Russia Sunseeds: Rail Transport Rockets to the Far East Due to China Demand

Talk to our team about AgFlow's offering →

Reading time: 2 minutes

According to preliminary data from Rosstat, the gross harvest of Sunflower Seeds this year decreased by 7.5% compared to last year, to 14.5 million tons, despite an increase in the sown area for this crop by 3.9%, to 10.1 million hectares. The production of unrefined Sunflower Oil in the country in the 2022 calendar year amounted to 6 million tons and increased by 14.3% compared to the previous year.

Russia is the world’s second-largest exporter of Sunflower Oil, with Ukraine taking first place. In the previous marketing year, according to the US Department of Agriculture, Ukrainian exports amounted to 4.5 million tons, or 41% of the global total, and Russian exports amounted to 3.1 million tons, or 28%.

Russia will produce 6.3-6.4 million tons of Sunflower Oil this season, of which at least 3.85 million can be exported. The country’s export potential for Sunflower Oil is 4.0-4.1 million tons. However, it is not sure that this export volume can be achieved due to competition with Ukraine, which offers its Oil at prices lower than Russian ones. “We sell Oil for $1,140-1,150 per ton in the Black Sea ports and Ukraine for $1,080-1,090,” says a Russian expert. “We lower prices a little, and they lower them.”

In just the first five months of 2023, 524,271 tons of Oil were exported by rail, compared to 378,226 tons a year earlier. In 2022, Sunflower Oil was mainly exported through the ports of the Azov-Black Sea Basin (ASB) – their share accounted for 394,697 tons, or 47%. 120,601 tons (14%) of Sunflower Oil were exported through the Caspian region, and 156,916 tons (18%) were shipped to the Far East. But, in January – May 2023, the share of Sunflower Oil exports by rail through the Far East increased to 38%, and through the Caspian Sea – to 19% (101,524 tons).

According to the executive director of the Fat and Oil Union, Mikhail Maltsev, in 2022, Russia exported 3.7 million tons of Sunflower Oil by all types of transport. Thus, the railway accounted for 23% of exports. Even though the traditional channel for transporting Oils is water transport, the role of transportation by rail has increased in the current conditions, the expert added. During January – May 2023, 1.78 million tons of Sunflower Oil were exported – 11% more than during the same period in 2022. Thus, the railway already accounted for 30% of Sunflower Oil transportation.

“Rail transportation is the only way to send products to many countries in Central Asia, which account for a significant volume of our exports of bottled Oil, as well as when sending products to ports,” explains Marketing Director of Blago Group of Companies Kirill Melnikov. He points out that the volume of exports of vegetable Oils, in general, did not change and remained at the level of 96,000 tons. But there was a redistribution of shipments to the east.

The share of China in the company’s exports has increased: in the five months of 2022, the volume of supplies to this country amounted to 25,700 tons, and for the same period in 2023 – 62,000 tons. This increased the number of railway shipments to China: for the whole of 2021, 2040 containers were sent, for 2022 – 4090, and five months of 2023 – already 2785.

The leading importers of Russian Sunflower Oil this year were China, Turkey, and India. The share of these countries now amounts to 58% of total exports. From January to May 2023, China purchased 448,000 tons, Turkey – 321,000 tons, India – 272,000 tons of Oil.

