Ireland Corn Imports: Brazil Vs Canada

Talk to our team about AgFlow's offering →

Reading time: 2 minutes

Ireland, an emerald isle known for its rolling landscapes and deep-rooted cultural traditions, is also a vital player in the world of agricultural commodities. As of 2023, Ireland’s corn trade and imports have witnessed significant shifts shaped by domestic and global influences. But what key elements have impacted the corn market from January to August 2023? And more importantly, how does Ireland navigate the trade-offs inherent in these dynamics?

Let’s dive in.

Ireland and Corn: A Historical Perspective

Corn, not native to Ireland, has gradually woven itself into the fabric of Irish agriculture. Historically, Ireland has leaned heavily on imports to satisfy its corn demand. This need for corn arises from its diverse applications in food processing, animal feed, and even as an energy source in recent times. Corn is grown commercially in Ireland for silage production and a lot of the crop is direct drilled through a strip of biodegradable clear plastic.

The Balancing Act: Trade-offs in the Corn Market

A dynamic interplay of factors has shaped Ireland’s corn imports this year:

• Domestic Production vs. Imports: While Ireland has made strides in cultivating corn, the yield often doesn’t match the nation’s demand. Should Ireland invest more in domestic production, potentially sacrificing other crops or land uses? Or should it rely on imports, with its inherent vulnerabilities?

• Sustainability vs. Economic Viability: With the world moving towards sustainable practices, there’s pressure on Ireland to import eco-friendly corn. But sustainable corn often comes with a higher price tag. Is the extra cost justifiable in the long run?

• Quality vs. Quantity: Higher-quality corn, often GMO-free or organic, tends to be pricier. Given the massive demand, should Ireland lean towards quantity over quality or pay a premium for better corn?

These aren’t easy questions. The answers lie in understanding the broader challenges associated with the corn trade.

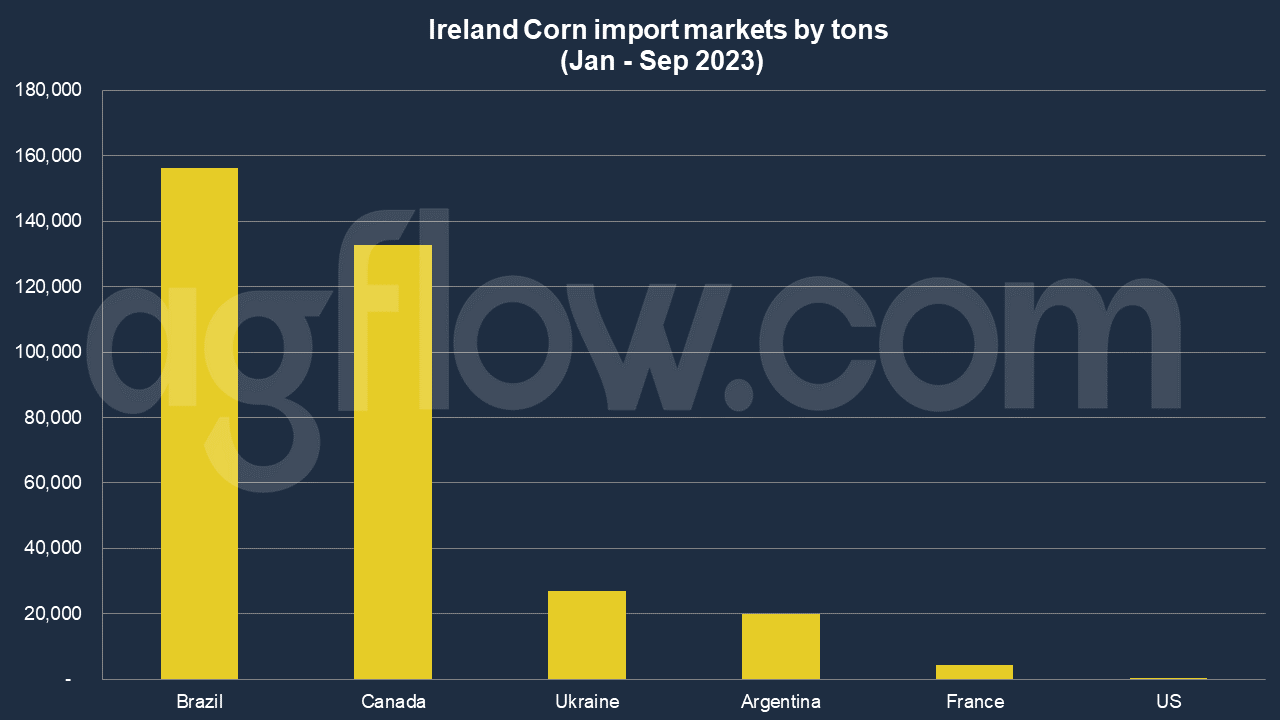

According to AgFlow data, Ireland imported 0.15 million tons of Corn from Brazil in Jan – Sep 2023, followed by Canada (0.13 million tons), Ukraine (27,000 tons), Argentina (20,000 tons), France (4,400 tons), and the US (264 tons). Total imports hit 0.34 million tons in Jan – Sep 2023. Average volume of shipments was 26,191 tons. Ireland was purchasing large amounts of Corn from Brazil and Canada, such as 93,000 tons, and 46,000 tons, respectively.

Challenges on the Horizon

- Global Market Volatility: Like any other commodity, corn prices are affected by global events. From weather anomalies affecting production in corn-heavy regions to geopolitical tensions, the unpredictability can wreak havoc on Ireland’s corn imports.

- Local Policies and Regulations: Ireland’s stance on GMOs, pesticides, and other agricultural norms can significantly impact which corn gets imported and at what cost.

- Supply Chain Bottlenecks: The global supply chain disruptions, as witnessed in previous years, can influence the timely availability of corn, affecting both prices and demand.

- Consumer Preferences: As the world grows more health-conscious, organic or non-GMO corn demand is rising. Catering to this niche while balancing the larger demand remains a challenge.

The Corn Conundrum: A Rhetorical Exploration

Imagine corn as a chess piece in Ireland’s vast agricultural game. Every move and every strategy has far-reaching consequences. Does Ireland take the aggressive approach, bolstering domestic production and possibly reducing its import dependency? Or does it play defensively, hedging its bets on international markets and diversifying its suppliers?

At its core, the corn trade is a dance of economics, sustainability, and consumer preferences. As Ireland navigates this intricate waltz, one can’t help but wonder: will Ireland’s corn strategy set a precedent for other nations? Or will it learn from the successes and failures of its peers?

In Conclusion

Ireland’s corn trade and imports in 2023 are more than just numbers and figures. They represent the challenges and opportunities of a nation adapting to global shifts. For professionals in the agricultural commodity industry, understanding these nuances is paramount. For the general audience, it’s a glimpse into the intricate web of global trade that touches our everyday lives. As the year unfolds, it’ll be fascinating to see how Ireland’s corn story evolves, offering lessons and insights for the world at large.

Try AgFlow Free

Access Free On Updates for Corn, Wheat, Soybean,

Barley, and Sunflower Oil.

No Credit Card Required & Unlimited Access In Time