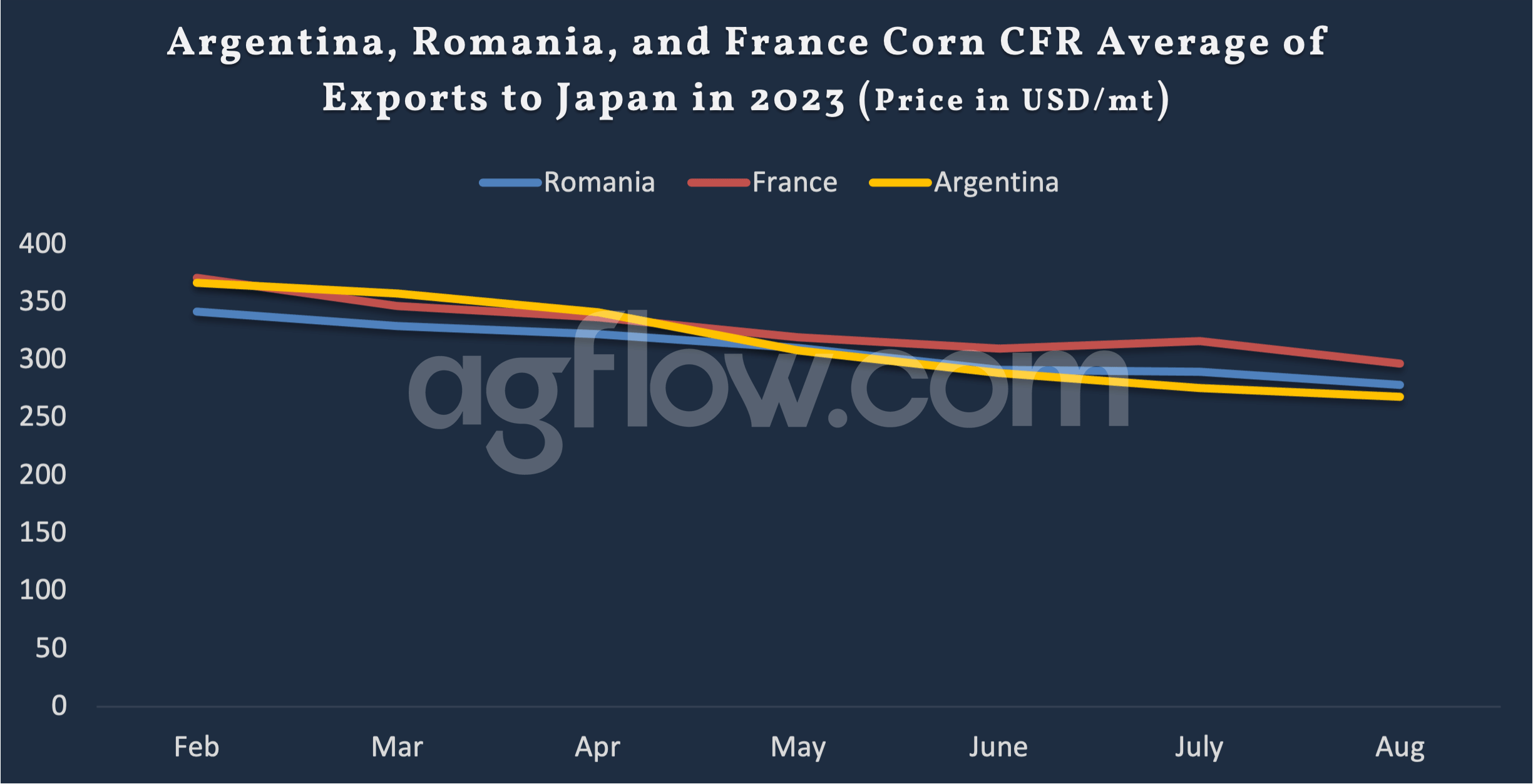

Argentina’s Corn CFR price has been falling each month in Feb – Aug of 2023, from USD 366.7 in Feb to USD 267.9 in Aug. Romania also did the same, from USD 341.7 in Feb to USD 278.4 in Aug. France played a little differently, offering USD 316.4 in July, which is the only month of increase of CFR.

France offered the highest CFR price, USD 328.5 on average, followed by the United States (USD 322.6), Argentina (USD 316.7), Romania (USD 316.4), Brazil (USD 288), Russia (USD 274.1), and Ukraine (258.7). Brazil offers attractive price to Japan.

According to weekly USDA export data, total U.S. Corn export sales in April and May were the lowest in at least 22 years. U.S. Corn exporters are hurt by stiff competition from cheaper Brazilian supplies and a strong dollar that makes their produce more expensive to buyers abroad, such as in Japan.

In A Nutshell

Despite its higher Corn CFR, Japan chooses the United States as its key Corn supplier. The main reason is related to their geopolitical allies, traditional trade relations, and direct sea routes. Brazil is the 2nd ranked supplier. Japan also has a special relationship with Brazil as its largest migrant community lives in Brazil. According to the United Nations COMTRADE database on international trade, Japan’s Imports from Brazil will be US$1.33 Billion in 2022.

It can be concluded that Brazil is gaining more market share in Japan’s Corn market. Illinois farmer says: “We need a good export market for our Corn. The seed technology in Brazil is getting better and better every year. Globally, Brazil is likely to export more Corn than the U.S. in the current marketing year.

Try AgFlow Free

Access Free On Updates for Corn, Wheat, Soybean,

Barley, and Sunflower Oil.

No Credit Card Required & Unlimited Access In Time