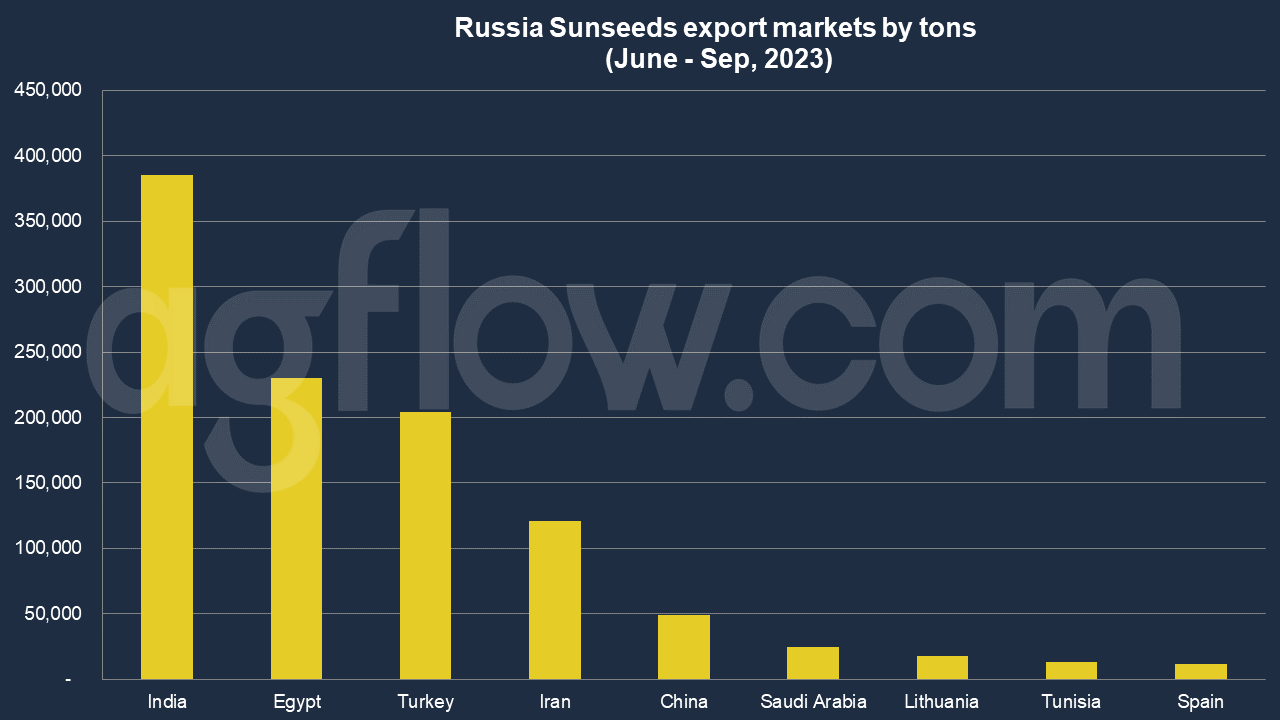

As per AgFlow data, Russia exported 0.38 million tons of Sunseeds to India in June – Sep 2023. The following markets were Egypt (0.23 million tons), Turkey (0.2 million tons), Iran (0.12 million tons), China (49,000 tons), Saudi Arabia (25,000 tons), Lithuania (18,000 tons) and Tunisia (13,072 tons). Total exports hit 2.4 million tons in Jan – Sep 2023.

