Where to Source Soybean & Other Feedstocks for Biodiesels & Renewable Fuels

Reading time: 6 minutes

Biodiesel and Renewable fuels are rapidly expanding due to the need for more durable energy sources. There are currently three generations of Biofuels: First-, Second- and Third-generation.

Each generation is categorized by types of feedstock used as inputs. In the short-to-mid term, the second generation has the most potential for growth as it relies on vegetable oils —or Vegoils— derived from the world’s most-produced Oilseeds. Therefore, understanding how these energy sources are made and intertwined with the agricultural market is critical.

What Are (Soybean) Biodiesels And How Are They Made?

The production process of Biodiesels, Bioethanol, and Renewable fuels differ due to the nature of the process. Biodiesels are made from refining oils through a chemical process called transesterification (AFDC), while Bioethanols are made from fermented feedstocks in a dry-milling process. Oil companies then blend Biodiesels and Bioethanol with either conventional fuels (diesel for Biodiesel and gasoline for Bioethanol) to produce the final commercialized products. The product is thus named depending on the proportion of Biofuel used in the final blend (e.g., E10 stands for 10% Bioethanol gasoline). On the other hand, Renewable fuels are radically different as they are not blended with crude oil derivatives.

This differentiation in Biofuels generations comes first and foremost in the feedstocks used for the processes. Second-generation Bioethanol can be produced from Sugarcane, corn, or wheat, while second-generation Biodiesels production reaction requires Vegoils like Soybean Oil, Palm Oil, or Rapeseed Oil.

– First-generation – recycled waste and residues:

-

- Yellow Grease (used vegetable or animal cooking oils)

- Animal grease

- Ethanol residue (e.g., Technical Corn Oil)

– Second-generation -agricultural products

-

- Raw or refined Vegoils like Soybean, Rapeseed, or Palm Oils for Biodiesels

- Coarse grain (e.g., Corn) for Bioethanol

- Plants (e.g., Sugarcane) for Bioethanol

– Third-generation – algaeculture

First- and third-generation biofuels feedstock sourcing is inherently tricky for two main reasons:

-

- There are not many established for waste and residue supply chains

- So far and the infrastructures for algae production are complex and costly to develop and not yet in the commercialization stages

On the other hand, second-generation biofuels – particularly when Soybean-based – have the most potential growth as they derive from inputs that are easily accessible in significant volumes globally through well-established supply chains.

Read also: What Should You Be Expecting if You Are Selling From the EU Or US Corn Market in 2021/22?

Access 8k+ Soybean Oil, Palm Oil, & Up to 28 Other Vegoils Monthly Cash Prices

Soybean Biodiesel Sources And Growth

As of 2021, most Biofuels projects are envisioned in Europe, North America, and South America due to governmental policies resulting from Climate Change conferences (COP) and the presence of large quantities of feedstock available.

Brazil and Argentina are the first and third Soybean producers globally. Their 2021/22 production estimate is 185.5 Mmt, which is about 49% of the global production. The US produces a large portion of the world supply on its own with an estimated 120.7 Mmt, about 32% of the global production.

However, this resource is not entirely dedicated to Biofuels. Until 2021, the Soybean market was driven mainly by Soybean Meal for animal feed and Soybean Oil for human consumption.

Read also: Feed – China: Hog Farmers Struggle With Prices Swing, And It Will Probably Last

