Malaysia Chooses Turkish Wheat

Reading time: 2 minute

Malaysia does not produce Wheat due to the hot tropical climate. The country is a price-sensitive market, so any increase in the price of Wheat will have a negative impact on consumption. Wheat flour alternatives such as cassava, lentil, and pea flour may be in demand instead. It is not clear whether the Malaysian Government will extend any subsidy to millers to stabilize flour prices.

The USDA forecasts that the total Wheat consumption in MY 2022/23 will increase slightly compared to the previous year, from 1.63 million tons to 1.65 million tons, assuming that Wheat prices will stabilize. The slight increase in consumption is in line with population growth and the return of tourism to Malaysia. The Malaysian government controls the price of general all-purpose flour sold in 1-kilogram (kg) bags at RM1.35 (roughly $0.34) per kilogram. This is an effort to control inflation, as flour is the main ingredient in roti-canai, a Malaysian staple breakfast food. For high-quality specialty flours, the price is market-based.

Some manufacturers have stopped producing subsidized Wheat flour due to increased production costs, said Community Development and People’s Wellbeing Minister Datuk Shahelmey Yahya. The majority consumption of Wheat flour in the market is the unsubsidized type. The subsidized multi-purpose Wheat flour is sold at RM1.35 each. However, most that are being sold in the market at RM3.83 each is unsubsidized Wheat flour.

Malaysian Wheat Trade

The USDA estimated MY 2021/22 Wheat imports to drop to 1.78 million tons as the Ukraine crisis disrupted supply and caused prices to increase to historical highs. As Malaysia is a sensitive to global Wheat price volatility, any changes in commodity prices, such as Wheat, will impact imports.

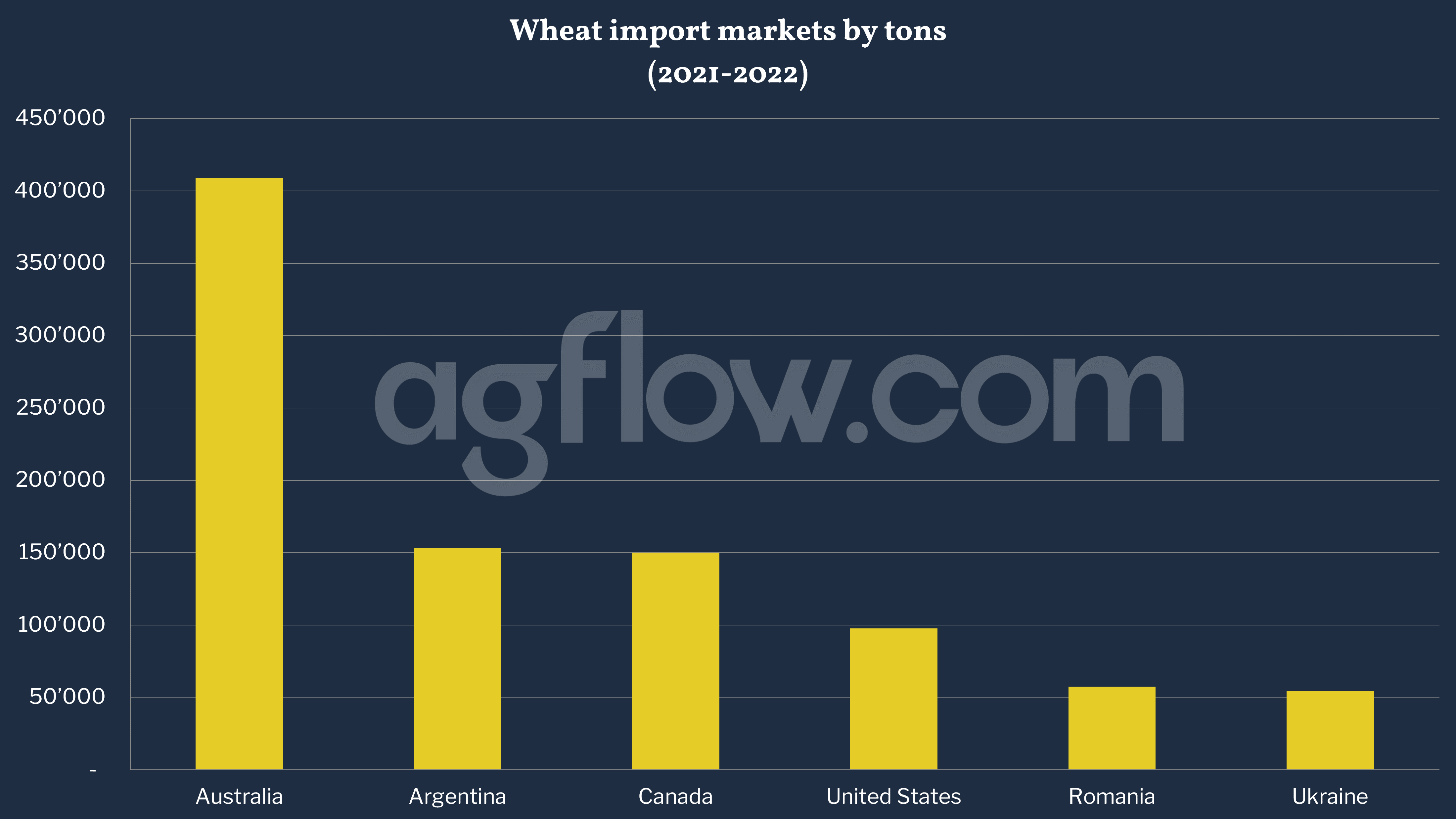

In MY 2022/23, total Wheat imports are forecast at 1.82 million tons. The slight increase in imports is based on the expectation that consumption will rebound slowly, with Wheat prices stabilizing. Australia remains the biggest Wheat exporter to Malaysia, holding roughly half of the market share, followed by the United States and Canada. Imports of Australian Wheat increased in MY2020/21 and were expected to be strong in MY2021/22. Based on the latest trade figures from Trade Date Monitor, Australian Wheat exports from July 2021 to December 2021 were over 410,000 tons, an increase of 92 percent from July 2020 to December 2020.

According to AgFlow data, Australia led the Malaysian Wheat import market with 0.4 million tons in 2021 – 2022, followed by Argentina (0.15 million tons), Canada (0.15 million tons), and the United States (0.1 million tons). In 2020, Malaysia imported Wheat worth $333 million, becoming the 38th largest Wheat importer in the world. In the same year, Wheat was Malaysia’s 109th most imported product. Malaysian import markets were Australia ($118 million), the United States ($74.3 million), Ukraine ($72.3 million), Canada ($38.4 million), and Argentina ($14 million).

The same year, Malaysia exported Wheat worth $2.15 million, making it the 56th largest Wheat exporter in the world. Malaysian Wheat exports are relatively low and primarily to neighboring countries such as Singapore, Thailand, and Brunei. In terms of value, the leading destination of from Malaysian Wheat export markets were Sri Lanka ($1.04 million), Singapore ($966k), Philippines ($94.1k), Thailand ($40.8k), and Brunei ($15.9k). The USDA lowered the MY 2021/22 export figure to 100,000 tons due to shorter supplies.

Malaysia plans to import Wheat from Turkey to diversify its food sources amid the worldwide battle with soaring prices and supply bottlenecks. The issue was discussed during Malaysian Prime Minister Ismail Sabri Yaakob’s four-day trip to Turkey in July.

Other sources: https://www.dailysabah.com/

Free & Unlimited Access In Time