Incoterms Guide – Explained Simply

Reading time: 6 minutes

What are Incoterms? What do they entail in terms of insurances and risks for the buyers and sellers?

What is an Incoterm?

Incoterm is an acronym for INternational COmmercial TERMS. It describes the rights and obligations of both buyers and sellers of merchandise on a national or international level. The ICC (International Chamber of Commerce) publishes these predefined rules. They are updated as and when required, with the latest amendment released in 2020. These rules aim to communicate the tasks, costs, and risks associated with the global or international transportation and delivery of goods.

They do not, however, serve as a contract. Rather, they act as a set of agreements between parties for the transportation of goods, to reduce or eliminate uncertainties arising from different rules in different countries, and how the various parties could interpret them.

The different Incoterms consist of three-lettered terms. Their main difference resides in where the transfer of risks occurs, i.e. where the seller’s obligations stop and where the buyer’s responsibilities begin. Moreover, it is important to note that some Incoterms apply to any mode of transportation, while others are only applicable to marine traffic.

We will now review each Incoterm and what it entails.

Read also: Q&A: The Methodology behind AgFlow’s Forward Curves

Read also: Do Not Base Your Risk Management On Incomplete Forward Curves

Know Your Incoterms 2020

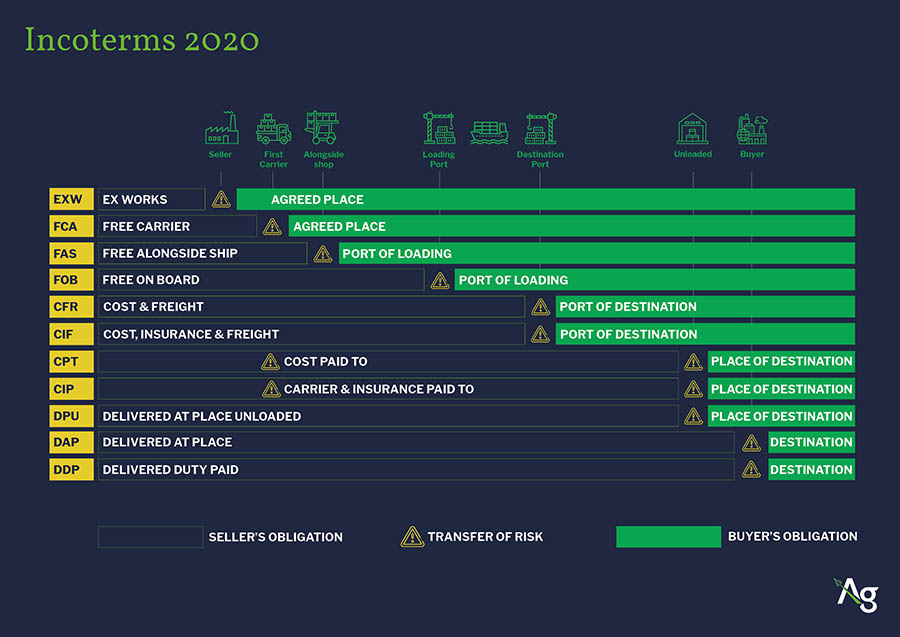

As of the new aforementioned 2020 amendment, there are eleven Incoterms in total – seven of which correspond to all modes of transportation. The last four are specific to sea and inland waterway transportation. We can note that some share the same location where risk is transferred but do not include the same obligations.

The significant differences between the latest edition of Incoterms and the 2020 version are the renaming of DAT (Deliver At Terminal) to DPU (Delivered at Place Unloaded), and the possibility of emitting Bills of Lading after loading for FCA.

