Did Egypt Wheat Tenders Lose Momentum in 2021?

Reading time: 6 minutes

As the world’s top Wheat importer, Egypt provides a good benchmark for tracking how net Wheat importers issued tenders in 2021. Net Wheat importers proceed by issuing tenders with a determined total volume and a set price per metric ton. The products bought through tender contracts fuel the country’s supply by being distributed or stored in granaries. However, tender issues depend on the product’s pricing, current stocks, and local consumption. Therefore, following tenders give a reasonable estimate of import trends and these countries’ storage capacities and strategies.

A Slow Start to Egypt Wheat Tenders in 2021

At the beginning of 2021, the Wheat market was dealing with bolstering prices due to China’s massively increasing imports. As such, net Wheat importers had a lower incentive to tender.

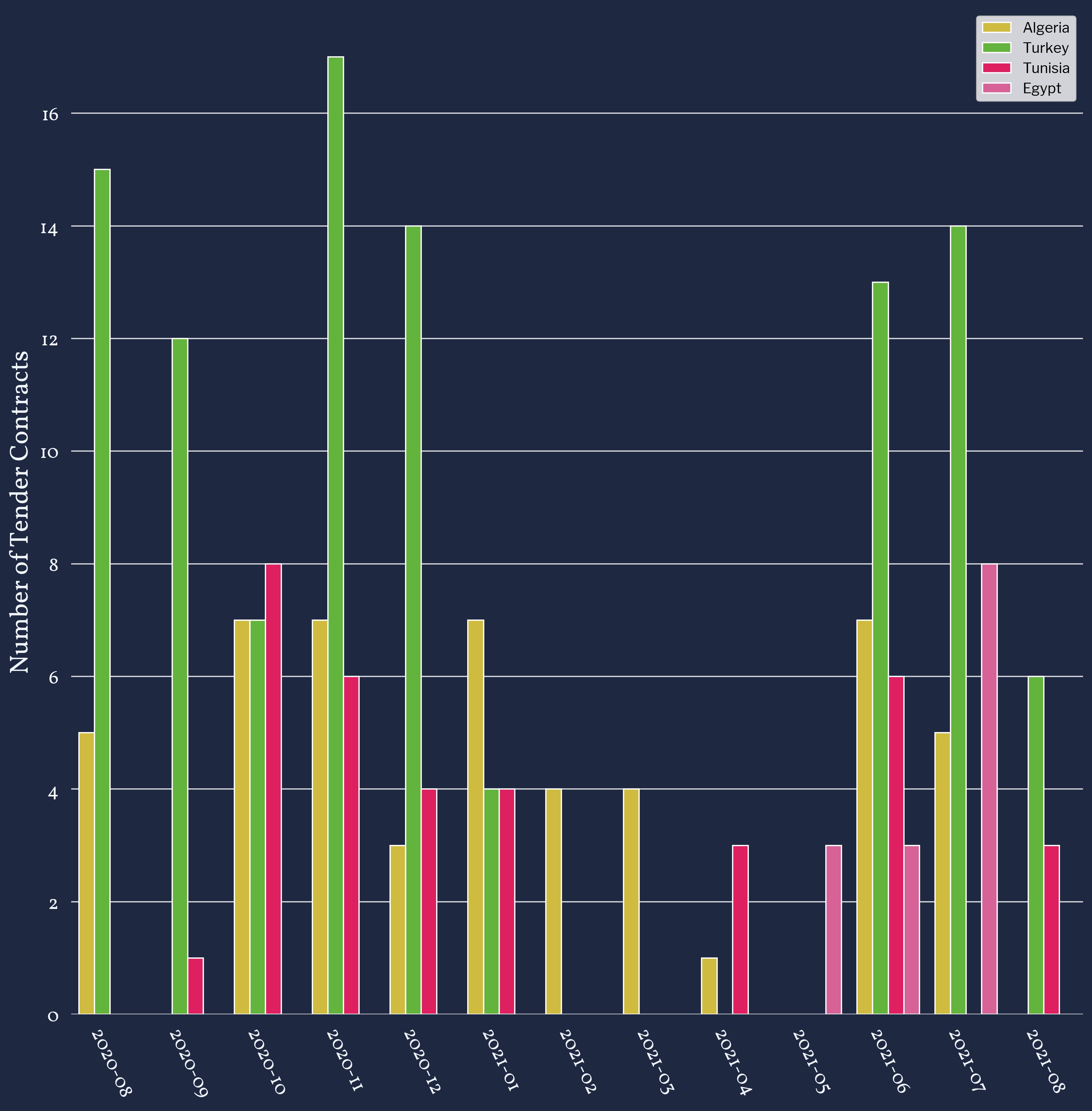

Figure 1: Tender Contracts Closed by Country Between Aug 2020 & Aug 2021

Figure 1 displays the number of tender contracts closed each month between August 2020 and August 2021. Mainly it shows the number of tenders per country between January and May 2021 decreased and reached a minimum of 4 contracts closed in May 2021. While this change is minor for Egypt (19 tender contracts closed in 2020 against 14 during that period in 2021), the tenders market in the Mediterranean region was slower overall. This is because large stocks have been accumulated in granaries in the second part of 2020, as the number of tender contracts suggests in figure 1. Furthermore, the slow trend in tender agreements can also be explained by the Wheat pricing since late 3Q 2020.

Figure 2: Wheat Tender Prices by Country Between Aug 2019 & Aug 2021

Indeed, leveraged by the Chinese impulse, the price per ton for tender contracts— displayed in Figure 2—increased rapidly at the end of 2020. Moreover, steep Wheat export taxes, which ultimately impacted tenders prices, were put in place by Russia—the world’s top Wheat exporter—to preserve the domestic market.

Read also: Black Sea and French Wheat: Why Quality Matters

Will Egypt Wheat Tenders Speed Up in the Second Half of 2021?

