The Netherlands Export: Belgium Buys More Soybean Than Germany

Talk to our team about AgFlow's offering →

Reading time: 2 minutes

The Netherlands is a crucial entry point for soy imports to the European Union. In 2021, 6.7 million metric tons (Mt) of Soybeans, Soybean Meal, and Soybean Oil arrived in the ports of Rotterdam and Amsterdam. This volume made the Netherlands the largest importer in the EU, with a share of 16.6%. Spain followed in second place with 16.4% (6.6 Mt), Germany was third with 14.2% (5.7 Mt), and Italy was fourth with 10.0% (4.1 Mt).

Brazil was the most critical origin of Dutch soy imports, with 2.4 Mt of beans and 1.6 Mt of Meal or 60% of total Dutch imports. North America supplies almost exclusively Soybeans, while Argentinian supplies primarily consist of Soybean Meal. European origins, mainly from Ukraine and Russia, have shown a steady increase in recent years but still only account for a small share of overall Dutch soy imports.

The Netherlands is a crucial European importer of soy to the European Union, both for its own use and for re-exports to other European countries. Around two-thirds of the total available soy on the Dutch market is re-exported directly or after crushing. In 2021, Germany accounted for 45% of combined Dutch exports of Soybeans, Soybean Meal, and Soybean Oil. Belgium received 26% and the United Kingdom 10%.

In turn, Germany, as the key destination of Dutch re-exports, also plays an essential role as a soy trading hub, particularly for Soybean Meal exports. Destinations include Denmark as well as Central and Eastern European countries.

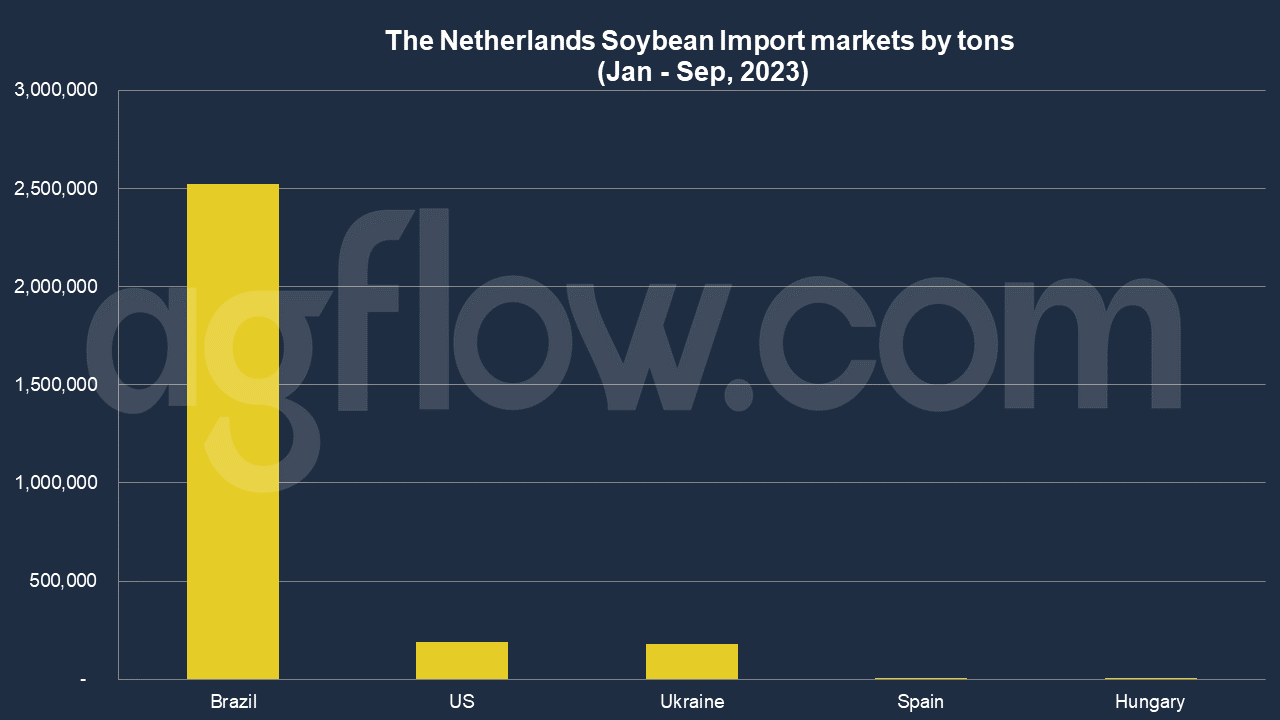

As per AgFlow data, the Netherlands imported 3 million tons of Soybeans in Jan – Sep 2023. The key suppliers were Brazil (2.5 million tons), the US (0.19 million tons), and Ukraine (0.18 million tons). Spain and Hungary supplied small volumes also.

