Is India on the Path to Become a Top-Tier Wheat Origin?

Reading time: 6 minutes

Until now, Indian Wheat hasn’t been known as one of the leading or consistent Indian exports. However, Indian Wheat registered a record forecasted output and yield for the fifth consecutive year. Moreover, the ongoing harvest seems to progress according to predictions, and Indian Wheat is heading towards yet another exceptional year. As a result, India kept the same Wheat export volume into the 2021 marketing year, reaching 2 Mmt. Indian Wheat also benefits from a marketing season that starts before other Wheat-producing countries like the United States or Russia, as India is the only country harvesting at this time of the year. With the US Spring Wheat production still in limbo and as Russian Wheat is having a difficult season, India has a real shot at reaching the rank of a top-tier Wheat origin.

Read also: Chinese Wheat Market since 2019, and the acceleration of imports in 2021

Competitive Prices and Improving Wheat Quality

With this year’s exceptional outlook, Indian Wheat spot cash prices decline. However, the price competitiveness can only be understood in light of other well-known origins.

Figure 1: Spot Wheat Prices – India, Russia, U.S. – Jan – April 2021

The Wheat price comparison between India, Russia, and the U.S. in Figure 1 – based on AgFlow data – shows that, bar the erratic movement of Russian Wheat prices in the recent past, Indian Wheat prices are competitive with U.S. origin Wheat. This is also thanks to a few factors:

- The Indian government has been subsidizing Wheat prices for the past two years

- Russian Wheat faced difficult weather conditions, and Russia had to review and decrease its exports for the 2021/2022 marketing year

- Russia recently put in place a grains tax increase

Consequently, they enhanced the competitiveness of Indian Wheat.

However, this raises the question of the Indian Wheat quality. Though the prices appear to be competitive with Russia or the U.S., the usage of Indian Wheat depends on the quality of the grains, and thus the pricing is not similar between Feed Wheat and Wheat quality fit for human consumption.

Indian Wheat products are predominantly destined for human consumption. In recent years a great effort has been made to increase the yield and the quality of crops, and favorable rains during critical periods also ensured the overall quality of crops. Moreover, a national program dedicated to developing new varieties more suitable for the climatic conditions and climate changes, with better yield and raise hope for Indian Wheat quality in the future.

Read also: Evolution of Wheat Prices on cash markets by protein levels in Germany since 2018

Keep Tabs On the Indian Wheat

Cash Market with AgFlow

Including 117 new freight rate indications from India daily to calculate best execution

Free & Unlimited Access In Time

Indian Wheat Export Volumes Too Low to Compete with the U.S. & Russia

India is an erratic country when it comes to exporting Wheat, and its export policy until now relied solely on the current marketing year’s yield. Nonetheless, in addition to increasing its Wheat production in the last five years, India has also increased its exports.

