Turkey Imports: Russia Ships Corn Mostly from Rostov-on-Don Port

Talk to our team about AgFlow's offering →

Reading time: 2 minutes

In the vast world of agricultural commodities, corn stands as a staple, feeding millions and serving as a primary ingredient in countless products. As we delve into the intricacies of Turkey’s corn imports from January to July 2023, we must ask ourselves: What drives this market? What challenges does Turkey face, and how do they balance the tradeoffs inherent in such a complex system?

Corn, or maize as it’s known in many parts of the world, is more than just a grain; it’s an economic powerhouse. For Turkey, a nation with a rich agricultural history, corn is both a dietary staple and a significant industrial ingredient. But why the surge in imports in 2023?

Economic Dynamics and Tradeoffs

The first half of 2023 saw a unique confluence of factors impacting Turkey’s corn imports. Global corn prices fluctuated due to unpredictable weather patterns in major corn-producing regions. Simultaneously, Turkey’s domestic demand surged, driven by a growing population and an expanding livestock sector.

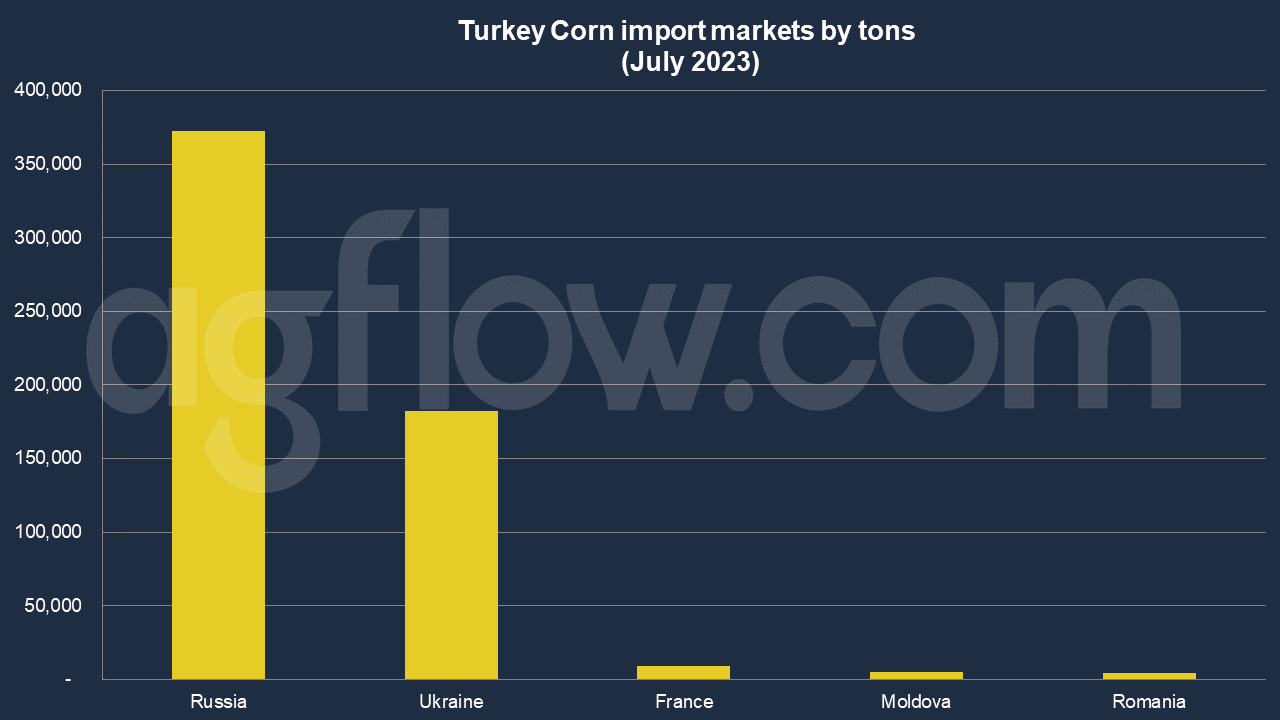

According to AgFlow data, Turkey imported 0.37 million tons of Corn from Russia in July 2023, followed by Ukraine (0.18 million tons), France (9,000 tons), Moldova (4,777 tons), and Romania (4,457 tons). Total imports hit 3.5 million tons in Jan-July 2023. Turkey was purchasing large amounts of Corn such as 0.4 million tons, 0.7 million tons, and 0.58 million tons per month. Russia ships Corn to Turkey by small amounts, mostly from its Rostov-on-Don port while Ukraine ships from its Reni port.

June shipments were the largest in Jan – July of 2023, with 0.7 million tons. The following months were May (0.58 million tons), and April (0.5 million tons).

But importing corn isn’t as straightforward as it sounds. Every tonne of corn brought into the country represents a tradeoff. On the one hand, it bolsters domestic supply, ensuring food security and stable prices. On the other, it can undermine local farmers, potentially depressing local corn prices and reducing the incentive to cultivate.

So, what’s the balance? How does Turkey ensure it supports its local farmers while also meeting the demands of its populace?

One of the primary challenges Turkey faces is the volatility of global corn prices. But why are these prices so unpredictable? Think of it as a domino effect. A drought in the U.S. Midwest or a flood in Brazil can send ripples throughout the global market. These fluctuations can be both a boon and a bane for a country like Turkey, which relies heavily on imports.

Moreover, geopolitical tensions can also play a role. Trade agreements, tariffs, and diplomatic relations can all influence the flow of corn into Turkey. Navigating these waters requires a deft hand and a keen understanding of international relations.

The Road Ahead

As we look beyond July 2023, one can’t help but wonder: What’s next for Turkey’s corn imports? Will they continue to rise, or will domestic production catch up?

It’s a delicate dance of economics, agriculture, and geopolitics. But one thing is clear: Corn remains a pivotal commodity for Turkey. As the nation grapples with the challenges of importing this golden grain, it will need to weigh the benefits against the costs, always keeping an eye on the broader picture.

Conclusion

In conclusion, Turkey’s corn imports in 2023 offer a fascinating glimpse into the world of agricultural commodities. It’s a tale of supply and demand, of global weather patterns and geopolitical tensions, and of a nation’s quest to feed its people while supporting its farmers. As we move forward, the story of Turkey and corn will undoubtedly continue to evolve, reflecting the ever-changing dynamics of our interconnected world.

Try AgFlow Free

Access Free On Updates for Corn, Wheat, Soybean,

Barley, and Sunflower Oil.

No Credit Card Required & Unlimited Access In Time