Despite having large Wheat stocks, Egypt only had five months’ supply worth according to the estimated local consumption (GASC) in January 2021. Until May 2021, countries continued importing, with fewer shipments to try and maintain stocks to curb prices. Yet, as reported by DTN, tenders heated up recently in reaction to low Wheat supply estimates in the US, Canada, and Russia.

Figure 3: Wheat Tenders Volume by Country Between Aug 2020 & Aug 2021

The Wheat import volumes displayed in Figure 3 show that Wheat imports overall vastly decreased between January and May of the same year. However, the overall trend shows that tenders are ramping up in June and July 2021, particularly for Turkey, which recorded its highest two monthly Wheat import volumes in the last two years, showing a growing fear of the low supply in marketing year 2021-22.

Read also: How the Extreme Weather Conditions Are Shaping the US Wheat Market in 2021-22

Figure 4: Egypt Distribution of Wheat Import Origins

Figure 4 shows where Egypt imports Wheat through tenders for the last year. While Russia represented most of the Wheat imports, export taxes on Russian Wheat led Egypt to diversify and source Wheat predominantly from Romania as it became more price-competitive. Furthermore, the two countries currently forecast record production in 2021-22, which will probably lead Egypt to continue favoring these pipelines over Russia, despite the recent export tax cut.

Read also: A Guideline to the Top Wheat Specifications

In a Nutshell

In 1Q 2021, net Wheat importers benefited from high stocks, particularly Egypt, which had five months reserves of Wheat in January 2021. In addition to soaring prices due to China rising imports and the Russian Wheat export tax increase, net Wheat importers decreased the number of Wheat tender contracts closed.

Consequently, Wheat imports decreased in the first two quarters of 2021, aligning with the number of tender contracts closed. Moreover, Egypt changed its pipelines by prioritizing Romania over Russia as a wheat origin since it became more price-competitive.

Finally, starting in June 2021, imports began ramping up again, sparked by a fear of low Wheat supply in the US, Canada, and Russia for the year 2021-22. However, the low supply is also increasing Wheat pricing globally. This, in turn, will further lower the incentive to tender and force net Wheat importers to turn towards more competitive origins, where Ukraine and Romania will strive, as they, on the other hand, have a record Wheat production in 2021-22.