Is Soybean the Winner of the 2022 Vegoils Crisis?

Reading time: 6 minutes

Since Q1 2022, the Vegoils market has been shaken up by the loss of Ukraine Sunseed Oil supply in Feb adding to the other disruptions the market faced in 21/22. With the early harvest of the Brazil Soybean Crop, global demand surged in Q1 22 to crush domestically. For these markets only, Q1 Brazil Soybean exports increased 149.5% YoY (+1.1 Mmt). The need for Soybean Oil is one of the main drivers of Soybean exports. The USDA raised Soybeans exports by 650 kmt for the future US crop, reducing global Soybean ending stocks by as much. With this much pressure on the Soybean complex, how is the market pricing the Oilseed?

Read also: How Biofuels & Weather Are Going to Impact Your Vegoils Trades In 2022

Figure: Top 10 Soybean (Oilseed) Growing Markets in Q1 2022 v. 2021

Track Soybean Oilseed Cargos From the US & Brazil to 74 Destinations

Free & Unlimited Access In Time

Read also: Year of the Tiger: Is China Going to Pounce on Soybean, Corn & Barley in 2022?

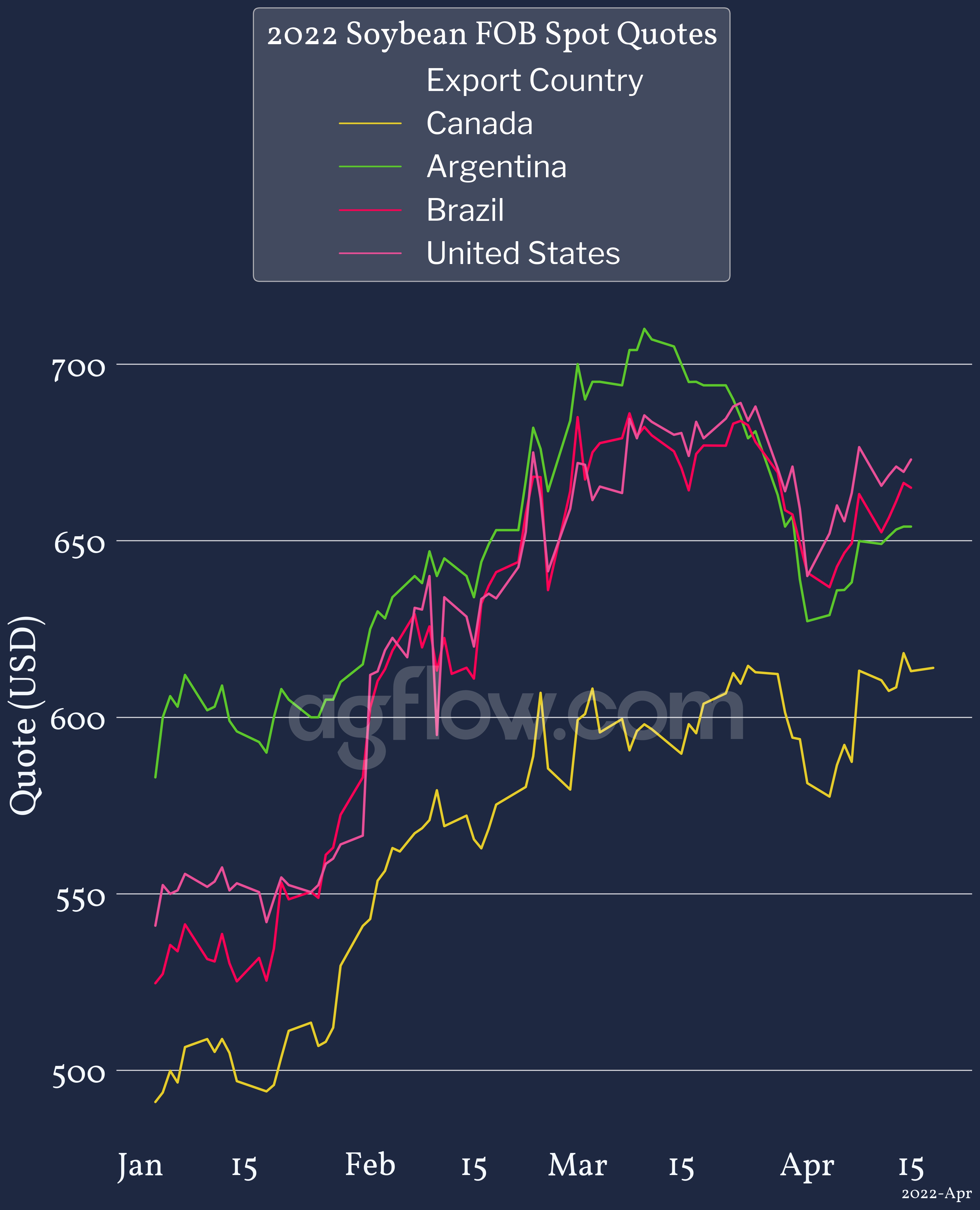

Since the start of 2022, Soybean cash prices have hiked up due to the pressure on Vegoils. Additionally, the conflict in Ukraine has further increased this pressure. From Feb 25 to Apr 15, Spot prices increased between 4.5 to 4.9%, & past the 650$/mt bar except for Canada. Argentina is the only origin whose prices decreased since then (-1.5%) due to them banning exports on Mar 13, thus curbing domestic inflation & price surges. As Soybean prices increased ~$116 on average since the beginning of 2022, domestic crush margins are thinning down. Did this advantage Soybean Oil exports?

Figure 2: 2022 Soybean (Oilseed) FOB Spot Cash Quotes

Access +19K Monthly Soybean Complex Cash Quotes From Brazil, the US, and Up to 23 Other Origins

Free & Unlimited Access In Time

Read also: Is the New 2022 Brazil Soybean Crop Going to Affect Your Trades?

Since the beginning of 2022, countries that depended on Vegoils other than Soyoil faced supply issues. From Mar to Apr 22, India (representing more than half of Soyoil imports) increased its Soybean Oil imports by 39.6% YoY as Indonesia Palm Oil availability was heavily disrupted by inflating prices and low supply. Conversely, Iraq & Bangladesh rely on Soymeal and domestic crush, and reduced imports by 52% and 38% YoY respectively, over the same period. Despite the mixed demand, Brazil exported 116 kmt (+1157% YoY) of Soybean Oil in Q1 2022.

