Tunisia Corn: Ukraine Slows Down and Brazil Hurries

Talk to our team about AgFlow's offering →

Reading time: 2 minutes

Corn, the golden grain that has been a staple in diets across the globe, has a unique story in Tunisia. But what’s the real kernel of truth behind Tunisia’s corn trade? How does this North African nation balance the scales of export and import? Let’s dive into the maize maze and explore the intricate dynamics of Tunisia’s corn market.

The Corn Landscape in Tunisia

Tunisia, a country known for its diverse landscapes and rich history, has a burgeoning corn industry. But why corn? Isn’t Tunisia more famous for its olive oil and dates?

The answer lies in the soil and climate. Tunisia’s agricultural regions provide an ideal environment for corn cultivation. But it’s not just about growing corn; it’s about trading it too.

Export: The Golden Opportunity

Tunisia’s corn export has seen a rise in 2023. The country’s strategic location, acting as a bridge between Africa and Europe, has played a pivotal role in this growth. But what’s the secret sauce?

1. Quality Control: Tunisia has invested in quality control measures, ensuring that the corn meets international standards.

2. Trade Agreements: Libya is a key importer of Tunisian Corn.

3. Balancing Act: Exporting corn without affecting the local market has been a tightrope walk. How much is too much? How little is too little? It’s a question of balance, and Tunisia seems to be getting it right.

Import: A Necessary Tradeoff

While export is a golden opportunity, import is a necessary tradeoff. Why import corn when you’re exporting it?

1. Diverse Corn Needs: Not all corn is created equal. Tunisia imports specific corn varieties for various industrial uses.

2. Market Dynamics: Sometimes, importing corn can be more cost-effective than producing it locally, especially when global corn prices fluctuate.

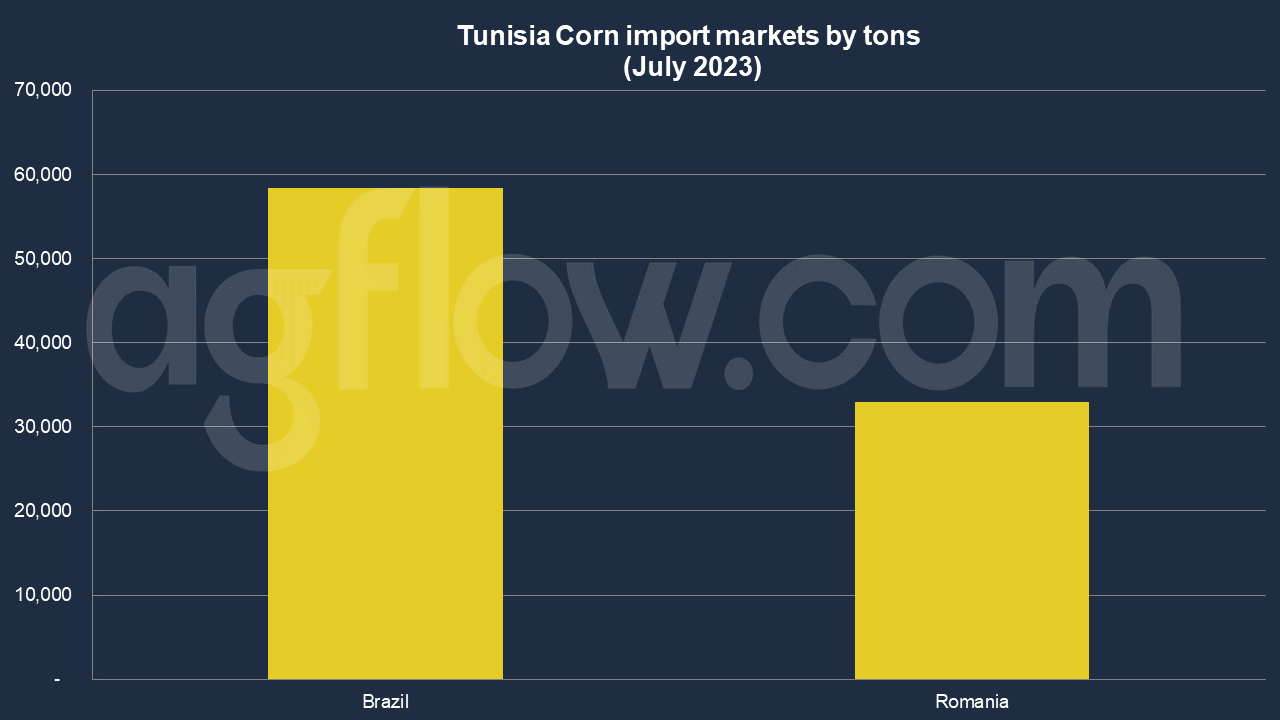

According to AgFlow data, Tunisia imported 58,392 tons of Corn from Brazil in July 2023, followed by Romania (33,000 tons). Total exports hit 0.45 million tons in Jan-July 2023.

In Jan – July of 2023, Apr shipments were the largest with 94,000 million tons. The following months were July (91,400 tons), Mar (94,000 tons), February (89,000 tons), and May (71,000 tons). Tunisia was purchasing large amounts of Corn from Ukraine, Romania, and Brazil, such as 44,000 tons, 33,000 tons, and 28,400 tons. It appears Russia’s grain deal exit influences Ukrainian Corn exports to Tunisia negatively.

Challenges and Approaches

Navigating the corn market is like sailing through a storm. It’s not always smooth sailing.

1. Climate Change: Unpredictable weather patterns have affected corn production. How does Tunisia adapt to these changes?

2. Global Market Fluctuations: The global corn market is like a roller coaster. How does Tunisia keep its balance?

The answers lie in innovative farming techniques, strategic planning, and a robust understanding of the global market.

Conclusion

Tunisia’s corn trade is a fascinating blend of opportunities, challenges, and intricate balancing acts. From the golden fields of corn to the bustling markets, the story of Tunisia and corn is a tale of growth, adaptation, and strategic thinking.

The journey of corn in Tunisia is like a well-cooked dish, with each ingredient playing its part. The export is the spice, the import is the salt, and the challenges are the fire that cooks it all together. It’s a recipe that Tunisia seems to be mastering, and the world is watching with keen interest.

Try AgFlow Free

Access Free On Updates for Corn, Wheat, Soybean,

Barley, and Sunflower Oil.

No Credit Card Required & Unlimited Access In Time