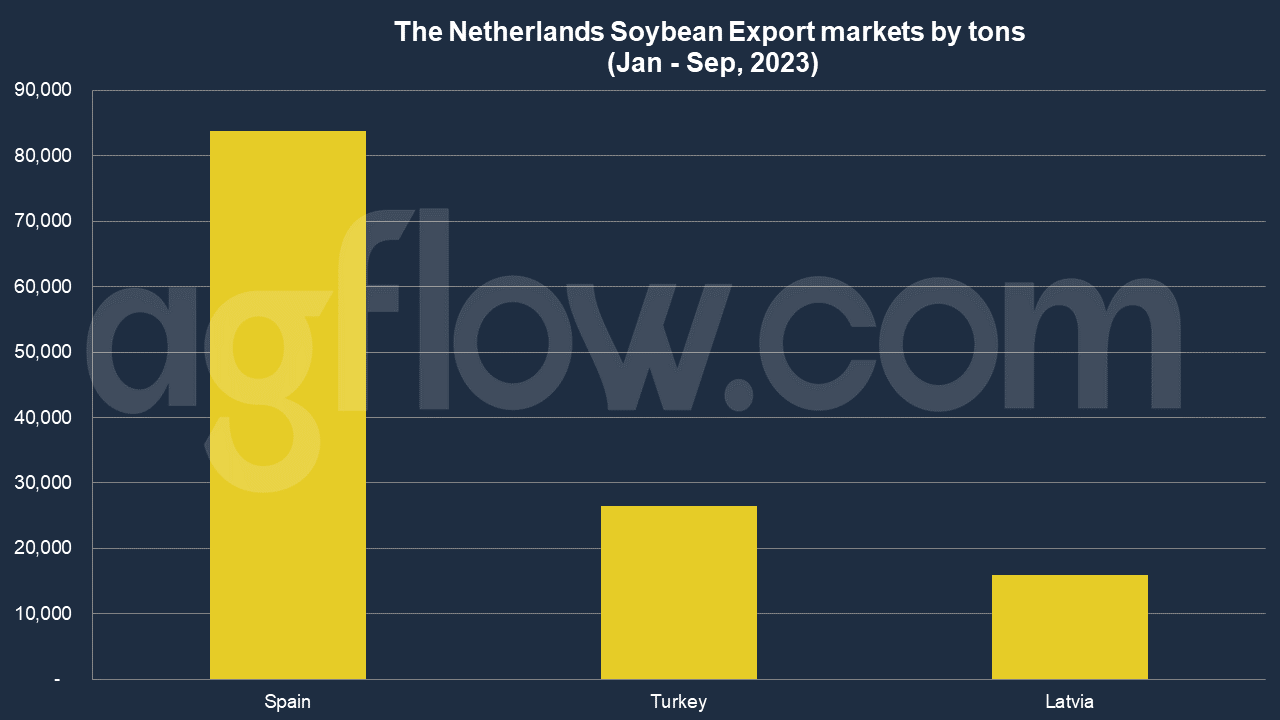

For exports, the Netherlands shipped 83,821 tons of Soybean to Spain in May – June 2023, followed by Turkey (26,500 tons) and Latvia (16,000 tons).

