Argentina’s Corn: Quotas on Exports To Continue

Reading time: 7 minutes

![]() Free Article

Free Article

Argentina’s Corn Production Remains Stable Despite the Droughts

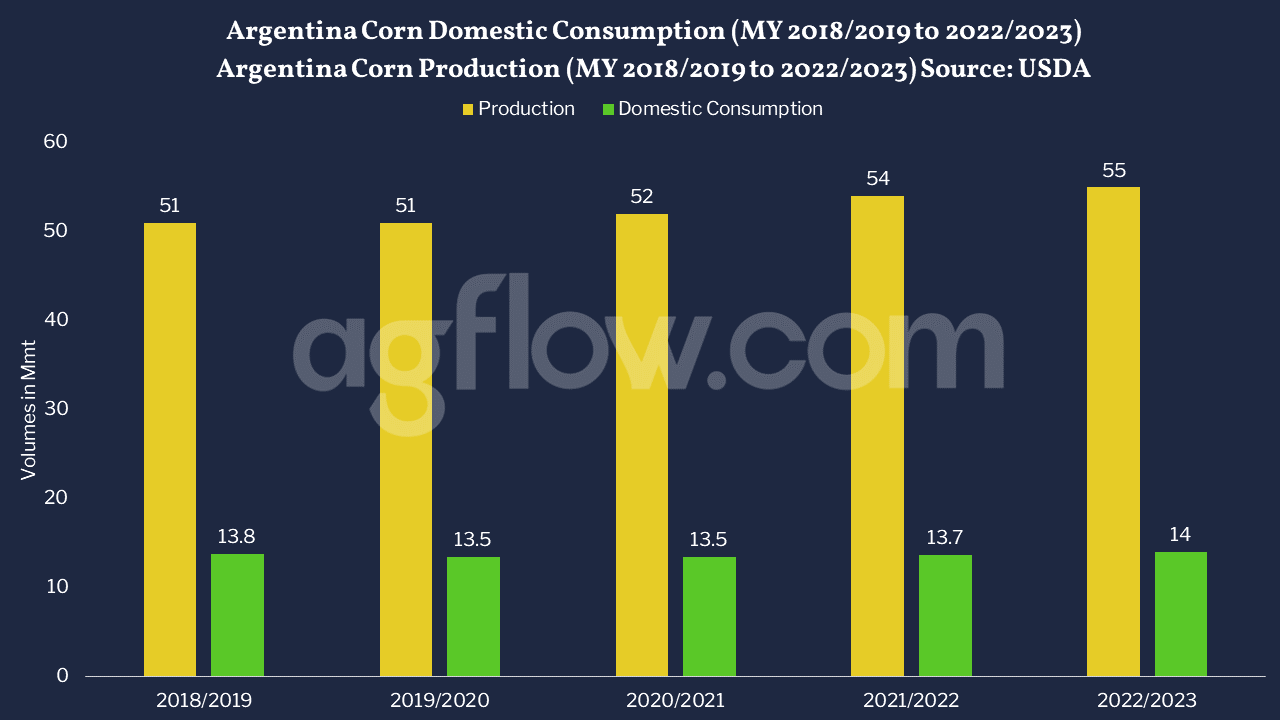

Argentina is a major Corn producer, reaching 54 Mmt in MY 2021/2022. However, the country suffered from severe droughts over the past three years due to La Niña, which has resulted in low Corn yields. Therefore, the country has increased the harvested area to maintain a stable production level. In MY 2021/2022, Argentina increased the Corn harvest area by 650 kha, yet, as the yield rate decreased by 0.58 mt/ha, production slightly increased by 2 Mmt YoY. In MY 2022/2023, the USDA estimates that production will only increase by 1 Mmt YoY, due to a 200 kha decrease in planted area and the persistence of droughts in the coming season. Nevertheless, Corn Domestic Consumption in Argentina represents only a quarter of the production and increased only by 100 kmt between MY 2018/2019 and 2021/2022, making Argentina’s production mainly a concern for Corn import markets.

Figure 1: Argentina Corn Domestic Consumption and Production (MY 2018/2019 to 2022/2023)

Track Corn Production in Argentina & Up to 138 Other Origins Since 2015

Free & Unlimited Access In Time

Read also: Ecuador to Reduce Corn Planting Area

How did the Ukraine War Affect Argentina’s Corn Exports?

