Japan Buys Large Volumes of RBD Palm Olein from Malaysia

Talk to our team about AgFlow's offering →

Reading time: 2 minutes

In a world where globalization and interconnectivity define trade dynamics, few commodities illustrate the intricacies of this nexus as emphatically as vegetable oils. Understanding the nuances of the vegetable oils trade becomes imperative for a nation like Japan, where self-sufficiency in food production has historically been a challenge. So, what key factors have impacted Japan’s vegetable oils trade and imports from January to August 2023?

Japan’s Dependence on Vegetable Oils

Firstly, one must recognize Japan’s intrinsic dependency on imports to meet its vegetable oil demand. Given its limited arable land and unique geography, the island nation has always looked outward to satisfy its consumption requirements. But why vegetable oils, you may ask? From cooking to manufacturing, vegetable oils have a multitude of applications in everyday Japanese life.

Global Supply Chain Dynamics

In 2023, the global supply chain of vegetable oils saw unprecedented disruptions. Climate change, for instance, affected the output of palm oil in Southeast Asia and sunflower oil in Europe. Can you imagine the ripple effect? Countries heavily dependent on imports, like Japan, felt these shocks profoundly. It’s akin to a pendulum: a swing on one side sends waves all the way to the other.

Balancing Costs with Environmental Concerns

A poignant challenge Japan faces is the trade-off between cost and sustainability. Palm oil, for instance, is cost-effective but poses severe environmental concerns, especially with the ongoing deforestation in Indonesia and Malaysia. On the other hand, oils like olive and flaxseed might be environmentally friendly but come with a higher price tag. It’s a balancing act, isn’t it? How does a nation prioritize between its economic constraints and global environmental responsibility?

Diversifying Import Sources

Given the unforeseeable challenges, Japan has proactively tried diversifying its vegetable oil sources. Instead of putting all their eggs (or should we say oils?) in one basket, they have looked at emerging markets in Africa and South America. Think of it as hedging bets in the volatile world of commodities.

Trade Agreements and Tariffs

Furthermore, Japan’s trade agreements in 2023 played a significant role. The nation has always been astute in leveraging its geopolitical position, and by fostering agreements with oil-rich nations, Japan ensures a steady supply even during global shortages.

In 2021, Japan imported Palm Oil worth $636 million, becoming the 19th largest importer of Palm Oil in the world. At the same year, Palm Oil was the 192nd most imported product in Japan. Japan imports Palm Oil primarily from: Malaysia ($415 million), Indonesia ($221 million), Colombia ($467k), the United States ($4.62k), and Singapore ($2.9k).

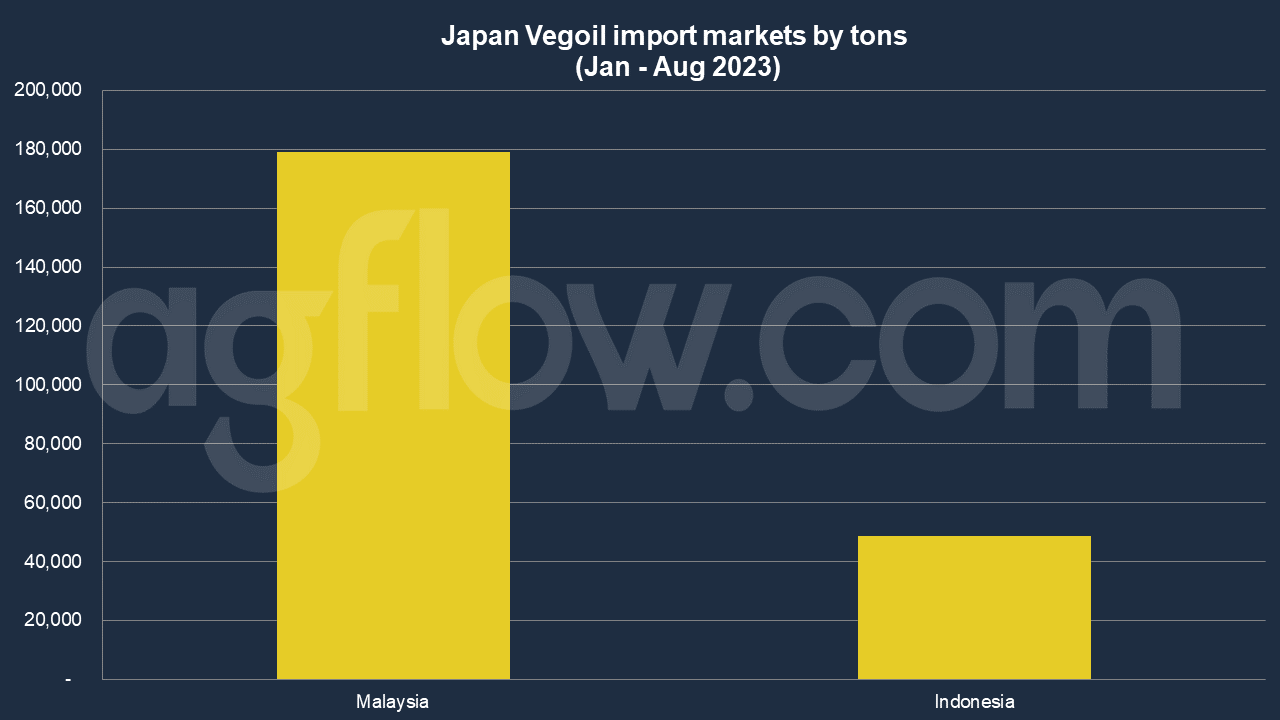

According to AgFlow data, Japan imported 0.18 million tons of VegOil from Malaysia in Jan – Aug 2023, followed by Indonesia (48,720 tons). Total imports hit 0.22 million tons in Jan – Aug 2023. Japan was purchasing large volumes of RBD Palm Olein from Malaysia, such as 25,770 tons and 23,130 tons. Average shipment volume was 2,812 tons.

Domestic Push for Alternative Oils

There’s been a notable push towards alternative vegetable oils on the domestic front. With health and wellness becoming a central theme, oils like avocado and grapeseed have seen a surge in popularity. But can these oils replace the staples? Only time will tell.

Challenges Ahead

So, as we steer through the tumultuous waters of global trade in 2023, Japan’s vegetable oil imports present a case study in adaptability, foresight, and resilience. Yet, challenges abound. How will Japan continue to ensure a steady supply amidst global disruptions? Can it balance its economic needs with environmental responsibilities? And how will domestic preferences evolve?

In conclusion, Japan’s vegetable oil trade and imports in 2023 serve as a testament to the nation’s ability to navigate global complexities. It’s a dance of supply, demand, geopolitics, and environmental responsibility. And as we’ve seen, in the ever-evolving landscape of global trade, staying on one’s toes is not just commendable, it’s essential. Understanding these nuances will be crucial in the coming years for professionals in the agricultural commodity industry. All eyes remain on Japan, a microcosm of global trade dynamics.

Try AgFlow Free

Access Free On Updates for Corn, Wheat, Soybean,

Barley, and Sunflower Oil.

No Credit Card Required & Unlimited Access In Time