Turkey’s Soybean Imports: Moldova Ships Small Volumes

Talk to our team about AgFlow's offering →

Reading time: 2 minutes

In the vast landscape of global trade, soybeans might seem like just another commodity. But for countries like Turkey, the import of soybeans is a nuanced affair, influenced by a myriad of factors. So, what exactly has been driving Turkey’s soybean imports from January to July 2023? Let’s delve deep into the intricacies of this market.

First, let’s address the elephant in the room: Why are soybeans so significant? Analogous to the way oil powers machines, soybeans are, in many ways, the lifeblood of the food industry. They’re a primary source of protein for both humans and livestock, and they play a pivotal role in the production of numerous products, from tofu to soy milk and even certain biofuels.

The Dynamics of Turkey’s Soybean Imports

In 2023, Turkey’s soybean imports have seen some interesting shifts. But why? What factors have been at play?

• Global Market Conditions: The global soybean market has been volatile. Fluctuations in prices, driven by factors like weather conditions in major producing countries and global demand, have impacted Turkey’s purchasing decisions. Would you buy a product if its price kept skyrocketing without warning?

• Domestic Demand: Turkey’s burgeoning food industry, especially its livestock sector, has an insatiable appetite for soybeans. As the country’s domestic production struggles to keep pace, imports become essential. It’s a classic case of supply not meeting demand.

• Trade Relations: Turkey’s diplomatic and trade relations with major soybean-producing countries have been instrumental. A smooth diplomatic relationship often translates to smoother trade routes and better deals. It’s akin to having a friend in a high place; it just makes things easier.

• Infrastructure and Logistics: The efficiency of Turkey’s ports, the speed of its customs clearances, and the reliability of its transport networks all play a role. Imagine trying to transport a massive shipment of soybeans, only to be bogged down by bureaucratic red tape or inefficient transport routes.

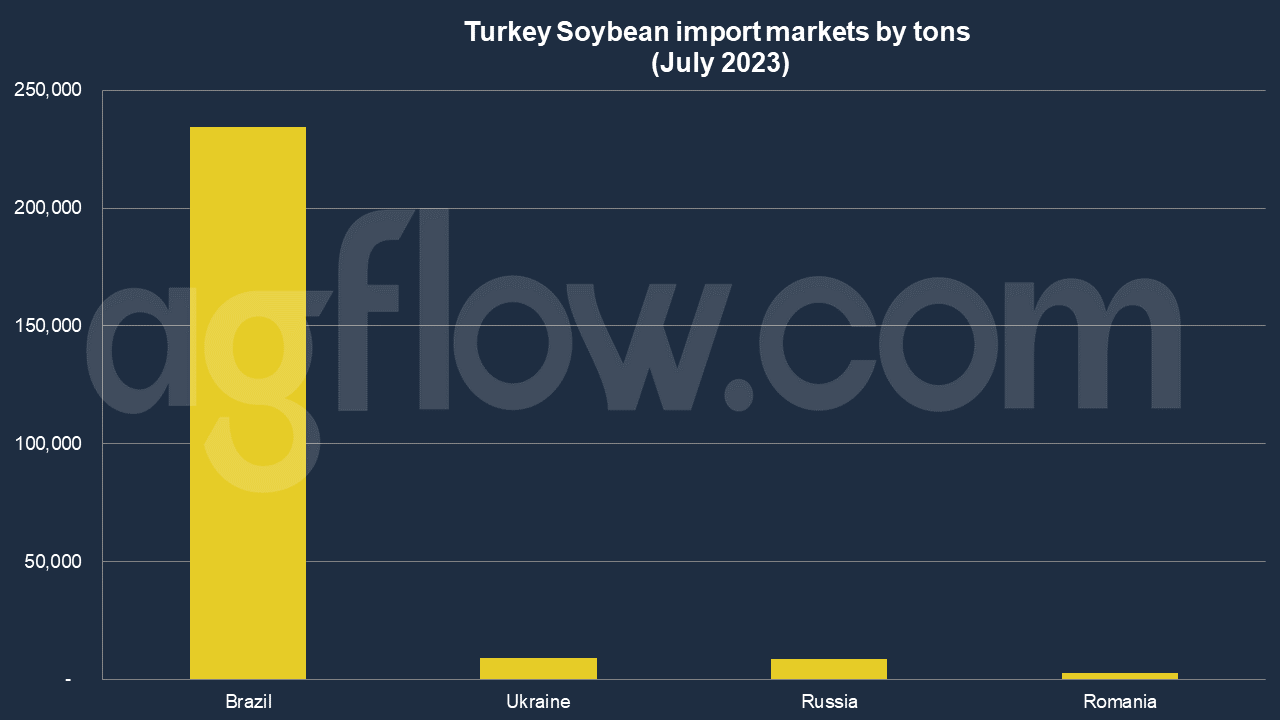

According to AgFlow data, Turkey imported 0.23 million tons of Soybean from Brazil in July 2023, followed by Ukraine (8,814 tons), Russia (8,694 tons), and Romania (2,500 tons). Total imports hit 2 million tons in Jan-July 2023. Turkey was purchasing large amounts of Soybean from Brazil and Ukraine such as 453,000 tons and 168,000 tons. Moldova shipped small amounts of Soybean (5,506 tons) to Turkey.

May shipments were the largest in Jan – July of 2023, with 0.47 million tons. The following months were Mar (0.4 million tons), Apr (0.32 million tons), Jul (0.25 million tons), Feb (0.2 million tons), and Jan (0.18 million tons).

The Tradeoffs and Challenges

Balancing the various factors impacting soybean imports is no easy task. For instance, while securing a lower price from a supplier might seem like a win, what if that supplier has a history of unreliable deliveries? Or what if a cheaper supplier is located in a country with which Turkey has tense diplomatic relations?

Furthermore, the challenge of predicting domestic demand is ever-present. Overestimating demand could lead to excess stock and wasted resources while underestimating could lead to shortages and skyrocketing prices.

In Conclusion

The world of soybean imports, especially in a dynamic country like Turkey, is a complex web of interrelated factors. Every aspect plays a crucial role, from global market conditions to domestic demand and from diplomatic ties to logistical challenges. As we’ve seen in the first seven months of 2023, navigating this maze requires a keen understanding of the broader global context and the nuances of Turkey’s domestic situation.

Staying abreast of these factors is essential for professionals in the agricultural commodity industry. And for the general public, understanding these dynamics offers a fascinating glimpse into the intricate dance of global trade.

Try AgFlow Free

Access Free On Updates for Corn, Wheat, Soybean,

Barley, and Sunflower Oil.

No Credit Card Required & Unlimited Access In Time