Singapore Makes Debut in Brazil’s Soybean Export Market

Talk to our team about AgFlow's offering →

Reading time: 2 minutes

Soybean is the most produced crop in Brazil, with around 155m tons made during the 2022/23 harvest. As a result, it’s critical for Brazilian rural employment. Approximately 243,000 producers employ 1.4m people across the country directly and indirectly.

Soybeans are primarily cultivated in the Center-West region of Brazil. The cultivation cycle lasts around 115 – 130 days. In the states of Mato Grosso and Goiás, where the climate is humid-tropical with a well-defined rainy season, productivity ranges between 3.5 and 3.9 tons/ha. In states such as Rio Grande do Sul, where the weather is predominantly subtropical (cold and dry), Soybean productivity tends to be below the average for Brazil.

Rainfall is significant during the plant’s reproductive period. At this stage, the formation of the Soybean pods occurs, and the plant requires up to 8mm/day. In case of water stress during this phase, crop yield can be drastically reduced, with losses up to 80-100%.

Soybeans are a summer crop, with planting carried out between September and December in the main producing regions of the country. In Brazil, crop rotation with Soybeans is very popular and widely used, with corn as the main alternative crop, followed by wheat. This practice improves soil fertility and structure, increasing yields and helping to reduce soil erosion, as well as reducing the need for fertilizers. It also helps prevent pests/diseases by interrupting their life cycles between the crops.

Producers generally opt for corn as an alternative crop because it provides the best returns. The most common practice is to rotate with corn at least once every three years; many producers alternate between the two crops as they have complementary calendars. Cost of Soybean production is also low relative to many other crops.

The crop has many uses in Brazil. As well as exports, it can be crushed in Brazil, transforming the grain into meal or oil for use in the domestic or international market. 63% of total Soybeans go for exports while 36% go to industry uses locally. In Brazil, 80% of Soybean meal makes up, together with corn, the primary feed produced to feed cattle, pigs, goats, sheep, and poultry.

Around 60% of Brazilian Soybean exports occur between March and June, mainly in the port of Santos, which accounts for 30% of the total exports. Paranagua and Rio Grande are the two next-largest Soybean ports and are located in the south of the country. Together, they are responsible for another 30% of exports.

Today, Brazil is the world’s largest Soybean exporter, accounting for more than half of the international Soybean market supply. Over 60% of Brazilian production is destined for export, with China as the leading destination.