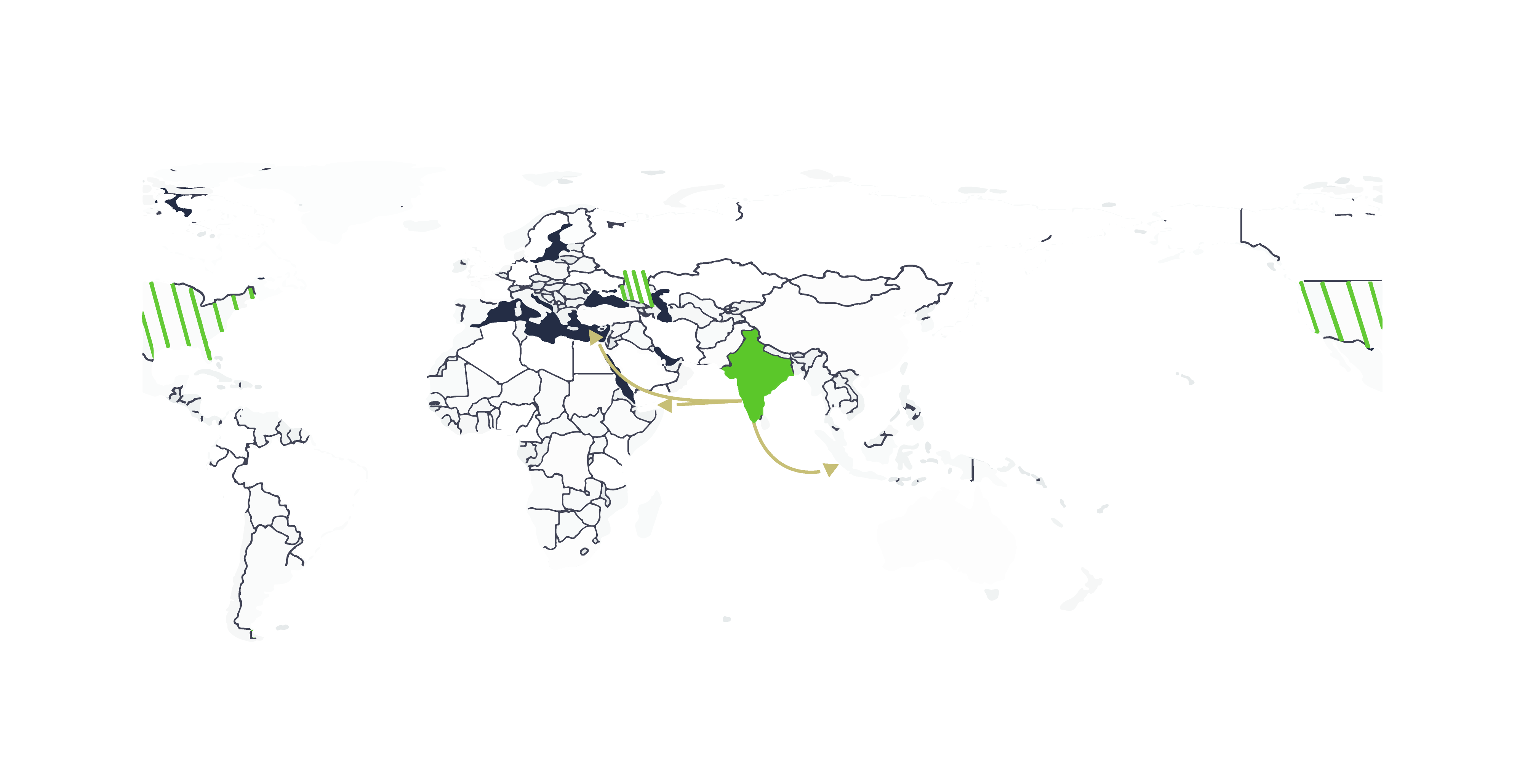

Figure 2: India-Centric World Map

India has a unique strategic location, as it is actually geographically located between the U.S and Russian main export centers. On top of that:

- It is close to South-East Asian countries like Indonesia

- Even closer to the Arabic peninsula and East African countries

The Suez canal provides strategic proximity to the Mediterranean Sea and the Maghreb.

Read also: Black Sea wheat prices sharply down on weak demand and good weather

Figure 3: Distribution of Indian Wheat Import Countries Between Dec 2020 & Apr 2021

Based on AgFlow’s trade flows data (though it is limited for these trade flows particularly), there are two major export pipelines:

- The Arabic Peninsula with Djibouti and the UAE

- Neighboring countries in the Indian subcontinent with Bangladesh and Sri Lanka

India is then a looming threat to East-Asian imports of U.S. Wheat or Russian exports with Egypt.

Consequently, India’s strategic geographical position could represent an alternative to both U.S. or Russian Wheat up to only 2 Mmt for 2021. Beyond that point, India can’t compete with Russia or the U.S. in raw export volume.

Read also: How is the 2021 USDA’s Planting Intentions Report Affecting the Current US Wheat Carryout?

Keep Tabs On the Indian Wheat

Cash Market with AgFlow

Including 117 new freight rate indications from India daily to calculate best execution

Free & Unlimited Access In Time

A Prime Source of High-Quality Wheat But Not A Major Player…Yet?

Indian Wheat improved significantly over the past few years in terms of quality. Moreover, Indian Wheat prices are more competitive than U.S. Wheat prices thanks to Indian government subsidies and an uncertain U.S. Spring Wheat season.

On top of that, the Russian Wheat market is hindered by both a challenging season and an increased export tax, which helps Indian Wheat’s price competitiveness.

India Wheat also benefits from its strategic geographical location compared to Russia or the U.S. and thus has a route advantage to Southeast Asia, to the Arabic Peninsula, and naturally to the whole Indian subcontinent.

Nonetheless, India’s Wheat export volume doesn’t compete with the United States and Russia and, as a result, cannot claim the title of top-tier Wheat origin just yet. Nevertheless, with the ongoing research to improve Wheat strain growing conditions (and thus the yield and the quality of crops), India could become a top-tier Wheat producer and exporter. But with the second most populated country, India would need to increase the acreage of Wheat crops in order to increase export volumes, and it hasn’t done so in the past 20 years, with an acreage remaining between 29 and 31 million hectares.

Read also: Black Sea wheat moved lower again but global benchmarks are on

the rise

Read also: Evolution of French Wheat Prices, a Breakdown by Protein Level

Read also: Russia: share of wheat in poor condition has fallen unprecedentedly