Poland Emerges in Belgium’s Corn Import Market

Talk to our team about AgFlow's offering →

Reading time: 2 minutes

When it comes to the agricultural commodity landscape, the dance between supply and demand takes center stage. In the first eight months of 2023, Belgium’s corn trade epitomizes this complex choreography. But what exactly governs this intricate relationship? What drives Belgium’s imports, and how does corn fit into the larger picture?

Is Belgium just an average player in the corn game?

Certainly not. With its strategic European location and advanced agricultural infrastructure, Belgium has historically been a noteworthy participant in the global corn market. But the dynamics of 2023 have placed it in a more prominent role. Now, let’s delve deeper into these dynamics, shall we?

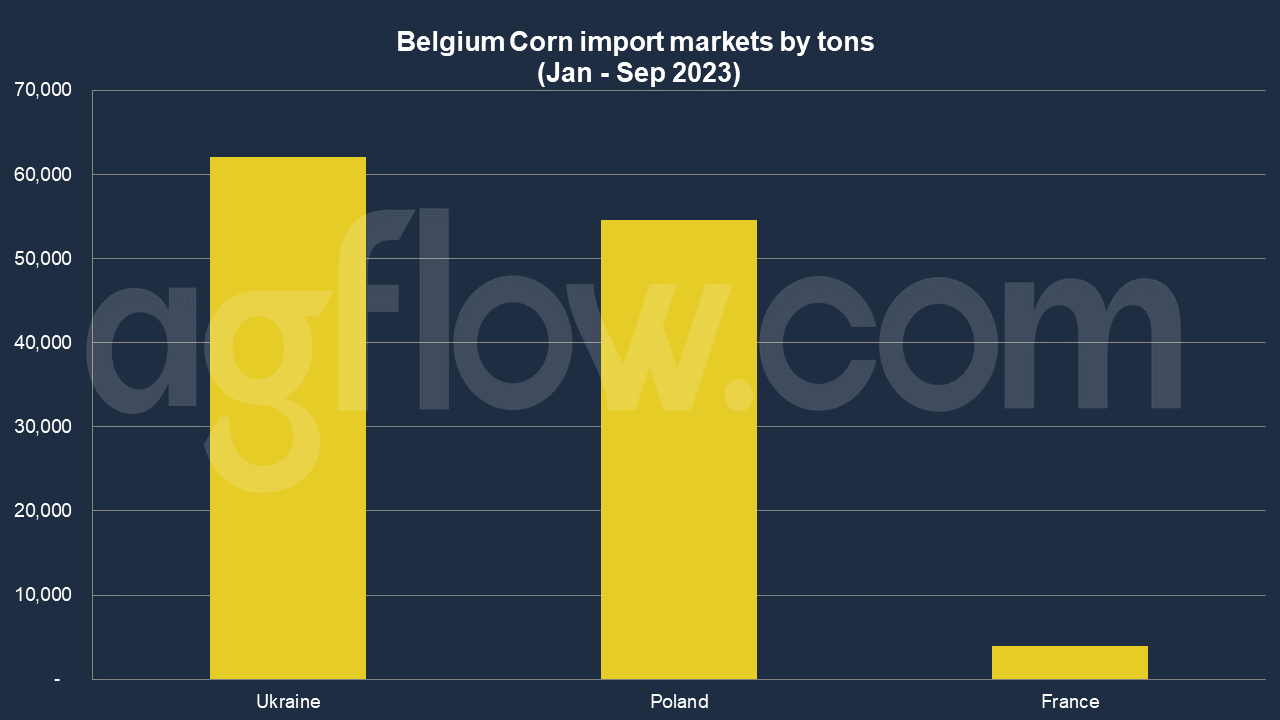

According to AgFlow data, Belgium imported 62,088 tons of Corn from Ukraine in Jan – Sep 2023, followed by Poland (54,602 tons) and France (4,000 tons). Total imports hit 0.12 million tons in Jan – Sep 2023. Average volume of shipment was 20,115 tons.

In 2021, Belgium imported Corn worth $471 million, becoming the 26th largest importer of Corn in the world. At the same year, Corn was the 187th most imported product in Belgium. Belgium imports Corn primarily from: France ($212 million), Ukraine ($133 million), Netherlands ($75.9 million), Romania ($14.5 million), and Germany ($9.8 million).

Balancing Act: Quality vs. Quantity

The tradeoff between quality and quantity is a primary factor that impacts Belgium’s corn imports. Is it better to import large amounts of average-quality corn or to bring in smaller quantities of premium-grade corn? This balance becomes especially significant considering the evolving preferences of consumers who are increasingly valuing quality over quantity.

Challenges of Trade Tariffs and International Relations

Trade is never just about products; it’s also intricately tied to geopolitics. The year 2023 has seen heightened tensions in some parts of the world, with nations leveraging tariffs as negotiation tools. How does this play into Belgium’s corn imports? The challenge lies in navigating these waters, ensuring that the corn’s quality or quantity doesn’t suffer due to political standoffs.

Climate Change: An Ever-Present Specter

Remember when corn yield predictions were relatively more straightforward? Climate change has altered that narrative. The reliability of consistent corn yields from traditional exporters has been questioned with unpredictable weather patterns. This creates a dilemma for Belgium: diversify the import sources or invest in more local cultivation.

Demand Dynamics: The Changing Palate

Beyond the obvious factors, there’s also the evolving palate of the Belgian populace. With a growing trend toward plant-based diets and sustainable consumption, corn is gaining prominence as a food staple and a key ingredient in many sustainable products.

So, what’s the bottom line for Belgium’s corn trade in 2023?

Navigating the corn trade waters requires Belgium to be agile and informed. It’s challenging balancing quality and quantity, considering geopolitical factors, accounting for climate change, and adjusting to shifting consumer demands. And while some might pose the rhetorical question, “Is it worth it?” With its rich trade history and adaptable nature, Belgium’s answer seems to be a resounding “Yes.”

In conclusion, as we reflect upon Belgium’s corn trade from January to August 2023, it’s evident that the journey is filled with challenges and tradeoffs. However, with its strategic acumen and adaptability, Belgium remains well-poised to not only navigate these challenges but also emerge as a global corn market leader. To professionals in the agricultural commodity industry, Belgium’s strategy might be a lesson in adaptability and foresight. To the general public, it’s a testament to the country’s resilience and dedication to ensuring the best for its populace.

Try AgFlow Free

Access Free On Updates for Corn, Wheat, Soybean,

Barley, and Sunflower Oil.

No Credit Card Required & Unlimited Access In Time