Figure 1: Visualization of the differences between obligations

and risk transfer for parties for all Incoterms

The Incoterms that can apply to all means of transport are:

• EXW: Ex Works

• FCA: Free Carrier

• CPT: Carriage Paid To

• CIP: Carriage and Insurance Paid To

• DPU: Delivered at Place Unloaded

• DAP: Delivered at Place

• DDP: Delivered Duty Paid

Those that apply only to marine traffic:

• FAS: Free Alongside Ship

• FOB: Free On Board

• CFR: Cost and Freight

• CIF: Cost, Insurance, and Freight

We now look at each one in more detail, starting with the first list.

EXW – Ex Work

This Incoterm is the most simple from a seller’s point of view. The seller’s only requirement is to make the goods available for pickup to the buyer, either at the seller’s location or another specified location. As such, the buyer assumes all the costs and risks of transporting the goods.

FCA – Free Carrier

In this case, the seller delivers the goods to the buyer at an agreed-upon location (this can also be the seller’s location). The seller then delivers the merchandise to a carrier or potentially to a third party nominated by the buyer. The buyer covers the costs and risks of unloading the goods and loading them into its carrier(s) until arrival.

CPT – Carriage Paid To (destination)

CPT is similar to CFR but applies to all modes of transportation. The seller covers the costs of merchandise carriage up to the named place of destination. However, once the seller hands over the merchandise to the first carrier, we consider the goods delivered. As such, the risks transfer to the buyers at the place of shipment. The seller covers all costs up until then (including export clearance) and the costs of freight. The parties can decide this to be until either the final destination or port of destination.

CIP – Carriage and Insurance Paid to (destination)

This Incoterm is similar to the previous one with the addition of insurance costs. The seller must insure the merchandise to 110% of the contract value under the Institute Cargo Clauses (A) of the Institute of London Underwriters or any similar set of clauses.

DPU – Delivered at Place Unloaded

Once again, this Incoterm is closely related to the previous two Incoterms. With DPU, the seller covers all costs and risks until arrival at the destination port or terminal. These also include unloading the goods upon arrival. The destination can be a port, airport, or inland freight interchange. All the fees after unloading (such as Import duty, taxes, customs, and on-carriage) are to the buyer’s expense.

DAP – Delivered at Place

This Incoterm is similar to DUP, only this time, the goods are delivered once they are at the buyer’s disposal at the final destination, ready for unloading. The risks then transfer to the buyer from the point of destination, at which point the destination port charges and clearance are taken care of by the buyer, in contrast with DPU.

DDP – Delivered Duty Paid

In this case, the seller has maximum obligations. The seller must deliver the goods at the place of destination in the importing country. As such, all costs and risks are the seller’s responsibility, including import duties and taxes. However, the seller is not responsible for unloading the goods.

Now we look at the marine-traffic-only Incoterms. Generally speaking, these Incoterms are not suitable for container shipments – as risks transfer once the goods board the ship, the content cannot be checked with a sealed container, which can pose some issues. Moreover, for these Incoterms, the transfer of risks can be staggered to different places.

FAS – Free Alongside Ship

Here, the seller must bring the merchandise alongside the buyer’s vessel in the determined port. The seller is still responsible for clearing the merchandise for export. Both parties can negotiate for the buyer to clear for exportation if they want to. Additionally, this term use is for the non-containerized transports only.

FOB – Free On Board

For FOB, the seller bears all responsibilities until the goods are on board the vessel. Unless the goods are “appropriated to the contract,” the seller only transfers part of the risks. He must deliver the goods on board a ship designated by the buyer and organize export clearance. In counterpart, the buyer is responsible for the cost of marine freight transportation, bill of lading fees, insurance, unloading, and transportation cost from the arrival port to destination. Most often used for all means of transport, some common law countries attach FOB to any land transportation and, as such, extend the meaning of vessel.

CFR – Cost and Freight

For this term, the seller covers the cost of the carriage of the goods to the destination port. The seller is then responsible for the origin costs (such as export clearance, or first carrier) and freight charges. However, it is the buyer who is responsible for the delivery to the final destination and insurance. Parties should use CFR for non-containerized marine shipping only, as otherwise its multipurpose pendent CPT is better.

