Indonesia emerges as a top market for Brazilian Wheat export

Reading time: 2 minutes

Wheat farms in Brazil are mostly family-owned, with an average size of 47 ha. The Wheat planting area in Brazil is pre-determined by farmers’ expectations from market signals and weather conditions during the planting period in April and May. Initially, planting decisions are driven by the Wheat price before the crop season.

Brazil’s Wheat production is insufficient to meet domestic demand as it has a large population of 216 million. Despite being the fourth largest producer of Grains in the world, the country imports up to 6 million tons of Wheat annually, particularly after years when national Wheat production is extremely low. Brazil produces 50% of the Wheat consumed in its domestic market.

Brazilian Wheat production is concentrated in the south of the country, especially in the states of Parana and Rio Grande do Sul. Together, those two states account for roughly 85% of total Brazilian production.

The new estimate from SAFRAS & Mercado for Brazilian Wheat production in 2022 indicates a crop of 10.42 million tons. This volume represents an increase of 34.5% compared to last year. The area planted with Wheat should total 3.18 million hectares, which corresponds to an increase of 16.6% compared to 2021. This would be the largest area cultivated since 1990 (the last year the market was regulated by the government). In 2021, Brazil planted 2.74 million hectares and harvested 7.7 million tons.

According to the National Supply Company (CONAB), Wheat inventories were 1.3 million tons as of Jul 31, 2021 and 0.3 million tons as of Aug 01, 2022. CONAB is a public company under the Ministry of Agriculture, Livestock, and Food Supply. It undertakes to manage the supply and agricultural policies, to ensure the basic needs of society, and it is responsible for implementing the Food Acquisition Program (PAA) at the federal level.

Wheat import totaled 6.5 million tons in 2021/2022. It was over 6 million tons in the last five years. In terms of export, Brazil’s export was minor, around 0.5 million tons each year from 2016-2021. Then hit 3 million tons in 2021/2022. Internal consumption was 12.1 million tons in 2021/2022 and is forecast to reach 12.7 million tons in 2022/2023.

CONAB revised the numbers for the coming crop, which will start in August 2022. The estimate is that they cultivated 2.8 million hectares of Wheat in Brazil, with a recovery of productivity of 2.8%, totaling 2,881 kg/ha, which could result in a crop of 8.1 million tons of Grain for 2022/2023.

Brazilian Wheat Import and Export

In Brazil, to meet the demand domestic market, 0.5 million tons of Wheat were imported in April, 2.3% less than the last month and 10.1% higher than the same period of the previous year. Of the total imported, 77% came from Argentina, 13% from Uruguay, and 10% from Paraguay.

Brazilian exports totaled 0.15 million tons in April, a volume well lower than in the last two months, but well above the period average. Of the total shipped, 36.6% were sent to Angola, 28.39% to Morocco, 19.5% to Vietnam, 15.7% to Egypt, and the remaining (0.2%) to Paraguay, Uruguay, and Marshall Islands.

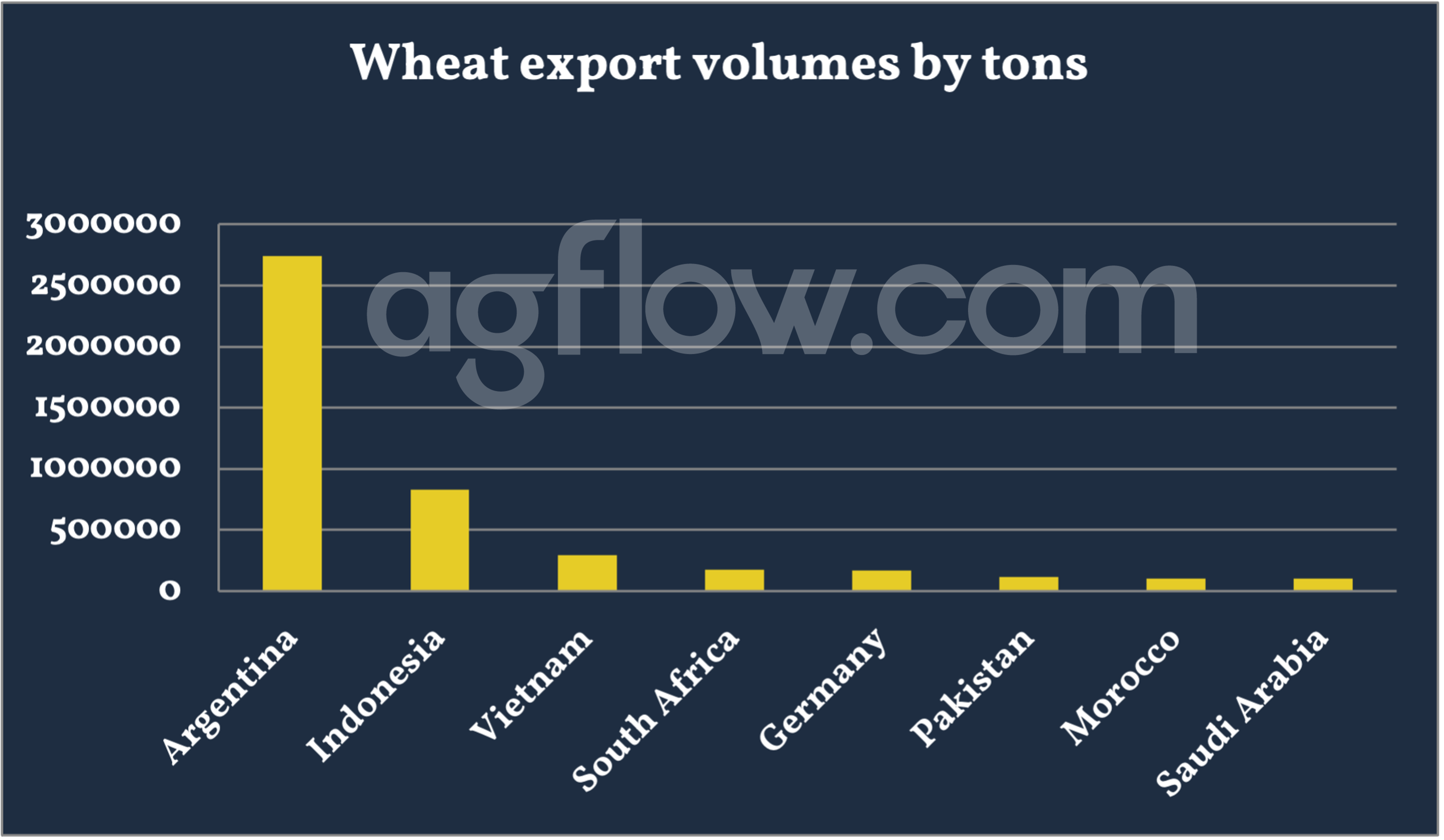

As per AgFlow data, Argentina (2.7 million tons) was the largest export market of Brazil Wheat in 2021-22 (Oct to Aug), followed by Indonesia (0.8 million tons) and Vietnam (0.3 million tons). South Africa, Germany, and Pakistan’s volumes were lower than 0.2 million tons each. Brazilian Wheat exports rose almost fivefold to 2.4 million tons in the first half of the year, according to Grain exporter group Anec.

In terms of pricing, Wheat bread PH 78 was quoted at R$ 93.53/sc of 60kg, showing a devaluation of 4.92%, and in Rio Grande do Sul, at R$ 94.36/sc from 60kg, with a depreciation of 2.2%.

Free & Unlimited Access In Time