China Becomes Top Wheat Supplier to Afghanistan

Reading time: 2 minutes

China’s Wheat imports soared 80 percent in the first four months of the year, mainly because the price of the cereal in overseas markets fell more than at home, according to the latest official data. China imported nearly 6 million tons of Wheat from January through April, equivalent to 60 percent of last year’s total, numbers from the General Administration of Customs showed. April’s imports jumped 141 percent from a year ago to 4.7 million tons.

Incoming Wheat shipments have exceeded 1.3 million tons a month this year mainly because prices were lower abroad than in China, making imports more profitable, said Meng Li, an agriculture ministry official. Rising imports are due to the excessive optimism among Chinese processing companies over replacing domestically grown Wheat with the overseas product as animal feed, Zheng Wenhui, a Grain economy researcher at Guangdong South China Grain Trading Center, told Yicai Global.

That has led to vast amounts of Australian standard white Wheat, mainly used as animal feed, being brought in, Zheng added. According to GAC data, sixty percent of China’s Wheat imports between January and April were from Australia. Imports from Canada accounted for 19 percent of the total, followed by France at 13 percent and the United States at 8 percent.

In the second half of the year, imports are not expected to exceed the same amount shipped a year earlier by very much, as most of it will be high-gluten Wheat, Zheng said. Meng predicted that Wheat imports will still surpass the tariff quota of 9.6 million tons for the third straight year in 2023. But given the higher tariff rates on the shipments exceeding the quota, Meng noted that China’s total Wheat imports this year will not exceed the quota by much.

China’s Corn imports fell 8.4 percent in the January to April period from a year earlier. Meng believes this is due to the narrowing price gap between Wheat and Corn, mainly used as animal feed. In northern China, the gap between the two prices fell to CNY50 (USD7) per ton, prompting local feed companies to substitute Corn with Wheat, with the replacement ratio at some firms exceeding 50 percent. Moreover, the new Wheat harvesting season in the main production areas will be at the end of May, further shrinking the demand for Corn.

The GAC also showed that China’s soybean imports rose 6.8 percent in the first four months, with a 6.5 increase in barley shipments. Imports of rice slumped 39.7 percent in the period, with Meng attributing it to high international prices. Sorghum imports plunged 71 percent.

Chinese Wheat Trade Pattern

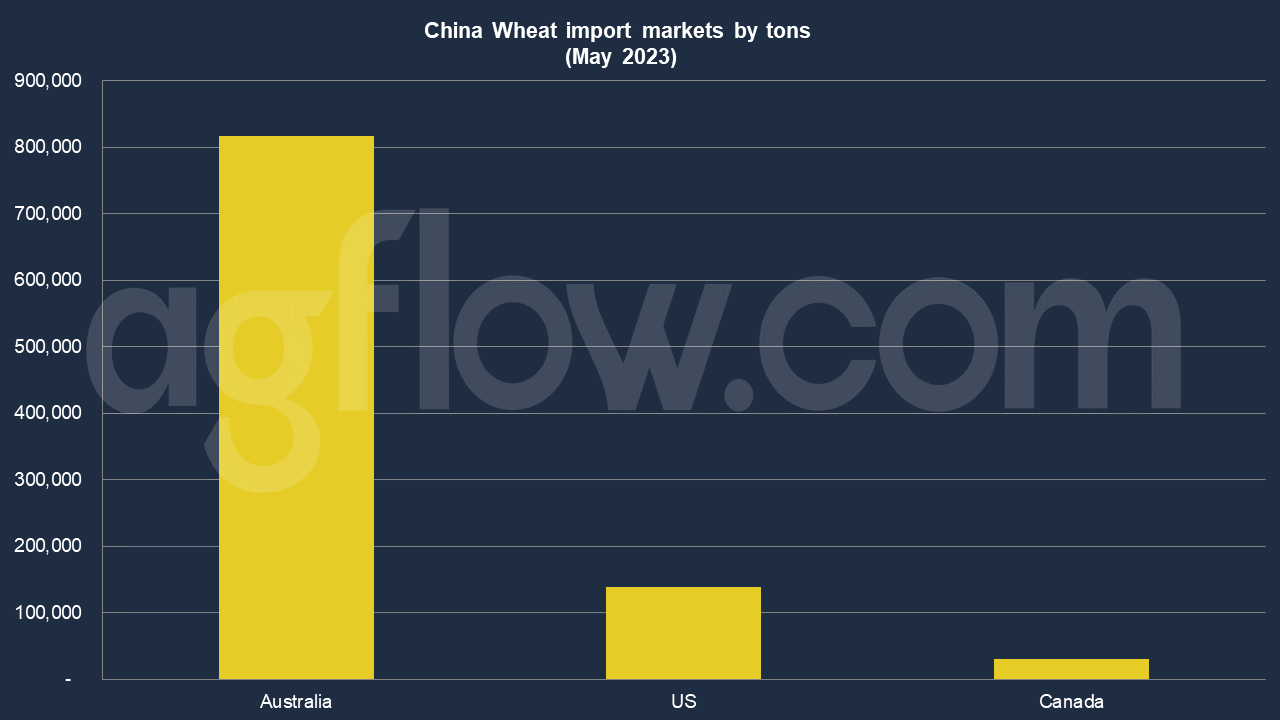

According to AgFlow data, China imported 0.8 million tons of Wheat from Australia in May 2023, followed by the United States (0.13 million tons) and Canada (30,900 tons). Total Wheat imports reached 4.1 million tons in Jan-May of this year.

In 2021, China imported Wheat worth $2.94 billion, becoming the world’s 4th largest importer of Wheat. In the same year, Wheat was China’s 111th most imported product. China imports Wheat primarily from Australia ($912 million), the United States ($801 million), Canada ($663 million), France ($498 million), and Kazakhstan ($41.5 million).

In 2021, China exported Wheat worth $2.98 million, making it the 56th largest exporter of Wheat in the world. In the same year, Wheat was China’s 1154th most exported product. The leading destination of Wheat exports from China is Afghanistan ($1.17 million), Ethiopia ($951k), Egypt ($299k), South Korea ($152k), and Spain ($142k).

Other sources: YICAI GLOBAL

Try AgFlow Free

Access Free On Updates for Corn, Wheat, Soybean,

Barley, and Sunflower Oil.

No Credit Card Required & Unlimited Access In Time