CIF – Cost, Insurance and Freight

CIF and CFR have a similar relationship to CPT and CIP. CIF is very similar to CFR, with the addition of the seller’s obligation to pursue insurance for the merchandise while transiting between both ports. Once again, the seller must insure the merchandise to 110% of the contract value, following the same close as CIP. Moreover, the seller must turn over the necessary documents for the obtention of the goods. The handover must include, but is not limited to, the invoice, the insurance policy, and the bill of lading (simplified to cost, insurance, and freight).

Read also: A Guide to Bulk Carriers Types for Agricultural Commodities

Read also: A Guide to Chemical Tanker Types for Palm and Edible Oils

Use and frequency of Incoterms

Clearly, from the understanding of the different Incoterms, some rules apply more pressure on the seller and others on the buyer. As such, it would be logical to have a majority of contracts using the sets of rules that seem the fairest for both parties.

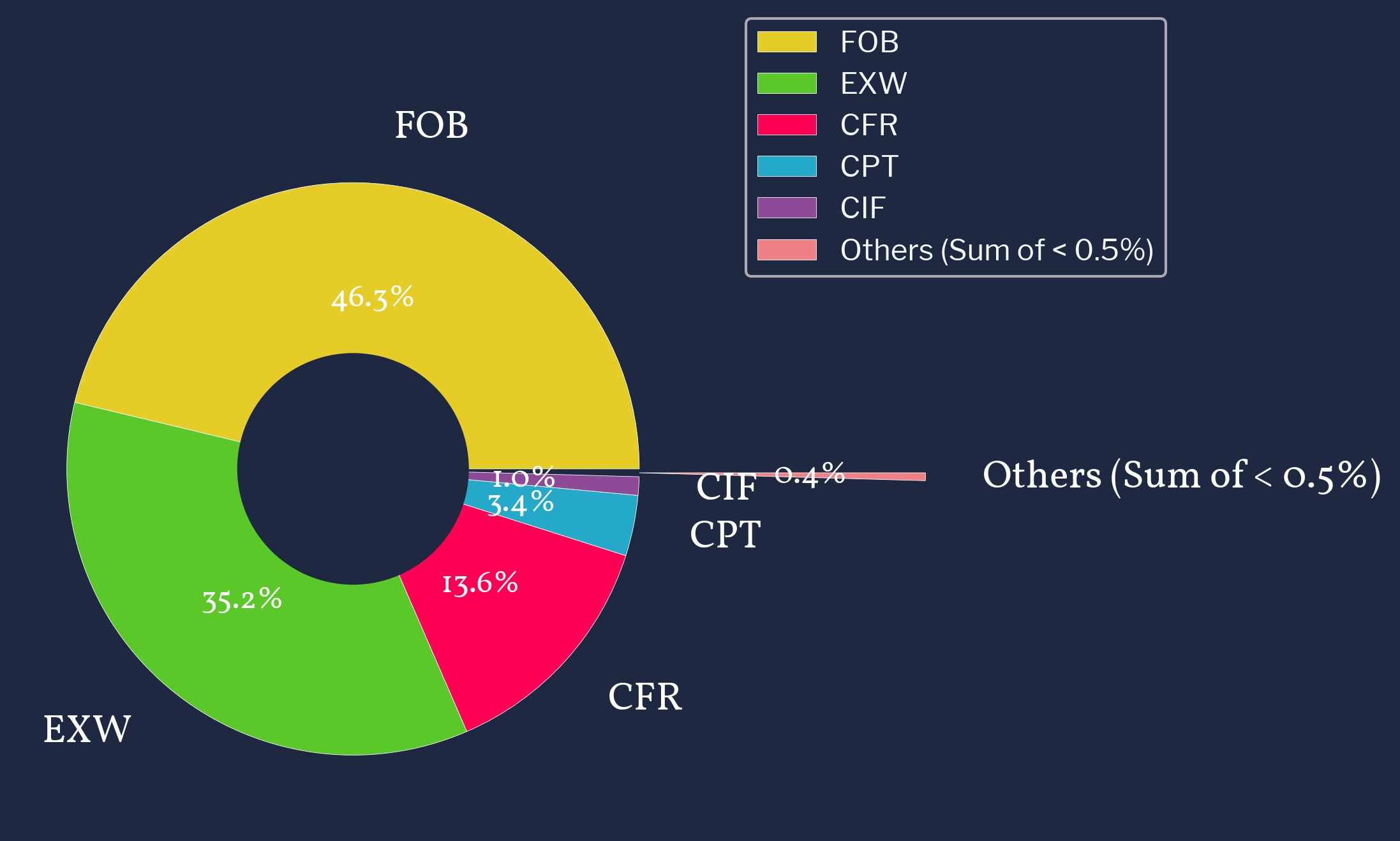

Figure 2: Pie Chart of the representation of Incoterms

in AgFlow’s quotes data between Jan 2010 and May 2021

Figure 2 represents the proportion of Incoterms used throughout the period between the previous (2010 edition) and the new amendments (2020). We see that FOB is the most recurrent Incoterm overall, with around 46% of all the quotes using this Incoterm. The other notables are EXW and CFR with a bit more than 35% and about 14%, respectively. That indicates that not all Incoterms are equal, and logically so.

First of all, a significant part of the data stored on AgFlow’s databases concerns marine transportation. As such, it is not a surprise to find marine-specific Incoterms in the top 3. Furthermore, FOB and CFR represent the most ‘balanced’ or ‘fair’ deal. Indeed, for both these, the risks and obligations are roughly evenly shared, thus, making it easier to guarantee trust for the parties in the transaction. Then EXW’s partition can be explained as the volumes available for the grains market are sizeable. Hence, it can be cheaper and easier to buy and obtain the buyer’s merchandise at the original storage place of the seller. implies that while they have a high correlation, each product’s quality has some independence from the other. Thus their respective prices are not only dependent on the product’s protein quality

