What Should You Expect if You Deal with the Black Sea Wheat Market In 2022?

Reading time: 6 minutes

In February 2022, the situation in Ukraine is causing major turmoils in the Black Sea Market. Wheat is the most significant agricultural product exported from the Black Sea and a critical source for many importers. Therefore, with Ukraine unable to ship its goods by sea and an increasing amount of sanctions imposed on Russia, the Black Sea market is causing disruptions and changing the dynamics of the global Wheat market. What are these disruptions, and what solutions are they to circumvent them?

Jump straight to the conclusion

How Important Is Wheat from the Black Sea Market Really?

Ukraine and Russia represent a critical share of the global Wheat supply.

Read also: Black Sea wheat market doesn’t seem to believe in export disruptions

Figure 1: Share of Wheat Exports In 2021

The share of Wheat export flows displayed in Figure 1 shows that Russia and Ukraine represent a cumulative share of 34.5% of global Wheat exports in 2021. Meanwhile, the EU (including Bulgaria and Romania) represented 15.8% and Australia 15.3%. Since Ukraine and Russia represent almost a quarter of worldwide Wheat exports, the surge of global Wheat prices is inevitable.

Figure 2: Russia, US, & Canada FOB Wheat Spot Cash Prices Between Nov 2021 & Feb 2022

Plot 1: Russia FOB Milling Wheat

[/dica_divi_carouselitem][dica_divi_carouselitem button_url_new_window=”1″ image=”https://www.agflow.com/wp-content/uploads/2022/03/Canada-Wheat-FOB-Spot-Prices-October-2021-to-March-2022.jpeg” image_alt=”Brazil Soybean S&D 2022 v 2021″ image_lightbox=”on” _builder_version=”4.14.5″ global_colors_info=”{}”]Plot 2: Canada Feed Wheat FOB

[/dica_divi_carouselitem][dica_divi_carouselitem button_url_new_window=”1″ image=”https://www.agflow.com/wp-content/uploads/2022/03/US-Wheat-FOB-Spot-Prices-October-2021-to-March-2022.jpeg” image_alt=”Brazil Soybean S&D 2022 v 2021″ image_lightbox=”on” _builder_version=”4.14.5″ global_colors_info=”{}”]Plot 3: US Hard/Red/Winter Wheat

[/dica_divi_carouselitem][/dica_divi_carousel]By 2021, Russia set up export quotas and increased taxes, which reached up to $100/mt. These measures created volatility, and Wheat prices surged domestically as well as globally, displayed in Figure 2. Due to the current situation in the Black Sea market, volatility and prices skyrocketed even further across all qualities. Additionally, ships sank or were hit by shelling, driving freight insurers to drastically increase risk premia (gcaptain.com), limiting exports from the Black Sea market even more.

Therefore, the Black Sea Wheat market is mostly inaccessible or difficult to access. Moreover, some major Black Sea Wheat importers have cut Russia from their pipelines.

Figure 3: 2021 Black Sea Wheat Exports Top Destination by Volume

The main destinations for Black Sea Wheat exports in Figure 3 show that Egypt and Turkey are the two largest Wheat importers from the Black Sea market. North African countries and the Middle East (MENA) rely strongly on Black Sea Wheat and thus need to find other Wheat supplies.

Read also: SovEcon ups 2022 Russian and Ukrainian wheat crop estimates

Access +44K Monthly Wheat Cash Quotes From Ukraine, Canada, and Up to 21 Other Origins

Free & Unlimited Access In Time

What Are the Alternatives to the Black Sea Wheat Market?

Although Ukraine & Russian Wheat supply are cut from the Black Sea market, other options are available for Black Sea Wheat’s largest importers. Australia and the EU can also provide a large amount of both human consumption and feed Wheat.

