Brazilian Wheat Takes Advantage on Arab World

Reading time: 7 minutes

Brazil Wheat production is forecast at a record 9.4 million tons in 2022/23 on improved yields. With ample domestic supplies, imports are slashed to 5.9 million tons—the lowest in 8 years. While Brazil is a significant Wheat producer, it still relies on imports to satisfy demand from its milling sector, especially in northern states where Wheat is not grown. Its largest supplier is Argentina, which captured nearly 90 percent market share last year. Argentina’s Wheat crop, however, is expected to shrink dramatically in 2022/23, and exports are forecast to decline by over 40 percent from the prior year.

The steep devaluation of the Brazilian real also impacted traders’ ability to purchase dollar-denominated Wheat. With the real currently trading at R$5.04/USD and domestic supplies expanding, mills are less willing to buy international Wheat. With elevated global Wheat prices and a devalued currency, selling for export has become an attractive revenue opportunity for Brazilian farmers and traders that partially offsets increased production costs.

Exports will reach record levels for the second year, forecast at 3.5 million tons for 2022/23. In 2021/22, constrained supplies from the Black Sea allowed Brazil to take advantage of strong demand in the Middle East, Southeast Asia, and North Africa. Exports to top destination Saudi Arabia, for example, were nearly five-fold higher than in 2020/21.

Mr. Carlos Cogo from Cogo Intelligence in Agribusiness comments: It is essential to point out that the Wheat exported by Brazil is the so-called hard Wheat, used in animal feed, and that the Wheat used in baking is the soft type, more produced in Argentina, Canada and Russia. Brazil currently consumes 12.5 million tons, and most mills in the country are already supplied. We won’t have shortage problems.

Also, according to Cogo, the price and liquidity of the cereal will encourage Brazilian producers to produce more. “We are estimating this year’s harvest, and the numbers are yet to be revised, approximately 3.3 million hectares, the largest area since 1987. If all goes well, Brazil could harvest up to 10.8 million tons in 2022”, he notes.

Brazilian Wheat Trade

In just the first 5 five months of this year, Brazil, which is traditionally one of the world’s main importers of the cereal, exported more than twice the entire volume of 2021. According to Canal Rural’s content director, Giovani Ferreira, the strong dollar and the war between Russia and Ukraine are the main reasons for growth.

“What’s up? The producer is taking advantage of the price. Because of the crisis in Eastern Europe, there is Wheat dammed up in Ukraine. And the country produces almost 30 million tons of cereal. With the dammed Wheat, the countries need to look for other suppliers. And many are coming to look for it in Brazil”, explains Ferreira.

Apart from China, many Arab countries are buying Brazilian Wheat, including Saudi Arabia, Morocco, Sudan, and Egypt. Last year, they imported 240 thousand tons in this period. And this year, the volume exceeds 1 million tons,” he says.

On average, the Brazilian industry consumes 12.5 million tons of cereal annually. In 2021, for example, the country imported 6.2 million tons. Brazil is exporting so much that it will need to import more. To meet the demand, Brazil will need to import approximately 8 million tons.

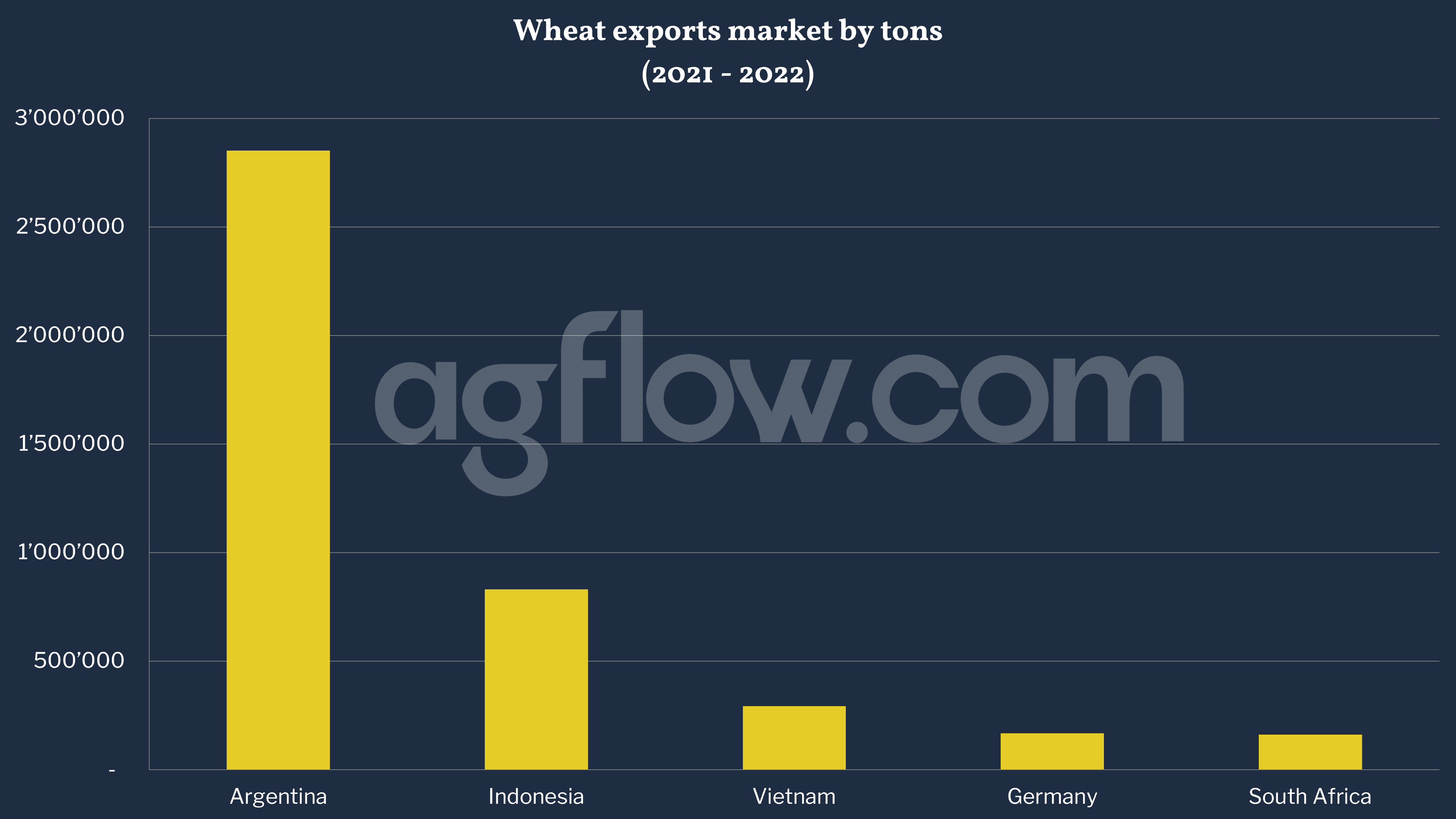

As per AgFlow data, Argentina was the largest export market of Brazilian Wheat with 2.8 million tons in 2021-2022, followed by Indonesia (0.8 million tons), Vietnam (0.3 million tons), Germany (0.2 million tons), South Africa (0.2 million tons), Pakistan (0.1 million tons), Morocco (0.1 million tons), and Saudi Arabia (0.1 million tons). In total, Brazil imported 7.6 million tons of Wheat in 2021-2022.

Other sources: CANALRURAL

Try AgFlow Free

Access Free On Updates for Corn, Wheat, Soybean,

Barley, and Sunflower Oil.

No Credit Card Required & Unlimited Access In Time