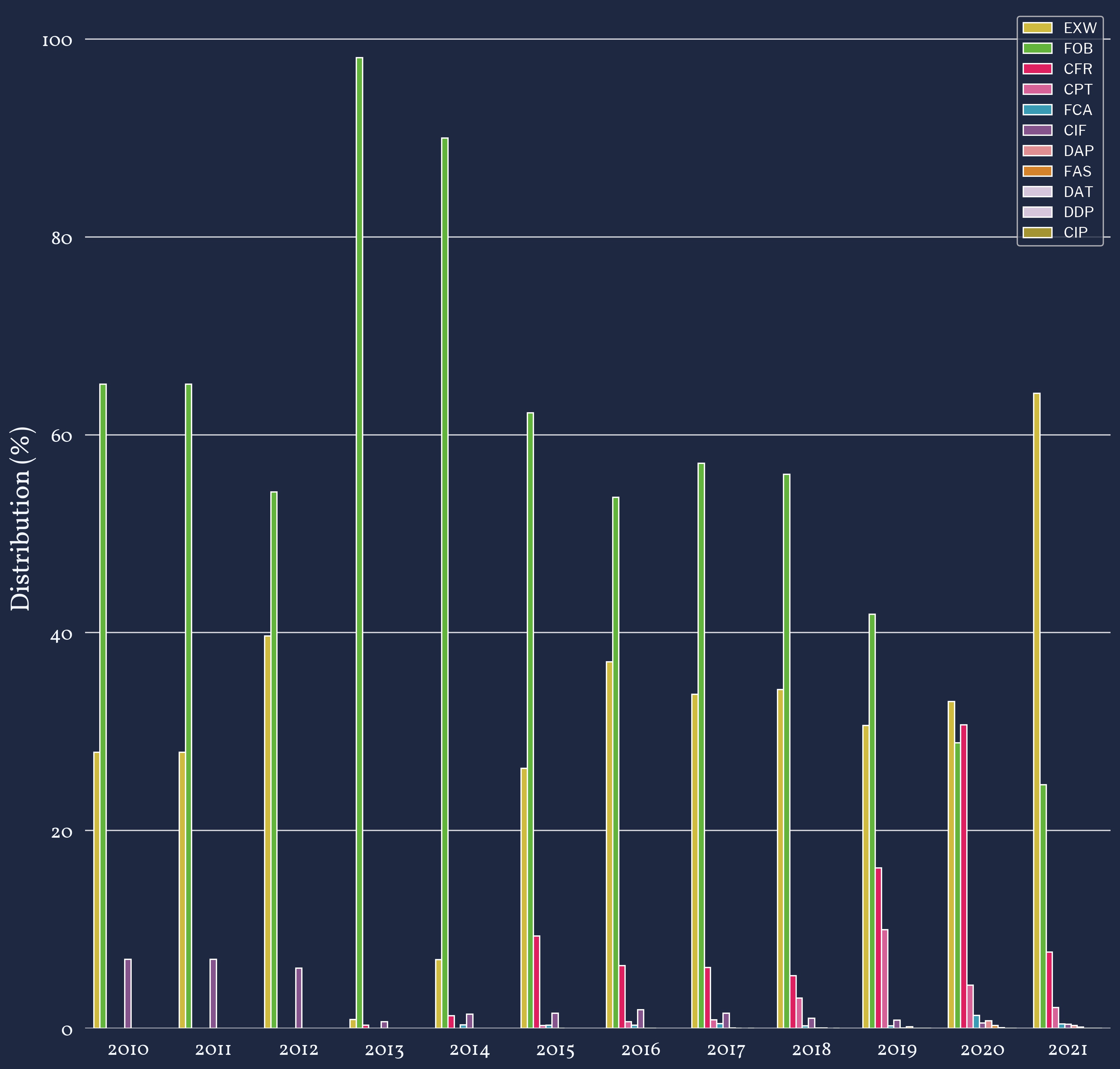

Figure 3: Yearly Distribution of Incoterms Usage in AgFlow’s Quotes Data

Between Jan 2010 and May 2021

Looking at the yearly distribution in figure 3 provides a more detailed view of the distribution in figure 2. It shows particularly that current FOB Incoterm usage is not as predominant as it was before. Especially in the last two to three years, EXW, CFR, CPT, and to a lesser extent FCA Incoterms all saw an increase in usage since 2018.

Over time, with better tools and best execution predictions, it is highly probable that this change in the distribution of Incoterms in the foreseeable future. Nonetheless, FOB is still valuable, as it is often used as a benchmark compared to other Incoterms.

Read also: How to Avoid Demurrage Charges? A ranking of 382 global ports

Conclusion

The ICC created a set of rules made to make the obligations, risks, and dues more clear for particulars or companies trading goods. These 11 rules frame the possibilities of sharing these constraints during the trading process and allow for a more transparent, more fundamental understanding for both parties during negotiations. As seen from AgFlow’s quotes data, FOB is the most common Incoterm, as it provides more balanced responsibilities and risk-sharing in general. Additionally, the supplemental cost associated with the different Incoterms – related to the nature of the distribution of responsibilities and risks of the specific rule – is a potential factor for the popularity of FOB.

The nature of the trades can also explain the difference between the different Incoterms’ frequencies. Thus, if EXW is the second most common Incoterm in AgFlow’s database all time, and the most common in the past two years, it is because the volumes involved with the trading of grains make it easier to pick up the goods at the seller’s storage, which in general makes it easier for the buyer in turn. It is also a signal the dynamics of trades changed.

Finally, the Incoterms are not legal contracts that bind international trades. But these rules allow the trading of goods around the world to be simpler, more efficient, and safer for both parties involved. As such, their popularity follows the nature of trades and the contracts associated with them. They are hence providing a good idea of the health status of deals around the world and the dynamics of trades.