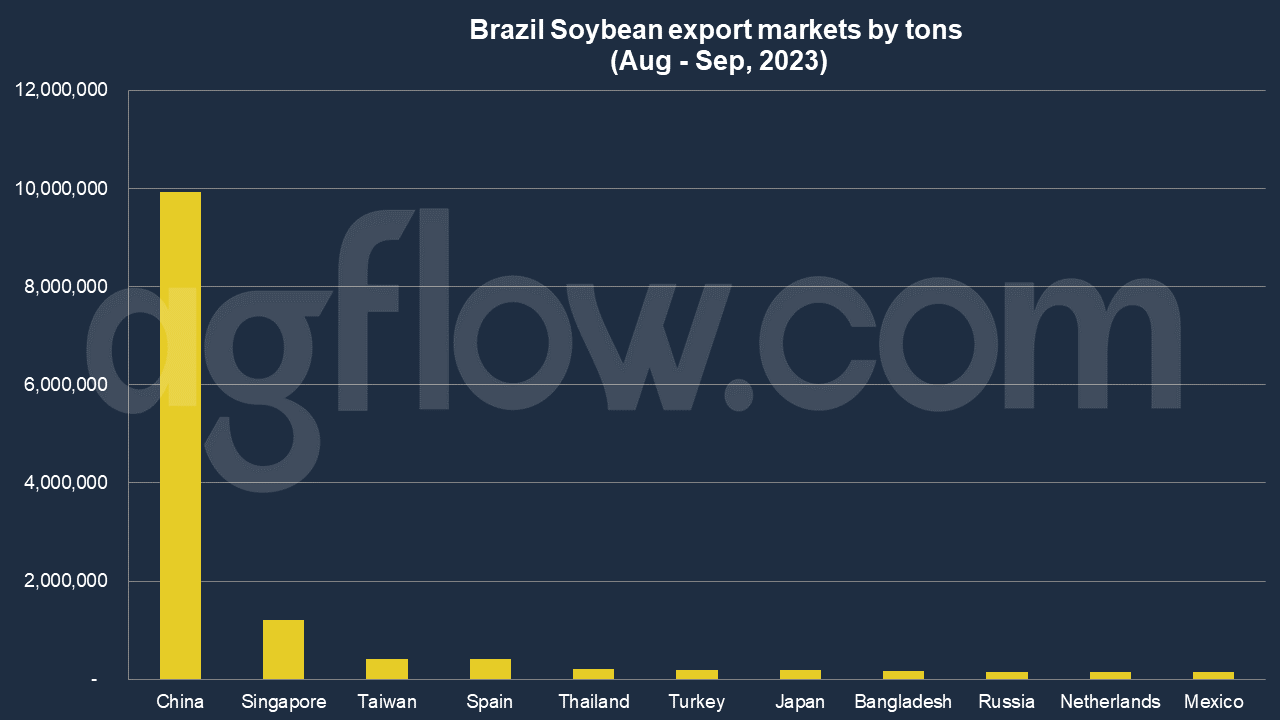

As per AgFlow data, Brazil exported 92.8 million tons of Soybeans in Jan – Sep 2023. In Aug – Sep, the key markets were China (9.9 million tons), Singapore (1.2 million tons), Taiwan (0.4 million tons), Spain (0.4 million tons), Thailand (0.2 million tons), Turkey (0.19 million tons), Japan (0.18 million tons), and Bangladesh (0.16 million tons).

Brazil quoted Bangladesh the highest CFR price, $691 on average, in June – July 2023. The following countries were Thailand ($568), Malaysia ($562), Vietnam ($562), and Indonesia ($561). Brazil quoted CFR price of $594 to China in Sep 2023.