Figure 3: Soybean Oil Imports by Country Between Mar & Apr 2022

Track Soybean Oil Cargos to India, Iran, & Up to 54 Other Destinations

Free & Unlimited Access In Time

Read also: What Should You Expect From The US Soybean Crop in 2021/22?

In a Nutshell

Since the beginning of 2022, the Vegoils market has been shaken up by low Rapeseed production in Canada, lingering Palm Oil production issues, and ramping inflation. Additionally, at the end of February, the conflict in Ukraine prevented further exports of Sunseed products which contributed to pressuring the Vegoils market even more.

Therefore, Soybean Oil and Rapeseed Oil (which remained available with low global supply) saw greater demand. Thanks to a fast and early planting pace, Brazil was able to sell its Soybean crop early in Q1 2022, despite losing some of its Soybean crop due to droughts and high temperatures induced by a long-lasting La Niña. The resulting Supply and Demand led to surging Soybean prices and thinning crush margins. As a result, the lack of Rapeseed, Sunseed, & Palm Oil supply led countries like India —the world’s largest Vegoils importer— and Iraq to substitute for Soybean Oil imports in March 2022. However, importers that mainly rely on Soybean Meal were deterred by the extremely high prices and reduced Soybean Oil imports.

All in all, Soybean Oil is currently profiting from the lack of Vegoils supply, and exports gained traction in Q1 2022. Brazil significantly benefitted from this demand as it helped balance sluggish Soybean exports due to China reducing its pork production. However, India is expected to import fewer Vegoils in the second half of 2022 as it plans to greatly increase Rapeseed Oil production, and Malaysia Palm Oil production is expected to ramp up as it enters its seasonal peak. Hence, Soybean Oil will not retain its favorable position in 2022 and is not a clear winner of this 2022 Vegoils crisis.

Read also: Feed – China: Hog Farmers Struggle With Prices Swing, And It Will Probably Last