Spain Imports Soybean Meal Worth $1.2 Billion

Reading time: 2 minutes

Oilseed production in Spain is limited to sunflower, which is primarily processed to extract Oil intended for the food market, followed by rapeseed to a much lower extent, which is usually exported to neighboring Portugal or France. Soybean production in Spain is primarily intended for the biotechnology-free food market under contracts with the food processing industry—Spain’s annual Soybean production averages just below 5 thousand metric tons (TMT). Consequently, Spain needs to import virtually all its protein feed ingredients.

Spain’s Soybean crushing capacity, which amounts to nearly 3.5 million metric tons (MMT), is divided into four Soybean-devoted crushing plants. Three are managed by Bunge (Barcelona, Bilbao, and Cartagena), and the fourth is by Cargill (Barcelona). Spain is the third largest soy-crushing EU Member State, accounting for 20 percent of the bloc’s imports (after the Netherlands and Germany, which account respectively for 25 and 21 percent of the EU’s Soybean imports). Crushers use installed capacity at a high level to ensure asset optimization. Soybeans are highly appreciated by those crushers who specialize in supplying the feed market.

On average, Spain’s annual combined imports of Soybean and Soybean Meal amount to nearly six million MT. Spain can import Soybean Meal through ports equipped with agricultural product unloading facilities. However, Soybeans intended for crushing are imported into Spain by ports with crushing facilities with devoted terminals.

Spain is the third largest EU Soybean Meal import market, accounting for 9 percent of the bloc’s imports (after France and the Netherlands, which account respectively for 11 and 10 percent of the EU’s Soybean imports).

The robust feed industry is Spain’s primary Oilseed Meals consumer, driven by the dynamic and export-oriented livestock sector. Nearly half of the Soybean Meal supply is met by Meals obtained through in-country crushing, while Meal imports meet the remainder. While crushing volume remains stable, Meal imports reflect changes in demand. Spain is the EU’s largest feed manufacturer. Pig feed represents the largest category, accounting on average for 45 percent of the feed demand.

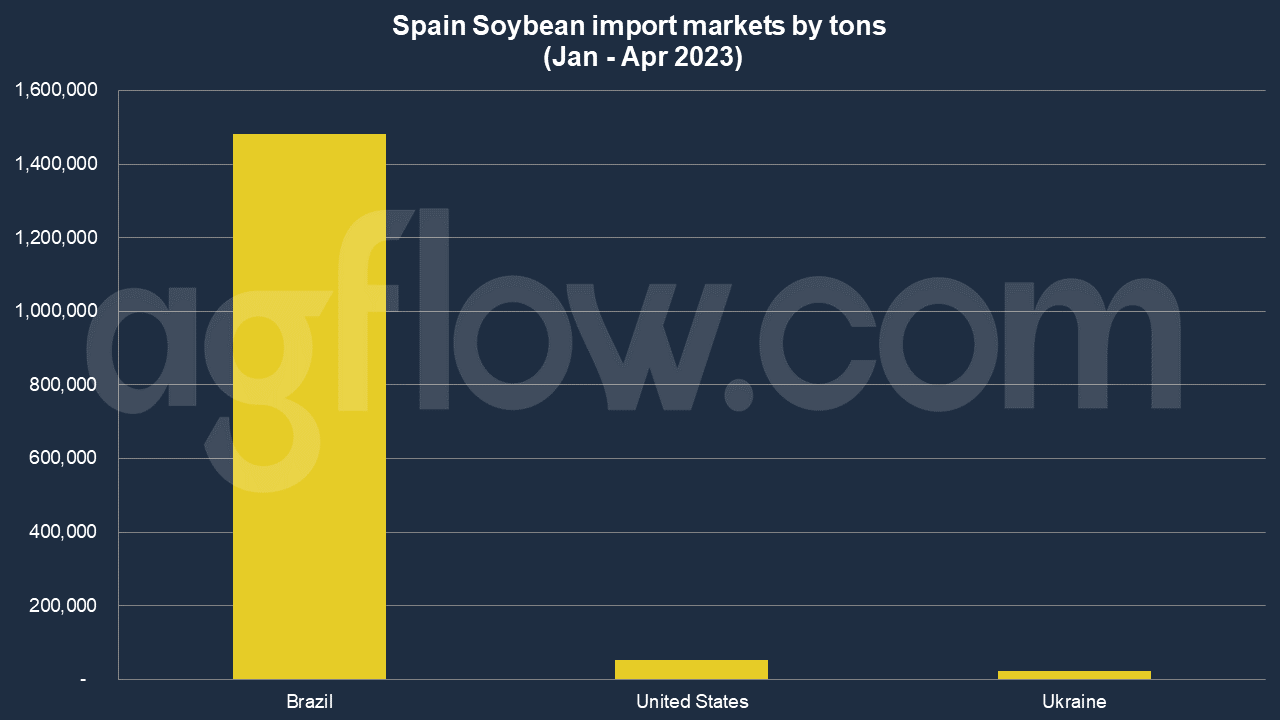

According to AgFlow data, Spain purchased 1.5 million tons of Soybean from Brazil in Jan-Apr 2023, followed by the US (51,817 tons) and Ukraine (21,100 tons). In 2021, Spain imported Soybean Meal worth $1.2 billion, becoming the world’s 6th largest importer of Soybean Meal. In the same year, Soybean Meal was Spain’s 74th most imported product. Spain imports Soybean Meal primarily from: Argentina ($694 million), Brazil ($327 million), Germany ($62.4 million), the United States ($59.7 million), and Portugal ($35.1 million). The fastest-growing import markets in Soybean Meal for Spain between 2020 and 2021 were Argentina ($310 million), Germany ($19 million), and Brazil ($16.1 million).

In 2021, Spain exported Soybean Meal worth $136 million, making it the world’s 17th largest exporter of Soybean Meal. In the same year, Soybean Meal was Spain’s 413th most exported product. The leading destination of Soybean Meal exports from Spain is France ($58.6 million), Portugal ($22.4 million), Cyprus ($13.9 million), Italy ($13.5 million), and Libya ($10.3 million).

Soybean Oil Market in Spain

The average annual domestic Soybean Oil extraction amounts to 550 thousand MT. The biodiesel sector’s demand for Soybean Oil contributes to reducing the exportable supply and improves crushers’ margins. Soybean is more present in the Spanish biodiesel mix during summer, given the iodine number permitted. However, competition from biodiesel imports and double-counting provision implementation contribute to reducing the amount of Soybean Oil consumed for biodiesel processing in Spain. With virtually no market other than the biofuel outlet, most domestically extracted Soybean Oil is exported to third countries.

Other sources: USDA

Try AgFlow Free

Access Free On Updates for Corn, Wheat, Soybean,

Barley, and Sunflower Oil.

No Credit Card Required & Unlimited Access In Time