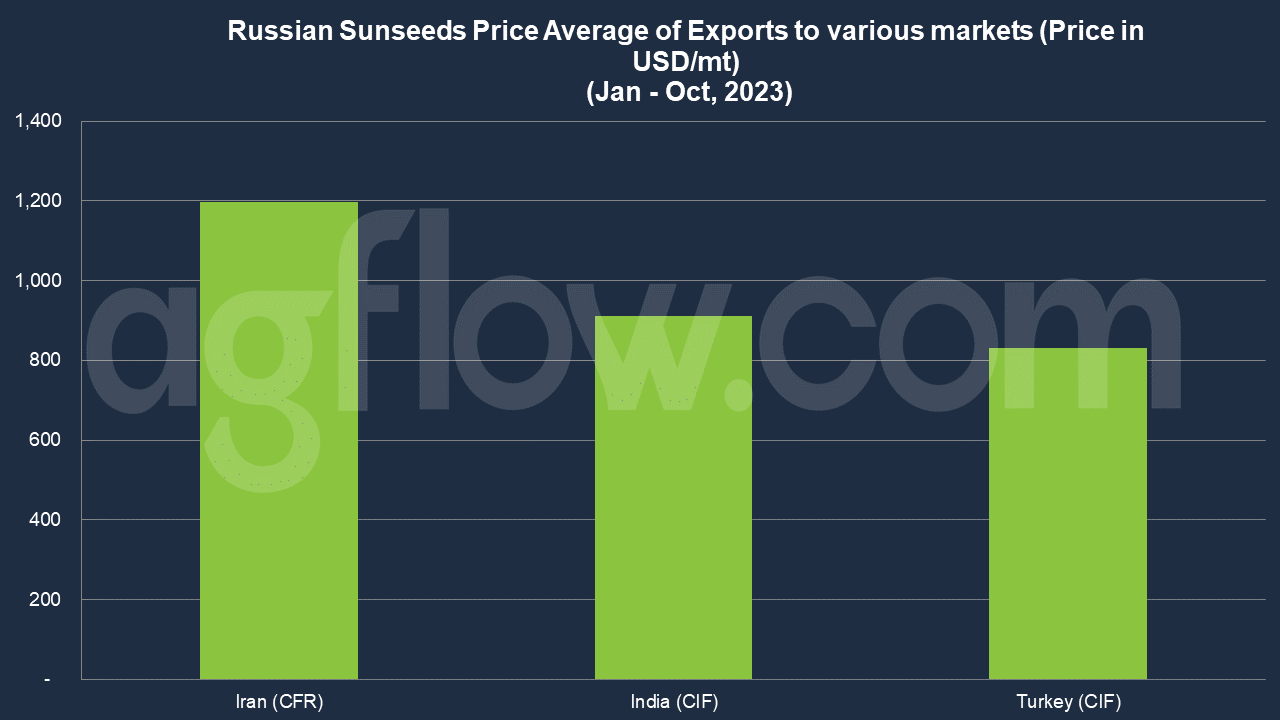

Russia offered CIF Price of $832 and $911 to Turkey and India, respectively, while it quoted CFR of $1,198 to Iran in Jan – Oct 2023. Russia’s CIF Price for India showed a little upward trend in May–August. After August, it has been falling.

Russian Market Leaders

The largest Sunflower Oil producers in Russia are Yug Rusi, GC Efko, and Aston. In September–October 2022, they provided 55% of export supplies. Director of the Export Potential Division of the Efko Group of Companies, Alexey Gavrilov, notes that the company’s Sunflower Oil exports are growing by about 20% yearly. The main export destinations, according to Gavrilov, are India, China, Egypt and Saudi Arabia.

Most of the Oil in the eastern direction went to the Eastern Stevedoring Company (VSK; part of Global Ports). Its share accounted for 159,653 tons, or 80% of shipments. Another 6%, or 11,749 tons of Oil, was sent to the Vladivostok Sea Commercial Port (VMTP; part of Fesco). Commercial Director of VMTP Elena Kazarina notes that the transshipment of Sunflower Oil in 2023 increased several times, mainly due to increased supplies to China and Vietnam.

The primary carrier of the product in the eastern direction was the Europack-Yug company – it transported 103,905 tons (52%) of Oil. Europack Commercial Director Sos Ghazaryan said that transportation of Sunflower Oil has increased. According to him, in 2023, Europack sent more than 80 trains with Sunflower Oil for export, while only 62 trains were sent for the entire last year.

Sunseeds Oil Redistribution

The growth in Sunflower Oil exports, in general, is due to an ample supply from Russia due to the record harvest. Moreover, domestic consumption of Sunflower Oil has not been growing for five years. The increase in Oil transportation volumes in the eastern direction relates to logistics barriers in the Azov-Black Sea Basin. Commonly, the growth in shipments by rail is associated with the revision of logistics routes and the redistribution of cargo.

Transit to China through Kazakhstan is virtually unavailable to suppliers from Russia due to high tariffs and lengthy downtime. The only workable alternative is sending products through the Far East by rail through Zabaikalsk or Far Eastern ports.

Changes in the geography of sales markets and sanctions have adjusted logistics. Until the end of the year, the trend for active rail transportation of Oil in the eastern direction will continue, with the development of the international North-South transport corridor.

Try AgFlow Free

Access Free On Updates for Corn, Wheat, Soybean,

Barley, and Sunflower Oil.

No Credit Card Required & Unlimited Access In Time