While the USDA estimated Argentina’s Corn exports would reach 39 Mmt in MY 2021/2022, Argentina has reached a record 50 Mmt of exports, increasing by 10 Mmt YoY. These exports were particularly strong in Q3 and Q4 2021 where they increased monthly volumes by almost 2 Mmt YoY. By the end of 2021, the Argentinian government decided to limit Corn and Wheat exports through quotas to avoid elevating inflation due to high domestic product prices. In MY 2022/2023, exports rose by 1.4 Mmt YoY in Mar following the war in Ukraine but then fell as Argentina’s export quotas were still in place. However, the quotas remain somewhat flexible , as the objective is to supply the domestic market primarily and export the rest.

Figure 2: Argentina Corn Exports (MY 2019/2022 to Mar-Oct2022/2023)

Track Monthly Corn Exports From Argentina, & 41 Other Origins Since 2017

Free & Unlimited Access In Time

Algeria Corn Imports From Argentina Compensates for Export Losses in Vietnam

Argentina’s Corn export destinations are diversified, reaching up to 65 countries in MY 2021/2022, with exports ranging from 5 kmt to 7 Mmt per country. Vietnam is the leading Corn destination for Argentina, reaching 7 Mmt in MY 2021/2022, despite decreasing by 1 Mmt YoY. Moreover, Vietnam cut total Corn imports by 5 Mmt YoY, mainly due to prices surging. In addition, between Mar and Oct 2022, Vietnam’s imports from Argentina decreased again by 558 kmt YoY since the war in Ukraine pushed the prices up and resulted in a tighter supply. Meanwhile, Algeria increased imports by 786 kmt during the same period. How did prices in Argentina affect its Corn exports in MY2022/2023 so far?

Figure 3: Argentina’s Top Corn Destinations MY 2021/2022

Track Argentina Corn Exports to up to 65 Destinations Since 2017

Free & Unlimited Access In Time

Argentina’s Corn Prices Surged Before the War Started in Ukraine

Argentina’s Corn FOB price averages were below USD 180/mt in MY 2019/2020. Since MY 2020/2021, FOB prices surged to a peak of USD 245/mt in Feb, increasing by USD 64/mt YoY. Similarly, in MY 2021/2022, FOB prices peaked at USD 276/mt in Feb, increasing by USD 31 YoY. So far in MY 2022/2023, prices have peaked in May at USD 326/mt – the highest FOB price over the past three years – USD 72/mt higher YoY. This is due to the crisis in Ukraine and the Argentinian government limiting Corn exports. Yet, Argentina opened up new markets, such as Australia, with 36kmt exports in April 2022 and Jamaica, with 35kmt in Aug 2022. The upward trend in Argentina FOB prices started in Q4 2020, and the war in Ukraine has fuelled this trend. Despite the Ukraine Grain corridor opening in Jul 2022 and helping prices decrease slightly, they will not go back to their previous level due to the continuing export quotas.

Figure 4: Argentina Corn Exports and FOB prices (Mar 2019 – Nov 2022)

Access 1.7k+ Monthly Corn FOB Prices From Up to 28 Origins

Free & Unlimited Access In Time

Read also: Brazil Corn Prices Hike & Fall in H1 2022

In a Nutshell

Argentina’s Corn production is a main concern for the world, as the country exports 75% of its production to more than 60 destinations yearly. Meanwhile, domestic consumption uses 15% of the production. However, in MY2021/2022, high export volumes led to increasing domestic product prices and deepening inflation in the country. Therefore the government decided to limit exports through quotas.

At the beginning of MY 2022/2023, the war in Ukraine affected the flow of commodities such as Corn. Which led Argentina to reach its highest export volumes on Mars. Yet, the government still applied the quotas, which decreased exports YoY in the following months.

In addition, Argentina suffered unfavourable climate conditions over the past three years due to La Niña. Leading Corn yields to decrease. Therefore the country increased the harvested area to keep a stable production level.

Finally, the higher production costs due to La Niña, the political deficiencies in Argentina leading to inflation, and the war in Ukraine resulted in rising Corn prices at the export level. As a result, developing countries such as Vietnam limited their imports, seeking alternative origins, and/or commodities.