Myanmar Progresses on Chinese Corn Market

Reading time: 2 minutes

In 2023/2024, global Corn production is forecast up on the increase for Ukraine and Zambia. Global trade is forecast to rise as increases for Ukraine and Brazil more than offset weaker exports from Argentina. International imports are forecast to increase on more robust demand from the European Union. The U.S. season-average farm price remains unchanged at $4.80 per bushel.

In the current season, global Corn production is forecast upwards as higher crops for Brazil, India, and South Africa more than offset reductions for Argentina and Mexico. International trade is forecast to go up modestly, with higher exports for Ukraine, the European Union, and South Africa more than offsetting reductions in exports from Argentina and the United States. Global imports are down marginally, with reduced imports from the United States. The U.S. season-average farm price is unchanged at $6.60 per bushel.

Since the May WASDE, U.S., and Brazilian bids were up, while bids for Argentina and Ukraine declined slightly. U.S. bids were up $3/ton to $272, little changed from last month, though prices have risen recently in response to dry conditions in the western and central Corn belts. Brazilian bids were up $5/ton to $245 on robust demand for the upcoming record harvest. Argentine bids were $241/ton, down $11 from last month.

Expectations of ample supplies in Brazil are pressuring Argentina suppliers to offer cheaper quotes to remain competitive despite tight supplies. Ukrainian bids were $215/ton, down $10. Uncertainty surrounding new export restrictions in the EU, escalation of the war, and the future of the Black Sea Grain Initiative (BSGI) has maintained the discount for Ukrainian Corn relative to other origins.

Since the start of 2023, South Africa has exported more than 100,000 tons of Corn to China, the most significant amount from Africa’s leading Corn producer since the signing of an export protocol in 2014. Ample exportable supplies in South Africa and a continued decline in the South African Rand (ZAR) have timed well with sustained demand in China.

Overall production of Corn in 2022/23 is expected to reach 17.0 million tons, of which South Africa is forecast to export 3.7 million tons. While a slight fall from the record reached in 2021/22, this increase in output has placed downward pressure on South African Corn export prices, allowing the country to become price competitive in the global Corn market.

This abundance of supplies has been matched by a steady decline in the value of the rand to the dollar. The rand has fallen more than 15 percent since the start of 2023. Official trade data indicates that the unit value for a 50,000-ton shipment of yellow Corn in March was just $318/ton. In the same month, China Customs data showed that unit values for Brazil and Ukraine Corn were more than $30/ton higher.

China Seeks New Corn Suppliers

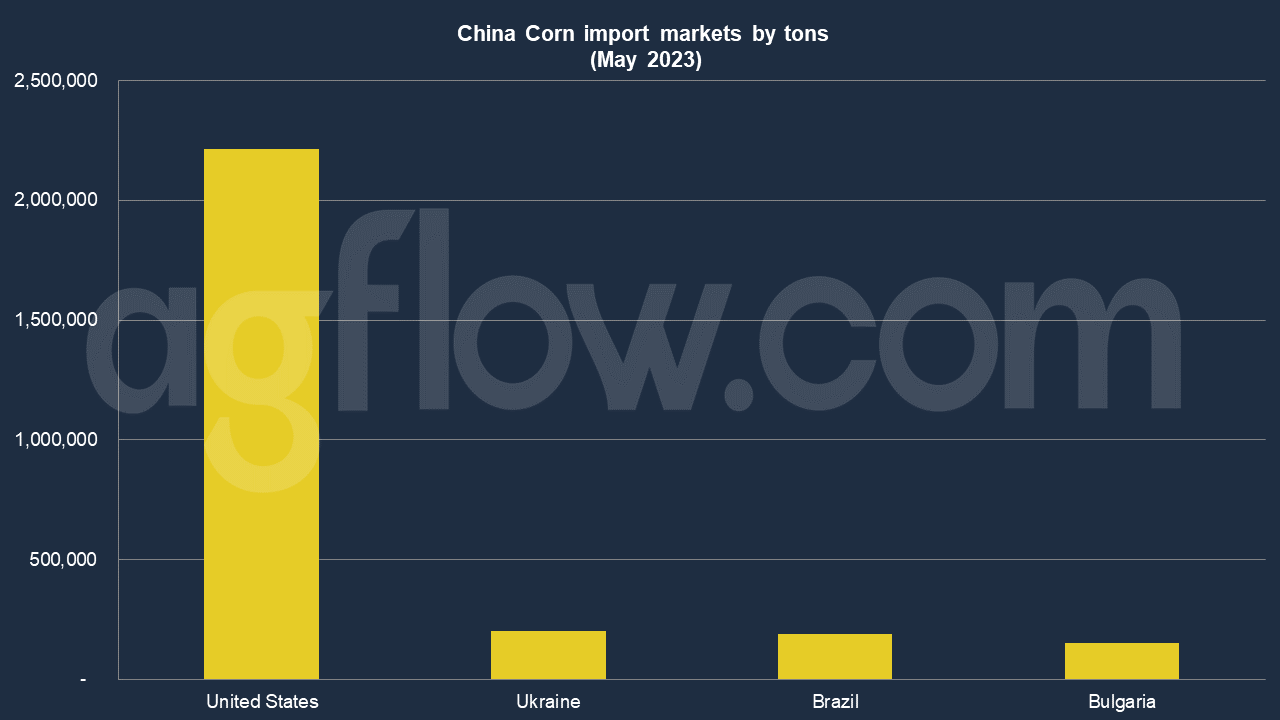

According to the AgFlow data, China imported 9.2 million tons of Corn in Jan-May 2023. Key suppliers were the United States (2.2 million tons), Ukraine (0.2 million tons), and Brazil (0.18 million tons). Relative to the size of China’s demand, recent purchases of a little more than 100,000 tons of yellow Corn are small. However, China is actively seeking to add new suppliers of Corn in part due to the ongoing war in Ukraine and uncompetitive prices out of its chief supplier, the United States.

Burma, an exporter of comparable size to South Africa, received phytosanitary permissions from China on February 18, 2022, enabling cross-border Corn trade to begin. The first shipment recorded in 2022 was only 16,000 tons. However, marketing year-to-date China Customs data reports Corn imports from Burma of more than 300,000 tons – a volume higher than its previous three years of exports without the phytosanitary protocol combined. South Africa could similarly benefit from renewed interest in this partnership.

Other sources: USDA

Try AgFlow Free

Access Free On Updates for Corn, Wheat, Soybean,

Barley, and Sunflower Oil.

No Credit Card Required & Unlimited Access In Time