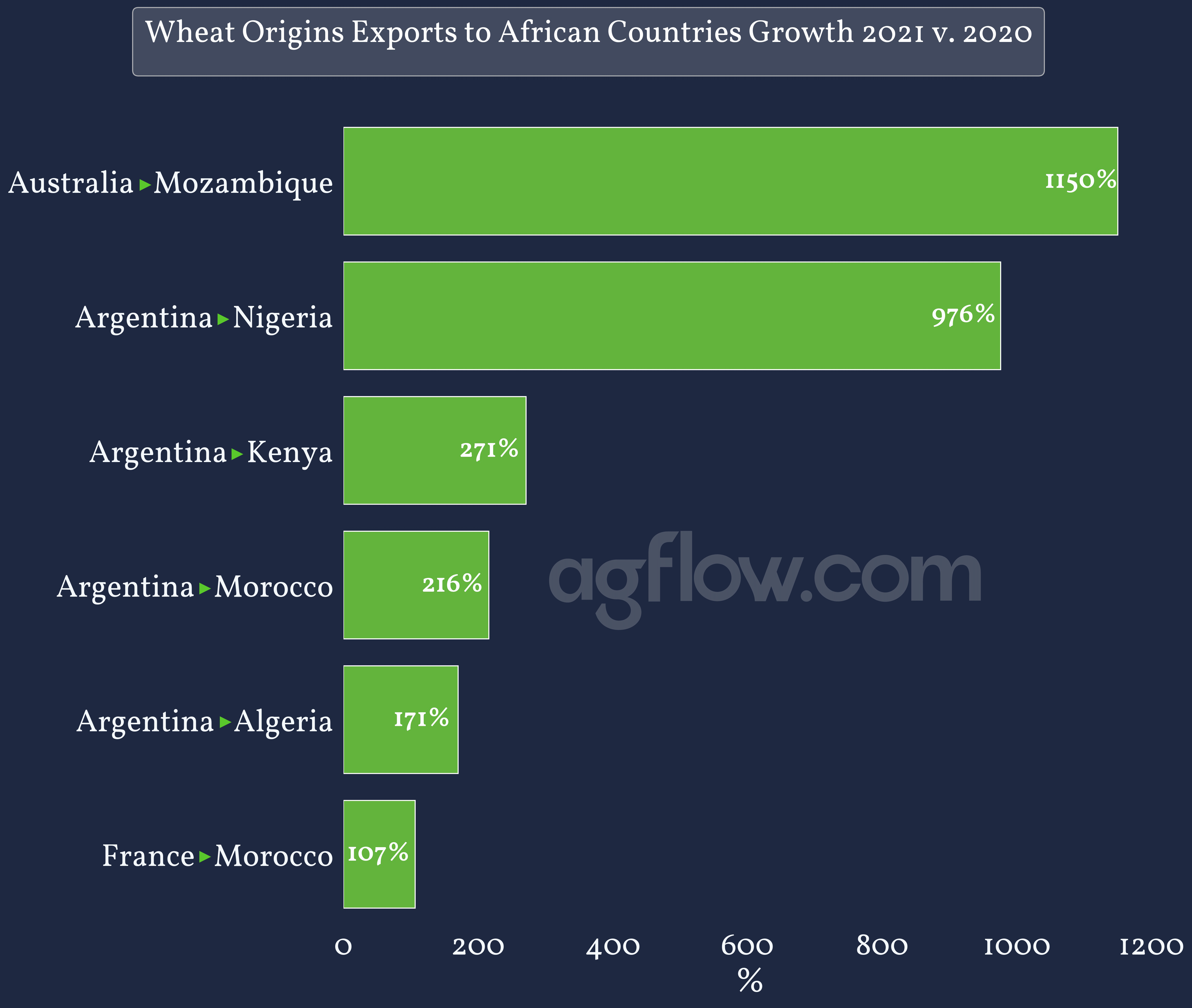

Figure 4: Wheat Origins Exports to African Countries Growth 2021 v. 2020

In Figure 4, France, Australia, and Argentina’s Wheat exports to MENA grew substantially in 2021. However, Australia’s export market expanded more towards East Africa than MENA countries. In contrast, France, the largest producer in the EU, exports rose primarily in Morocco; and Argentina, the largest South American Wheat producer, and exporter, increased its market share in Algeria and Morocco. Nonetheless, France Wheat is not cheap like Australia’s. With the Oil price increase, freight costs from Argentina will also substantially increase the execution costs to North Africa.

Read also: Here is Why Turkey and Iran Grain Imports Surged in August 2021

Track Wheat Cargo Vessels From Australia, the US, and 31 Other Export Origins

Free & Unlimited Access In Time

In a Nutshell

Due to the current situation in Ukraine, most of the Black Sea Wheat market is inaccessible or difficult to access. Representing more than 25% of Wheat exports globally, this cut from global supply leveraged volatility, and prices already surging are reaching historic highs. Additionally, the insecurity in the area made freight insurance costs soar, which made it more expensive and difficult to export from Romania and Bulgaria.

MENA countries that rely heavily on this supply are already trying to find alternative sources to the Black Sea market. Large providers such as the EU (France in particular), Australia, and Argentina could supply the MENA market. Australia has the cheapest Wheat globally and is well-positioned for the Middle East. Meanwhile, France and Argentina grew their market share in North Africa in 2021 and can provide accessible freight routes.

All in all, sourcing from outside the Black Sea for the MENA market will depend on the quality requirements, prices, and surging freight costs, making this transition challenging. Nonetheless, Ukraine has managed to circumvent the difficulties in the Black Sea to export its supply via Romania & Bulgaria through trains (Reuters), partially reestablishing accessibility to this supply which will alleviate some of the pressure on the Wheat market.

Need more insights? Read the full Analysis