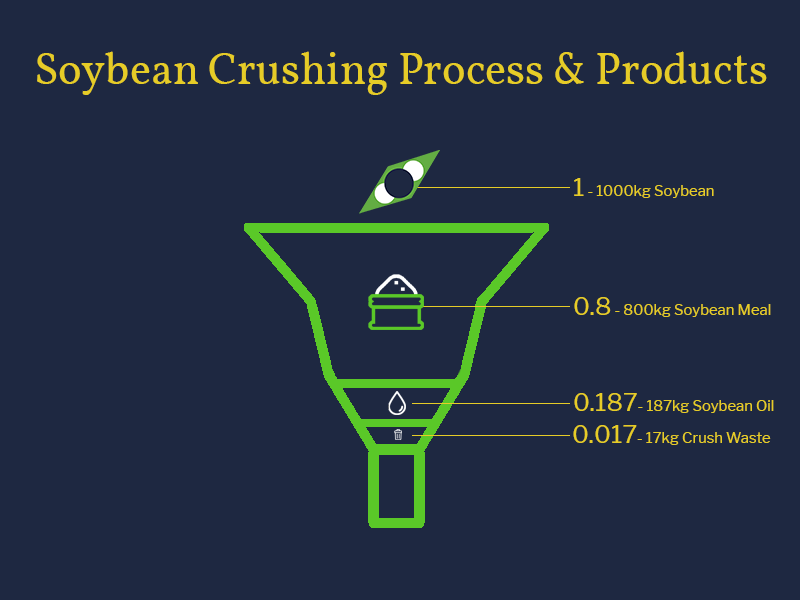

In fact, the Soybean crushing process mainly produces Soybean Meal, while Soybean Oil is a minor byproduct in terms of quantity, although the price value is the highest of all Soybean complexes. As illustrated above, for 1 mt of Soybean crushed, only 187 kg of Oil will come out, although it depends on the Oil content of the Soybean crushed.

Nonetheless, the Soybean market remains one of the most attractive for biofuels as the crop requires less fertilizer than Corn or Wheat, providing a significant advantage in light of supply chain issues and fertilizer shortage in 2021, which will likely continue in 2022. Moreover, Soybean provides farmers with a better premium than Corn since there are fewer input costs involved and a high global demand. Supported by the energy market and Biofuels industry, Soybean Biodiesels could become the fastest-growing product in the field. As such, analysts see Soybean Oil production for Biodiesels to overcome all other Vegoils, including Palm Oil, by 2030 (Brownfieldagnews). All the while, other feedstock sources remain viable solutions. Bioethanol in particular also has large growth potential, as it is already the largest Biofuel produced on the planet.

Access 33k Soybean & Soybean Complex Monthly Cash Prices from the US, Brazil, and up to 27 Other Origins

Alternative Feedstocks to Soybean

Biodiesels:

Second-generation Biodiesels require Vegoils feedstock such as Palm Oil, Sunseed Oil, or Rapeseed Oil which already benefits from existing supply chains, particularly in Europe. First-generation biodiesels can also be based on animal fat waste from the food industry or fish cleaning waste.

Bioethanol:

Bioethanol is made by fermenting high-sugar content Coarse Grain or Plants like Corn, Wheat, and Sugarcane. Bioethanol represents the largest part of Biofuels produced so far, with the US and Brazil producing around 52% and 28% of all Bioethanols in 2021. With first-generation, many feedstock resources are available, such as Yellow Grease (used cooking oils), Tall Oil, or Technical Corn Oil (Neste) (waste from Corn-based ethanol production).

Reach 15 AgFlow Contributors Providing Information on 26+ Feedstocks

Free & Unlimited Access In Time

In a Nutshell

The Biofuels production and market are growing due to the need for more durable and less-polluting energy sources. Industrials currently have three generations of feedstock they can use to produce Biofuels. Second-generation feedstocks (i.e., Oilseed, Coarse Grain, and Plants) are the most sought after due to their ease of access and large production globally.

Amongst second-generation feedstocks, Soybean is the Oilseed with the most considerable potential for Biodiesel production. As Palm Oil is posing sustainability and ecological concerns, governments are limiting the use of the product while trying to make it sustainable (Reuters), which will help Soybean Oil overtake Palm Oil in Biodiesel production by 2030. The US Soybean industry already sees changing dynamics towards Soybean Oil driving the Soybean market. Additionally, other feedstocks for bioethanol and renewable fuels should also see growth simultaneously, as Bioethanol production with Corn and Sugarcane is well established in the US and Brazil notably, and represent the largest part of Biofuels produced as of 2021. Nonetheless, regular engines can not properly function with them, posing engineering and commercial challenges.

However, with climate change making agricultural production more and more unpredictable, the market is getting hard to read and navigate. In this instance, AgFlow provides a transparent and unbiased view of the market, which becomes critical for both the experienced and neophytes stakeholders.

Read also: What Should You Expect From The US Soybean Crop in 2021/22?