Ukraine to Lower Sunseeds Output by 42%

Reading time: 2 minute

Ukraine is the largest Sunflower seed producer in the world. The country has been the world’s top producer of Sunflower seeds since 2008, holding market share of 25 percent, followed by Russia (22%) and Argentina (9%). Sunflower is a strategically important oilseed crop in the country, which plays a vital role in the agricultural sector and accounts for 71 percent of all oilseed crops in 2020, followed by Soybean seeds (15%) and Rapeseeds (14%).

The main producing regions are Dnipropetrovsk, Kirovohrad, Kharkiv, Zaporizhia, Nikolaev, Luhansk, Odessa, and Poltava, which combined account for 62% of the country’s total sown area. In general, Sunflower cultivation is more intensive in central and eastern Ukraine, i.e., in the areas particularly affected by the war. The most favorable conditions for Sunflower establishment are in the forest-steppe and steppe zones, with the exception of the southern regions of the steppe zone.

2021 season, the Sunflower area in Ukraine was slightly more than 6.5 million hectares. Sunflower production has been growing steadily since the 1990s. Despite minor fluctuations in Sunflower production in Ukraine, there is a stable trend toward increasing its production capacity. In the marketing year 2020/2021, the Sunseeds output amounted to slightly over 14 million metric tons, having decreased from the previous period. The peculiarities of Sunflower cultivation are that it is an entirely export-oriented crop with high profitability.

Areas under Sunflowers exceed the norms recommended by scientists, which is due to the high profitability of their cultivation and significant global demand for vegetable fats. Accordingly, it causes soil depletion and the need for additional fertilizers. Yield per 1 hectare of the harvested area increased by 11.3% in 2019 compared to 2018, but in 2020 decreased by 21% and amounted to 20.2 centners per hectare. In terms of yielding, Ternopil region led others by 3.42 t/ha, followed by Khmelnitsky (3.30 t/ha), Ivano-Frankivsk (3.25 t/ha), and Zhytomyr (3.21 t/ha).

Ukrainian Sunseeds Prospects

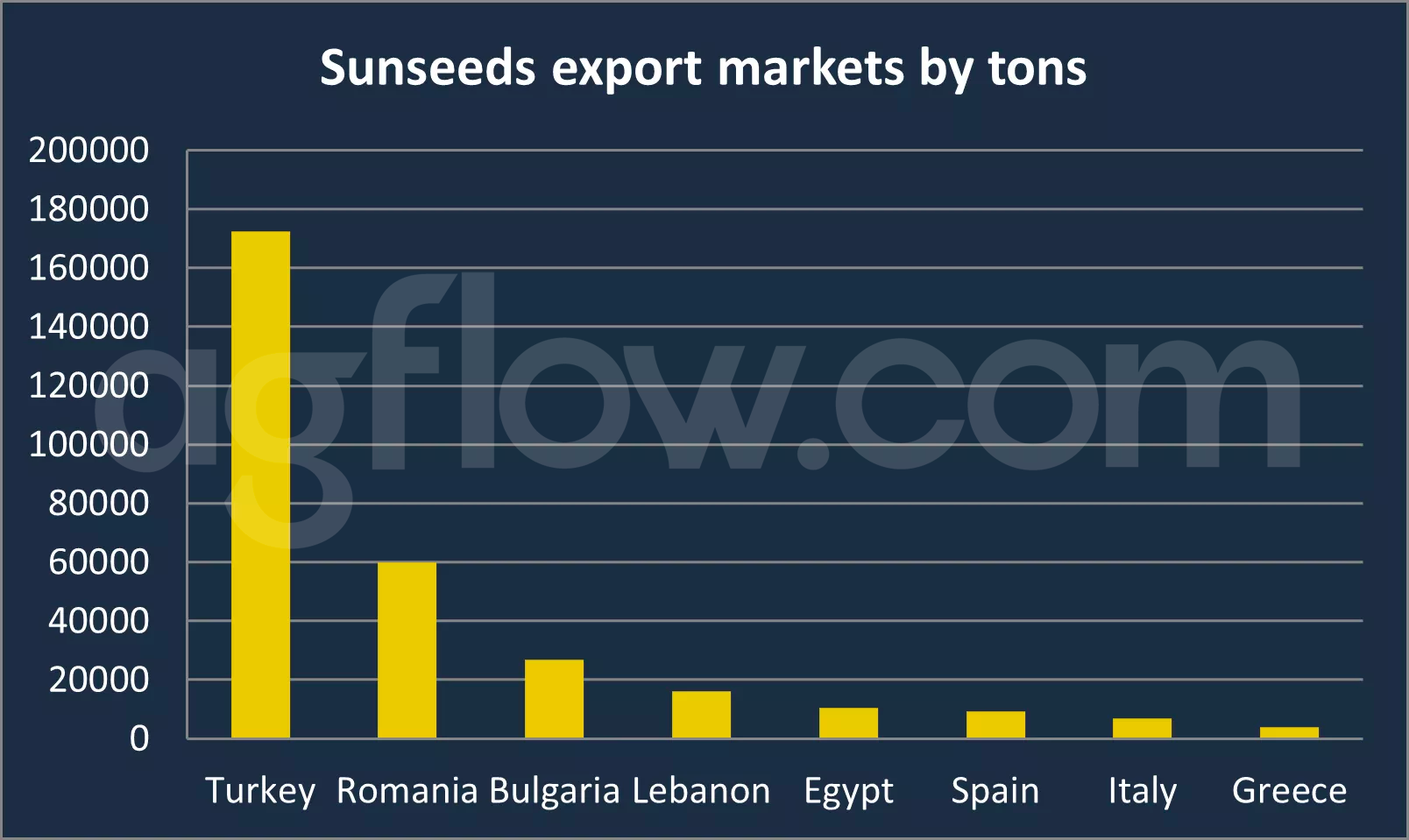

For 2022/23, Ukraine’s Sunflower area is expected to decrease by 48%. Accordingly, Ukraine is planning to harvest 9.4 million tons of Sunflower seeds in the marketing year 2022/2023 (September to August), down 42.6% from 16.4 million tons produced in the previous marketing year, while such exports may drop by from 1.7 million tons to 1 million tons, according to Stepan Kapshuk, General Director of Ukroliyaprom Association (Umbrella of the largest fat-and-oil entities of Ukraine). As per AgFlow data, Turkey led the Ukrainian Sunseeds export market with 172,000 tons in 2021-2022, followed by Romania (60,000 tons), Bulgaria (27,000 tons), and Lebanon (16,000 tons).

Thus, Sunflower seed production may drop to the lowest level of the past decade in this marketing year. On the whole, Ukraine is planning to harvest 14.86 million tons of oilseed crops in the marketing year 2022/2023, including 9.4 million tons of Sunflower seeds, 2.87 million tons of rapeseeds, and 2.59 million tons of soybeans. The exports of oilseed crops may decrease by 10.6% in the marketing year 2022/2023.

In this season, Ukraine is planning to process 95.7% of harvested Sunflower seeds (9.0 million tons), 38% of soybeans (1 million tons), and 7% of rapeseeds (0.2 million tons). According to USDA data, the total production capacity of Ukraine’s oilseed presses in 2020 was about 23 million tons, of which 19 million tons were Sunflower seeds. Due to its focus on the export market, most Ukrainian crushing plants are logistically located near Black Sea ports. They are often well away from the seed-growing areas of the central and eastern parts of the country.

Free & Unlimited Access In Time