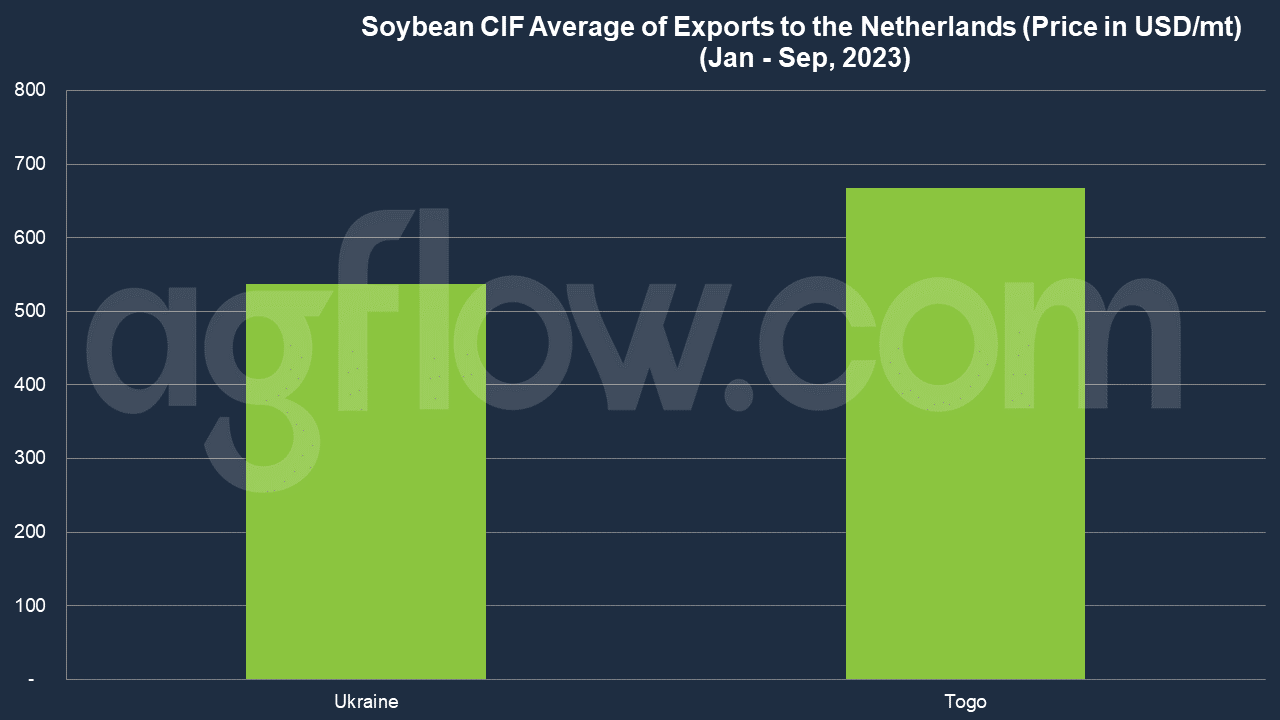

Regarding CIF price, Ukraine quoted $ 537 on average to the Netherlands, while Togo offered $667 on average.

In 2021, the Netherlands exported Soybean Meal worth $1.2 billion. The main destinations of the Netherlands exports on Soybean Meal were Belgium ($392M), Germany ($389M), the United Kingdom ($145M), France ($59.4M), and Lithuania ($35M). The same year, the Netherlands imported Soybean Meal worth $1.21 billion, mainly from Brazil ($843M), India ($84.4M), Argentina ($63.5M), Russia ($53.8M), and Paraguay ($44.8M).

Soybean Value Chain and Profit Share

After deducting re-exports, around one-third, or 2.2 Mt, of the imported soy is used in the Netherlands, with around 2 Mt of Soybean Meal accounting for most of this volume. Based on the share of Brazilian soy in the imported volumes, an estimated 1.2 Mt or 61% of the total Soybean Meal used in animal feed in the Netherlands in 2021 originated from Brazil.

As calculated in a 2020 report on the Dutch soy sector, the poultry and pork sector are the most significant users of Brazilian Soybean Meal, with estimated shares of 29% and 27%, respectively. In total, meat production takes up around 62%, dairy accounts for around 23%, and egg production for 15%

Within the European Union (EU), the Netherlands is the largest soy importer and the leading importer of Brazilian soy. In 2018, the Netherlands imported 4.3 million tons of Soybeans and 2.7 million tons of soyMeal, of which Brazilian imports accounted for, respectively, 23% and 76% percent.

The 3 million tons of Brazilian soy imported to the Netherlands is estimated at € 1 billion. However, a part of this volume is transhipped to other markets. According to Profundo research, Important Soybean traders include, among others (subsidiaries of) Amaggi (Brazil), ADM (U.S.), Bunge (U.S.), Cargill (U.S.), Caramuru (Brazil) and Cefetra (Netherlands, part of BayWa Group, Germany). As a leading trader, Amaggi realizes a high value of Brazilian soy sales (€ 126 million) but a low profit (€ -0.3 million) as it has low margins. Bunge (€ 3.6 million) and Cargill (€ 2 million) realized the highest gross profits. The top 6 traders earned only a gross profit of € 7.5 million in 2018.

The Dutch agricultural chain is marked by a high export share of production, which means that embedded Brazilian soy is exported in dairy, meat, and eggs. Ahold’s Dutch supermarket chain Albert Heijn generated an estimated annual value of € 100 million on embedded Brazilian soy and an estimated gross profit of € 40 million annually. This is generated mainly through perishable products, which account for 46% of its system-wide sales. In the Netherlands, Albert Heijn is the largest beneficiary of processed Brazilian soy. The company earned a gross profit in 2018 of € 44 million, which was 15 percent of all Dutch profits in all chains related to Brazilian soy.

In total, the leading companies in the supply chain of Brazilian soy in the Netherlands generated a net value of € 1,338 million in 2018. The gross profit of Brazilian soy was 291 million in 2018. Agri-commodity traders account for a relatively small share (3-5%) of the total gross profit benefits due to their limited value-adding. The soy crushers and refiners show a volatile development (4-6% share) as they compete with counterparts in soy-producing countries.

The egg producers and packers also see relatively small benefits (2-3% of the total) as these are comparatively small companies operating in a competitive environment with little value-adding. Dairy companies appear in the middle of the field (12%). Animal feed producers (19% in 2017/18) and slaughterhouses (22-24%) show higher shares in the pool of gross profit benefits. The outcomes for slaughterhouses are positively impacted by their large size based on the strong export orientation of the sector.

The sector benefitting most from the gross profit pool of the processing of Brazilian Soybean in the Netherlands is the food retailers (33-35% of the total). This sector is dominated by a small group of prominent players, where two retailers controlled 54% of the market in 2018. Their strong negotiation position enables them to achieve comparatively high margins on perishable products such as meat and dairy, with high shares of embedded soy.

Try AgFlow Free

Access Free On Updates for Corn, Wheat, Soybean,

Barley, and Sunflower Oil.

No Credit Card Required & Unlimited Access In Time