EU Wheat Exports to Hit 33 Million Tons

Reading time: 2 minutes

EU Wheat area is expected to increase slightly in MY 2023/24. French, Hungarian, Romanian, and Polish Wheat growers are anticipated to plant more Wheat, while producers in Spain, Czech Republic, Denmark, Germany, and Slovakia are expected to reduce their Wheat plantings.

Wheat production is forecast to bounce back to 137.8 MMT in MY 2023/24, driven by higher output in France, Bulgaria, Baltic countries, Hungary, Romania, and Italy, not offset by lower crop expectations anticipated for Denmark, Germany, and Poland. However, weather conditions until harvest can still play a significant role in final production volumes. Planting conditions were good to ideal for Wheat in most growing regions. Little or no winterkill was reported, and cold waves in western Europe in February helped to harden. Despite rains resuming in early spring, soil moisture remains a concern in most EU Wheat-producing countries, especially in west EU MS, specifically France, where winter was significantly dry.

Regions with light or sandy soils are more vulnerable to this.

On the other hand, Wheat growers in Bulgaria, Romania, and Hungary report good soil moisture levels despite some abnormally high temperatures in the winter that led to higher evaporation. If the dryness in major EU Wheat-producing countries extends into April and May, it could limit the amount of nitrogen the Wheat plant can absorb and ultimately lower the protein content in Wheat. Overall, significant rain is needed in most of the EU throughout the spring to keep MY 2023/24 Wheat yields above average and to allow efficient fertilization.

Within FSI, both food and industrial Wheat uses in the EU are expected to increase slightly in MY 2023/24. Wheat uses for biofuel purposes are anticipated to increase marginally in MY 2023/24 as, contrary to what occurred in MY 2022/23; lower Wheat prices are likely to support the demand for Wheat feedstocks against other feedstocks. Likewise, food uses of Wheat are expected to increase slightly in MY 2023/24 as the COVID-19 pandemic-related restrictions affecting tourism and the HRI sector throughout the EU are now fully lifted.

Moreover, population growth in most EU MS, but especially in Poland, Germany, and the Czech Republic, fueled by several million refugees from Ukraine since February 2022, drove Wheat food uses slightly up. The hike in Wheat prices since the conflict in Ukraine had a direct consequence on food prices, starting with pasta prices. However, food inflation does

not seem to have lowered the consumption of Wheat-based food products in the EU, as it is a staple food. Moreover, the decline in Wheat prices since the fall of 2022 is now easing the inflationary pressure on Wheat-based food products.

EU feed use of Wheat in MY 2023/24 is forecasted to rise slightly from MY 2022/23. Ample supplies, both domestically and from imports, and lower expected prices will support the competitiveness of Wheat in feed rations, despite a stagnant overall feed demand. In MY 2022/23, EU Wheat feed uses suffered from higher Wheat prices, especially in the first half of the MY, but on the other hand, benefited from a lower corn crop and high imports from Ukraine, especially in Spain.

EU Wheat Exports

EU Wheat exports are anticipated to reach a very high level in MY 2023/24, partly benefiting from the ongoing war in Ukraine hampering the country’s production and exports and the larger anticipated Wheat crop and price competitiveness for EU Wheat. Main Wheat-exporting MS include France, Romania, Germany, Poland, Bulgaria, and the Baltic States.

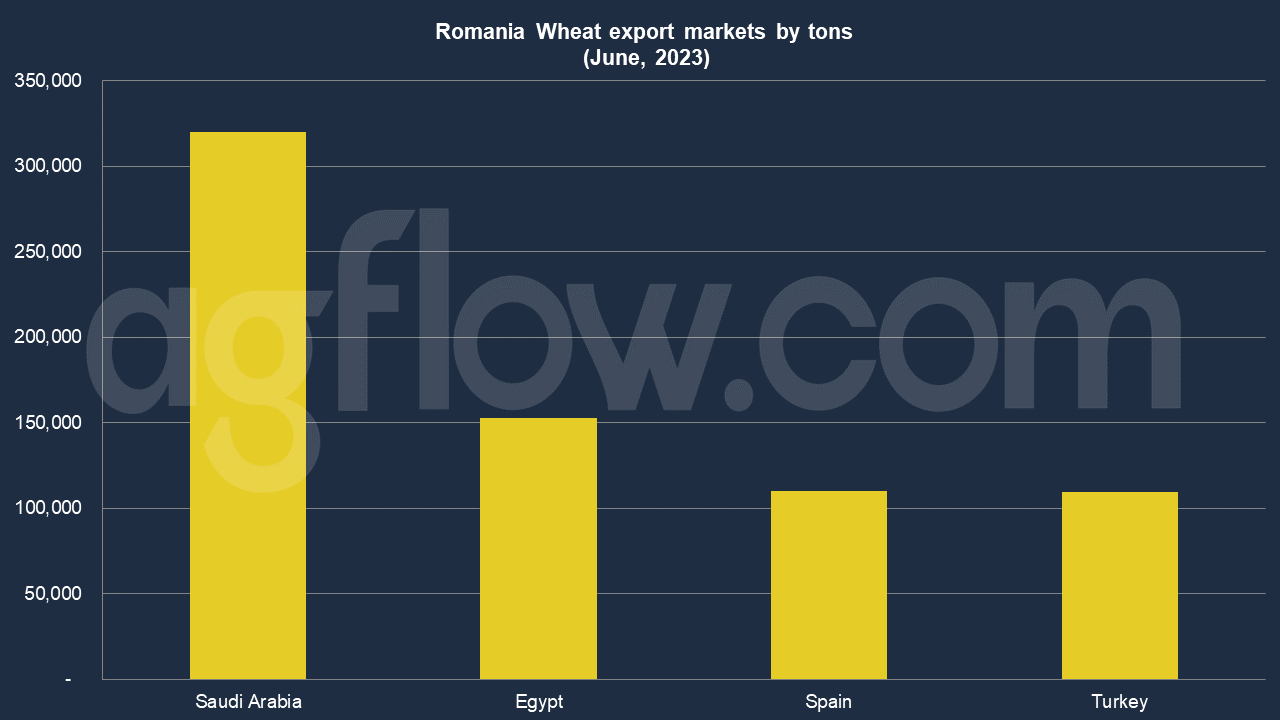

According to AgFlow data, Romania exported 4.3 million tons of Wheat in Jan-Jun 2023. In June, key markets were Saudi Arabia (0.3 million tons), Egypt (0.15 million tons), Spain (0.1 million tons), and Turkey (0.1 million tons). In MY 2022/23, EU Wheat exports are expected to increase to 33.3 MMT despite the somewhat lower domestic crop.

Other sources: USDA

Try AgFlow Free

Access Free On Updates for Corn, Wheat, Soybean,

Barley, and Sunflower Oil.

No Credit Card Required & Unlimited Access In Time