New Investments in Brazil to Boost Paraguayan Corn

Reading time: 2 minutes

Corn exports in MY 2022/2023 are forecast at 2.8 million tons in Paraguay, significantly lower than in the previous year but in line with historical averages for good crop years. Most exports are expected to be trucked to Brazil to supply poultry and pork producers. The remaining Corn will be exported primarily to other South American countries, with a few shipments outside the region. New investments in ethanol and meat packing plants in Brazil, very close to the border with Paraguay, are expected to increase local demand for Corn beginning in MY 2023/2024.

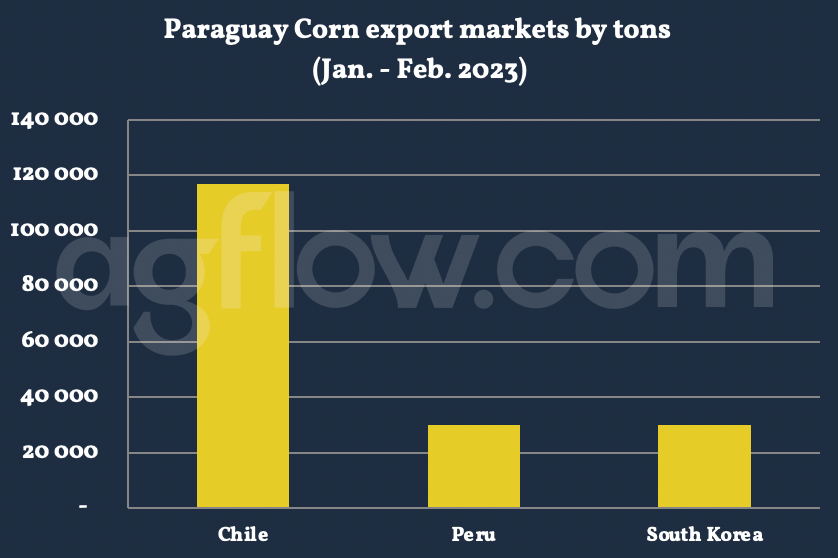

According to AgFlow data, Paraguay exported 0.11 million tons of Corn to Chile in Jan. & Feb. 2023, followed by Peru (30,000 tons) and South Korea (30,000 tons). The Corn exports in the calendar year 2021 totaled 1.9 million tons. The three leading exporters were a local distributor of agricultural inputs, followed by a Brazilian agrarian cooperative with a significant presence in Paraguay and a multinational grain trader.

In MY 2021/2022, Corn exports were forecast at a record 4.4 million tons due to an expected bumper crop. There are some discussions if Paraguay will be able to handle such a significant export of Corn. Still, a significantly smaller soybean crop (less than half its average volume) will make room at town elevators, trucking companies, port facilities, and barges. A major limiting factor is the capacity of Brazilian customs to process a volume of incoming trucks. Although the Production, Supply, and Distribution table does not take into account the broken Corn trade (HTS 110423), Paraguay imported 116,000 MT of damaged Corn from Argentina in the second half of 2021, and this was primarily used by the bioethanol industry.

The impact of Argentine broken Corn has also been felt on the export side as it has displaced some Paraguayan Corn exports to Uruguay. Corn consumption for MY 2022/2023 is forecast at 1.9 MMT, unchanged from the previous year. The leading consuming sector by far is the domestic bioethanol industry which consumes roughly 1 million tons of Corn annually. The sector also utilizes some sugarcane during 2-3 months a year. The consumption of the livestock sector is expected to remain relatively stable. Corn use in 2020 and 2021 was intense as severe droughts forced cattlemen to use more feed alternatives to the shared pastures, which were less productive.

The poultry and dairy sectors face high input prices, mainly feed, and intense competition for products from neighboring countries with lower retail prices. The feedlot sector is growing, but Paraguay’s cattle herd has been diminishing over the past few years. Local brokers and industry contacts indicate that beginning stocks in MY 2020/2021 and MY 2021/2022 ranged between 50,000-150,000 MT, significantly lower than those shown by USDA, which represents the production of about half of an average crop. Ending stocks in MY 2021/2022 could be higher due to an expected record-high yield, but it will depend primarily on the volume of exports and how efficiently the logistics work out. Stocks are usually kept by cooperatives and elevators.

Corn Yield in Paraguay

During the zafrinha crop, farmers plant significantly more Corn, usually planting in fields recently harvested from soybeans. Zafrinha Corn production has grown in popularity, partially as farmers have begun to take into account the long-term negative consequences of increasing two soybean crops in a single year and see the benefits of crop rotation between Corn and soybeans. Average yields in the zafrinha crop are highly variable and dependent on the weather, which can easily and rapidly change the condition of the crop. Generally, farmers expect yields to range between 5-6 tons per hectare.

Other sources: USDA

Try AgFlow Free

Access Free On Updates for Corn, Wheat, Soybean,

Barley, and Sunflower Oil.

No Credit Card Required & Unlimited Access In Time