Agricultural Market Coverage – Week 27

Reading time: 5 minutes

Argentina Soybean Meal Gained Renewed Interest in 2022

Argentina is the largest exporter of Soybean Meal & Soybean Oil globally. In the first half of 22, Argentina saw its exports to Vietnam increase by 569 kmt YoY. More impressively, Turkey Soybean Meal imports increased by 857 kmt YoY for the same period, due notably to the loss of Ukraine Corn supply for Feed. Meanwhile, although remaining the 2nd & 3rd-largest importers of goods, Indonesia & Spain decreased imports by 398 kmt & 243 kmt YoY from Jan through Jun 22. Overall, Argentina exported ~19 Mmt of Soybean Meal in just six months, improving by 1.13 Mmt from the previous year. With the current truck strike blocking the supply chain, will Argentina continue the upward trend?

Argentina Soybean Meal Exports Top 10 Destinations By Volume Between Jan & Jun 2022

Track Soybean Meal Cargos From Argentina to Up to 55 Destinations

Free & Unlimited Access In Time

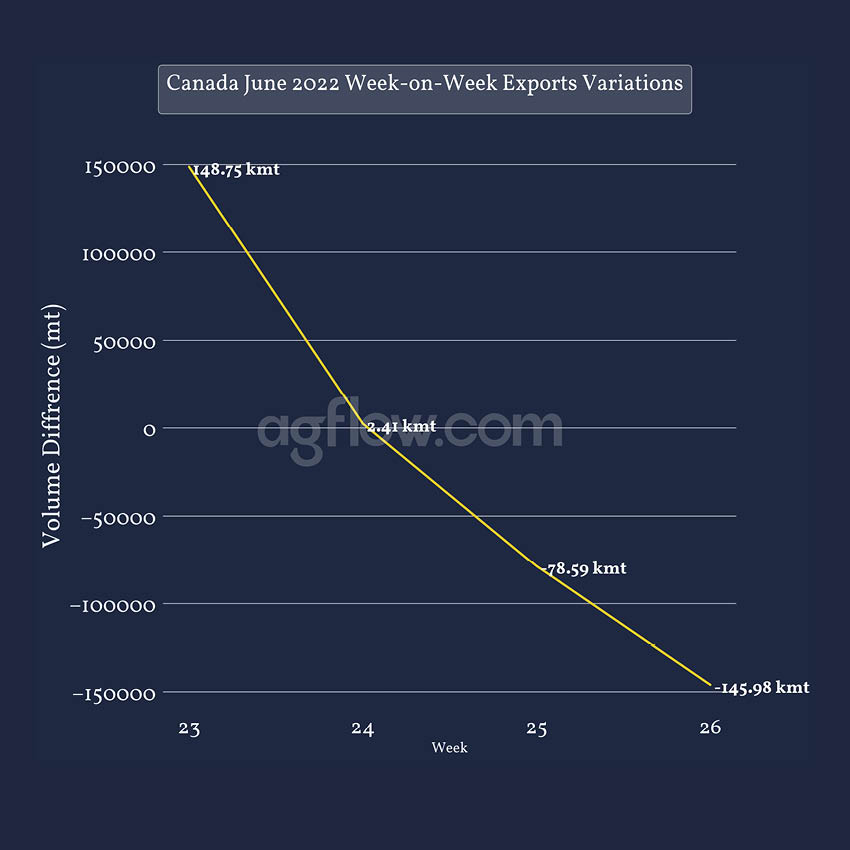

Canada Exports Continue to Collapse

Canada Grains, Oilseeds, & Vegoils suffered heavily from droughts in 2021, leading to a considerable drop in exports and supply availability. At the end of the 21/22 season in Jun, exports saw some WoW volume increases in week 23, nearing 414 kmt in total. Yet, the trend slowed down and then collapsed, reaching only ~192 kmt exports in the last week of Jun, equating to 22,396 kmt less YoY. Canada exports were retreating throughout the season, and while 500 kmt+ were exported every week in Jun 21, the weekly max was 416 kmt in week 24 of 22, 94 kmt less YoY. With much better initial conditions, Canada exports might yet recover in 22/23.

Canada June 2022 Agricultural Exports WoW Variations

Track Canada Exports for 12 Commodities to Up to 53 Destinations

Free & Unlimited Access In Time

Indonesia Palm Oil Exports On the Rise Again

Since Nov 21, Indonesia saw its Palm Edible Oils exports decrease drastically every month with Palm Oil & Olein exports dipping by 853 kmt YoY combined, with the exception of Feb 22, which saw exports increase by ~141 kmt YoY. As the supply continued to run low, the government imposed a ban on exports, and volumes reached their lowest point in May 22 with a 1.62 Mmt decrease YoY. However, exports finally rose in Jun, increasing by ~164 kmt YoY. Recently, the Indonesian government announced an increase in export quotas, allowing as much as 2.4 Mmt – will Indonesian exporters manage to fulfill the quotas in the coming months?

Indonesia Palm Oil & Olein Exports Between Nov 2021 & Jun 2022

Track Palm Oil & Olein Exports from Indonesia to Up to 45 Destinations

Free & Unlimited Access In Time

Algeria Wheat Imports Rise in 2022 to Secure Supply

Algeria Wheat production in 21/22 decreased by 800 kmt YoY. Since the beginning of 22, Algeria has increased its Wheat imports every month. In Q1 22, Jan & Feb Wheat imports were ~403 & 188 kmt higher YoY, respectively. By March the country declared it had enough supply till the end of 22. However, with drought conditions rising, the country picked up Wheat imports again in Q2. Wheat imports surged 1.27 Mmt in May, & 1.53 Mmt in Jun, thanks notably to an increase in France & Bulgaria imports by 324 & 392 kmt respectively in Jun YoY. So far, Algeria has not seemed to slow down Wheat imports, as by Jul 7th, 22 they already surpassed the whole of Jul 21 Wheat imports by 54 kmt.

Algeria Wheat Imports Between Jan & Jul 2022

Track Algeria Wheat Imports from Argentina, France, & Up to 11 Origins

Free & Unlimited Access In Time