Spain Emerges as a Key Importer of Bulgarian Corn

Talk to our team about AgFlow's offering →

Reading time: 2 minutes

Bulgaria had lower exportable Corn availability due to a much shorter Corn crop in MY2022/23. In addition, Corn export demand has faced intense competition from Black Sea suppliers (Ukraine). The Corn exports decline was 34 percent at the end of May 2023 over 2022.

Corn exports in the first half of MY2022/23 (October-March) were at 541,861 MT to main destinations China, Spain, and Greece. According to the EC Customs data, as of June 26, 2023, Bulgaria exported 644,756 MT of Corn to non-European Union markets with a share of 18 percent of European Union total exports raking the country as the second largest EU exporter after Romania.

Corn imports declined and were reported by the Ministry of Agriculture of Bulgaria at 26,000 MT at the end of May, or a reduction of 58 percent compared to May 2022. European Commission Customs data shows imports at 22,655 MT. Imports in the first half of the current marketing year are for 31,997 MT, mainly from Romania, Greece, and Ukraine.

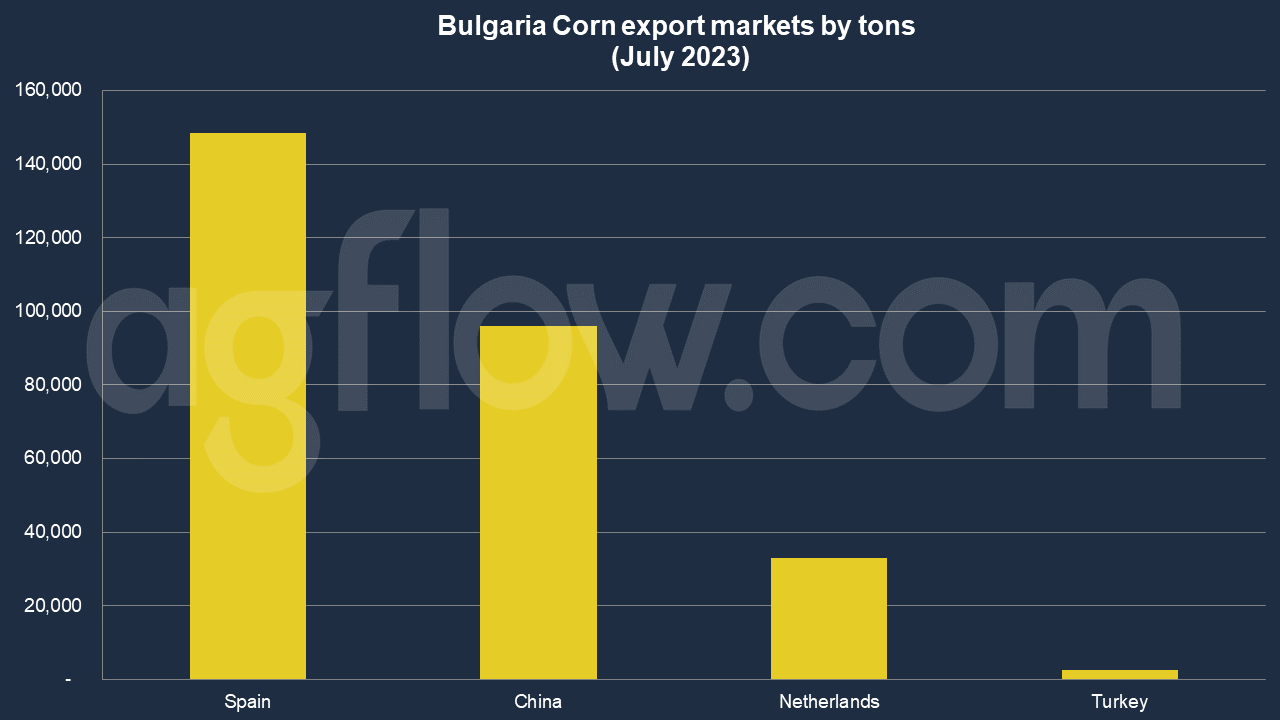

According to AgFlow data, Bulgaria exported 0.14 million tons of Corn to Spain in July 2023, followed by China (96,000 tons), the Netherlands (33,000 tons), and Turkey (2,525 tons). Total imports hit 1 million tons in Jan-July 2023. Key Corn shipping ports and Varna and Burgas. The average shipment volume was 24,500 tons. Bulgaria ships small volumes of Corn to Turkey, Malta, Greece, and Cyprus.

Corn prices have been declining since the beginning of the MY, and since March, they have fallen below the prices a year ago with a widening gap. As of June, the Corn price was 33 percent lower than in June 2022. Ukraine is a significant Corn producer and exporter, and ample availabilities in the region impacted the local market.

Domestic Corn consumption has been more stable to slightly lower to date, both for food and feed. Due to the lower crop in MY2022/23 and despite the decline in exports, ending stocks for the MY is not estimated to increase. As of the end of May, Corn stocks were already 23 percent less than the level a year ago at below 1.0 MMT.

Dent Corn, also known as Dent Maize, is a field Corn mainly used for animal feed, biofuel, and making syrup. Starch content is high at the expense of lower sugar content in the kernel. Bulgarian farmers from the Western part of the country have strong traditions of growing yellow Corn with excellent quality and high yields. Last few years, farmers from south Bulgaria increased Corn fields, planted with high-quality seeds. Ren Agro, as a part of Ren Group Bulgaria, works closely with local farmers and sources extra quality Corn yellow from them for its export activities.

The company is a medium-sized exporter whose primary goal is to provide its customers with high-quality Bulgarian Corn at attractive prices.

Corn Trade Value in Bulgaria

In 2021, Bulgaria exported Corn worth $541 million, making it the 14th largest exporter of Corn in the world. In the same year, Corn was Bulgaria’s 14th most shipped product. The leading destination of Corn exports from Bulgaria is Greece ($152 million), Romania ($88.8 million), South Korea ($73.9 million), Spain ($61.3 million), and China ($45.2 million).

In 2021, Bulgaria imported Corn worth $70.7 million, becoming the world’s 66th largest importer of Corn. In the same year, Corn was Bulgaria’s 138th most imported product. Bulgaria imports Corn primarily from: Romania ($34.1 million), Hungary ($13.1 million), France ($12M), Serbia ($4.75 million), and Italy ($2.07 million).

Other sources: USDA

Try AgFlow Free

Access Free On Updates for Corn, Wheat, Soybean,

Barley, and Sunflower Oil.

No Credit Card Required & Unlimited Access In Time