Singapore’s Top Corn Export Market – Israel

Talk to our team about AgFlow's offering →

Reading time: 2 minutes

Singapore, often lauded as an economic powerhouse and a global trading hub, plays a pivotal role in the international trade of various commodities, and corn is no exception. The year 2023 has brought with it its unique set of challenges and opportunities for Singapore’s corn trade and imports. In this article, we delve into the multifaceted world of Singapore’s corn trade, exploring the key factors that have influenced the trade landscape from January to August 2023.

Singapore Corn Landscape

1. Singapore’s Strategic Position

Singapore’s geographical location, nestled in the heart of Southeast Asia, positions it as a crucial gateway for corn imports into the region. This strategic advantage allows Singapore to efficiently distribute corn to neighboring countries, thus enhancing its status as a global trading center. The city-state’s well-established infrastructure, including world-class ports and logistics, facilitates seamless trade operations.

2. Corn Demand in Southeast Asia

The demand for corn in Southeast Asia has been steadily growing due to its diverse applications, ranging from animal feed to industrial products. As economies in the region continue to develop, the need for this versatile commodity remains high. With its efficient supply chain network, Singapore is well-equipped to meet this increasing demand, further solidifying its position as a corn trade hub.

3. Corn Supply Sources

Singapore’s corn imports primarily originate from key global suppliers, including the United States, Brazil, Argentina, and Ukraine. These sourcing decisions are influenced by factors such as price competitiveness, quality standards, and geopolitical stability. In 2023, trade tensions and geopolitical shifts have prompted traders and importers to diversify their supply sources to mitigate risks associated with overreliance on any single country.

4. Price Volatility

Corn prices are subject to global market dynamics, including weather patterns, supply and demand fluctuations, and commodity market speculations. Managing price volatility is a perennial challenge in the corn trade. In 2023, the market has experienced price fluctuations, forcing industry players to employ risk management strategies such as futures contracts and options to safeguard against price shocks.

5. Sustainable Sourcing

The importance of sustainability in the corn trade cannot be overstated. Consumers and regulatory bodies increasingly demand transparency in supply chains and environmentally responsible sourcing practices. As a responsible trading hub, Singapore has been proactive in encouraging sustainable sourcing and promoting certifications like the Roundtable on Sustainable Biomaterials (RSB).

6. Regulatory Considerations

Singapore maintains stringent regulations and quality standards to ensure the safety of imported corn products. Compliance with these regulations is not only essential for market access but also vital for maintaining consumer trust. Importers must navigate the complex regulatory compliance landscape to avoid supply chain disruptions.

7. Trade Financing and Currency Fluctuations

Trade financing and currency exchange rates play a pivotal role in the corn trade. In 2023, fluctuations in global currencies and changes in interest rates have added an additional layer of complexity for traders and importers, affecting their financing strategies and overall profitability.

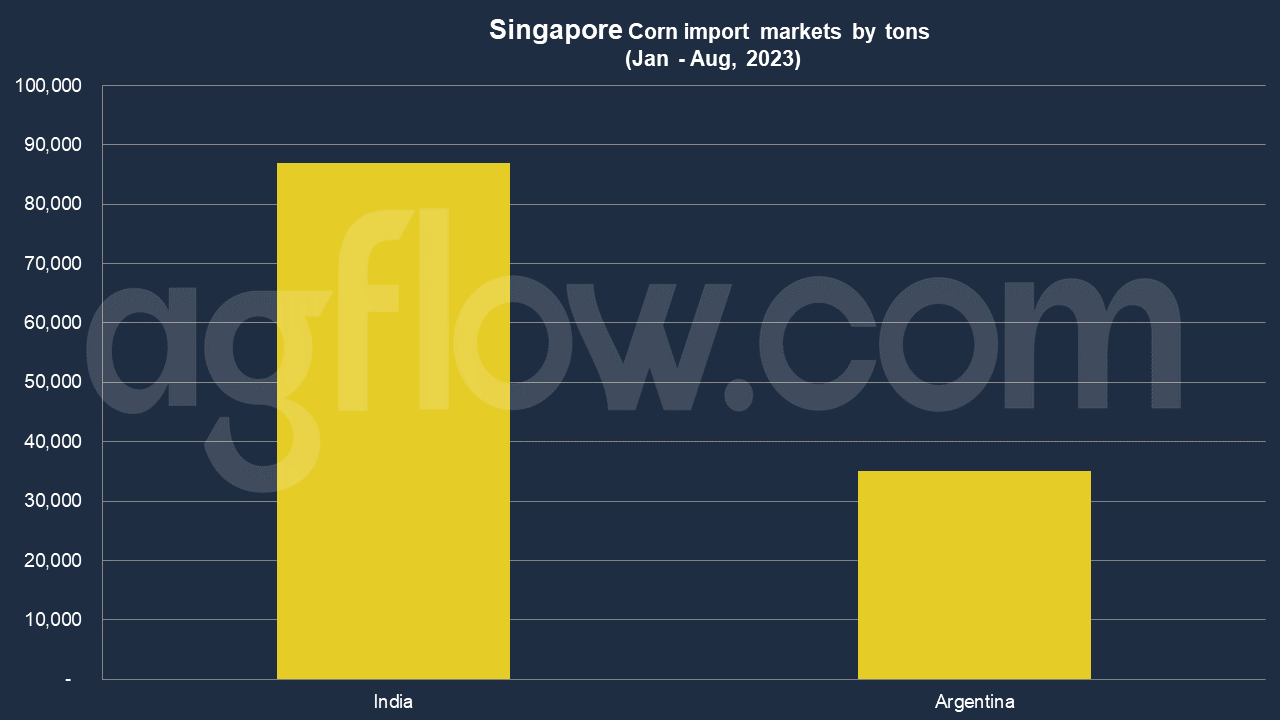

According to AgFlow data, Singapore imported 87,000 tons of Corn from India in Jan – Aug 2023, followed by Argentina (35,000 tons). In 2021, Singapore imported Corn worth $2.5 million, becoming the 148th largest importer of Corn in the world. At the same year, Corn was the 951st most imported product in Singapore. Singapore imports Corn primarily from: India ($891k), Malaysia ($449k), Indonesia ($321k), the United States ($246k), and Australia ($192k).

In 2021, Singapore exported Corn worth $5.94 million, making it the 59th largest exporter of Corn in the world. The main destination of Corn exports from Singapore are: Israel ($5.84 million), Chinese Taipei ($25.3k), Brunei ($15.2k), Cambodia ($14.9k), and Thailand ($12.1k).

Conclusion

Navigating the Singapore corn trade and import landscape in 2023 demands a delicate balance of strategic decisions and risk management. Singapore’s role as a global trading hub and its efficient infrastructure position it favorably in the corn trade. However, the industry must contend with challenges such as price volatility, sustainability concerns, regulatory compliance, and currency fluctuations.

As the year progresses, it is crucial for stakeholders in the Singapore corn trade to remain vigilant, adaptable, and innovative in their approach. By addressing these challenges with informed decision-making, the industry can continue to thrive, serving both regional demand and global markets and reinforcing Singapore’s status as a corn trade powerhouse.

Try AgFlow Free

Access Free On Updates for Corn, Wheat, Soybean,

Barley, and Sunflower Oil.

No Credit Card Required & Unlimited Access In Time