Indonesia Suspends 2/3 of Palm Oil Exports

Reading time: 2 minutes

The Government of Indonesia (GOI) suspended two-thirds of Indonesia’s palm oil export permits to secure sufficient domestic cooking oil supplies ahead of Ramadan and Eid festivities. On February 6, 2023, Luhut Pandjaitan, Coordinating Minister for Maritime and Investment Affairs, announced that 66 percent of palm oil export permits (i.e., export permits already issued to companies that complied with the GOI’s Domestic Market Obligation policy) will be suspended immediately until May 1, 2023.

The GOI’s decision to suspend two-thirds of palm oil exports was made in response to rising cooking oil prices. In addition to rising prices, consumers in several regions of Indonesia reported difficulty finding subsidized cooking oil, even after the Ministry of Trade imposed a 5-kg per person purchase limit. The average price of subsidized cooking oil increased 7 percent from IDR14,019 ($0.93) per liter in December 2022 to IDR15,047 ($0.99) per liter. In early February 2023, the GOI targeted increasing domestic cooking oil supplies by 50 percent to 450,000 MT a month over the next three months. Exporters may still ship the remaining 34 percent of authorized palm oil exports, while the suspension of the 66 percent may be lifted in early May 2023, pending a GOI review.

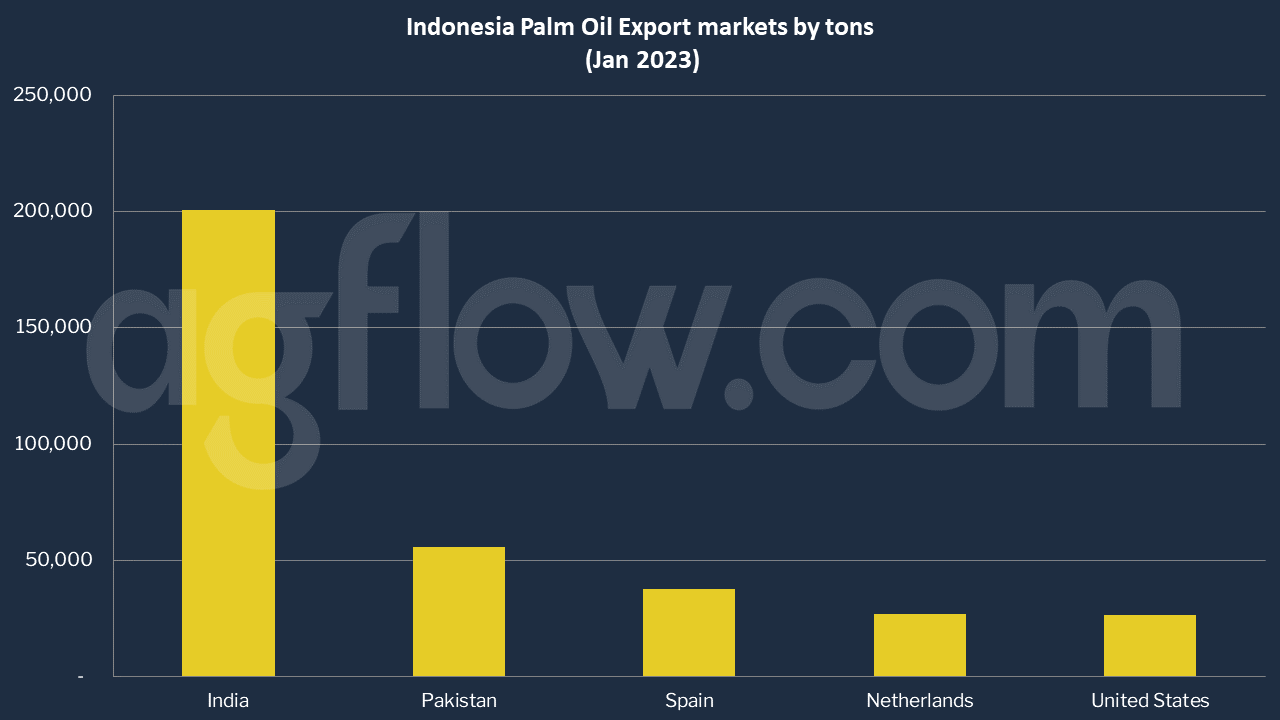

In early January 2023, the GOI already tightened restrictions on palm oil exports by reducing its Domestic Market Obligation (DMO) ratio to 1:6 from 1:8, meaning for every metric ton of palm oil sold domestically, exporters will receive export permits for only 6 MT of palm oil instead of 8 MT. This latest GOI policy to curb palm oil exports to shore up domestic cooking oil supplies will likely impact global palm oil supplies for the first quarter of 2023. A projected 400,000 to 800,000 MT of palm oil is expected to be blocked from the worldwide market from February 6 to May 1, 2023. According to AgFlow data, Indonesia exported 0.2 million tons of Palm oil to India in Jan 2023, followed by Pakistan (55,830 tons), Spain (37,605 tons), and the Netherlands (26,865 tons). Export volumes reached 6.3 million tons last year.

Indonesia’s Government issued the permits last year on condition that exporters satisfy the DMO, which requires them to allocate 6 tons of palm oil for domestic cooking consumption before they are issued a permit to export 1 ton. Domestic cooking oil prices increased, and bulk cooking oil packages have recently been selling above the regulated price of IDR14,000 (US$0.93) per liter. Producers complain that official prices are insufficient to cover production costs.

In global markets, however, palm oil prices have been subdued, having fallen more than 40% since reaching an all-time peak in May 2022 in the wake of Russia’s invasion of Ukraine. Therefore, Indonesia’s palm oil sellers with export permits have held onto inventory to await improved pricing.

Palm oil prices on the Malaysia Bursa showed little reaction to Indonesia’s new export restriction. The front-month FCPO futures contract closed at 3,974 ringgit per tonne in early February. FCPO is a Ringgit Malaysia denominated Crude Palm Oil Futures Contract traded on Bursa Malaysia Derivatives, providing market participants with a global price benchmark.

B35 impact on Indonesian Palm Oil Trade

Jakarta this month mandated a higher blend of palm oil-based fuel in biodiesel, leaving less for exports. Jakarta’s mandate is to increase the mix of palm oil-based fuel in biodiesel to 35% from 30%. The so-called B35 program (Biodiesel 35) is designed to cut greenhouse gas emissions and reduce the country’s dependence on imported crude oil.

B35 is expected to increase the amount of palm oil used for fuel by 20% in 2023. This will curtail Indonesia’s export capabilities, and the Indonesian Palm Oil Association anticipates that the country’s 2023 shipments will fall about 20% from just over 30 million tonnes last year.

Other sources: ASIA

Try AgFlow Free

Access Free On Updates for Corn, Wheat, Soybean,

Barley, and Sunflower Oil.

No Credit Card Required & Unlimited Access In Time