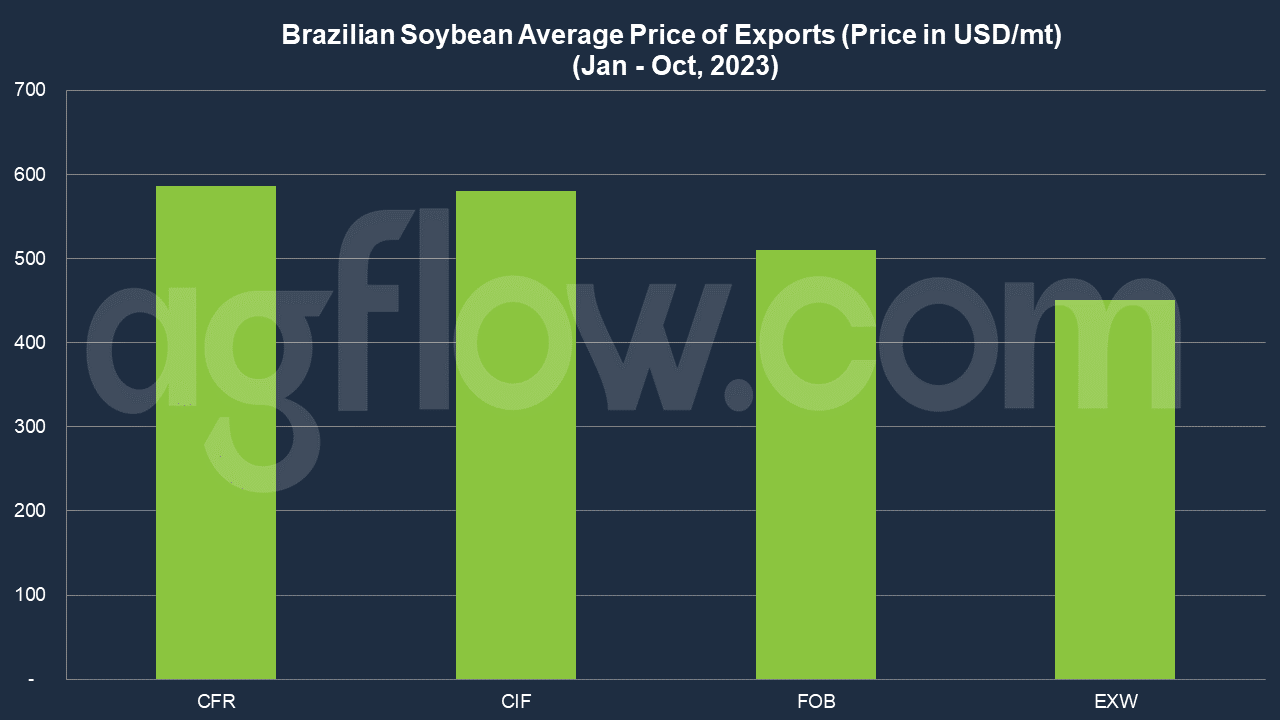

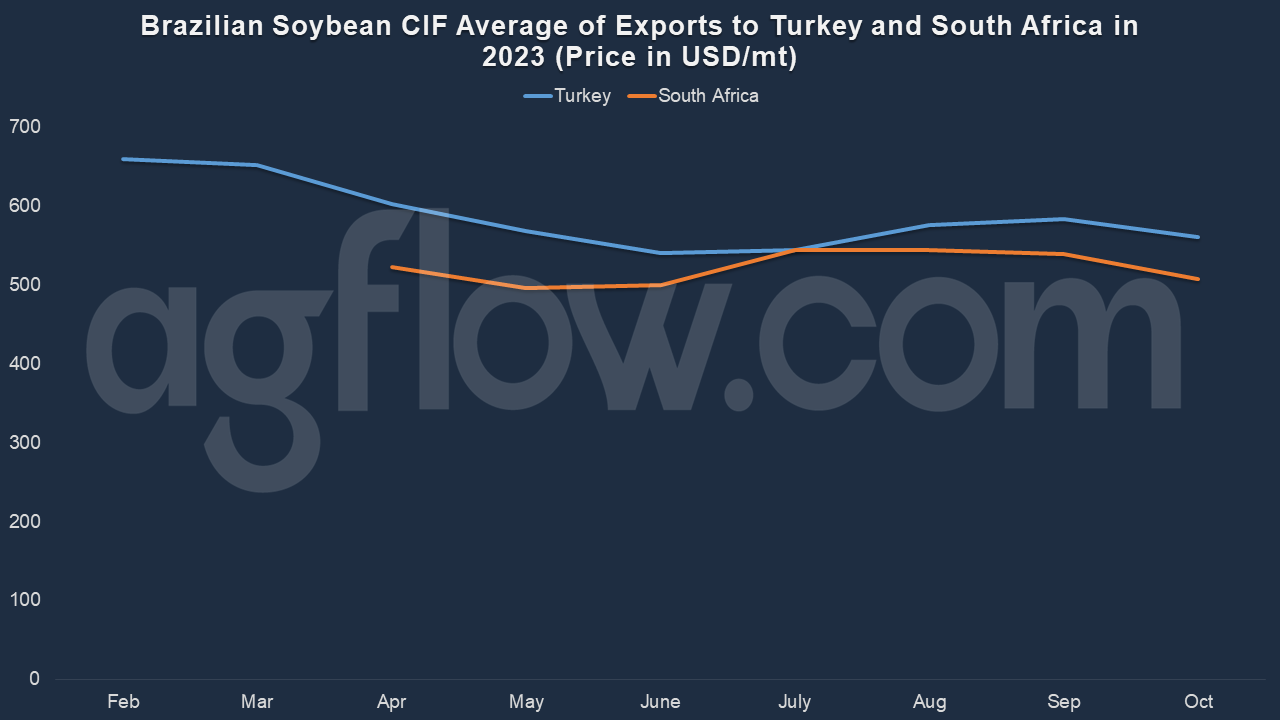

For selected countries, the CIF price showed a downward trend for Turkey in March – July while it had upward trends for South Africa in May – July. In terms of incoterms, Brazil’s average CFR price was $586, followed by CIF ($581), FOB ($510.7), and ExW ($450.7).

Soybean Futures Market

Trade houses are responsible for most of the volume exported. Global traders such as Louis Dreyfus, Cargill, Cofco, and Bunge account for 70% of global grain market sales and are also the largest exporters of Brazilian grain. In Brazil, when exporting Soybeans to the international market, the export premium must be considered.

The premium represents a way of relating the Chicago Stock Exchange quotation and the Brazilian domestic market quotation. The value of the premium must be added to the Chicago quotation to obtain the value that the exporter should receive for the product (FOB).

Soybean futures in Brazil are traded on the CME group’s CBOT (Chicago Board of Trades) market. In Brazil, Soybean prices on the domestic market are directly influenced by freight, production costs, crop production, taxes, and external factors such as the dollar exchange rate and prices on the international market. This explains the different prices in different markets in Brazil (cities that serve as a reference for price formation in other regions).

Hedging by Brazilian rural producers is still low, mainly due to the lack of knowledge of the subject. Most operations in the futures market are carried out by trading companies, which negotiate in the spot market with producers. This means there is low liquidity in Brazilian agricultural futures markets. Therefore, despite Brazil’s significant influence on the commodities market, Bm&FBovespa is not a price reference.

Thus, the physical basis is used for negotiations. This is the difference between the spot price in each market and the price on the reference exchange. Soybeans are also often sold through barter. The Soybeans can be used as payment for production inputs. Negotiations are made with the supplier before harvest, allowing the producer to use the necessary inputs during the planting process, and at the end of the crop, payment is made with the products obtained from the farm.

Logistics Issues

One of the significant challenges of Brazilian Soybean exports is logistics. Brazil is a vast country, and inland logistics are mainly road-dependent. Soybean production areas are far from the ports. Brazilian Soybean farms are concentrated inland. Mato Grosso state, the largest producer and exporter of Soybeans, has no seaports within a 900 km radius.

The long distances between Soybean-producing regions and the ports affect the FOB price of the commodity.

All sugar terminals now operate grains, generating competition between commodities for logistical capacity in Santos and Paranagua ports. Competition between commodities generates bottlenecks in the country’s main ports, which not only results in delays in shipments and allocation of wagons to the port but also increases freight rates.

Try AgFlow Free

Access Free On Updates for Corn, Wheat, Soybean,

Barley, and Sunflower Oil.

No Credit Card Required & Unlimited Access In Time